Which Tax Office Issues Form Sa900 2013

What is the Which Tax Office Issues Form Sa900

The form Sa900 is a specific tax document used in the United States for reporting certain types of income and expenses. It is primarily associated with partnerships and limited liability companies (LLCs) that are treated as partnerships for tax purposes. This form is essential for ensuring compliance with federal tax regulations and accurately reporting the financial activities of the entity.

How to use the Which Tax Office Issues Form Sa900

Using the Sa900 form involves several steps to ensure accurate completion. Taxpayers must first gather all necessary financial information related to the business activities, including income, deductions, and credits. Once the information is collected, the form can be filled out, detailing the partnership's financial performance. It is crucial to follow the IRS guidelines closely to avoid errors that could lead to penalties.

Steps to complete the Which Tax Office Issues Form Sa900

Completing the Sa900 form requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial documents, including income statements and expense reports.

- Fill out the identification section, including the name and address of the partnership.

- Report all income earned by the partnership during the tax year.

- List all allowable deductions and credits.

- Review the completed form for accuracy before submission.

Legal use of the Which Tax Office Issues Form Sa900

The Sa900 form must be used in accordance with IRS regulations to ensure its legal validity. This includes accurately reporting all financial information and adhering to deadlines. Failure to comply with these legal requirements can result in penalties or audits by the IRS. It is advisable to consult with a tax professional if there are any uncertainties regarding the form's use.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Sa900 form. These guidelines include instructions on what information must be reported, how to calculate income and deductions, and the importance of filing the form by the due date. Adhering to these guidelines is essential for maintaining compliance and avoiding potential issues with the IRS.

Form Submission Methods (Online / Mail / In-Person)

The Sa900 form can be submitted through various methods. Taxpayers have the option to file online using approved tax software, which can streamline the process and reduce errors. Alternatively, the form can be printed and mailed to the appropriate IRS office. In some cases, in-person submission may be possible, depending on local IRS office policies. It is important to choose the method that best suits the taxpayer's needs while ensuring timely submission.

Quick guide on how to complete which tax office issues form sa900

A concise guide on how to prepare your Which Tax Office Issues Form Sa900

Finding the appropriate template can be difficult when you need to submit official international documents. Even if you possess the necessary form, it may be cumbersome to promptly fill it out according to all the specifications if you are using printed copies instead of managing everything digitally. airSlate SignNow is the online electronic signature platform that assists you in overcoming these challenges. It allows you to obtain your Which Tax Office Issues Form Sa900 and swiftly complete and sign it on-site without needing to reprint documents if you make an error.

Here are the steps you should follow to prepare your Which Tax Office Issues Form Sa900 with airSlate SignNow:

- Click the Get Form button to instantly add your document to our editor.

- Begin with the first blank field, enter details, and proceed with the Next option.

- Complete the empty fields using the Cross and Check functionalities from the toolbar above.

- Choose the Highlight or Line features to emphasize the most crucial information.

- Select Image and upload one if your Which Tax Office Issues Form Sa900 requires it.

- Utilize the right-side panel to add more fields for you or others to complete if needed.

- Review your entries and validate the form by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it with a camera or QR code.

- Conclude modifying the form by clicking the Done button and selecting your file-sharing preferences.

Once your Which Tax Office Issues Form Sa900 is ready, you can share it as you prefer - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely keep all your completed documents in your account, organized in folders according to your preferences. Don’t waste time on manual form filling; try airSlate SignNow!

Create this form in 5 minutes or less

Find and fill out the correct which tax office issues form sa900

FAQs

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

Which form is to be filled out to avoid an income tax deduction from a bank?

Banks have to deduct TDS when interest income is more than Rs.10,000 in a year. The bank includes deposits held in all its branches to calculate this limit. But if your total income is below the taxable limit, you can submit Forms 15G and 15H to the bank requesting them not to deduct any TDS on your interest.Please remember that Form 15H is for senior citizens, those who are 60 years or older; while Form 15G is for everybody else.Form 15G and Form 15H are valid for one financial year. So you have to submit these forms every year if you are eligible. Submitting them as soon as the financial year starts will ensure the bank does not deduct any TDS on your interest income.Conditions you must fulfill to submit Form 15G:Youare an individual or HUFYou must be a Resident IndianYou should be less than 60 years oldTax calculated on your Total Income is nilThe total interest income for the year is less than the minimum exemption limit of that year, which is Rs 2,50,000 for financial year 2016-17Thanks for being here

-

How do you fill out tax forms?

I strongly recommend purchasing a tax program, Turbo tax, H&R block etc.These programs will ask you questions and they will fill out the forms for you.You just print it out and mail it in. (with a check, if you owe anything)I used to use an accountant but these programs found more deductions.

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

How do I fill out tax form 4972?

Here are the line by line instructions Page on irs.gov, if you still are having problems, I suggest you contact a US tax professional to complete the form for you.

Create this form in 5 minutes!

How to create an eSignature for the which tax office issues form sa900

How to make an eSignature for your Which Tax Office Issues Form Sa900 online

How to generate an electronic signature for the Which Tax Office Issues Form Sa900 in Google Chrome

How to generate an electronic signature for putting it on the Which Tax Office Issues Form Sa900 in Gmail

How to generate an electronic signature for the Which Tax Office Issues Form Sa900 straight from your mobile device

How to make an eSignature for the Which Tax Office Issues Form Sa900 on iOS devices

How to make an eSignature for the Which Tax Office Issues Form Sa900 on Android devices

People also ask

-

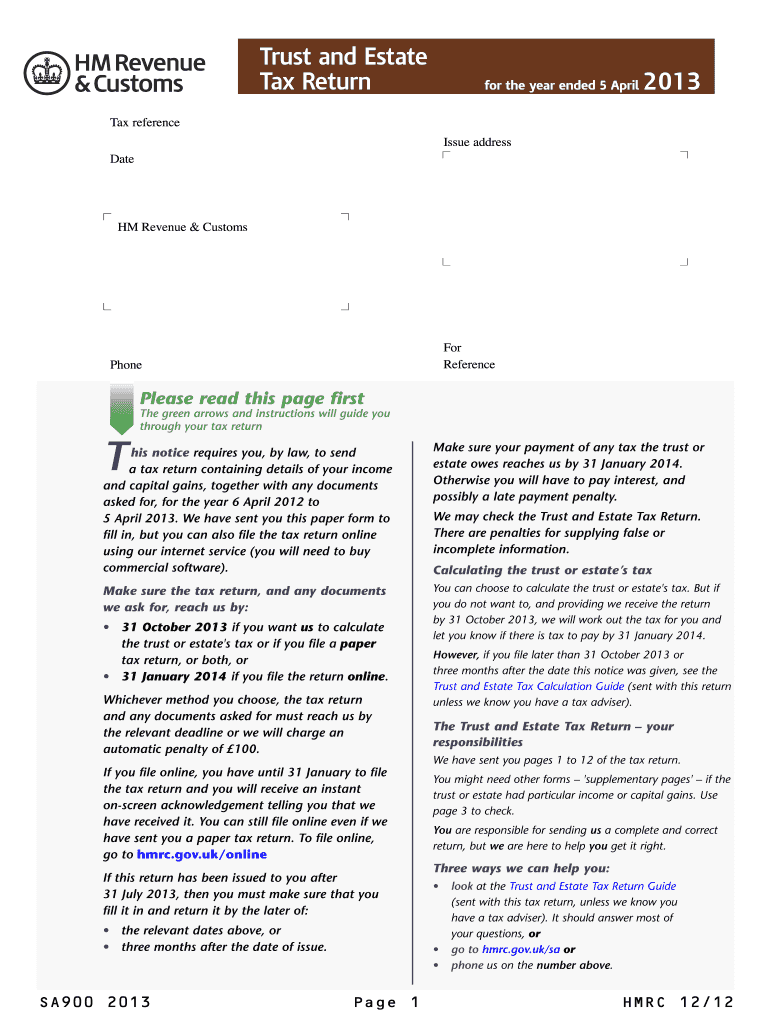

Which Tax Office Issues Form Sa900?

The tax office that issues Form Sa900 is typically the HM Revenue and Customs (HMRC) in the UK. It's important for individuals and businesses to check with HMRC or consult the official website for the most accurate and up-to-date information regarding this form. Ensuring you have the correct tax office information helps in managing your tax obligations effectively.

-

What is the purpose of Form Sa900?

Form Sa900 is used to report the income and gains from partnerships to HMRC. Completing this form is essential for ensuring accurate partnership taxation. This helps in determining the tax obligations of each partner based on their share in the partnership.

-

How can airSlate SignNow assist in filling out Form Sa900?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending documents like Form Sa900. With features such as templates and real-time collaboration, it's simple to ensure accuracy in your tax documents. Utilizing airSlate SignNow can streamline the process and save valuable time.

-

Are there any costs associated with using airSlate SignNow for Form Sa900?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. These plans can vary based on the features and volume of documents processed. However, the cost is often justified by the efficiency and ease of use that airSlate SignNow provides for managing forms like Sa900.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers numerous features for tax document management, including customizable templates, secure electronic signatures, and document tracking. These tools ensure a smooth workflow when preparing and submitting forms like Sa900. Enhanced security measures also protect sensitive tax information.

-

Can I integrate airSlate SignNow with other software for tax purposes?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, including accounting and tax software. This integration facilitates easy data transfer and document management, making it simpler to handle forms like Form Sa900 alongside your existing systems.

-

Is airSlate SignNow suitable for small businesses handling Form Sa900?

Yes, airSlate SignNow is particularly well-suited for small businesses needing to manage tax forms like Sa900. The platform's user-friendly interface and competitive pricing make it accessible for companies of all sizes. Small businesses can benefit from efficient document management without incurring high costs.

Get more for Which Tax Office Issues Form Sa900

- Combination supplementary and claim summary formpdf

- Search for ads ad hunter the wetumpka herald form

- In the guardianship of ae an incapacitated person form

- Date form

- How to address a letter the balance careers form

- County alabama form

- Forms for guardianship of an incapacitated individual

- In re guardianship of the estate of kathryn h gibbs an form

Find out other Which Tax Office Issues Form Sa900

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free