Form 540NR California Nonresident or Part Year Resident 2020-2026

What is the Form 540NR California Nonresident Or Part Year Resident

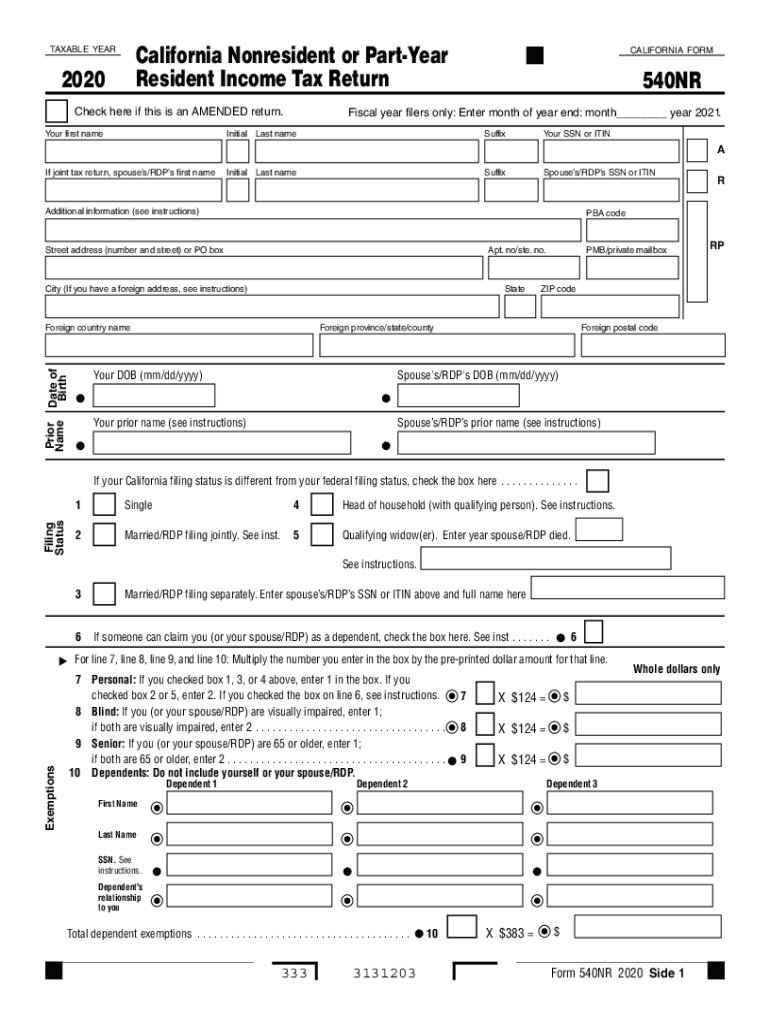

The Form 540NR is specifically designed for individuals who are nonresidents or part-year residents of California. This form allows these taxpayers to report their income earned within the state while excluding income earned outside of California. It is essential for those who have moved to or from California during the tax year, ensuring compliance with state tax laws.

Steps to complete the Form 540NR California Nonresident Or Part Year Resident

Completing the Form 540NR involves several key steps:

- Gather all relevant income documents, including W-2s and 1099s.

- Determine your residency status for the tax year.

- Fill out personal information, including your name, address, and Social Security number.

- Report your California-source income in the designated sections.

- Calculate your deductions and credits applicable to nonresidents or part-year residents.

- Review your completed form for accuracy before submission.

How to obtain the Form 540NR California Nonresident Or Part Year Resident

The Form 540NR can be obtained through the California Franchise Tax Board's official website. It is available for download in PDF format, allowing taxpayers to print and fill it out manually. Additionally, many tax preparation software programs include the form, making it easier to complete electronically.

Legal use of the Form 540NR California Nonresident Or Part Year Resident

The Form 540NR is legally recognized for filing California state taxes. It must be filled out accurately and submitted by the appropriate deadlines to avoid penalties. The form adheres to California tax laws, ensuring that nonresidents or part-year residents fulfill their tax obligations correctly.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines for the Form 540NR. Typically, the deadline aligns with the federal tax filing date, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to check for any updates or changes to ensure timely submission.

Required Documents

To complete the Form 540NR, taxpayers need to gather several documents, including:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any other income received during the tax year.

- Documentation for deductions and credits claimed.

Eligibility Criteria

Eligibility to use the Form 540NR is determined by residency status. Individuals who lived outside California for the entire year but earned income from California sources, or those who moved into or out of California during the year, qualify to file this form. Understanding your residency status is crucial in determining the correct tax obligations.

Quick guide on how to complete form 540nr california nonresident or part year resident

Complete Form 540NR California Nonresident Or Part Year Resident effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly and without hold-ups. Handle Form 540NR California Nonresident Or Part Year Resident on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to modify and electronically sign Form 540NR California Nonresident Or Part Year Resident with ease

- Find Form 540NR California Nonresident Or Part Year Resident and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Craft your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management requirements in just a few clicks from your preferred device. Edit and electronically sign Form 540NR California Nonresident Or Part Year Resident and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 540nr california nonresident or part year resident

Create this form in 5 minutes!

How to create an eSignature for the form 540nr california nonresident or part year resident

The way to make an e-signature for a PDF document online

The way to make an e-signature for a PDF document in Google Chrome

The way to generate an e-signature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The way to make an e-signature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What are fill ins teeth and how do they work?

Fill ins teeth refer to dental restorations used to repair cavities or damage in teeth. They are designed to restore the tooth's shape, function, and appearance, ensuring your smile remains intact. These fillings can be made from various materials, including composite resins and amalgams, depending on aesthetic and durability preferences.

-

How much do fill ins teeth typically cost?

The cost of fill ins teeth can vary signNowly based on factors such as location, dentist experience, and materials used. On average, you may expect to pay between $100 to $500 per filling. It's best to consult with your dental provider to receive a detailed estimate tailored to your specific needs.

-

What are the benefits of getting fill ins teeth?

Fill ins teeth provide numerous benefits, such as preventing further decay, maintaining tooth structure, and enhancing the overall appearance of your smile. Additionally, they restore proper function, allowing you to chew and speak comfortably. Investing in fill ins can signNowly contribute to your long-term oral health.

-

How long do fill ins teeth last?

The longevity of fill ins teeth varies depending on the material used and individual habits, like oral hygiene and diet. Generally, composite fillings can last about 5 to 10 years, while amalgam fillings may last longer, up to 15 years. Regular dental check-ups will help ensure the durability of your fillings over time.

-

Are the materials used for fill ins teeth safe?

Yes, the materials used for fill ins teeth are generally considered safe by dental professionals. Composite resins and amalgams have been thoroughly tested for safety and effectiveness. Your dentist can help you choose the most suitable material based on your health needs and aesthetic preferences.

-

Can I get fill ins teeth if I have dental insurance?

Most dental insurance plans cover a portion of the costs for fill ins teeth, as they are considered necessary treatments. It's recommended to review your insurance policy or speak with your provider to understand the coverage details. This will help minimize out-of-pocket expenses when obtaining the necessary fillings.

-

How do I maintain my fill ins teeth after treatment?

Maintaining your fill ins teeth involves practicing good oral hygiene, including brushing twice a day and flossing regularly. Regular dental visits for check-ups and professional cleanings are also essential to monitor the condition of your fillings. Additionally, be mindful of your diet to avoid excessive sugar intake, which can contribute to further decay.

Get more for Form 540NR California Nonresident Or Part Year Resident

- Disclaimer property form 481379359

- Delaware disclaimer form

- Delaware defendant form

- 5 days notice form

- Delaware assignment of mortgage by corporate mortgage holder form

- Delaware business trust certificate form

- Delaware notice of intent not to renew at end of specified term from landlord to tenant for residential property form

- Rule show cause form

Find out other Form 540NR California Nonresident Or Part Year Resident

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement