Form 540nr 2017

What is the Form 540nr

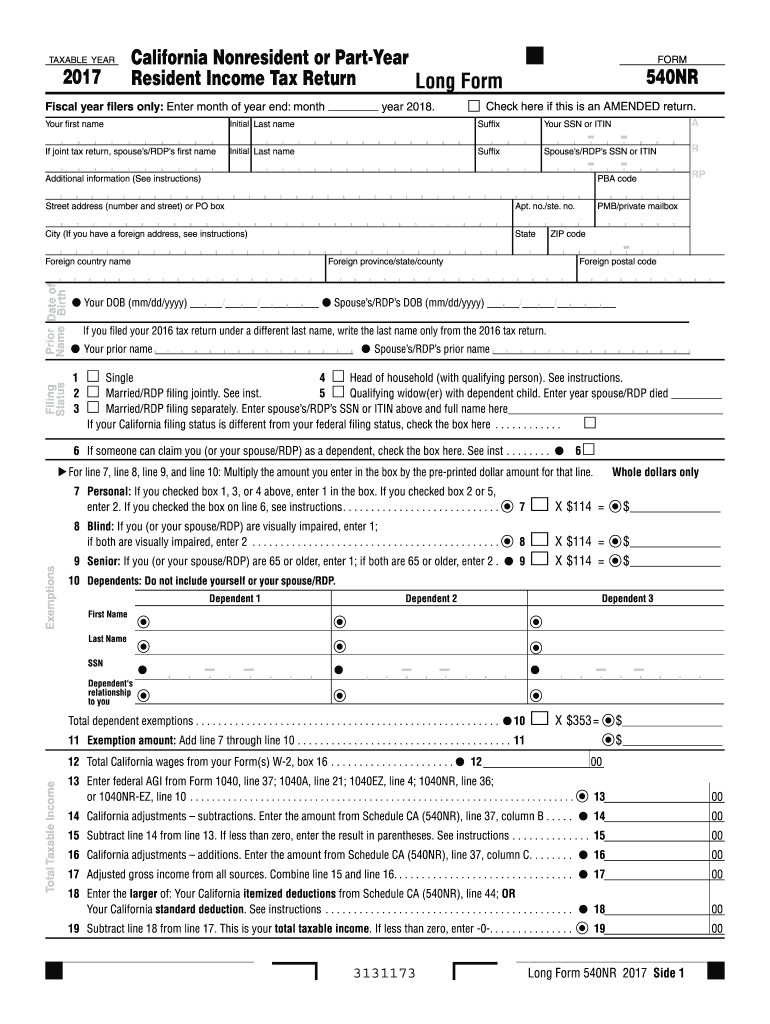

The Form 540nr, or California Nonresident or Part-Year Resident Income Tax Return, is a tax form used by individuals who earn income in California but do not reside in the state for the entire year. This form allows nonresidents and part-year residents to report their income earned from California sources and calculate their tax liability accordingly. It is essential for ensuring compliance with California tax laws and for accurately determining the amount of tax owed or refunded.

How to use the Form 540nr

Using the Form 540nr involves several steps to ensure accurate reporting of income and deductions. Taxpayers must gather all relevant financial documents, including W-2s, 1099s, and any other income statements. After completing the form, individuals should review it for accuracy and ensure all necessary schedules and attachments are included. Once finalized, the form can be submitted either electronically or via mail, depending on the taxpayer's preference and eligibility for e-filing.

Steps to complete the Form 540nr

Completing the Form 540nr requires careful attention to detail. Follow these steps:

- Gather all necessary documents, including income statements and deduction records.

- Fill out personal information, including your name, address, and Social Security number.

- Report your income earned in California, including wages, interest, and dividends.

- Claim any applicable deductions and credits to reduce your taxable income.

- Calculate your total tax liability based on the provided tax tables.

- Review the completed form for accuracy before submission.

Legal use of the Form 540nr

The Form 540nr is legally binding when completed accurately and submitted in compliance with California tax laws. It is crucial to ensure that all information provided is truthful and reflects actual earnings and deductions. Failure to comply with tax regulations can result in penalties, including fines and interest on unpaid taxes. Utilizing digital tools for completion can enhance security and ensure adherence to legal standards.

Filing Deadlines / Important Dates

Filing deadlines for the Form 540nr typically align with federal tax deadlines. For most taxpayers, the due date is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any changes to deadlines due to special circumstances, such as natural disasters or state-specific announcements. Timely submission is essential to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form 540nr can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online: Eligible taxpayers can e-file their Form 540nr using approved tax software, which often streamlines the process and ensures accuracy.

- Mail: Taxpayers can print the completed form and mail it to the appropriate California tax authority address, ensuring it is postmarked by the deadline.

- In-Person: For those who prefer personal assistance, some tax preparation services and local government offices may offer in-person filing options.

Quick guide on how to complete 2017 form 540nr

Complete Form 540nr effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage Form 540nr on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The easiest method to modify and electronically sign Form 540nr with ease

- Locate Form 540nr and click Get Form to initiate the process.

- Utilize the tools available to complete your document.

- Emphasize signNow sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Form 540nr and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2017 form 540nr

Create this form in 5 minutes!

How to create an eSignature for the 2017 form 540nr

How to generate an eSignature for your 2017 Form 540nr in the online mode

How to create an electronic signature for the 2017 Form 540nr in Chrome

How to create an eSignature for signing the 2017 Form 540nr in Gmail

How to create an electronic signature for the 2017 Form 540nr straight from your smart phone

How to create an eSignature for the 2017 Form 540nr on iOS devices

How to create an electronic signature for the 2017 Form 540nr on Android OS

People also ask

-

What is Form 540nr, and why do I need it?

Form 540nr is the California Nonresident or Part-Year Resident Income Tax Return. If you earned income in California but are not a full-time resident, you need to file this form to report your earnings. airSlate SignNow simplifies the process of signing and submitting Form 540nr electronically, making it easier to comply with state tax regulations.

-

How can airSlate SignNow help me with Form 540nr?

airSlate SignNow allows you to upload, fill out, and eSign Form 540nr quickly and securely. With our user-friendly interface, you can easily manage all your tax documents and ensure that your Form 540nr is submitted on time. Our platform also enables you to track the status of your documents in real-time.

-

Is airSlate SignNow a cost-effective solution for filing Form 540nr?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses and individuals looking for a cost-effective solution to manage their document signing needs. By using our platform to handle Form 540nr, you can save both time and money compared to traditional methods of document handling.

-

What features does airSlate SignNow offer for managing Form 540nr?

airSlate SignNow provides features such as customizable templates, secure cloud storage, and multi-party signing options, which are essential for managing Form 540nr. Our platform also supports various file formats, ensuring that you can work with your tax documents seamlessly and efficiently.

-

Can I integrate airSlate SignNow with other applications for Form 540nr?

Absolutely! airSlate SignNow integrates with various applications, including Google Drive, Dropbox, and CRM systems, which can streamline your workflow when handling Form 540nr. These integrations allow you to easily access and manage your documents without switching between multiple platforms.

-

Is it safe to eSign Form 540nr using airSlate SignNow?

Yes, airSlate SignNow prioritizes the security of your documents. We utilize advanced encryption and compliance with industry standards to ensure that your Form 540nr and other sensitive information are protected. You can eSign your documents with peace of mind knowing that your data is secure.

-

What support does airSlate SignNow offer for users filing Form 540nr?

airSlate SignNow offers comprehensive customer support to assist you with any questions or issues you may encounter while filing Form 540nr. Our support team is available through various channels, including live chat and email, ensuring you receive timely assistance whenever you need it.

Get more for Form 540nr

- Civil rights compliance questionnaire form

- Pa600r form

- Pa 586 report of physicalmental examination form

- Consent template combined hipaa the childrenamp39s hospital of research chop form

- Sentara advance directive form

- Printing out a form for a tetanus shot

- Los colinas medical center authorization form

- Hospital bed pm shedule form

Find out other Form 540nr

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT