Form 1023 2020-2026

What is the Form 1023

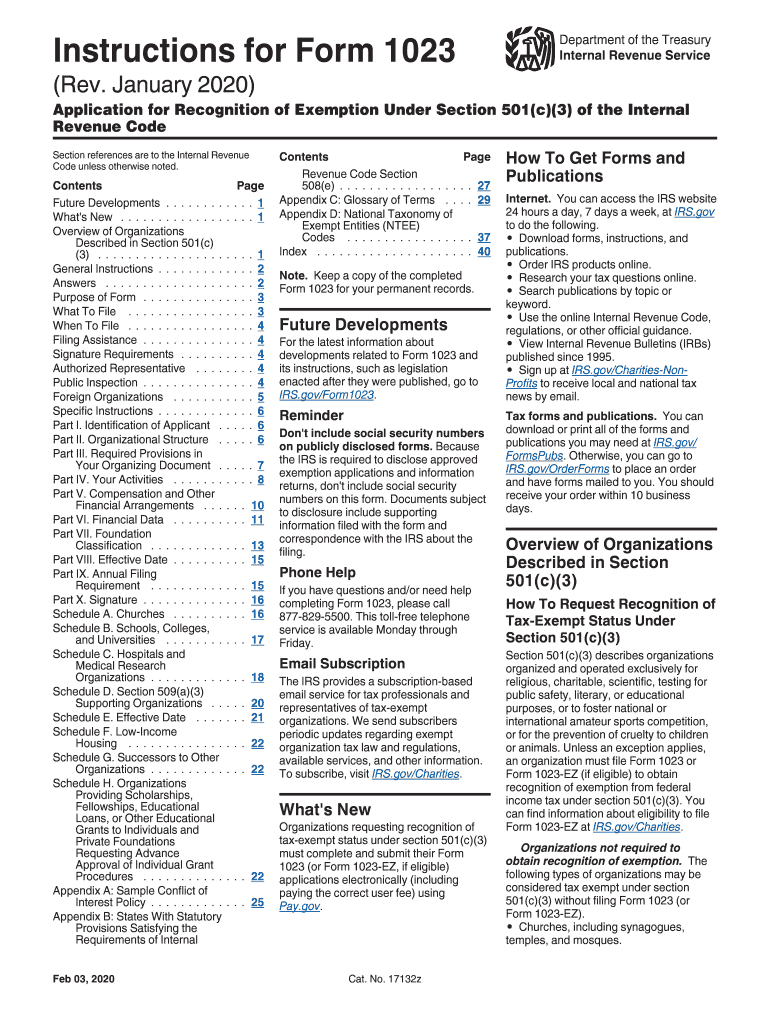

The Form 1023 is the application used by organizations seeking recognition as a tax-exempt nonprofit under Section 501(c)(3) of the Internal Revenue Code. This form is essential for nonprofits aiming to obtain federal tax exemption, allowing them to receive tax-deductible contributions. Completing the Form 1023 accurately is crucial, as it requires detailed information about the organization's structure, purpose, and activities.

Steps to complete the Form 1023

Completing the Form 1023 involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding the organization, including its mission statement, financial data, and governance structure. Next, fill out the form, paying close attention to each section, particularly the narrative description of activities. After completing the form, review it thoroughly for any errors or omissions. Finally, submit the form along with the required fee to the IRS.

Legal use of the Form 1023

The legal use of the Form 1023 is governed by IRS regulations. Organizations must ensure that the information provided is truthful and complete, as inaccuracies can lead to denial of tax-exempt status. Proper use of the form also involves adhering to the guidelines for nonprofit activities, which must align with the charitable purposes outlined in the application. Compliance with these legal standards is critical for maintaining tax-exempt status.

Required Documents

When submitting the Form 1023, several documents are required to support the application. These may include the organization's articles of incorporation, bylaws, a detailed budget, and financial statements. Additionally, any relevant contracts or agreements that demonstrate the organization's activities should be included. Having these documents prepared in advance can streamline the application process and enhance the likelihood of approval.

Eligibility Criteria

To be eligible for tax-exempt status under Section 501(c)(3), organizations must meet specific criteria. They must operate exclusively for charitable, religious, educational, or scientific purposes. Additionally, the organization should not engage in substantial lobbying or political activities. Understanding these eligibility requirements is essential for organizations to ensure they qualify before submitting the Form 1023.

IRS Guidelines

The IRS provides comprehensive guidelines for completing the Form 1023, which include instructions on the necessary documentation and information required. Organizations should refer to these guidelines carefully to understand the expectations for their applications. Following the IRS guidelines helps ensure that the application is complete and increases the chances of receiving tax-exempt status.

Quick guide on how to complete form 1023 ez internal revenue service

Effortlessly Complete Form 1023 on Any Device

Digital document management has become increasingly popular among companies and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without hassle. Manage Form 1023 on any device using airSlate SignNow's Android or iOS applications and streamline your document processes today.

How to Modify and Electronically Sign Form 1023 with Ease

- Obtain Form 1023 and click on Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or redact confidential information with the tools that airSlate SignNow offers specifically for this purpose.

- Generate your electronic signature using the Sign tool, which only takes a few seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Form 1023 and ensure excellent communication at any stage of your document preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1023 ez internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the form 1023 ez internal revenue service

How to create an eSignature for the Form 1023 Ez Internal Revenue Service in the online mode

How to make an eSignature for your Form 1023 Ez Internal Revenue Service in Google Chrome

How to create an eSignature for putting it on the Form 1023 Ez Internal Revenue Service in Gmail

How to make an eSignature for the Form 1023 Ez Internal Revenue Service straight from your smartphone

How to generate an electronic signature for the Form 1023 Ez Internal Revenue Service on iOS devices

How to generate an electronic signature for the Form 1023 Ez Internal Revenue Service on Android devices

People also ask

-

What is an NTEE code for nonprofits and why is it important?

The NTEE code for nonprofits is a classification system that categorizes nonprofit organizations based on their primary activities. Understanding your NTEE code is crucial as it helps in identifying funding opportunities, complying with regulations, and improving communication with stakeholders in the nonprofit sector.

-

How can I find the right NTEE code for my nonprofit organization?

You can find the right NTEE code for your nonprofit organization by visiting the National Center for Charitable Statistics (NCCS) website, where they provide a searchable database. Choosing the correct NTEE code for nonprofits ensures that your organization is properly classified and can access relevant resources and support.

-

Does airSlate SignNow support nonprofits in managing their documents related to NTEE codes?

Yes, airSlate SignNow provides nonprofits with powerful tools to manage their documents efficiently, including those related to NTEE codes. With our eSignature solution, you can send, track, and sign important documents, ensuring compliance and organizational transparency.

-

What pricing options does airSlate SignNow offer for nonprofits?

airSlate SignNow offers competitive pricing options designed to fit the budget of nonprofit organizations. We provide a special discount for nonprofits, enabling them to utilize features like document management and electronic signatures while adhering to their financial constraints.

-

What features does airSlate SignNow provide that are beneficial for nonprofits?

airSlate SignNow offers numerous features beneficial for nonprofits, including customizable templates, collaboration tools, and secure electronic signatures. These features streamline document workflows, making it easier for nonprofit organizations to focus on their mission while managing paperwork efficiently.

-

Can airSlate SignNow integrate with other software used by nonprofits?

Yes, airSlate SignNow can seamlessly integrate with various software platforms commonly used by nonprofits, such as CRM systems and project management tools. This integration allows for a more efficient workflow, enabling organizations to manage their documents and NTEE-related tasks in one place.

-

How can airSlate SignNow help my nonprofit stay compliant with NTEE code requirements?

airSlate SignNow helps your nonprofit stay compliant with NTEE code requirements by providing secure, trackable document management solutions. With features that ensure proper retention of signed agreements and forms, you can maintain compliance effortlessly while focusing on your nonprofit's initiatives.

Get more for Form 1023

Find out other Form 1023

- eSignature Pennsylvania Letter Bankruptcy Inquiry Computer

- Electronic signature Virginia Residential lease form Free

- eSignature North Dakota Guarantee Agreement Easy

- Can I Electronic signature Indiana Simple confidentiality agreement

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure