Fl Form Dr 907 2018

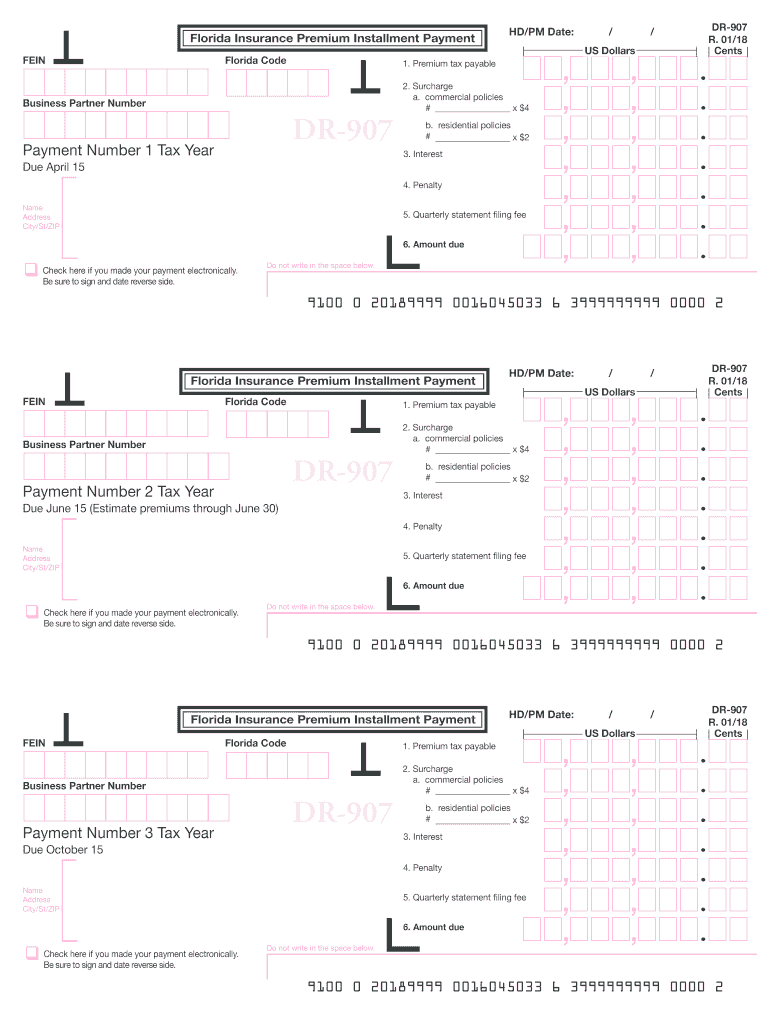

What is the Florida Form DR-907?

The Florida Form DR-907 is a document utilized by the Florida Department of Revenue for the purpose of reporting and remitting sales and use tax. This form is essential for businesses operating within Florida to ensure compliance with state tax regulations. It is typically required for various types of entities, including corporations, partnerships, and sole proprietorships, that engage in taxable sales or use of goods and services.

How to Use the Florida Form DR-907

To effectively use the Florida Form DR-907, businesses must accurately fill out the required fields, detailing their taxable sales and any applicable deductions. The form must be submitted along with the appropriate payment for the sales tax collected during the reporting period. It is crucial to ensure that all information is complete and correct to avoid delays or penalties.

Steps to Complete the Florida Form DR-907

Completing the Florida Form DR-907 involves several key steps:

- Gather necessary documentation, including sales records and tax exemption certificates.

- Fill in your business information, including name, address, and sales tax registration number.

- Report total taxable sales for the reporting period.

- Calculate the total sales tax due based on the applicable rate.

- Include any deductions or exemptions, if applicable.

- Sign and date the form to certify its accuracy.

Legal Use of the Florida Form DR-907

The Florida Form DR-907 is legally binding when completed and submitted according to state regulations. It serves as an official record of sales tax obligations and compliance. Ensuring that the form is filled out correctly and submitted on time is essential to avoid legal repercussions, such as fines or audits from the Florida Department of Revenue.

Required Documents for the Florida Form DR-907

When preparing to submit the Florida Form DR-907, businesses should have the following documents ready:

- Sales records for the reporting period.

- Tax exemption certificates for any exempt sales.

- Previous sales tax returns for reference.

Form Submission Methods for the Florida Form DR-907

The Florida Form DR-907 can be submitted through multiple methods, providing flexibility for businesses. Options include:

- Online submission through the Florida Department of Revenue's e-Services portal.

- Mailing a physical copy of the form to the appropriate address.

- In-person submission at a local Department of Revenue office.

Penalties for Non-Compliance with the Florida Form DR-907

Failure to comply with the requirements of the Florida Form DR-907 can result in significant penalties. These may include:

- Fines for late submission or underpayment of sales tax.

- Interest charges on unpaid tax amounts.

- Potential audits by the Florida Department of Revenue.

Quick guide on how to complete form dr 907 florida department of revenue

Complete Fl Form Dr 907 effortlessly on any gadget

Digital document management has gained traction with businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your documents swiftly without delays. Manage Fl Form Dr 907 on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and eSign Fl Form Dr 907 without hassle

- Find Fl Form Dr 907 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important parts of the documents or redact sensitive data using tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click the Done button to save your alterations.

- Decide how you wish to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Fl Form Dr 907 to ensure excellent communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form dr 907 florida department of revenue

Create this form in 5 minutes!

How to create an eSignature for the form dr 907 florida department of revenue

How to make an electronic signature for the Form Dr 907 Florida Department Of Revenue in the online mode

How to create an eSignature for the Form Dr 907 Florida Department Of Revenue in Chrome

How to generate an eSignature for putting it on the Form Dr 907 Florida Department Of Revenue in Gmail

How to create an electronic signature for the Form Dr 907 Florida Department Of Revenue straight from your mobile device

How to generate an electronic signature for the Form Dr 907 Florida Department Of Revenue on iOS devices

How to make an eSignature for the Form Dr 907 Florida Department Of Revenue on Android

People also ask

-

What is the dr 907 feature in airSlate SignNow?

The dr 907 feature in airSlate SignNow allows users to easily create, send, and eSign documents electronically. This feature enhances document management by streamlining the signature process, saving time and increasing efficiency for businesses. With dr 907, you can manage your documents with just a few clicks.

-

How does dr 907 improve document workflow?

dr 907 improves document workflow by automating the signing process and reducing manual errors. With its user-friendly interface, teammates can easily collaborate on documents, ensuring faster approvals. This leads to signNow improvements in productivity and team communication.

-

What pricing plans does airSlate SignNow offer for dr 907?

airSlate SignNow offers competitive pricing plans tailored to meet diverse business needs, including for the dr 907 functionality. You can choose from different tiers based on features and the number of users, ensuring that you find a plan that fits your budget. A free trial is also available, allowing you to explore dr 907 at no cost.

-

Can I integrate dr 907 with other software tools?

Yes, dr 907 can seamlessly integrate with various software tools such as CRM systems, cloud storage, and productivity apps. This integration ensures that you can centralize your document management process. Compatible applications enhance the overall functionality of airSlate SignNow, making it a versatile solution.

-

What are the security features associated with dr 907?

dr 907 ensures high-level security features to protect your documents and data. airSlate SignNow employs encryption, secure access controls, and compliance with industry standards to safeguard your information. This commitment to security gives users peace of mind when sending and signing important documents.

-

Is dr 907 suitable for small businesses?

Absolutely! dr 907 is particularly well-suited for small businesses looking for cost-effective document management solutions. Its intuitive design and affordable pricing enable small teams to enhance their workflow without needing extensive resources. Many small businesses choose dr 907 for its simplicity and efficiency.

-

What are the benefits of using dr 907 compared to traditional signing methods?

Using dr 907 offers numerous benefits over traditional signing methods, such as faster processing times and reduced paperwork. Electronic signatures eliminate the need for printing, scanning, and mailing documents, making the entire process quicker and more eco-friendly. This modern approach leads to a more efficient workflow for your business.

Get more for Fl Form Dr 907

- Fishing license educational exemption pennsylvania fish and form

- City of miami beach application forms building permits miami

- 60 spoa form

- 60 spoa 2602b form

- Sag station 12 form

- Sag aftra taft hartley report extreme reach form

- Cobb county liquor by the drink excise tax reporting bb form

- Delray beach building permit application form

Find out other Fl Form Dr 907

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast