Employees Owned Special Corporation Informative Tax Return Hacienda Gobierno 1999

What is the Employees Owned Special Corporation Informative Tax Return Hacienda Gobierno

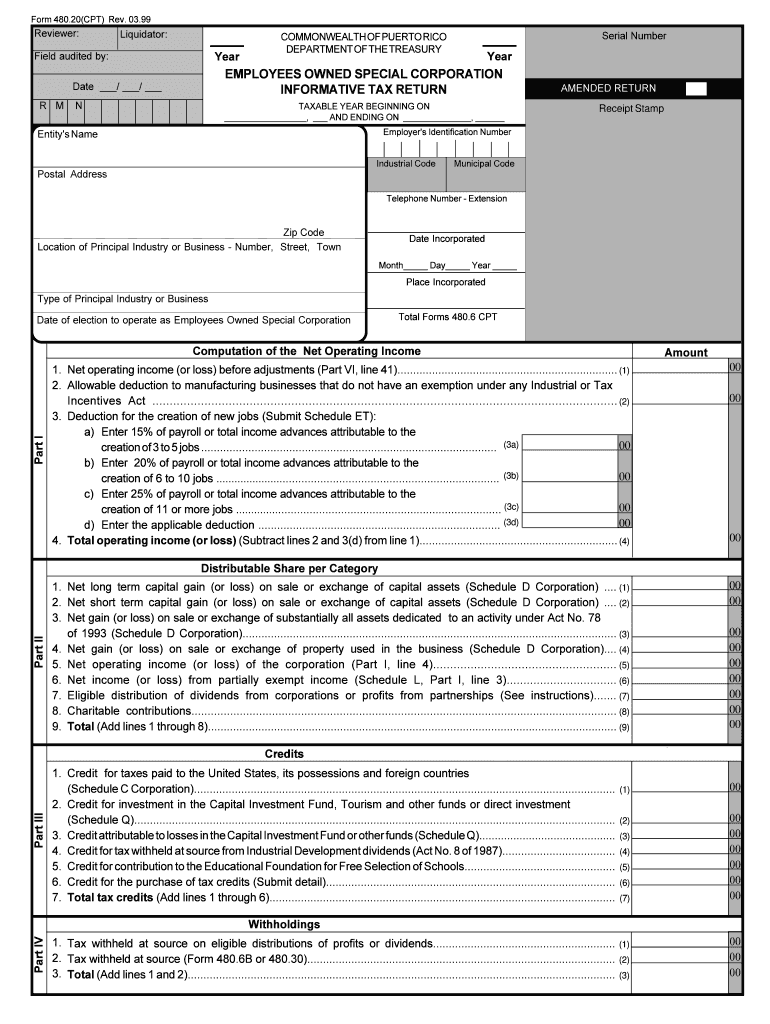

The Employees Owned Special Corporation Informative Tax Return Hacienda Gobierno is a specific tax form designed for employee-owned corporations in the United States. This form serves to report financial information related to the operations of these corporations, ensuring compliance with federal tax regulations. It is essential for maintaining transparency and accountability within employee-owned businesses, allowing the government to monitor their economic impact and ensure proper tax collection.

Steps to complete the Employees Owned Special Corporation Informative Tax Return Hacienda Gobierno

Completing the Employees Owned Special Corporation Informative Tax Return Hacienda Gobierno involves several key steps:

- Gather necessary financial documents, including profit and loss statements, balance sheets, and any relevant tax documentation.

- Fill out the form accurately, ensuring all sections are completed with the correct figures and information.

- Review the completed form for any errors or omissions before submission.

- Submit the form through the appropriate channel, whether online or via mail, ensuring it is sent to the correct governmental office.

Legal use of the Employees Owned Special Corporation Informative Tax Return Hacienda Gobierno

The legal use of the Employees Owned Special Corporation Informative Tax Return Hacienda Gobierno is crucial for compliance with U.S. tax laws. This form must be filled out in accordance with the guidelines set forth by the Internal Revenue Service (IRS). Failure to comply with these regulations can result in penalties or legal repercussions for the corporation. It is important to ensure that all information provided is accurate and truthful to maintain the corporation's legal standing.

Filing Deadlines / Important Dates

Filing deadlines for the Employees Owned Special Corporation Informative Tax Return Hacienda Gobierno vary based on the corporation's fiscal year. Typically, corporations must submit their tax returns by the fifteenth day of the fourth month following the end of their fiscal year. It is essential to be aware of these deadlines to avoid late fees and ensure timely processing of the return.

Required Documents

To complete the Employees Owned Special Corporation Informative Tax Return Hacienda Gobierno, several documents are required:

- Financial statements, including income statements and balance sheets.

- Previous tax returns for reference and accuracy.

- Documentation of employee ownership percentages and any changes in ownership.

- Records of any distributions or dividends paid to employees.

IRS Guidelines

The IRS provides specific guidelines for completing the Employees Owned Special Corporation Informative Tax Return Hacienda Gobierno. These guidelines outline the necessary information to include, the format for reporting, and any additional disclosures required. Adhering to these guidelines is vital for ensuring that the form is accepted and processed without issues.

Quick guide on how to complete employees owned special corporation informative tax return hacienda gobierno

Finish Employees Owned Special Corporation Informative Tax Return Hacienda Gobierno effortlessly on any device

Managing documents online has become widely adopted by companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, enabling you to access the correct form and securely store it digitally. airSlate SignNow provides all the resources needed to swiftly create, modify, and electronically sign your documents without any holdups. Handle Employees Owned Special Corporation Informative Tax Return Hacienda Gobierno on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and eSign Employees Owned Special Corporation Informative Tax Return Hacienda Gobierno with ease

- Locate Employees Owned Special Corporation Informative Tax Return Hacienda Gobierno and click on Get Form to begin.

- Make use of the tools offered to finalize your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools provided by airSlate SignNow designed specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and hit the Done button to save your modifications.

- Choose how you prefer to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Employees Owned Special Corporation Informative Tax Return Hacienda Gobierno to ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct employees owned special corporation informative tax return hacienda gobierno

Create this form in 5 minutes!

How to create an eSignature for the employees owned special corporation informative tax return hacienda gobierno

How to generate an eSignature for the Employees Owned Special Corporation Informative Tax Return Hacienda Gobierno in the online mode

How to make an electronic signature for the Employees Owned Special Corporation Informative Tax Return Hacienda Gobierno in Chrome

How to make an eSignature for signing the Employees Owned Special Corporation Informative Tax Return Hacienda Gobierno in Gmail

How to make an eSignature for the Employees Owned Special Corporation Informative Tax Return Hacienda Gobierno right from your mobile device

How to create an eSignature for the Employees Owned Special Corporation Informative Tax Return Hacienda Gobierno on iOS

How to create an electronic signature for the Employees Owned Special Corporation Informative Tax Return Hacienda Gobierno on Android devices

People also ask

-

What is the Employees Owned Special Corporation Informative Tax Return Hacienda Gobierno?

The Employees Owned Special Corporation Informative Tax Return Hacienda Gobierno is a specific tax form required for companies operating as employee-owned corporations. This form helps ensure compliance with tax regulations and accurate reporting of income and expenses. Proper completion of this return can signNowly impact a corporation's tax obligations.

-

How can airSlate SignNow assist with the Employees Owned Special Corporation Informative Tax Return Hacienda Gobierno?

airSlate SignNow offers a streamlined platform for creating, signing, and managing the Employees Owned Special Corporation Informative Tax Return Hacienda Gobierno. By digitizing the signing process, users can ensure their documents are completed efficiently and securely. This reduces the time spent on paperwork while ensuring regulatory compliance.

-

Is there a cost associated with using airSlate SignNow for tax returns?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of individuals and businesses. The cost varies based on features, usage, and the number of users. Investing in this service can save you time and reduce errors when filing important documents like the Employees Owned Special Corporation Informative Tax Return Hacienda Gobierno.

-

What features does airSlate SignNow provide for tax document management?

airSlate SignNow includes features such as template creation, real-time tracking, secure storage, and eSigning capabilities. These tools enable you to effectively manage the Employees Owned Special Corporation Informative Tax Return Hacienda Gobierno and other tax documents. Efficient management promotes accuracy and helps you stay organized throughout the tax season.

-

Will airSlate SignNow integrate with my existing tax software for smooth processing?

Yes, airSlate SignNow supports integrations with various tax software solutions, enhancing your workflow when preparing the Employees Owned Special Corporation Informative Tax Return Hacienda Gobierno. Seamless integration allows for easy import and export of documents. This ensures all your information is readily available and reduces the chances of errors.

-

What are the benefits of eSigning the Employees Owned Special Corporation Informative Tax Return Hacienda Gobierno?

ESigning the Employees Owned Special Corporation Informative Tax Return Hacienda Gobierno speeds up the process, making it easier for all parties involved to approve documents quickly. It also provides a secure, legally binding way to sign documents remotely, eliminating the need for paper, ink, and physical storage. The convenience of eSigning can save valuable time and resources for your business.

-

How can I ensure the security of my documents on airSlate SignNow?

AirSlate SignNow prioritizes document security with advanced encryption, multi-factor authentication, and secure data storage. This ensures the confidentiality and integrity of sensitive documents like the Employees Owned Special Corporation Informative Tax Return Hacienda Gobierno. You can trust that your information is protected at all times while using our platform.

Get more for Employees Owned Special Corporation Informative Tax Return Hacienda Gobierno

- Dd form 2088 statement of ecclesiastical endorsement march 2004 vko va ngb army

- Da form 5646

- Verification of clinical competencies for critical care nursing skill identifier si 8a da form 7653 apr 2009 apd army

- Verification of clinical competencies for emergency nursing skill identifier si m5 da form 7654 apr 2009 apd army

- Dd1857 form

- Da 2590 form

- Army funds verification form

- Ae form 190

Find out other Employees Owned Special Corporation Informative Tax Return Hacienda Gobierno

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template