481 10 Form 2013

What is the 481 10 Form

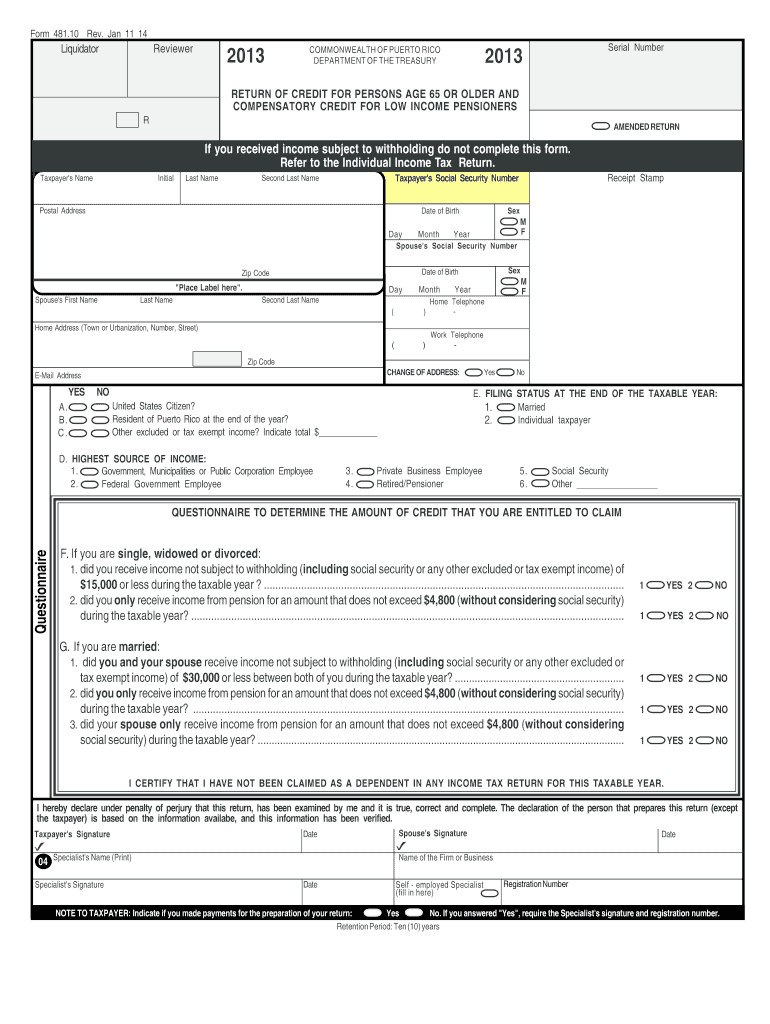

The 481 10 Form is a specific document used primarily for reporting certain financial information related to tax obligations. This form is essential for individuals and businesses to ensure compliance with IRS regulations. It serves as a means to disclose income, deductions, and other relevant financial data that may impact tax calculations. Understanding the purpose and requirements of the 481 10 Form is crucial for accurate tax reporting and avoiding potential penalties.

How to use the 481 10 Form

Using the 481 10 Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and expense records. Next, carefully fill out the form, ensuring that all information is accurate and complete. Pay close attention to any specific instructions provided by the IRS regarding the form. Once completed, review the form for any errors before submitting it to the appropriate tax authority. Utilizing digital tools can streamline this process, allowing for easy editing and secure submission.

Steps to complete the 481 10 Form

Completing the 481 10 Form requires a systematic approach to ensure accuracy. Follow these steps:

- Gather all relevant financial documents, such as W-2s, 1099s, and receipts.

- Begin filling out the form with personal information, including your name, address, and Social Security number.

- Enter income details, ensuring that all sources of income are reported.

- List deductions and credits that apply to your situation, following IRS guidelines.

- Review the completed form for any discrepancies or missing information.

- Submit the form electronically or via mail to the IRS, depending on your preference.

Legal use of the 481 10 Form

The legal use of the 481 10 Form is governed by IRS regulations. It is essential to ensure that the information provided is truthful and accurate, as providing false information can lead to severe penalties. The form must be submitted within the designated filing deadlines to maintain compliance with tax laws. Utilizing a reliable eSignature solution can enhance the legal validity of your submission, ensuring that all signatures are properly authenticated and recorded.

Who Issues the Form

The 481 10 Form is issued by the Internal Revenue Service (IRS), the U.S. government agency responsible for tax collection and enforcement of tax laws. The IRS provides guidelines and instructions for completing the form, ensuring that taxpayers understand their obligations. It is important to refer to the IRS website or official publications for the most current version of the form and any updates related to its use.

Filing Deadlines / Important Dates

Filing deadlines for the 481 10 Form are critical to avoid penalties. Typically, the form must be submitted by April fifteenth of the tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should stay informed about any changes to these dates, as the IRS occasionally adjusts deadlines. Marking your calendar with these important dates can help ensure timely submission and compliance.

Quick guide on how to complete 481 10 form

Complete 481 10 Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as a suitable environmentally friendly alternative to conventional printed and signed papers, enabling you to obtain the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents rapidly without delays. Manage 481 10 Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

How to modify and electronically sign 481 10 Form effortlessly

- Obtain 481 10 Form and click on Get Form to begin.

- Utilize the tools we provide to finish your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to finalize your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate issues of lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign 481 10 Form and ensure efficient communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 481 10 form

Create this form in 5 minutes!

How to create an eSignature for the 481 10 form

How to generate an electronic signature for the 481 10 Form online

How to create an electronic signature for your 481 10 Form in Chrome

How to generate an electronic signature for putting it on the 481 10 Form in Gmail

How to make an eSignature for the 481 10 Form from your mobile device

How to create an electronic signature for the 481 10 Form on iOS

How to generate an eSignature for the 481 10 Form on Android

People also ask

-

What is the 481 10 Form and how does airSlate SignNow support it?

The 481 10 Form is a crucial document often used for various business purposes. With airSlate SignNow, you can easily create, send, and eSign the 481 10 Form, ensuring a streamlined process that saves time and enhances efficiency. Our platform provides templates that simplify the completion of this form, allowing you to focus on your business.

-

How much does it cost to use airSlate SignNow for the 481 10 Form?

airSlate SignNow offers competitive pricing plans tailored to meet your business needs. Whether you’re processing a few 481 10 Forms or managing high volumes, our pricing is designed to be cost-effective. Check our website for the latest subscription options and discover how affordable eSigning can be.

-

What features does airSlate SignNow offer for managing the 481 10 Form?

airSlate SignNow provides several features to enhance the management of the 481 10 Form, including customizable templates, secure eSigning, and real-time tracking. These features ensure that you can easily handle the document workflow while maintaining compliance and security. The user-friendly interface also allows for quick edits and sharing.

-

Can I integrate airSlate SignNow with other software for the 481 10 Form?

Yes, airSlate SignNow seamlessly integrates with a variety of software applications to enhance the handling of the 481 10 Form. You can connect it with CRM systems, cloud storage services, and other productivity tools to streamline your workflow. This integration capability helps centralize your document processes.

-

Is it safe to eSign the 481 10 Form using airSlate SignNow?

Absolutely! airSlate SignNow employs advanced security protocols to protect your data while eSigning the 481 10 Form. Our platform is compliant with industry standards, ensuring that your information remains confidential and secure throughout the signing process.

-

Can multiple users access the 481 10 Form in airSlate SignNow?

Yes, airSlate SignNow allows multiple users to access and collaborate on the 481 10 Form. This feature is particularly useful for teams that need to review or sign the document simultaneously. You can easily manage user permissions to control who can edit or sign the form.

-

What benefits does airSlate SignNow provide for businesses using the 481 10 Form?

Using airSlate SignNow for the 481 10 Form brings numerous benefits, including increased efficiency, reduced paper waste, and faster turnaround times. Businesses can expedite document processes and improve overall productivity by leveraging our digital signing solutions. Additionally, the ease of use ensures that anyone can navigate the platform without extensive training.

Get more for 481 10 Form

Find out other 481 10 Form

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word