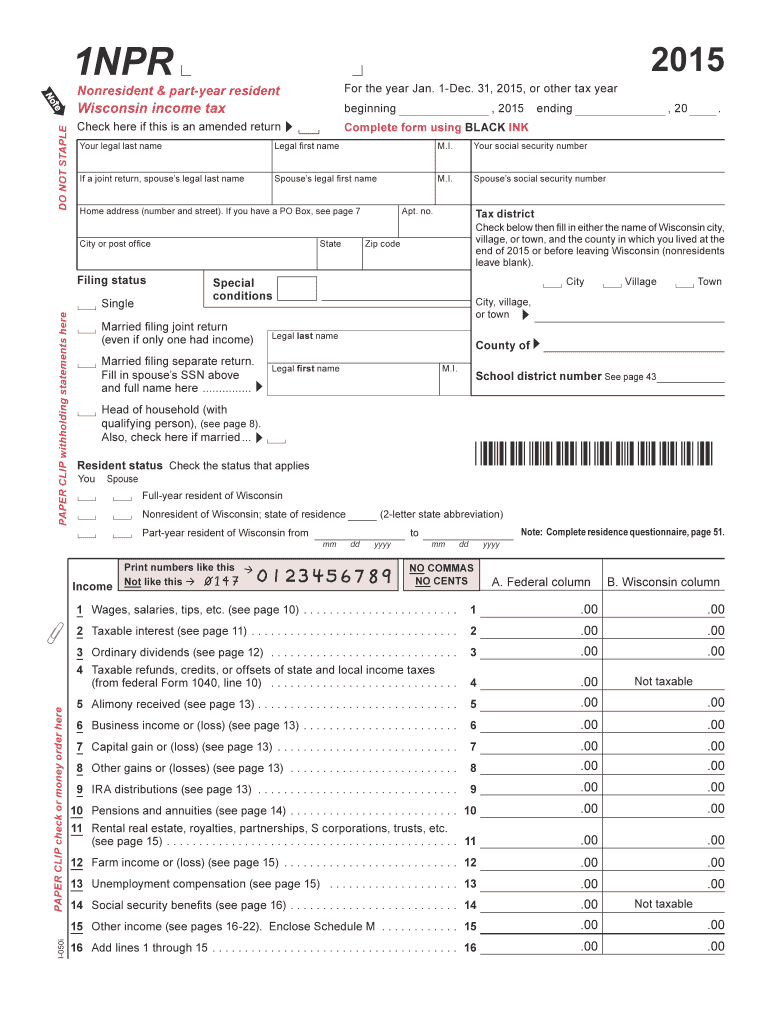

1npr Tax Form 2015

What is the 1npr Tax Form

The 1npr Tax Form is a specific tax document used primarily for reporting income and calculating tax liabilities. It is essential for individuals and businesses to accurately report their financial information to the Internal Revenue Service (IRS). This form is particularly relevant for those who may have unique tax situations or specific deductions to claim. Understanding the purpose and requirements of the 1npr Tax Form is crucial for ensuring compliance with federal tax laws.

How to use the 1npr Tax Form

Using the 1npr Tax Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements, receipts for deductions, and any previous tax returns. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is important to follow the instructions provided with the form to avoid errors that could lead to delays or penalties. Once completed, the form can be submitted electronically or via traditional mail, depending on your preference and the guidelines set by the IRS.

Steps to complete the 1npr Tax Form

Completing the 1npr Tax Form requires attention to detail. Here are the key steps:

- Gather all relevant financial documents.

- Read the instructions carefully to understand each section of the form.

- Fill in personal information, including your name, address, and Social Security number.

- Report all sources of income accurately.

- Claim any eligible deductions or credits.

- Review the form for accuracy before submission.

- Submit the form electronically or by mail, ensuring it is sent by the deadline.

Legal use of the 1npr Tax Form

The legal use of the 1npr Tax Form is governed by IRS regulations. To be considered valid, the form must be filled out accurately and submitted within the specified deadlines. Electronic signatures are acceptable under the ESIGN Act, provided that the eSigning process complies with legal standards. It is crucial to keep a copy of the submitted form and any supporting documents for your records, as they may be needed for future reference or audits.

Filing Deadlines / Important Dates

Filing deadlines for the 1npr Tax Form are critical to avoid penalties. Typically, individual taxpayers need to submit their forms by April fifteenth each year. However, extensions may be available under certain circumstances. It is important to stay informed about any changes to deadlines, especially during tax season, to ensure timely compliance with IRS requirements.

Who Issues the Form

The 1npr Tax Form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement of tax laws in the United States. The IRS provides the necessary guidelines and updates regarding the form, ensuring that taxpayers have access to the most current information needed for accurate reporting.

Quick guide on how to complete 1npr tax 2015 form

Effortlessly Prepare 1npr Tax Form on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It serves as an excellent environmentally-friendly alternative to traditional printed and signed documents, since you can easily access the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, edit, and electronically sign your documents quickly without any holdups. Manage 1npr Tax Form on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-driven workflow today.

How to Edit and Electronically Sign 1npr Tax Form with Ease

- Find 1npr Tax Form and then click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight relevant sections of your documents or redact sensitive information using tools offered by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose how you want to send your form: via email, text message (SMS), an invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign 1npr Tax Form and ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1npr tax 2015 form

Create this form in 5 minutes!

How to create an eSignature for the 1npr tax 2015 form

How to create an eSignature for the 1npr Tax 2015 Form online

How to generate an electronic signature for the 1npr Tax 2015 Form in Google Chrome

How to create an electronic signature for putting it on the 1npr Tax 2015 Form in Gmail

How to make an electronic signature for the 1npr Tax 2015 Form right from your smart phone

How to generate an eSignature for the 1npr Tax 2015 Form on iOS devices

How to create an eSignature for the 1npr Tax 2015 Form on Android OS

People also ask

-

What is the 1npr Tax Form and why is it important?

The 1npr Tax Form is a crucial document used for reporting certain tax information to the IRS. It is important because it helps ensure compliance with tax regulations and can impact your tax liability. Completing the 1npr Tax Form accurately can streamline your tax filing process and prevent potential penalties.

-

How can airSlate SignNow assist with completing the 1npr Tax Form?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending documents, including the 1npr Tax Form. With its intuitive interface, you can efficiently fill out and submit the form while ensuring that all signatures are securely captured. This not only saves time but also enhances the accuracy of your submissions.

-

Is there a cost associated with using airSlate SignNow for the 1npr Tax Form?

Yes, airSlate SignNow offers a variety of pricing plans to accommodate different business needs. The cost-effective solution allows you to manage eSigning and document workflows seamlessly, including for the 1npr Tax Form. You can choose a plan that fits your budget and ensures you have access to all the necessary features.

-

Can I integrate airSlate SignNow with other software to manage the 1npr Tax Form?

Absolutely! airSlate SignNow offers integrations with popular software applications, allowing you to streamline your workflow when managing the 1npr Tax Form. This feature helps you connect with other platforms, enhancing productivity and ensuring that all your documents are organized and easily accessible.

-

What features does airSlate SignNow offer for managing the 1npr Tax Form?

airSlate SignNow includes features such as document templates, secure eSigning, and automated workflows specifically designed for handling the 1npr Tax Form. These features simplify the process, reduce manual errors, and provide a seamless experience for both senders and recipients.

-

How secure is airSlate SignNow for submitting the 1npr Tax Form?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption methods to protect your documents, including the 1npr Tax Form, ensuring that your sensitive information remains confidential. Additionally, it complies with industry standards to safeguard data integrity throughout the signing process.

-

Can I track the status of my 1npr Tax Form submission with airSlate SignNow?

Yes, airSlate SignNow provides tracking capabilities that allow you to monitor the status of your 1npr Tax Form submissions. You can easily check when the document has been viewed, signed, and completed, giving you peace of mind and keeping you informed throughout the process.

Get more for 1npr Tax Form

- Request reactivate form

- Transaction report form department of labor licensing and dllr maryland

- John hancock beneficiary change form

- The kansas city southern railway company 427 kcs form

- Transfer money form

- Kentucky 2012 tangible personal property tax return form

- Schedule 8812 form 1040 sp credits for qualifying children and other dependents spanish version

- Or 20 v form

Find out other 1npr Tax Form

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free