Form 1120 FSC Rev December Irs 2016

What is the Form 1120 FSC Rev December IRS

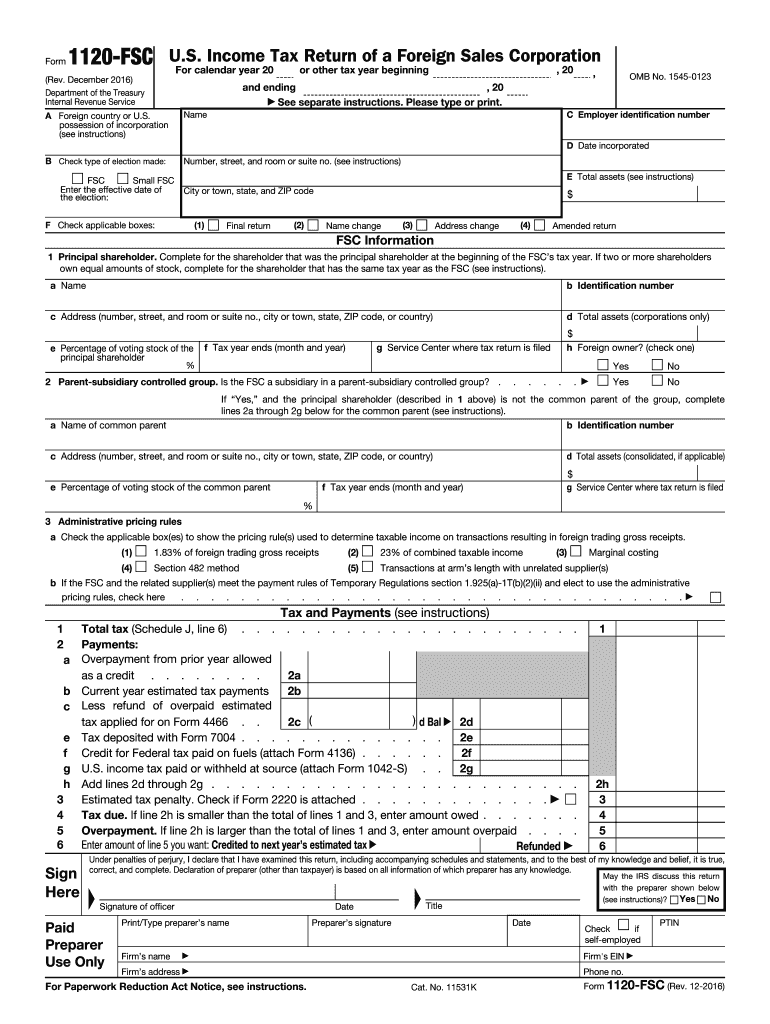

The Form 1120 FSC Rev December is a tax document specifically designed for foreign sales corporations (FSCs) as outlined by the Internal Revenue Service (IRS). This form is used to report the income, gains, losses, deductions, and credits of a foreign sales corporation. It is essential for FSCs to accurately complete this form to comply with U.S. tax laws and to take advantage of any applicable tax benefits. The form includes various sections that require detailed financial information, including operational income and expenses related to foreign sales activities.

How to use the Form 1120 FSC Rev December IRS

Using the Form 1120 FSC Rev December involves several steps. First, gather all necessary financial records, including income statements and expense reports related to foreign sales activities. Next, complete each section of the form accurately, ensuring that all figures are supported by documentation. Once the form is filled out, review it for any errors or omissions. Finally, submit the completed form to the IRS by the specified deadline to avoid penalties. It is advisable to keep a copy of the submitted form for your records.

Steps to complete the Form 1120 FSC Rev December IRS

Completing the Form 1120 FSC Rev December requires careful attention to detail. Follow these steps:

- Begin by entering the corporation's name, address, and Employer Identification Number (EIN) at the top of the form.

- Report all income from foreign sales in the appropriate sections, ensuring accuracy in the amounts reported.

- Deduct any allowable expenses related to the foreign sales activities, such as marketing and operational costs.

- Calculate the taxable income by subtracting total deductions from total income.

- Complete the necessary schedules that may apply, such as those for foreign tax credits.

- Sign and date the form, certifying that the information provided is accurate and complete.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 1120 FSC Rev December. These guidelines include instructions on eligibility, the information required for each section of the form, and the deadlines for submission. It is crucial to refer to the most current IRS publications related to the form to ensure compliance with any updates or changes in tax law. Adhering to these guidelines helps prevent errors that could lead to audits or penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1120 FSC Rev December are generally aligned with the corporate tax return due dates. Typically, the form must be filed by the fifteenth day of the fourth month following the end of the corporation’s tax year. For corporations operating on a calendar year, this means the form is due by April 15. It is essential to be aware of any extensions that may apply and to file any necessary requests for extensions in a timely manner to avoid late filing penalties.

Penalties for Non-Compliance

Failure to file the Form 1120 FSC Rev December on time or providing inaccurate information can result in significant penalties. The IRS may impose fines for late filings, which can accumulate quickly. Additionally, inaccuracies may lead to audits, further scrutiny, and potential legal ramifications. It is essential for corporations to ensure compliance with all filing requirements to avoid these penalties and maintain good standing with the IRS.

Quick guide on how to complete form 1120 fsc rev december 2016 irs

Complete Form 1120 FSC Rev December Irs seamlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely preserve it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your files quickly without delays. Manage Form 1120 FSC Rev December Irs on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and electronically sign Form 1120 FSC Rev December Irs with ease

- Find Form 1120 FSC Rev December Irs and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive details with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Bid farewell to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Form 1120 FSC Rev December Irs to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1120 fsc rev december 2016 irs

Create this form in 5 minutes!

How to create an eSignature for the form 1120 fsc rev december 2016 irs

How to generate an electronic signature for the Form 1120 Fsc Rev December 2016 Irs online

How to create an eSignature for your Form 1120 Fsc Rev December 2016 Irs in Chrome

How to generate an eSignature for putting it on the Form 1120 Fsc Rev December 2016 Irs in Gmail

How to create an eSignature for the Form 1120 Fsc Rev December 2016 Irs from your smart phone

How to make an eSignature for the Form 1120 Fsc Rev December 2016 Irs on iOS

How to create an eSignature for the Form 1120 Fsc Rev December 2016 Irs on Android OS

People also ask

-

What is the Form 1120 FSC Rev December Irs?

The Form 1120 FSC Rev December Irs is a tax form used by foreign sales corporations to report income, deductions, and credits to the IRS. It is essential for businesses operating internationally to comply with tax regulations and deduct relevant expenses. Understanding this form can help streamline your tax filing process while ensuring compliance.

-

How does airSlate SignNow assist with the Form 1120 FSC Rev December Irs?

airSlate SignNow simplifies the process of preparing and signing the Form 1120 FSC Rev December Irs by providing a user-friendly online platform. You can easily upload your documents, add necessary information, and eSign with a few clicks. This eliminates the hassles of manual paperwork and enhances efficiency for your tax filings.

-

Are there any specific features for tax-related documents in airSlate SignNow?

Yes, airSlate SignNow offers features tailored for tax-related documents, including the Form 1120 FSC Rev December Irs. Key features include customizable templates, a secure eSignature solution, and workflow automation to keep your tax documents organized. These features ensure that your tax preparation is not only efficient but also secure.

-

Is airSlate SignNow a cost-effective solution for managing Form 1120 FSC Rev December Irs?

Absolutely! airSlate SignNow offers cost-effective pricing plans that cater to businesses of all sizes, making it a smart choice for managing the Form 1120 FSC Rev December Irs. With various subscription options, you can find a plan that fits your budget while providing essential features for your document signing needs.

-

What integrations does airSlate SignNow offer for tax document management?

airSlate SignNow integrates seamlessly with many popular accounting and tax software products, enhancing your workflow for the Form 1120 FSC Rev December Irs. Whether you use QuickBooks, Xero, or other platforms, SignNow can help streamline your document management process. This level of integration ensures all your tax documents are easily accessible and manageable.

-

Can multiple users collaborate on the Form 1120 FSC Rev December Irs in airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate efficiently on the Form 1120 FSC Rev December Irs. You can invite team members to review, edit, and eSign documents in real-time. This collaboration feature helps facilitate teamwork, ensuring everyone is on the same page during the tax filing process.

-

How secure is airSlate SignNow for handling sensitive tax forms like the Form 1120 FSC Rev December Irs?

airSlate SignNow prioritizes security by implementing advanced encryption and compliance measures to protect sensitive documents, including the Form 1120 FSC Rev December Irs. Your data is stored securely, and access is controlled, ensuring that only authorized users can view or sign your documents. This commitment to security helps you confidently manage your tax filings.

Get more for Form 1120 FSC Rev December Irs

Find out other Form 1120 FSC Rev December Irs

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request