EMPLOYEES OWNED SPECIAL CORPORATION INFORMATIVE 2018

What is the employees owned special corporation informative

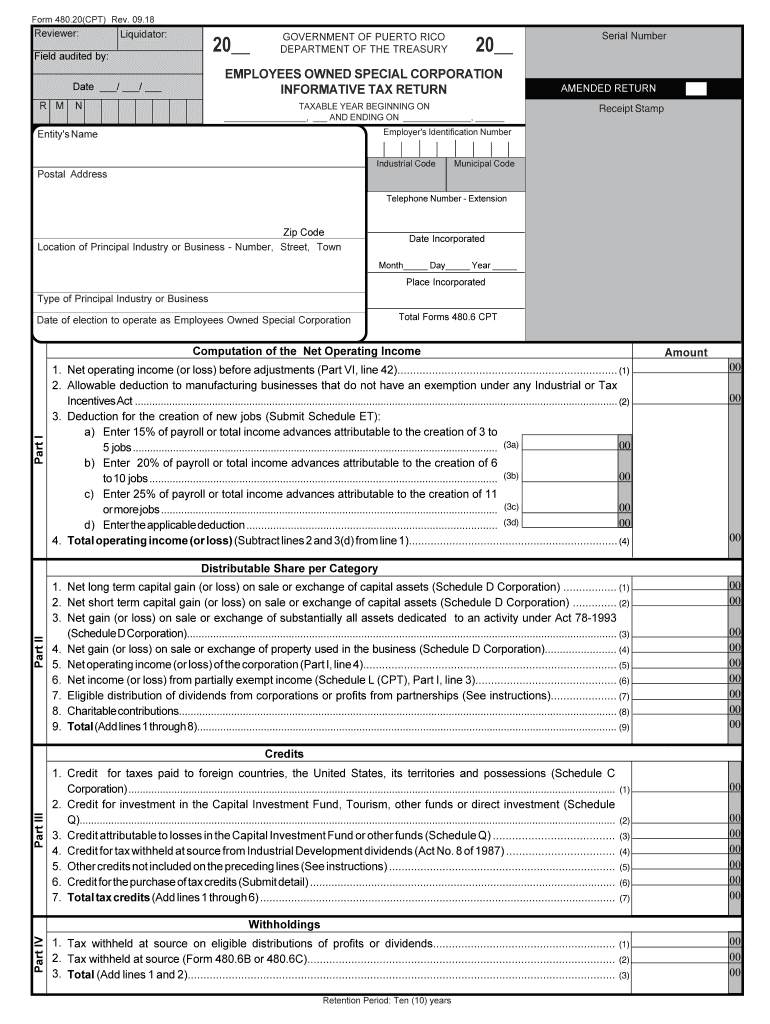

The employees owned special corporation informative serves as a crucial document for businesses structured as employee-owned corporations. This form outlines the rights, responsibilities, and benefits of employees who hold shares in the corporation. It is designed to provide clarity on how the corporation operates, the voting rights of employees, and how profits are distributed among shareholders. Understanding this document is essential for employees to engage effectively in their roles within the corporation.

How to use the employees owned special corporation informative

Using the employees owned special corporation informative involves several steps to ensure that all relevant information is accurately captured. First, gather necessary details about the corporation, including its structure and employee ownership percentages. Next, fill out the form with precise information, ensuring that all sections are completed. It is advisable to review the document thoroughly before submission to avoid any errors that could lead to complications. Once completed, the form can be submitted to the appropriate regulatory bodies or kept for internal records.

Steps to complete the employees owned special corporation informative

Completing the employees owned special corporation informative requires a systematic approach. Follow these steps:

- Gather all necessary information about the corporation, including its name, address, and ownership structure.

- Identify the employees who are shareholders and their respective ownership percentages.

- Fill out the form, ensuring all required fields are accurately completed.

- Review the form for any errors or omissions.

- Submit the completed form to the designated authority or maintain it within the company records.

Legal use of the employees owned special corporation informative

The employees owned special corporation informative must be used in compliance with relevant legal frameworks. This includes adherence to state and federal regulations governing employee ownership and corporate governance. The form serves as a legal document that outlines the rights of employee shareholders, making it essential for protecting their interests. Proper use of this form can help prevent disputes and ensure that all parties are aware of their rights and obligations within the corporation.

Key elements of the employees owned special corporation informative

Several key elements should be included in the employees owned special corporation informative to ensure its effectiveness:

- Company information: Name, address, and contact details of the corporation.

- Ownership structure: Details on employee share ownership percentages.

- Rights of shareholders: Explanation of voting rights and profit distribution.

- Corporate governance: Outline of how decisions are made within the corporation.

- Compliance information: References to relevant laws and regulations.

Eligibility Criteria

To utilize the employees owned special corporation informative, certain eligibility criteria must be met. Generally, the corporation must be structured as an employee-owned entity, meaning that a significant portion of its shares is owned by its employees. Additionally, the corporation should comply with state laws regarding employee ownership and governance. Understanding these criteria is essential for ensuring that the corporation is recognized as an employee-owned special corporation.

Quick guide on how to complete employees owned special corporation informative

Effortlessly prepare EMPLOYEES OWNED SPECIAL CORPORATION INFORMATIVE on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers a sustainable alternative to traditional printed and signed papers, enabling you to locate the right template and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents promptly without any delays. Manage EMPLOYEES OWNED SPECIAL CORPORATION INFORMATIVE using the airSlate SignNow apps for Android or iOS and enhance your document-related tasks today.

The simplest way to modify and eSign EMPLOYEES OWNED SPECIAL CORPORATION INFORMATIVE effortlessly

- Locate EMPLOYEES OWNED SPECIAL CORPORATION INFORMATIVE and click Obtain Form to begin.

- Utilize the tools at your disposal to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers for that purpose.

- Create your signature using the Sign tool, which only takes a few seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Complete button to preserve your changes.

- Select your preferred method of sending your form, whether by email, SMS, invite link, or download it to your computer.

Don't worry about misplaced files, tedious form searches, or mistakes that require reprinting documents. airSlate SignNow covers all your document management needs in just a few clicks from any device of your choice. Edit and eSign EMPLOYEES OWNED SPECIAL CORPORATION INFORMATIVE to ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct employees owned special corporation informative

Create this form in 5 minutes!

How to create an eSignature for the employees owned special corporation informative

How to create an eSignature for your Employees Owned Special Corporation Informative in the online mode

How to generate an electronic signature for the Employees Owned Special Corporation Informative in Google Chrome

How to make an eSignature for putting it on the Employees Owned Special Corporation Informative in Gmail

How to create an eSignature for the Employees Owned Special Corporation Informative from your smartphone

How to generate an eSignature for the Employees Owned Special Corporation Informative on iOS

How to generate an electronic signature for the Employees Owned Special Corporation Informative on Android devices

People also ask

-

What is an Employees Owned Special Corporation Informative?

An Employees Owned Special Corporation Informative refers to a business structure where employees have a signNow stake in ownership through various means, fostering collaboration and engagement. This model promotes transparency and can enhance job satisfaction while also aligning employee interests with business success.

-

How does airSlate SignNow benefit Employees Owned Special Corporations?

airSlate SignNow provides an efficient and streamlined eSignature solution tailored for Employees Owned Special Corporations. By simplifying document workflows, it enables timely approvals and maintains compliance, allowing businesses to focus on growth and collaboration among employee-owners.

-

What features does airSlate SignNow offer for Employees Owned Special Corporations?

airSlate SignNow offers a range of features vital for Employees Owned Special Corporations, including customizable templates, advanced security measures, and real-time collaboration tools. These features empower businesses to manage and execute critical documents securely and efficiently.

-

Is airSlate SignNow cost-effective for small Employees Owned Special Corporations?

Yes, airSlate SignNow is designed to be a cost-effective solution for small Employees Owned Special Corporations. With flexible pricing plans, companies can choose a package that aligns with their budget while still accessing premium features that enhance their document management processes.

-

Can airSlate SignNow integrate with other tools used by Employees Owned Special Corporations?

Absolutely! airSlate SignNow seamlessly integrates with a variety of popular applications that Employees Owned Special Corporations often use, such as CRM systems, project management tools, and cloud storage services. This integration enhances productivity by enabling smooth workflows across different platforms.

-

How does airSlate SignNow ensure the security of documents for Employees Owned Special Corporations?

airSlate SignNow prioritizes the security of documents for Employees Owned Special Corporations by implementing advanced encryption protocols and secure access controls. We ensure that sensitive information remains confidential, providing peace of mind for businesses and their employee-owners alike.

-

What support resources does airSlate SignNow provide for Employees Owned Special Corporations?

airSlate SignNow offers comprehensive support resources tailored for Employees Owned Special Corporations, including a detailed knowledge base, live chat assistance, and dedicated account managers. Our goal is to ensure that businesses have all the necessary tools and guidance to thrive.

Get more for EMPLOYEES OWNED SPECIAL CORPORATION INFORMATIVE

- Mass atomic worksheet form

- Assessment report outline university of kentucky edsrc uky form

- Change of ownership form virgin mobile

- Directv change of ownership form

- Affidavit regarding custody and identity sharpschool form

- Dust control permit closure form clark county nevada clarkcountynv

- Grade 1 assessments form

- Spad data collection form rt3119b railway undertakings

Find out other EMPLOYEES OWNED SPECIAL CORPORATION INFORMATIVE

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template

- Electronic signature Wyoming Indemnity Agreement Template Free

- Electronic signature Iowa Bookkeeping Contract Safe

- Electronic signature New York Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Computer

- Electronic signature South Carolina Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Easy

- How To Electronic signature South Carolina Bookkeeping Contract

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple