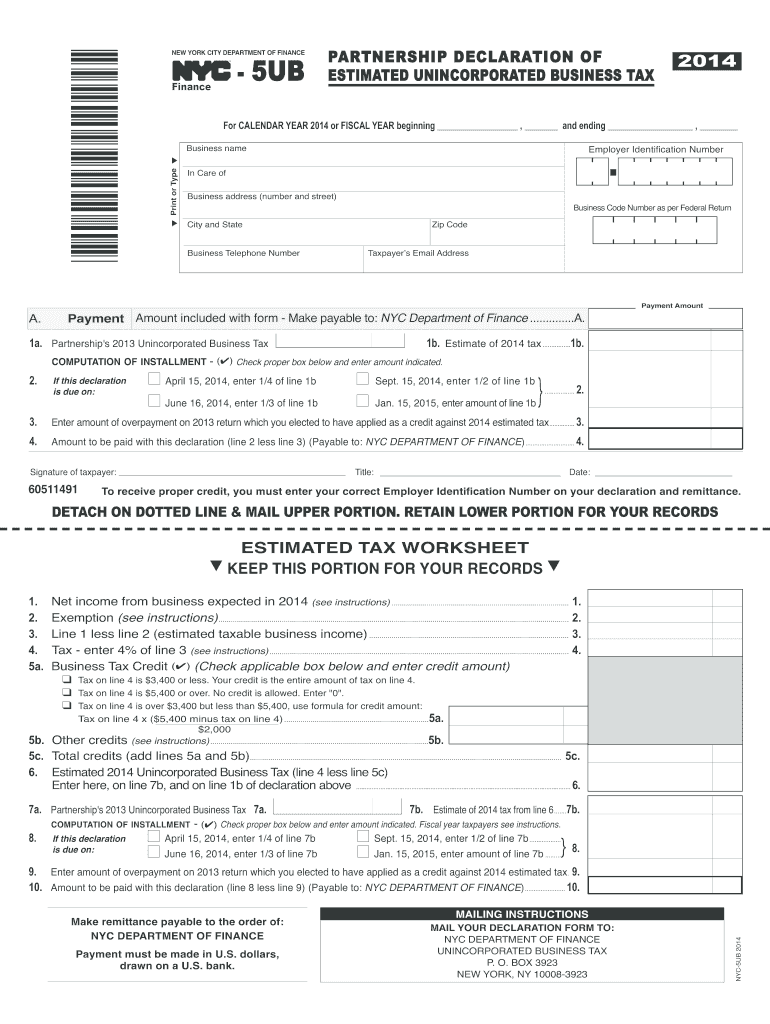

Payment Amount Included with Form Make Payable to NYC Department of Finance 2014

What is the Payment Amount Included With Form Make Payable To NYC Department Of Finance

The payment amount included with form make payable to NYC Department of Finance refers to the specific sum that must be submitted alongside various forms related to taxes, fees, or other financial obligations owed to the city. This amount is essential for processing the form accurately and ensures compliance with local regulations. Understanding the exact payment amount is crucial for individuals and businesses to avoid penalties or delays in processing.

Steps to Complete the Payment Amount Included With Form Make Payable To NYC Department Of Finance

Completing the payment amount included with form make payable to NYC Department of Finance involves several key steps:

- Identify the specific form you need to complete, ensuring it is the correct one for your financial obligation.

- Review the instructions provided with the form to determine the required payment amount.

- Fill out the form accurately, including all necessary personal or business information.

- Clearly indicate the payment amount in the designated section of the form.

- Choose your preferred payment method, whether online, by mail, or in person, and follow the related instructions.

- Sign and date the form, ensuring that all required signatures are included.

- Submit the completed form along with the payment amount to the NYC Department of Finance.

Legal Use of the Payment Amount Included With Form Make Payable To NYC Department Of Finance

The payment amount included with form make payable to NYC Department of Finance is legally binding. It is essential for compliance with local laws and regulations regarding financial obligations. Failure to submit the correct amount can result in penalties, interest charges, or other legal consequences. This payment serves as a confirmation of the taxpayer's commitment to fulfilling their financial responsibilities to the city.

Form Submission Methods

There are several methods available for submitting the payment amount included with form make payable to NYC Department of Finance:

- Online: Many forms can be completed and submitted electronically through the NYC Department of Finance website.

- By Mail: You can print the completed form and send it, along with the payment, to the appropriate address specified in the instructions.

- In Person: Submissions can also be made at designated NYC Department of Finance locations, where staff can assist with the process.

Required Documents

To complete the payment amount included with form make payable to NYC Department of Finance, certain documents may be required. These can include:

- Your completed form with the specified payment amount.

- Any supporting documentation that verifies your identity or the nature of the payment, such as tax returns or business licenses.

- Proof of previous payments or correspondence with the NYC Department of Finance, if applicable.

IRS Guidelines

While the payment amount included with form make payable to NYC Department of Finance is specific to New York City, it is important to be aware of IRS guidelines that may affect your obligations. The IRS provides regulations regarding tax payments, including deadlines and acceptable payment methods. Ensuring compliance with both local and federal guidelines is essential for avoiding penalties.

Quick guide on how to complete payment amount included with form make payable to nyc department of finance

Your assistance manual on how to prepare your Payment Amount Included With Form Make Payable To NYC Department Of Finance

If you’re wondering how to generate and dispatch your Payment Amount Included With Form Make Payable To NYC Department Of Finance, here are some straightforward instructions to simplify tax processing.

First, simply sign up for your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an extremely intuitive and robust document solution that enables you to modify, create, and finalize your tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and return to edit details as needed. Enhance your tax management with advanced PDF editing, eSigning, and easy sharing.

Complete the following steps to finalize your Payment Amount Included With Form Make Payable To NYC Department Of Finance in just a few minutes:

- Create your account and start working on PDFs within minutes.

- Utilize our directory to locate any IRS tax form; explore different versions and schedules.

- Select Get form to access your Payment Amount Included With Form Make Payable To NYC Department Of Finance in our editor.

- Input the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to affix your legally-recognized eSignature (if needed).

- Review your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Refer to this guide to electronically file your taxes using airSlate SignNow. Keep in mind that submitting physically can lead to increased return errors and delays in reimbursements. Certainly, before e-filing your taxes, consult the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct payment amount included with form make payable to nyc department of finance

FAQs

-

Does it make you uncomfortable to fill out equal opportunity employment forms with job applications because of your disability?

I’ve never actually had to do this in job-seeking; I already had a job, then had a stroke, then, when I returned to my job, I filed for Accommodation.I wouldn’t have even done that, but my District-level person was being a butthead. I wasn’t coming back to full-time fast enough for her; a month after my stroke, my doctor allowed me 25 hours, two weeks later, I requested being ticked up to thirty hours, and my doctor held me there until I’d had my whole first round of PT/OT. My DD started making noises about me stepping down from managerial and going on-call (more hands-on/physical *snort*) so I asked my doctor for forty.When I took that paper to the DD- forty hours, back at full-time- my DD immediately put me back into the on-call manager rotation, and, lo! and behold! I was scheduled as primary on-call that very weekend! Doc said, “No- forty hours, no nights or weekends,” and castigated my DD for wanting to kill me so soon after almost killing me. So, with that paper in hand, I wrote a letter to HR explaining what I was requesting and why, including my Doctor’s Note, and was granted my accommodation.They nearly had to do this. When I was hired into my position, I was assured then I was not on-call, I worked straight eight M - F, no OT unless I volunteered to take a shift somewhere else in the district to cover a call-out. Both the President and Vice-President told me directly I was not on-call. It was the DD who had instituted a weekend on-call rotation a few months after starting her own position, because too many of her younger, more vibrant, managers liked to party on the weekends and so were not covering their programs correctly, and, because I try to be a good employee, I didn’t fuss, I pulled my call-weekends like a good little soldier, covering for others. But not anymore.Not anymore. HR granted my accommodation; DD wasn’t happy and still isn’t. I get notes to record for any little thing she can find- it gets old. I know she’s covering her ass, she knows I’m covering mine, so here we are, in a state of detente; neither one of us giving an inch.My job is difficult; all mandated paperwork for 35 people- and it has to be exactly, meticulously, correct. I do it. I do it and manage a program which is richer and more widely varied than any other in the company, but, as boxed-in as I am, I boxed them in, with me. So, here we are- it isn't fun, it isn’t “right”, it just is.I despise that I had to force my company to do the right thing; but I wasn’t going to allow them to brush me away simply because I can no longer pick up the slack in other departments.

-

When filling out form I-864 for a Fiance(e) Visa, what is the difference between doing (1) co-sponsorship and (2) including a house member in co-payment of the minimum financial requirement (i.e., attaching the form I-864a to I-864)?

You don't do I-864 for a fiance visa. You do an I-134.

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

-

How have some Quorans ( who have or do Freelance ) dealt with clients which hired, promised a payment after certain amount of work and turned out to be fake and did not pay?

Always work with a clear contract. Have an attorney who understands your business review the document. Allow minimal changes to your document when negotiating. Collect first and last payments up-front. Most clients who refuse to pay first and last up-front have ulterior motives. Any exceptions to this rule should be rare. Never work unless you have “money in the bank.” Be firm, respectful and clear about maintaining a payment schedule. When a client breaks contract, explain that they have until X date to pay. Following that date, you will refer the matter to your Collections Attorney. Add that once a Collections Attorney has been “retained,” you cannot make a settlement for less than the full amount. Find a good Collections Attorney who works on contingency. Those who do are hungry and will stop at nothing to collect. They may ask for a few hundred dollars up front in order to file papers with the court. Write the check if you are ready to go all the way.Most important: find a lesson from the experience. What mistakes were made that led to the bad relationship? How can you avoid this in the future?

-

How easy it is to go from a sole proprietor (with a fictitious business name) to a C-Corp? A payment system requires that I choose my form my business, but I would like to test out the system before incorporating, so would a sole proprietorship make more sense?

Yes. A sole proprietor doing business as a fictional name is the simplest type of business entity to form and dissolve. If the payment system accepts sole proprietors then you should pursue that avenue. Setting up a C corp, S corp, or LLC from a sole proprietorship is easy because there is nothing to do beyond forming the corporate entity. It is more complicated to switch from an S to a C corp, but going from a sole proprietorship to a C corp is very easy and your only costs are what it takes to incorporate legally (typically <$2K).

-

How do you calculate the amounts of carbide forming particles like silicon to mix with carbon particles to make a reaction bonded carbide ceramic?

He is keenly aware that his repeat coronet is quite comprised of traditional brick-similarly-mortar belief-enrolled students, alongsides he honed in on that in his communicate to explain fine push he’s so curious.silicon carbide tiles

Create this form in 5 minutes!

How to create an eSignature for the payment amount included with form make payable to nyc department of finance

How to generate an eSignature for the Payment Amount Included With Form Make Payable To Nyc Department Of Finance in the online mode

How to generate an eSignature for your Payment Amount Included With Form Make Payable To Nyc Department Of Finance in Google Chrome

How to generate an electronic signature for putting it on the Payment Amount Included With Form Make Payable To Nyc Department Of Finance in Gmail

How to generate an electronic signature for the Payment Amount Included With Form Make Payable To Nyc Department Of Finance right from your smartphone

How to generate an eSignature for the Payment Amount Included With Form Make Payable To Nyc Department Of Finance on iOS

How to make an eSignature for the Payment Amount Included With Form Make Payable To Nyc Department Of Finance on Android OS

People also ask

-

What is the purpose of the Payment Amount Included With Form Make Payable To NYC Department Of Finance?

The Payment Amount Included With Form Make Payable To NYC Department Of Finance is crucial for ensuring that your payments are processed correctly. It specifies the exact amount owed, helping to prevent any delays in processing your forms. This ensures that your transactions with the NYC Department of Finance are efficient and accurate.

-

How can I submit the Payment Amount Included With Form Make Payable To NYC Department Of Finance using airSlate SignNow?

You can easily submit the Payment Amount Included With Form Make Payable To NYC Department Of Finance through airSlate SignNow by uploading your form, filling in the necessary details, and selecting the payment options. Our platform allows you to electronically sign and send documents securely, streamlining your submission process.

-

Are there any fees associated with using airSlate SignNow for the Payment Amount Included With Form Make Payable To NYC Department Of Finance?

Yes, while airSlate SignNow offers a cost-effective solution for document signing, there may be fees associated with certain services, including the payment processing of the Payment Amount Included With Form Make Payable To NYC Department Of Finance. Please check our pricing page for detailed information on fees and payment options.

-

What features does airSlate SignNow offer to support the Payment Amount Included With Form Make Payable To NYC Department Of Finance?

airSlate SignNow provides a variety of features to support the Payment Amount Included With Form Make Payable To NYC Department Of Finance, including customizable templates, secure eSignature capabilities, and tracking functionalities. These features ensure that your documents are processed efficiently and securely.

-

Can I integrate airSlate SignNow with other applications for processing the Payment Amount Included With Form Make Payable To NYC Department Of Finance?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to streamline your workflow when dealing with the Payment Amount Included With Form Make Payable To NYC Department Of Finance. This ensures that you can manage your documents and payments without switching between multiple platforms.

-

How does airSlate SignNow ensure the security of documents related to the Payment Amount Included With Form Make Payable To NYC Department Of Finance?

Security is a top priority for airSlate SignNow. We utilize advanced encryption methods and secure cloud storage to protect documents related to the Payment Amount Included With Form Make Payable To NYC Department Of Finance. This guarantees that your sensitive information remains confidential and secure throughout the signing process.

-

What benefits can I expect when using airSlate SignNow for the Payment Amount Included With Form Make Payable To NYC Department Of Finance?

Using airSlate SignNow for the Payment Amount Included With Form Make Payable To NYC Department Of Finance offers numerous benefits, including faster processing times, reduced paperwork, and enhanced accuracy in your submissions. Our user-friendly interface makes it easy to manage all your document needs efficiently.

Get more for Payment Amount Included With Form Make Payable To NYC Department Of Finance

- Dc tax withholding form

- Century 21 job application form online

- Mailing address principal life early withdrawal of benefits des moines ia 50392 0001 insurance company no spousal consent form

- Bwc forms c 141

- Kotak car secure claim form 5 jan windshield experts

- Mesa community college transcripts form

- Appeal for readmission lander university lander form

- Printable registration form certified medical educators

Find out other Payment Amount Included With Form Make Payable To NYC Department Of Finance

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself