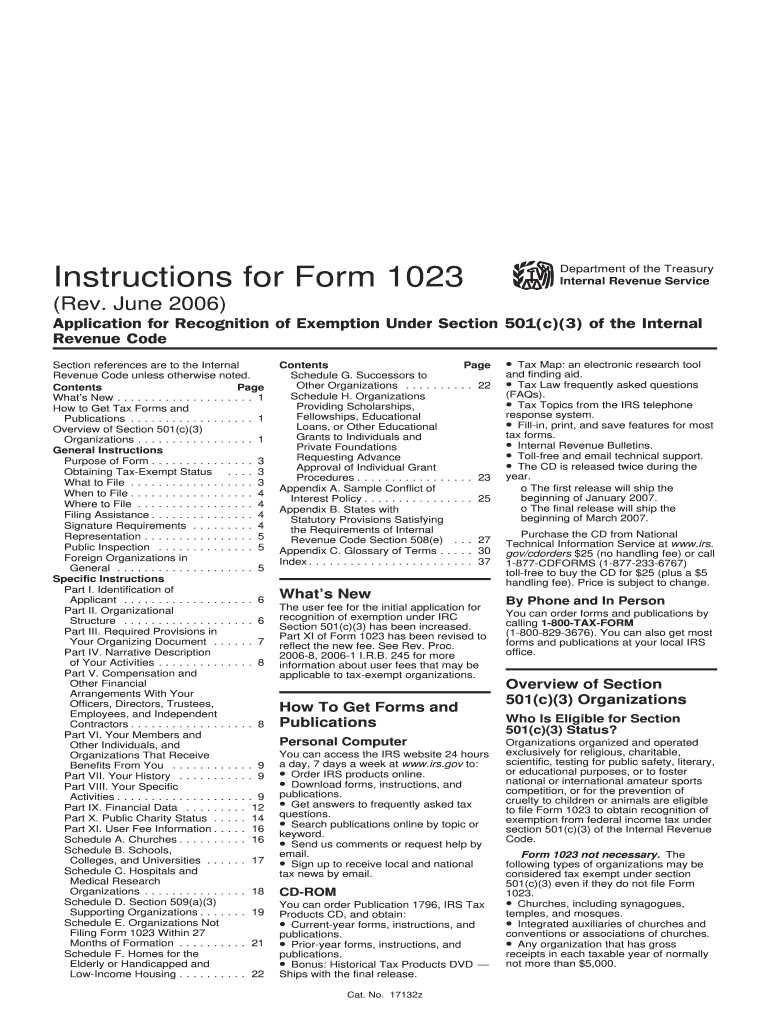

Irs Form 1023 Instructions 2006

What is the IRS Form 1023 Instructions

The IRS Form 1023 Instructions provide detailed guidance for organizations seeking tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. This form is essential for non-profit entities aiming to operate as charitable organizations. The instructions outline the requirements for eligibility, necessary documentation, and the process for completing the form accurately. Understanding these instructions is crucial for ensuring compliance with IRS regulations and successfully obtaining tax-exempt status.

Steps to complete the IRS Form 1023 Instructions

Completing the IRS Form 1023 involves several key steps to ensure accuracy and compliance. First, gather all required documents, including your organization's articles of incorporation, bylaws, and financial statements. Next, carefully read through the IRS Form 1023 Instructions to understand the information needed for each section of the form. Fill out the form methodically, ensuring that all questions are answered completely and accurately. Finally, review the completed form for any errors before submission to avoid delays in processing.

Legal use of the IRS Form 1023 Instructions

The legal use of the IRS Form 1023 Instructions is vital for organizations seeking tax-exempt status. These instructions are designed to help applicants meet the legal requirements set forth by the IRS. By following the guidelines, organizations can ensure that their applications are compliant with federal laws, reducing the risk of rejection or penalties. It is important that all information provided is truthful and complete, as any discrepancies can lead to legal issues or loss of tax-exempt status.

Required Documents

When completing the IRS Form 1023, specific documents are required to support your application. These typically include:

- Articles of incorporation

- Bylaws of the organization

- Financial statements for the past three years, if applicable

- Detailed descriptions of your organization’s activities

- Conflict of interest policy

Having these documents prepared and organized will facilitate a smoother application process and help ensure compliance with IRS requirements.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the IRS Form 1023 is crucial for organizations aiming to secure tax-exempt status. Generally, organizations should file the form within 27 months of incorporation to receive retroactive tax-exempt status from the date of incorporation. If filed after this period, the organization may only receive tax-exempt status from the date of submission. Keeping track of these important dates helps organizations avoid potential tax liabilities and ensures compliance with IRS regulations.

Form Submission Methods (Online / Mail / In-Person)

The IRS Form 1023 can be submitted through various methods. Organizations have the option to file online using the IRS e-File system, which provides a streamlined process and quicker confirmation of receipt. Alternatively, the form can be mailed to the appropriate IRS address, ensuring that it is sent via a reliable postal service to track delivery. In-person submission is generally not available, making online or mail submission the primary methods for filing.

Quick guide on how to complete irs form 1023 instructions 2006

Complete Irs Form 1023 Instructions effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without any delays. Manage Irs Form 1023 Instructions on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign Irs Form 1023 Instructions with ease

- Obtain Irs Form 1023 Instructions and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Irs Form 1023 Instructions to ensure effective communication throughout the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 1023 instructions 2006

Create this form in 5 minutes!

How to create an eSignature for the irs form 1023 instructions 2006

How to generate an electronic signature for your Irs Form 1023 Instructions 2006 online

How to create an eSignature for the Irs Form 1023 Instructions 2006 in Chrome

How to make an electronic signature for putting it on the Irs Form 1023 Instructions 2006 in Gmail

How to generate an eSignature for the Irs Form 1023 Instructions 2006 right from your smartphone

How to make an electronic signature for the Irs Form 1023 Instructions 2006 on iOS devices

How to generate an electronic signature for the Irs Form 1023 Instructions 2006 on Android

People also ask

-

What are the main components of the Irs Form 1023 Instructions?

The Irs Form 1023 Instructions outline the necessary steps for applying for tax-exempt status as a nonprofit organization. Key components include eligibility requirements, detailed descriptions of the required documentation, and guidance on how to complete each section of the form accurately. Understanding these instructions is crucial for a successful application.

-

How can airSlate SignNow help me with the Irs Form 1023 Instructions?

airSlate SignNow simplifies the process of preparing and submitting your Irs Form 1023 Instructions by allowing you to easily eSign and manage documents online. Our platform ensures that your forms are completed accurately and securely, helping you stay compliant with IRS requirements. With airSlate SignNow, you can focus on your nonprofit's mission while we handle the paperwork.

-

What features does airSlate SignNow offer for managing Irs Form 1023 Instructions?

airSlate SignNow offers features such as customizable templates, document tracking, and secure eSigning, all of which are beneficial when working with Irs Form 1023 Instructions. These tools help streamline the application process, minimize errors, and enhance collaboration among your team members. You can also store your documents securely in the cloud for easy access.

-

Is airSlate SignNow affordable for small nonprofits looking to file Irs Form 1023 Instructions?

Yes, airSlate SignNow is designed to be a cost-effective solution for small nonprofits needing to file Irs Form 1023 Instructions. Our pricing plans are tailored to fit various budgets, ensuring that even organizations with limited resources can access the tools they need for efficient document management. Investing in airSlate SignNow can save you time and reduce stress during the application process.

-

Can I integrate airSlate SignNow with other software for handling Irs Form 1023 Instructions?

Absolutely! airSlate SignNow offers integrations with various applications, enabling you to streamline your workflow when dealing with Irs Form 1023 Instructions. Whether you use project management tools or customer relationship management systems, our platform can connect seamlessly, ensuring that your documents are organized and accessible from one place.

-

What benefits do I gain from using airSlate SignNow for Irs Form 1023 Instructions?

Using airSlate SignNow for Irs Form 1023 Instructions provides several benefits, including improved efficiency, enhanced security, and better collaboration among team members. You'll experience faster turnaround times for document signing and submissions, which can be critical for meeting IRS deadlines and ensuring your nonprofit’s compliance. Plus, our user-friendly interface makes the process straightforward for everyone involved.

-

How do I get started with airSlate SignNow for my Irs Form 1023 Instructions?

Getting started with airSlate SignNow for your Irs Form 1023 Instructions is easy! Simply sign up for an account on our website and explore our user-friendly interface. You can access templates specifically designed for the Irs Form 1023 Instructions, and our support team is available to assist you if you have any questions during the process.

Get more for Irs Form 1023 Instructions

Find out other Irs Form 1023 Instructions

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free