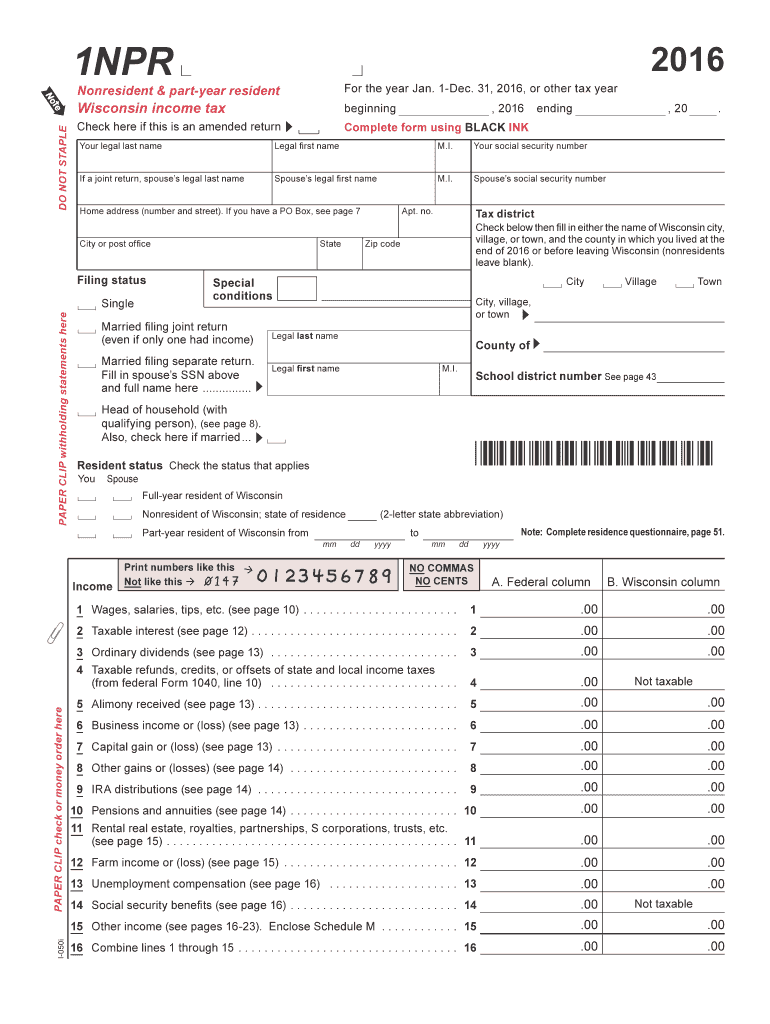

1npr Tax Form 2016

What is the 1npr Tax Form

The 1npr Tax Form is a specific document used for reporting certain tax information to the Internal Revenue Service (IRS). It is essential for individuals and businesses who need to disclose specific financial details, ensuring compliance with federal tax regulations. This form is often required in various tax situations, such as income reporting or deductions. Understanding the purpose and requirements of the 1npr Tax Form is crucial for accurate tax filing.

How to use the 1npr Tax Form

Using the 1npr Tax Form involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents, such as income statements and previous tax returns. Next, carefully fill out the form, ensuring that each section is completed with accurate data. After completing the form, review it for any errors or omissions. Finally, submit the form to the IRS by the designated deadline, either electronically or via mail, depending on your preference.

Steps to complete the 1npr Tax Form

Completing the 1npr Tax Form requires attention to detail. Here are the steps to follow:

- Gather necessary documents, including income statements and deduction records.

- Obtain the latest version of the 1npr Tax Form from the IRS website or authorized sources.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income and any applicable deductions accurately.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

- Submit the form electronically or by mail, ensuring it is sent before the deadline.

Legal use of the 1npr Tax Form

The legal use of the 1npr Tax Form is governed by IRS regulations. To be considered valid, the form must be filled out accurately and submitted by the required deadlines. Additionally, the form must be signed by the taxpayer or an authorized representative. Failure to comply with these legal requirements can result in penalties or delays in processing. It is essential to keep copies of submitted forms for your records.

Filing Deadlines / Important Dates

Filing deadlines for the 1npr Tax Form are crucial for compliance. Typically, the form must be submitted by April fifteenth of the tax year. However, extensions may be available under certain circumstances. It is important to stay informed about any changes to deadlines, especially during tax season, to avoid penalties. Marking your calendar with these important dates can help ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

The 1npr Tax Form can be submitted through various methods, providing flexibility for taxpayers. The options include:

- Online Submission: Many taxpayers prefer to submit the form electronically through authorized e-filing services.

- Mail: The form can be printed and mailed to the IRS, ensuring that it is sent to the correct address based on your state.

- In-Person: Some taxpayers may choose to deliver the form in person at local IRS offices, although this option may vary by location.

Quick guide on how to complete 1npr tax 2016 form

Effortlessly Complete 1npr Tax Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly and without holdups. Handle 1npr Tax Form on any device using the airSlate SignNow apps for Android or iOS, and simplify any document-related process today.

How to Edit and eSign 1npr Tax Form with Ease

- Obtain 1npr Tax Form and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight important sections of the documents or redact sensitive information with the specialized tools provided by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your selected device. Edit and eSign 1npr Tax Form to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1npr tax 2016 form

Create this form in 5 minutes!

How to create an eSignature for the 1npr tax 2016 form

How to create an electronic signature for the 1npr Tax 2016 Form in the online mode

How to create an electronic signature for your 1npr Tax 2016 Form in Chrome

How to create an eSignature for signing the 1npr Tax 2016 Form in Gmail

How to generate an electronic signature for the 1npr Tax 2016 Form straight from your mobile device

How to make an electronic signature for the 1npr Tax 2016 Form on iOS devices

How to create an electronic signature for the 1npr Tax 2016 Form on Android

People also ask

-

What is the 1npr Tax Form and why is it important?

The 1npr Tax Form is a crucial document used to report non-payment of taxes, ensuring compliance with tax regulations. Businesses need this form to accurately detail their financial activities and avoid potential penalties.

-

How does airSlate SignNow simplify the process of eSigning the 1npr Tax Form?

airSlate SignNow provides an intuitive platform that allows users to effortlessly eSign the 1npr Tax Form. With features like drag-and-drop templates and real-time notifications, the signing process becomes faster and more efficient.

-

Is there a cost associated with using airSlate SignNow for the 1npr Tax Form?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs, making it a cost-effective solution for handling the 1npr Tax Form. You can choose a plan that suits your volume and usage requirements.

-

What features does airSlate SignNow offer for managing the 1npr Tax Form?

AirSlate SignNow comes equipped with features such as document templates, advanced security options, and audit trails specifically for the 1npr Tax Form. These features ensure that your documents are not only signed but also secure and trackable.

-

Can I integrate airSlate SignNow with other applications for the 1npr Tax Form?

Absolutely! airSlate SignNow offers seamless integrations with various applications, enhancing your workflow when handling the 1npr Tax Form. You can connect it with CRM systems, cloud storage, and other productivity tools.

-

How does airSlate SignNow enhance compliance regarding the 1npr Tax Form?

By using airSlate SignNow, businesses can ensure that their 1npr Tax Form is completed accurately and in a timely manner, enhancing compliance. The platform provides robust features to maintain records and secure documents necessary for audits.

-

What are the benefits of using airSlate SignNow for the 1npr Tax Form?

The primary benefits of using airSlate SignNow for the 1npr Tax Form include increased efficiency, reduced paper usage, and improved accuracy. These advantages help in minimizing the administrative workload associated with tax documentation.

Get more for 1npr Tax Form

Find out other 1npr Tax Form

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template