FP 100 Homestead Deduction, Senior Citizen, and Disabled 2018

What is the FP 100 Homestead Deduction, Senior Citizen, And Disabled

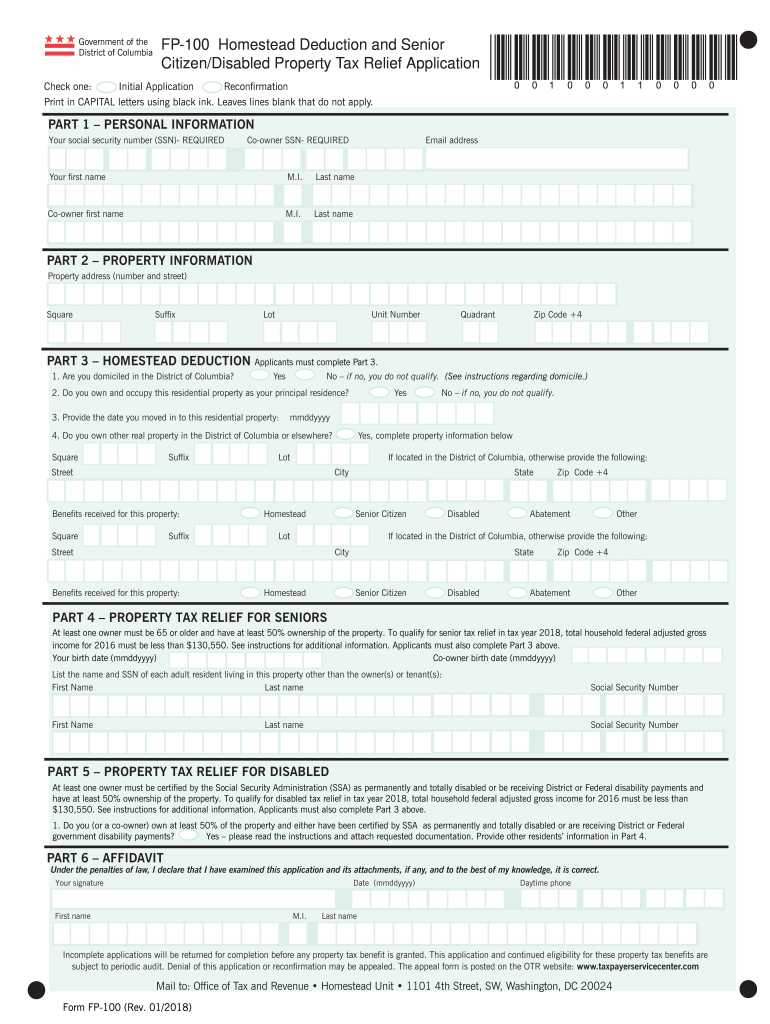

The FP 100 Homestead Deduction, Senior Citizen, and Disabled is a specific tax benefit available to eligible homeowners in the United States. This deduction aims to reduce the property tax burden for senior citizens and individuals with disabilities. By applying for this deduction, qualifying individuals can lower their taxable property value, which ultimately results in reduced property taxes. Each state may have its own regulations regarding eligibility and the application process, making it essential for applicants to understand the specific requirements in their state.

Eligibility Criteria

To qualify for the FP 100 Homestead Deduction, applicants typically need to meet several criteria. Generally, they must be a senior citizen, often defined as being sixty-five years or older, or be classified as disabled according to state guidelines. Additionally, applicants usually need to own and occupy the property as their primary residence. Income limits may also apply, depending on the state, which can affect eligibility for the deduction. It is important for applicants to review their state's specific eligibility requirements to ensure compliance.

Steps to complete the FP 100 Homestead Deduction, Senior Citizen, And Disabled

Completing the FP 100 Homestead Deduction form involves several key steps. First, applicants should gather necessary documentation, such as proof of age or disability, property ownership records, and income statements. Next, they need to fill out the FP 100 form accurately, ensuring all required information is provided. After completing the form, applicants should review it for any errors before submitting it to the appropriate local tax authority. It is advisable to keep a copy of the submitted form and any supporting documents for personal records.

How to obtain the FP 100 Homestead Deduction, Senior Citizen, And Disabled

Obtaining the FP 100 Homestead Deduction form can typically be done through the local tax authority's website or office. Many states provide downloadable versions of the form, which can be printed and filled out manually. In some cases, local governments may also offer online submission options for convenience. Applicants should ensure they are using the most current version of the form and check for any specific instructions or additional documentation that may be required during the application process.

Form Submission Methods

There are several methods available for submitting the FP 100 Homestead Deduction form. Applicants may choose to submit the form online, if their state offers this option, which can streamline the process. Alternatively, forms can often be mailed directly to the local tax authority. Some jurisdictions may also allow in-person submissions at designated offices. Regardless of the chosen method, it is important to confirm that the form is submitted by any applicable deadlines to ensure eligibility for the deduction.

Required Documents

When applying for the FP 100 Homestead Deduction, applicants need to provide specific documents to support their eligibility. Commonly required documents include proof of age or disability, such as a birth certificate or disability certificate, and proof of property ownership, such as a deed or property tax statement. Additionally, income verification documents may be necessary to demonstrate compliance with any income limits set by the state. Ensuring all required documents are included with the application can help prevent delays in processing.

Quick guide on how to complete fp 100 homestead deduction senior citizen and disabled

Complete FP 100 Homestead Deduction, Senior Citizen, And Disabled seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and safely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents promptly without delays. Manage FP 100 Homestead Deduction, Senior Citizen, And Disabled on any device using airSlate SignNow's Android or iOS applications and enhance your document-centered processes today.

How to modify and eSign FP 100 Homestead Deduction, Senior Citizen, And Disabled effortlessly

- Obtain FP 100 Homestead Deduction, Senior Citizen, And Disabled and click Get Form to begin.

- Employ the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to store your changes.

- Select your preferred method to send your form, whether via email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tiring form searches, or errors that necessitate the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Adjust and eSign FP 100 Homestead Deduction, Senior Citizen, And Disabled and maintain excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fp 100 homestead deduction senior citizen and disabled

Create this form in 5 minutes!

How to create an eSignature for the fp 100 homestead deduction senior citizen and disabled

How to create an eSignature for your Fp 100 Homestead Deduction Senior Citizen And Disabled in the online mode

How to create an eSignature for your Fp 100 Homestead Deduction Senior Citizen And Disabled in Chrome

How to make an electronic signature for signing the Fp 100 Homestead Deduction Senior Citizen And Disabled in Gmail

How to make an electronic signature for the Fp 100 Homestead Deduction Senior Citizen And Disabled right from your smart phone

How to generate an electronic signature for the Fp 100 Homestead Deduction Senior Citizen And Disabled on iOS

How to make an electronic signature for the Fp 100 Homestead Deduction Senior Citizen And Disabled on Android OS

People also ask

-

What is the FP 100 Homestead Deduction, Senior Citizen, And Disabled?

The FP 100 Homestead Deduction, Senior Citizen, And Disabled is a tax benefit offered to eligible senior citizens and disabled individuals, providing them with a signNow property tax exemption. This deduction primarily aims to reduce the financial burden on seniors and disabled homeowners. Understanding this deduction can greatly assist these groups in managing their housing costs.

-

Who qualifies for the FP 100 Homestead Deduction, Senior Citizen, And Disabled?

To qualify for the FP 100 Homestead Deduction, Senior Citizen, And Disabled, applicants must be a senior citizen or have a disability. Additionally, they need to meet specific income and residency requirements as set by state and local regulations. Gathering all necessary documentation will help streamline the application process.

-

How can I apply for the FP 100 Homestead Deduction, Senior Citizen, And Disabled?

To apply for the FP 100 Homestead Deduction, Senior Citizen, And Disabled, you should contact your local tax assessor's office. Typically, you'll need to provide proof of age or disability, along with your property information. Some jurisdictions also allow online applications for added convenience.

-

What documents do I need for the FP 100 Homestead Deduction, Senior Citizen, And Disabled application?

When applying for the FP 100 Homestead Deduction, Senior Citizen, And Disabled, you generally need a valid form of identification, proof of age, and any documentation supporting your disability. Additionally, providing proof of income may be required for certain applicants. Ensuring all documents are correctly prepared can increase your chances of a successful application.

-

How will the FP 100 Homestead Deduction, Senior Citizen, And Disabled impact my property taxes?

The FP 100 Homestead Deduction, Senior Citizen, And Disabled directly reduces the taxable value of your property, often leading to substantial savings on your property tax bill. By lowering your tax liability, this deduction allows seniors and disabled individuals to allocate funds to other important areas of their lives. Understanding this impact can be beneficial for financial planning.

-

Are there any limitations to the FP 100 Homestead Deduction, Senior Citizen, And Disabled?

Yes, the FP 100 Homestead Deduction, Senior Citizen, And Disabled may have certain limitations, including income thresholds and property value caps. Some jurisdictions may impose additional restrictions based on local laws. It's essential to research your local regulations to fully understand these limitations.

-

Can I receive help with my application for the FP 100 Homestead Deduction, Senior Citizen, And Disabled?

Absolutely, many local organizations and tax assistance programs offer help with the FP 100 Homestead Deduction, Senior Citizen, And Disabled application process. These resources can guide you through each step and ensure that your application is complete and accurate. Seeking assistance can alleviate the stress of navigating tax forms and requirements.

Get more for FP 100 Homestead Deduction, Senior Citizen, And Disabled

Find out other FP 100 Homestead Deduction, Senior Citizen, And Disabled

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF