W 4P Psers Psers State Pa 2012

What is the W-4P PSERS State PA?

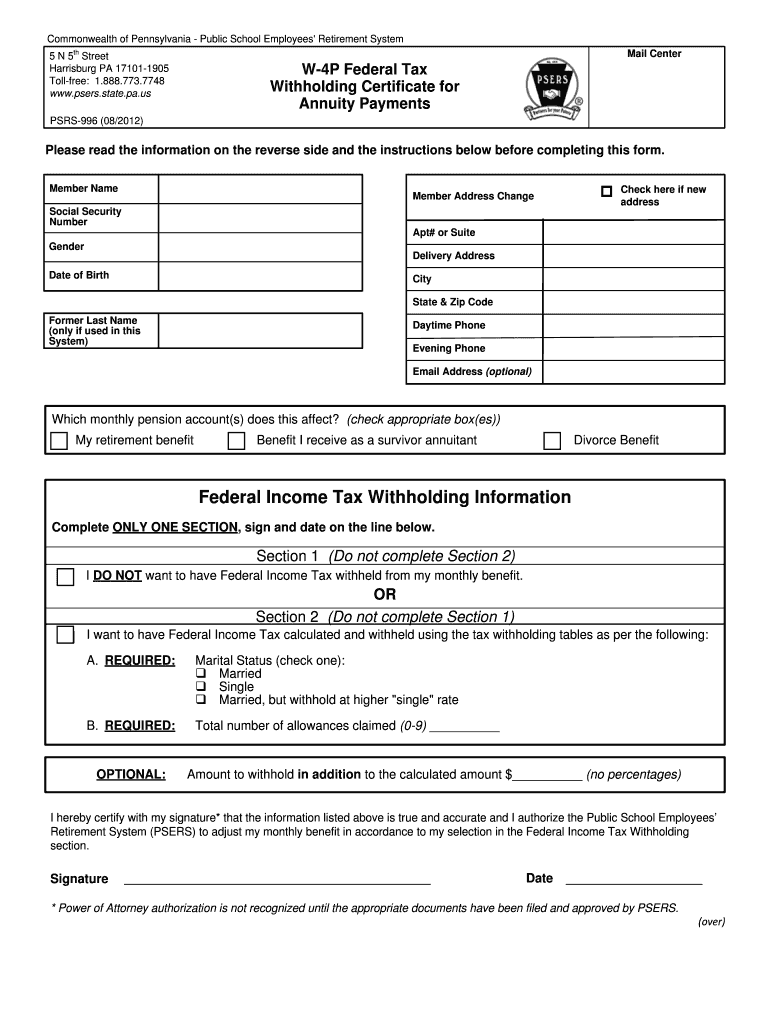

The W-4P PSERS State PA form is a specific document used by individuals who receive pension payments from the Pennsylvania State Employees' Retirement System (PSERS). This form allows recipients to indicate their withholding preferences for state income taxes. By completing the W-4P, pensioners can ensure that the correct amount of tax is withheld from their monthly pension payments, helping them manage their tax liabilities effectively.

How to use the W-4P PSERS State PA

Using the W-4P PSERS State PA form involves a few straightforward steps. First, download the form from the PSERS website or obtain a physical copy from your retirement services office. Next, fill in your personal information, including your name, address, and Social Security number. Indicate your desired withholding amount by selecting the appropriate options provided on the form. Once completed, submit the form to PSERS either by mail or electronically, depending on the submission methods available.

Steps to complete the W-4P PSERS State PA

Completing the W-4P PSERS State PA form requires careful attention to detail. Follow these steps:

- Download or request a copy of the form.

- Fill in your personal information accurately.

- Choose your withholding preferences by marking the appropriate boxes.

- Review the completed form for any errors or omissions.

- Submit the form to PSERS through the designated method.

Legal use of the W-4P PSERS State PA

The W-4P PSERS State PA form is legally binding when properly completed and submitted. It complies with state tax regulations, ensuring that pensioners meet their tax obligations. For the form to be considered valid, it must be signed and dated by the individual submitting it. This signature verifies that the information provided is accurate and that the individual understands the implications of their withholding choices.

Key elements of the W-4P PSERS State PA

Key elements of the W-4P PSERS State PA form include:

- Personal Information: Name, address, and Social Security number.

- Withholding Preferences: Options to select the amount of tax to withhold.

- Signature: Required to validate the form.

- Date: Indicates when the form was completed.

State-specific rules for the W-4P PSERS State PA

Each state has its own regulations regarding tax withholding. In Pennsylvania, the W-4P PSERS State PA form must adhere to state income tax laws. It is important for pensioners to stay informed about any changes to withholding rules that may affect their tax obligations. Regularly reviewing state tax guidelines can help ensure compliance and avoid potential issues with tax authorities.

Quick guide on how to complete w 4p psers psers state pa

Complete W 4P Psers Psers State Pa with ease on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely archive it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage W 4P Psers Psers State Pa on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest method to modify and eSign W 4P Psers Psers State Pa without effort

- Find W 4P Psers Psers State Pa and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important parts of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Craft your signature with the Sign tool, which takes seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and eSign W 4P Psers Psers State Pa and ensure outstanding communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct w 4p psers psers state pa

Create this form in 5 minutes!

How to create an eSignature for the w 4p psers psers state pa

How to generate an eSignature for your W 4p Psers Psers State Pa in the online mode

How to generate an electronic signature for your W 4p Psers Psers State Pa in Chrome

How to create an electronic signature for signing the W 4p Psers Psers State Pa in Gmail

How to make an electronic signature for the W 4p Psers Psers State Pa right from your smart phone

How to make an electronic signature for the W 4p Psers Psers State Pa on iOS devices

How to create an electronic signature for the W 4p Psers Psers State Pa on Android OS

People also ask

-

What is the W 4P Psers Psers State Pa form?

The W 4P Psers Psers State Pa form is specifically designed for Pennsylvania state employees to declare their withholding preferences. This form allows you to inform your employer about the number of allowances you wish to claim for state tax purposes. Proper completion of the W 4P Psers Psers State Pa is vital to ensure you are taxed accurately.

-

How does airSlate SignNow streamline the signing process for W 4P Psers Psers State Pa?

AirSlate SignNow simplifies the signing process for the W 4P Psers Psers State Pa form by allowing users to send, receive, and eSign documents electronically. This ensures that you can complete your tax forms quickly and securely from anywhere, eliminating the need for paper-based processes. Our intuitive platform enhances productivity by reducing turnaround time.

-

What are the costs associated with using airSlate SignNow for W 4P Psers Psers State Pa?

AirSlate SignNow offers affordable pricing plans tailored to fit organizations of all sizes that need to manage forms like the W 4P Psers Psers State Pa. We provide a free trial so you can explore our features before committing. Additionally, our pricing is designed to ensure that businesses can enjoy all the benefits of eSigning without breaking the bank.

-

What features does airSlate SignNow offer for managing W 4P Psers Psers State Pa forms?

AirSlate SignNow comes with a variety of features for managing W 4P Psers Psers State Pa forms, including customizable templates, advanced tracking, and reminders. You can easily create, send, and store your documents securely. Additionally, integration with other software applications enhances your workflow further.

-

How do I integrate airSlate SignNow with my existing HR software for W 4P Psers Psers State Pa?

Integrating airSlate SignNow with your existing HR software is straightforward and can signNowly enhance how you handle W 4P Psers Psers State Pa forms. Our platform supports numerous integrations through APIs, allowing you to synchronize data seamlessly. This reduces errors and centralizes your document management for better efficiency.

-

Can airSlate SignNow help me track the status of my W 4P Psers Psers State Pa documents?

Yes, airSlate SignNow allows you to track the status of your W 4P Psers Psers State Pa documents in real time. You will receive notifications for each step of the signing process, so you know when your forms have been viewed, signed, or completed. This transparency helps you manage your document workflow effectively.

-

What benefits do I gain from using airSlate SignNow for W 4P Psers Psers State Pa?

Using airSlate SignNow for your W 4P Psers Psers State Pa forms offers multiple benefits, including increased efficiency, enhanced security, and reduced paperwork. Our solution is designed to help you save time while ensuring that your sensitive information is protected. You’ll also have access to digital storage, making it easy to retrieve documents when needed.

Get more for W 4P Psers Psers State Pa

Find out other W 4P Psers Psers State Pa

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online