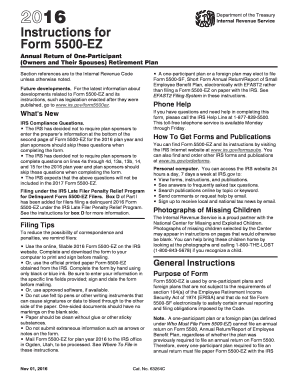

Irs 5500ez Instructions Form 2016

What is the Irs 5500ez Instructions Form

The Irs 5500ez Instructions Form is a crucial document used by certain retirement plan sponsors to report information about their plans to the Internal Revenue Service (IRS). This form is specifically designed for one-participant plans, which include plans covering only the business owner and their spouse. It provides essential details regarding the plan's financial condition, investments, and operations, ensuring compliance with federal regulations. The information collected through this form helps the IRS monitor retirement plans and enforce tax laws effectively.

How to use the Irs 5500ez Instructions Form

Using the Irs 5500ez Instructions Form involves several key steps. First, gather all necessary information about your retirement plan, including financial statements and participant details. Next, follow the specific instructions outlined in the form to accurately fill out each section. Ensure that all financial data is reported correctly, as inaccuracies can lead to penalties. Once completed, you can submit the form electronically or by mail, depending on your preference and the IRS guidelines. It's important to keep a copy of the submitted form for your records.

Steps to complete the Irs 5500ez Instructions Form

Completing the Irs 5500ez Instructions Form requires careful attention to detail. Here are the steps to follow:

- Review the form instructions thoroughly to understand the requirements.

- Collect all necessary documents, including financial statements and participant information.

- Fill out the form accurately, ensuring all information is complete and correct.

- Double-check your entries for any errors or omissions.

- Submit the form electronically through the IRS e-filing system or mail it to the appropriate address.

- Retain a copy of the completed form for your records.

Legal use of the Irs 5500ez Instructions Form

The legal use of the Irs 5500ez Instructions Form is essential for compliance with federal regulations governing retirement plans. Proper completion and timely submission of this form help ensure that the retirement plan meets IRS requirements. Failure to file the form or inaccuracies in reporting can result in penalties or disqualification of the plan. It is advisable to consult with a tax professional or legal advisor to ensure that all legal obligations are met when using this form.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Irs 5500ez Instructions Form is critical for compliance. Generally, the form must be filed by the last day of the seventh month after the end of the plan year. For example, if your plan year ends on December 31, the form is due by July 31 of the following year. If additional time is needed, you may file for an extension, but it is essential to adhere to the extended deadline to avoid penalties. Keeping track of these important dates helps ensure timely submission.

Required Documents

To complete the Irs 5500ez Instructions Form accurately, several documents are required. These typically include:

- Financial statements for the retirement plan.

- Information about all plan participants, including beneficiaries.

- Details of any plan investments and transactions.

- Records of contributions and distributions made during the plan year.

Having these documents ready will facilitate a smoother completion process and help ensure compliance with IRS requirements.

Quick guide on how to complete irs 5500ez instructions 2016 form

Complete Irs 5500ez Instructions Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without interruptions. Handle Irs 5500ez Instructions Form on any device with airSlate SignNow mobile applications for Android or iOS and enhance any document-related process today.

The optimal way to modify and electronically sign Irs 5500ez Instructions Form with ease

- Access Irs 5500ez Instructions Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact confidential information using tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and possesses the same legal standing as a traditional handwritten signature.

- Review the details and hit the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Irs 5500ez Instructions Form and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs 5500ez instructions 2016 form

Create this form in 5 minutes!

How to create an eSignature for the irs 5500ez instructions 2016 form

How to generate an electronic signature for the Irs 5500ez Instructions 2016 Form online

How to create an eSignature for the Irs 5500ez Instructions 2016 Form in Chrome

How to create an electronic signature for signing the Irs 5500ez Instructions 2016 Form in Gmail

How to create an electronic signature for the Irs 5500ez Instructions 2016 Form from your mobile device

How to generate an eSignature for the Irs 5500ez Instructions 2016 Form on iOS devices

How to make an electronic signature for the Irs 5500ez Instructions 2016 Form on Android devices

People also ask

-

What are the Irs 5500ez Instructions Form requirements?

The Irs 5500ez Instructions Form is designed for pension plan administrators to report information about their plans. It requires detailed information regarding plan assets, participants, and financial statements. Understanding these requirements is crucial for compliance and to avoid penalties.

-

How can airSlate SignNow help with the Irs 5500ez Instructions Form?

airSlate SignNow offers a seamless eSigning solution that allows you to easily prepare and sign the Irs 5500ez Instructions Form electronically. Our platform ensures secure document handling and provides templates that can streamline the completion process for your reporting needs.

-

Are there any fees associated with filing the Irs 5500ez Instructions Form through airSlate SignNow?

airSlate SignNow provides a cost-effective solution for electronically signing documents, including the Irs 5500ez Instructions Form. While there are subscription fees associated with using our platform, we offer various pricing plans to fit different business needs, ensuring you get the best value.

-

What features does airSlate SignNow offer for managing the Irs 5500ez Instructions Form?

With airSlate SignNow, you benefit from features such as customizable templates, secure eSigning, and document tracking for the Irs 5500ez Instructions Form. These tools enhance your workflow, making it easier to manage and submit your forms accurately and on time.

-

Can I integrate airSlate SignNow with other software for the Irs 5500ez Instructions Form?

Yes, airSlate SignNow supports various integrations with popular software solutions, allowing you to streamline the process of managing the Irs 5500ez Instructions Form. This interoperability ensures that your documents flow seamlessly between platforms, saving you time and reducing errors.

-

What are the benefits of using airSlate SignNow for the Irs 5500ez Instructions Form?

Using airSlate SignNow for the Irs 5500ez Instructions Form provides numerous benefits, including enhanced security, faster processing times, and easy accessibility. Our user-friendly interface allows you to manage your documents efficiently, ensuring compliance with IRS regulations.

-

Is there customer support available for using the Irs 5500ez Instructions Form with airSlate SignNow?

Yes, airSlate SignNow offers dedicated customer support to assist you with any questions regarding the Irs 5500ez Instructions Form. Our team is available to help you navigate the platform and ensure that your document management process runs smoothly.

Get more for Irs 5500ez Instructions Form

- Health care directives minnesota form

- Petition for removal of minority emancipation form

- Automobile mississippi form

- Bill of sale la dps wesite louisianagov form

- Non stock corporations form

- How to file notice non responsibility nevada resident form

- Oregon warranty deed for husband and wife converting property from tenants in common to joint tenancy form

- Ndcc 23 065 17 form

Find out other Irs 5500ez Instructions Form

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile