How to Get a Pa Tax Exempt Number Form 2012

What is the How To Get A Pa Tax Exempt Number Form

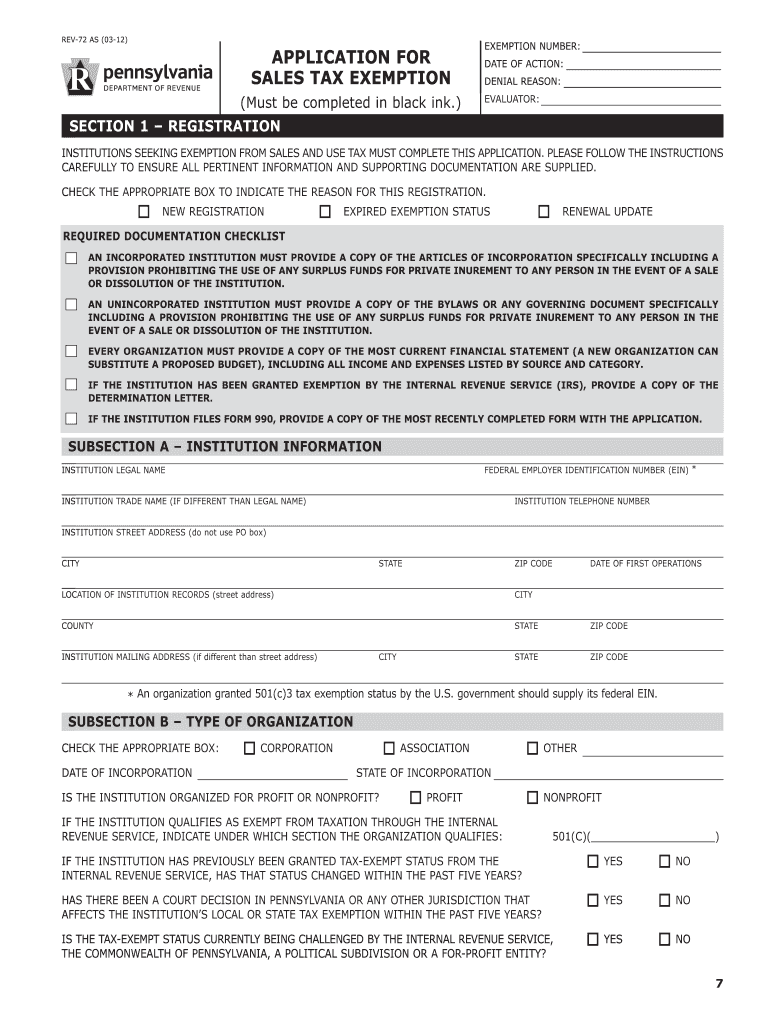

The How To Get A Pa Tax Exempt Number Form is a crucial document used by organizations in Pennsylvania to apply for tax-exempt status. This form allows qualifying entities, such as non-profits and certain businesses, to avoid paying sales tax on purchases related to their exempt activities. Understanding this form is essential for any organization seeking to benefit from tax exemptions in Pennsylvania.

Steps to complete the How To Get A Pa Tax Exempt Number Form

Completing the How To Get A Pa Tax Exempt Number Form involves several important steps:

- Gather necessary information about your organization, including its legal name, address, and federal tax identification number.

- Provide details about the nature of your organization and its purpose, ensuring it aligns with the criteria for tax exemption.

- Complete the form accurately, ensuring all sections are filled out without omissions.

- Review the form for errors or missing information before submission.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal use of the How To Get A Pa Tax Exempt Number Form

The legal use of the How To Get A Pa Tax Exempt Number Form is governed by Pennsylvania state tax laws. Organizations must ensure they meet the eligibility criteria for tax exemption, which typically includes being a non-profit or charitable entity. Using this form improperly or submitting false information can lead to penalties, including the revocation of tax-exempt status and potential fines.

Eligibility Criteria

To qualify for a Pennsylvania tax exempt number, organizations must meet specific eligibility criteria. Generally, these include:

- Being organized as a non-profit or charitable organization.

- Having a defined purpose that serves the public interest, such as educational, religious, or charitable activities.

- Maintaining compliance with federal and state regulations regarding tax-exempt entities.

Required Documents

When applying for the How To Get A Pa Tax Exempt Number Form, several documents may be required to support your application. These typically include:

- Proof of your organization’s legal status, such as articles of incorporation or bylaws.

- A copy of your federal tax-exempt determination letter from the IRS, if applicable.

- Financial statements or budgets that demonstrate the organization’s operations and funding sources.

Form Submission Methods

The How To Get A Pa Tax Exempt Number Form can be submitted through various methods, depending on the preferences of the organization and the requirements set by the Pennsylvania Department of Revenue. Common submission methods include:

- Online submission through the Pennsylvania Department of Revenue’s official website.

- Mailing a completed paper form to the appropriate state office.

- In-person submission at designated state offices for immediate processing.

Quick guide on how to complete how to get a pa tax exempt number 2012 form

Complete How To Get A Pa Tax Exempt Number Form effortlessly on any device

Online document management has become popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed papers, as you can locate the appropriate form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without interruptions. Manage How To Get A Pa Tax Exempt Number Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centered task today.

How to edit and eSign How To Get A Pa Tax Exempt Number Form with ease

- Locate How To Get A Pa Tax Exempt Number Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using features that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and has the same legal validity as a traditional handwritten signature.

- Review all the information and click the Done button to save your changes.

- Choose your preferred method for submitting your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors requiring new copies to be printed. airSlate SignNow takes care of all your document management needs with just a few clicks from any device you choose. Edit and electronically sign How To Get A Pa Tax Exempt Number Form and ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to get a pa tax exempt number 2012 form

Create this form in 5 minutes!

How to create an eSignature for the how to get a pa tax exempt number 2012 form

How to make an electronic signature for the How To Get A Pa Tax Exempt Number 2012 Form online

How to create an eSignature for the How To Get A Pa Tax Exempt Number 2012 Form in Chrome

How to create an electronic signature for signing the How To Get A Pa Tax Exempt Number 2012 Form in Gmail

How to generate an eSignature for the How To Get A Pa Tax Exempt Number 2012 Form right from your smartphone

How to generate an electronic signature for the How To Get A Pa Tax Exempt Number 2012 Form on iOS

How to make an eSignature for the How To Get A Pa Tax Exempt Number 2012 Form on Android

People also ask

-

What is a PA Tax Exempt Number Form?

The PA Tax Exempt Number Form is a document that allows qualifying organizations in Pennsylvania to make tax-exempt purchases. This form is essential for nonprofits, government entities, and certain educational institutions. Knowing how to get a PA Tax Exempt Number Form can streamline your purchasing process and save money.

-

How do I get a PA Tax Exempt Number Form?

To get a PA Tax Exempt Number Form, you typically need to complete an application through the Pennsylvania Department of Revenue. This process involves providing details about your organization and its tax-exempt status. Understanding how to get a PA Tax Exempt Number Form is crucial for compliance and successful tax-exempt transactions.

-

What are the benefits of having a PA Tax Exempt Number?

Having a PA Tax Exempt Number allows organizations to make purchases without paying sales tax, signNowly reducing operational costs. This is particularly beneficial for nonprofits and educational institutions. Knowing how to get a PA Tax Exempt Number Form can enable your organization to take full advantage of these savings.

-

Are there any fees associated with obtaining a PA Tax Exempt Number Form?

Generally, there are no direct fees for obtaining a PA Tax Exempt Number Form from the state. However, some organizations may wish to consult with tax professionals, which could incur costs. It’s important to understand how to get a PA Tax Exempt Number Form to avoid unexpected expenses.

-

Can businesses use the PA Tax Exempt Number Form?

In Pennsylvania, only qualifying nonprofit organizations, government agencies, and certain educational institutions can use the PA Tax Exempt Number Form for tax-exempt purchases. Regular businesses do not qualify for this exemption. Knowing how to get a PA Tax Exempt Number Form is vital for eligible organizations to leverage these benefits.

-

What documents do I need to submit with the PA Tax Exempt Number Form?

When applying for a PA Tax Exempt Number Form, you typically need to provide proof of your organization's tax-exempt status, such as 501(c)(3) documentation. Additional information may include your organization's IRS determination letter. Being prepared with these documents is crucial for successfully obtaining a PA Tax Exempt Number Form.

-

How long does it take to receive a PA Tax Exempt Number?

The time frame for receiving a PA Tax Exempt Number Form can vary, but it typically takes several weeks to process the application. Factors such as application volume and accuracy of submitted information can affect this timeline. Understanding how to get a PA Tax Exempt Number Form efficiently may help expedite the process.

Get more for How To Get A Pa Tax Exempt Number Form

Find out other How To Get A Pa Tax Exempt Number Form

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement