Form 1120 FSC Rev December IRS Gov Irs 2010

What is the Form 1120 FSC Rev December IRS gov Irs

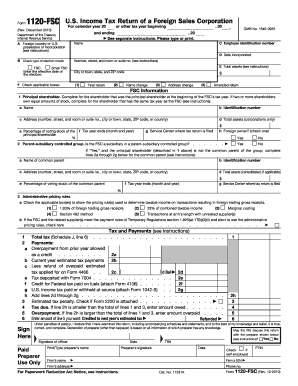

The Form 1120 FSC, officially known as the U.S. Income Tax Return for a Foreign Sales Corporation, is a tax document used by corporations that qualify as Foreign Sales Corporations (FSCs). This form is specifically designed for U.S. corporations that earn income from foreign sales. The form allows these corporations to report their income and claim certain tax benefits associated with their foreign sales activities. The IRS mandates the use of this form to ensure compliance with U.S. tax laws regarding international business operations.

How to use the Form 1120 FSC Rev December IRS gov Irs

Using the Form 1120 FSC involves several key steps. First, ensure that your corporation qualifies as a Foreign Sales Corporation under IRS guidelines. Next, gather all necessary financial information, including income statements and expense reports related to foreign sales. Complete the form by accurately entering this information in the designated sections. It is crucial to follow the IRS instructions carefully to avoid errors that could lead to penalties. After completing the form, submit it to the IRS by the specified deadline, ensuring that you retain a copy for your records.

Steps to complete the Form 1120 FSC Rev December IRS gov Irs

Completing the Form 1120 FSC requires a methodical approach. Begin by obtaining the latest version of the form from the IRS website. Follow these steps:

- Step 1: Enter your corporation's name, address, and Employer Identification Number (EIN).

- Step 2: Report your income from foreign sales in the appropriate section.

- Step 3: Deduct allowable expenses related to these sales.

- Step 4: Calculate your taxable income and any applicable tax credits.

- Step 5: Review the form for accuracy and completeness before submission.

Legal use of the Form 1120 FSC Rev December IRS gov Irs

The legal use of the Form 1120 FSC is governed by IRS regulations that outline the requirements for corporations operating as Foreign Sales Corporations. To be legally compliant, corporations must ensure that they meet the eligibility criteria set forth by the IRS. This includes maintaining proper records of foreign sales and adhering to the reporting requirements. Failure to comply with these regulations may result in penalties, including fines or disqualification from tax benefits associated with FSC status.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1120 FSC are crucial for compliance. Typically, the form is due on the fifteenth day of the third month following the end of your corporation's tax year. For corporations operating on a calendar year, this means the form is due by March 15. If additional time is needed, corporations may file for an extension, but it is important to note that any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Penalties for Non-Compliance

Non-compliance with the requirements associated with the Form 1120 FSC can lead to significant penalties. These may include monetary fines for late filing or inaccuracies on the form. Additionally, failure to provide required information can result in the denial of tax benefits. It is essential for corporations to understand these potential consequences and ensure timely and accurate submission of the form to maintain compliance with IRS regulations.

Quick guide on how to complete form 1120 fsc rev december 2010 irsgov irs

Prepare Form 1120 FSC Rev December IRS gov Irs easily on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly substitute to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Handle Form 1120 FSC Rev December IRS gov Irs on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest way to modify and electronically sign Form 1120 FSC Rev December IRS gov Irs effortlessly

- Locate Form 1120 FSC Rev December IRS gov Irs and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your needs in document management in just a few clicks from any device you prefer. Modify and electronically sign Form 1120 FSC Rev December IRS gov Irs and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1120 fsc rev december 2010 irsgov irs

Create this form in 5 minutes!

How to create an eSignature for the form 1120 fsc rev december 2010 irsgov irs

The best way to generate an eSignature for your PDF file in the online mode

The best way to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

How to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

How to create an electronic signature for a PDF on Android

People also ask

-

What is Form 1120 FSC Rev December IRS gov Irs?

Form 1120 FSC Rev December IRS gov Irs is a tax return for foreign sales corporations that allows for the reporting of income and tax deductions specific to their operations. Completing this form correctly is crucial for compliance with IRS regulations, and it can signNowly impact your tax liabilities. Using our service, you can ensure that your Form 1120 FSC Rev December IRS gov Irs is filled out accurately and efficiently.

-

How does airSlate SignNow simplify the signing process for Form 1120 FSC Rev December IRS gov Irs?

airSlate SignNow streamlines the signing process by allowing users to eSign Form 1120 FSC Rev December IRS gov Irs digitally, making it faster and more convenient. Our platform enables real-time tracking of document status, ensuring you always know who has signed. This digital approach reduces processing time and improves overall efficiency.

-

What are the pricing options for using airSlate SignNow to complete Form 1120 FSC Rev December IRS gov Irs?

airSlate SignNow offers flexible pricing plans designed to suit various business sizes and needs. You can choose between monthly and annual subscriptions, each providing access to our full suite of features, including eSigning and document management for Form 1120 FSC Rev December IRS gov Irs. Check our website for specific pricing details to find the plan that best fits your budget.

-

What features does airSlate SignNow provide for managing Form 1120 FSC Rev December IRS gov Irs?

Our platform offers numerous features for efficiently managing Form 1120 FSC Rev December IRS gov Irs, including templates, document sharing, and eSigning capabilities. You can easily store, access, and edit your tax forms directly on the platform, ensuring compliance and maximizing productivity. Additionally, we provide secure storage and audit trails for all your signed documents.

-

Can airSlate SignNow integrate with other software when filing Form 1120 FSC Rev December IRS gov Irs?

Yes, airSlate SignNow seamlessly integrates with various accounting and business management software. This ensures that you can efficiently manage your Form 1120 FSC Rev December IRS gov Irs alongside your other business processes. Our integrations allow for streamlined data transfer, saving you time and reducing the chance for errors.

-

What are the benefits of using airSlate SignNow for Form 1120 FSC Rev December IRS gov Irs?

Using airSlate SignNow for Form 1120 FSC Rev December IRS gov Irs offers numerous benefits, including enhanced efficiency, improved compliance, and reduced paperwork. Our electronic signature solution accelerates the signing process, allowing you to focus more on your business. Additionally, our platform provides security features that protect sensitive tax information.

-

Is there a free trial available for airSlate SignNow to handle Form 1120 FSC Rev December IRS gov Irs?

Yes, airSlate SignNow offers a free trial for new users looking to handle Form 1120 FSC Rev December IRS gov Irs. This allows you to explore our features and determine how our solutions can benefit your business before committing to a subscription. Sign up on our website to take advantage of the trial and start streamlining your document processes.

Get more for Form 1120 FSC Rev December IRS gov Irs

- Brick mason contract for contractor indiana form

- Roofing contract for contractor indiana form

- Electrical contract for contractor indiana form

- Sheetrock drywall contract for contractor indiana form

- Flooring contract for contractor indiana form

- Agreement or contract for deed for sale and purchase of real estate aka land or executory contract indiana form

- Notice of intent to enforce forfeiture provisions of contact for deed indiana form

- In final notice 497306657 form

Find out other Form 1120 FSC Rev December IRS gov Irs

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later