Wisconsin Form 1 Npr 2022-2026

What is the Wisconsin Form 1 Npr

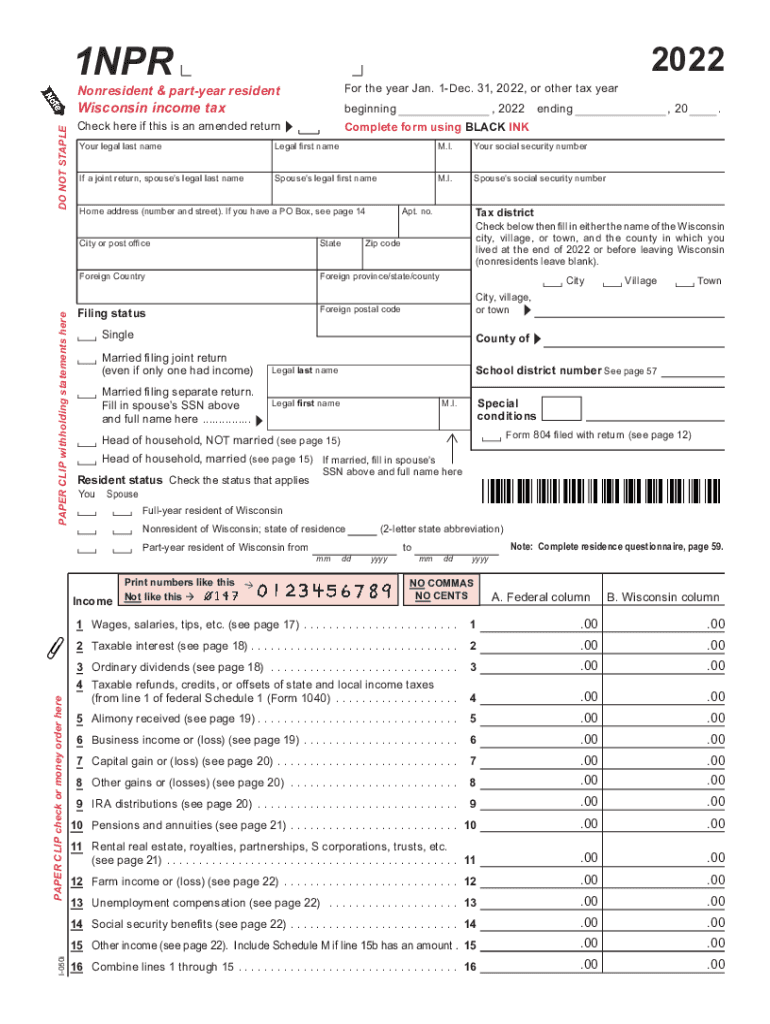

The Wisconsin Form 1 Npr is a tax form specifically designed for nonresidents of Wisconsin who have earned income within the state. This form allows individuals to report their income, calculate their tax liability, and claim any applicable credits or deductions. Understanding the purpose of this form is essential for nonresidents to ensure compliance with state tax laws and to avoid potential penalties.

How to use the Wisconsin Form 1 Npr

Using the Wisconsin Form 1 Npr involves several key steps. First, gather all necessary financial documents, including W-2s and any other income statements. Next, accurately fill out the form by reporting your income earned in Wisconsin and any adjustments that apply. It is important to follow the instructions carefully to ensure that all required information is included. Once completed, the form can be submitted either electronically or via mail, depending on your preference.

Steps to complete the Wisconsin Form 1 Npr

Completing the Wisconsin Form 1 Npr involves a systematic approach:

- Gather necessary documents, such as W-2 forms and other income records.

- Begin filling out the form by entering your personal information, including your name, address, and Social Security number.

- Report your total income earned in Wisconsin, including wages, salaries, and any other taxable income.

- Calculate your tax liability based on the income reported, applying any deductions or credits you may qualify for.

- Review the form for accuracy before submitting it to ensure compliance with Wisconsin tax regulations.

Legal use of the Wisconsin Form 1 Npr

The legal use of the Wisconsin Form 1 Npr is governed by state tax laws. It is crucial for nonresidents to file this form accurately to avoid any legal repercussions. Submitting a correctly completed form ensures that taxpayers fulfill their obligations and can protect them from penalties associated with non-compliance. Additionally, utilizing a secure electronic signature platform can enhance the legal standing of the submitted document.

Filing Deadlines / Important Dates

Filing deadlines for the Wisconsin Form 1 Npr are critical to ensure timely compliance. Typically, the form must be filed by April 15 of the year following the tax year in question. However, if April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes to deadlines each tax year to avoid late filing penalties.

Who Issues the Form

The Wisconsin Form 1 Npr is issued by the Wisconsin Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. The department provides resources and guidance for completing the form, as well as information on filing procedures and deadlines.

Quick guide on how to complete wisconsin form 1 npr

Effortlessly prepare Wisconsin Form 1 Npr on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the features needed to create, modify, and electronically sign your documents quickly and without delays. Handle Wisconsin Form 1 Npr on any platform using airSlate SignNow’s Android or iOS applications and streamline your document-related tasks today.

How to edit and eSign Wisconsin Form 1 Npr with ease

- Locate Wisconsin Form 1 Npr and press Get Form to begin.

- Utilize the tools at your disposal to fill out your document.

- Emphasize important sections of the documents or obscure private information using the tools provided by airSlate SignNow specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all details and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Wisconsin Form 1 Npr and ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wisconsin form 1 npr

Create this form in 5 minutes!

People also ask

-

What is the 2014 wi nonresident tax form?

The 2014 wi nonresident tax form is used by nonresidents to report income earned in Wisconsin. This form ensures compliance with state tax laws and allows nonresidents to calculate taxes owed. Filing this form is essential to avoid penalties and ensure proper tax reporting for income generated in Wisconsin.

-

How can airSlate SignNow help me with my 2014 wi nonresident tax form?

With airSlate SignNow, you can easily create, sign, and send your 2014 wi nonresident tax forms electronically. Our platform streamlines the eSigning process, making it simple to manage and submit your documents promptly. This ensures that you focus more on your business and less on paperwork.

-

What features does airSlate SignNow offer for eSigning 2014 wi nonresident forms?

airSlate SignNow offers a wide range of features, including document templates, secure cloud storage, and real-time tracking for your 2014 wi nonresident forms. The platform also supports various file formats, ensuring compatibility with your documents. This enhances efficiency and accuracy while handling your tax forms.

-

Is airSlate SignNow affordable for filing 2014 wi nonresident documents?

Yes, airSlate SignNow provides cost-effective pricing plans that cater to businesses of all sizes looking to file 2014 wi nonresident documents. Our transparent pricing structure allows you to choose a plan that fits your needs without hidden fees. Investing in our solution can save you both time and resources.

-

Can I incorporate airSlate SignNow with my existing software for 2014 wi nonresident filing?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions, allowing you to streamline your workflows when filing your 2014 wi nonresident forms. This integration enhances productivity by connecting your existing tools with our eSigning platform, making document management effortless.

-

What are the benefits of using airSlate SignNow for my 2014 wi nonresident tax submissions?

Using airSlate SignNow for your 2014 wi nonresident tax submissions brings numerous benefits, including enhanced security, efficient document tracking, and time savings. Our platform ensures that your important documents are signed and sent quickly, reducing the overall turnaround time for tax filing. Plus, you'll have peace of mind knowing your data is protected.

-

How quickly can I get started with airSlate SignNow for 2014 wi nonresident forms?

Getting started with airSlate SignNow for your 2014 wi nonresident forms is quick and easy. You can sign up for an account and access our platform within minutes. Once you're registered, you can begin creating and managing your tax documents right away, streamlining your filing process.

Get more for Wisconsin Form 1 Npr

- Buyers notice of intent to vacate and surrender property to seller under contract for deed iowa form

- General notice of default for contract for deed iowa form

- Ia rights form

- Iowa contract land 497304815 form

- Contract for deed sellers annual accounting statement iowa form

- Notice of default for past due payments in connection with contract for deed iowa form

- Notice default form 497304818

- Assignment of contract for deed by seller iowa form

Find out other Wisconsin Form 1 Npr

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple