Florida Severance Tax 2013

What is the Florida Severance Tax

The Florida Severance Tax is a tax imposed on the extraction of natural resources within the state, including oil and gas. This tax is applicable to businesses that engage in the removal of these resources, ensuring that the state receives revenue from its natural assets. The tax rate varies based on the type of resource being extracted, and it is essential for businesses to understand their obligations under this tax framework to remain compliant with state regulations.

How to use the Florida Severance Tax

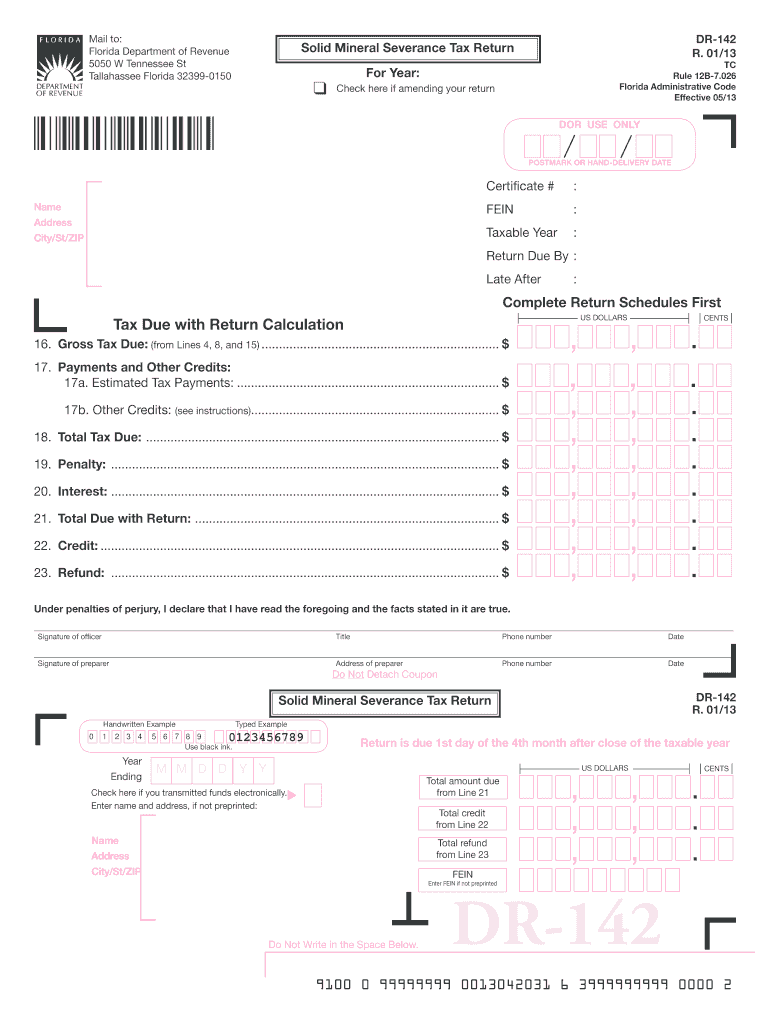

To effectively use the Florida Severance Tax, businesses must first determine their liability based on the type and volume of resources extracted. Once this is established, they should accurately calculate the tax amount owed. This involves keeping detailed records of production quantities and sales prices, as these figures are crucial for determining the correct tax rate. Businesses must then file the appropriate forms, including the FL 142 PDF, to report their severance tax obligations to the Florida Department of Revenue.

Steps to complete the Florida Severance Tax

Completing the Florida Severance Tax involves several key steps:

- Identify the type of resource being extracted and the applicable tax rate.

- Gather production data, including quantities and sales prices.

- Calculate the total tax liability based on the collected data.

- Fill out the FL 142 PDF form accurately, ensuring all required information is included.

- Submit the completed form to the Florida Department of Revenue by the specified deadline.

Required Documents

When filing the Florida Severance Tax, certain documents are necessary to support your submission. These include:

- Production reports detailing the quantities of resources extracted.

- Sales invoices or receipts that indicate the sale prices of the extracted resources.

- Any previous tax returns related to severance tax, if applicable.

Having these documents ready can streamline the filing process and ensure compliance with state regulations.

Penalties for Non-Compliance

Failing to comply with the Florida Severance Tax regulations can result in significant penalties. Businesses may face fines for late filings or underreporting their tax liabilities. Additionally, interest may accrue on any unpaid taxes, increasing the overall amount owed. It is crucial for businesses to stay informed about their tax obligations and ensure timely and accurate submissions to avoid these penalties.

Form Submission Methods

Businesses can submit the FL 142 PDF form through various methods, including:

- Online submission via the Florida Department of Revenue's website, where electronic filing options may be available.

- Mailing the completed form to the designated address provided by the department.

- In-person submission at local Department of Revenue offices, if preferred.

Choosing the right submission method can help ensure that your filing is processed efficiently.

Quick guide on how to complete agenda myfloridacom

Easily Manage Florida Severance Tax on Any Device

Digital document management has become widely adopted by businesses and individuals alike. It offers an ideal eco-friendly solution compared to traditional printed and signed paperwork, allowing you to find the necessary form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without any delays. Handle Florida Severance Tax on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

Effortlessly Modify and eSign Florida Severance Tax

- Obtain Florida Severance Tax and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select important sections of the documents or conceal sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, time-consuming form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Florida Severance Tax while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct agenda myfloridacom

Create this form in 5 minutes!

How to create an eSignature for the agenda myfloridacom

How to generate an electronic signature for your Agenda Myfloridacom online

How to create an electronic signature for the Agenda Myfloridacom in Google Chrome

How to make an eSignature for putting it on the Agenda Myfloridacom in Gmail

How to create an electronic signature for the Agenda Myfloridacom straight from your smart phone

How to make an eSignature for the Agenda Myfloridacom on iOS devices

How to create an eSignature for the Agenda Myfloridacom on Android devices

People also ask

-

What is the fl 142 pdf form used for?

The fl 142 pdf form, also known as the Income and Expense Declaration, is commonly used in family law cases in Florida. It helps to outline financial information, which is essential for the court to understand each party's financial situation. Completing this form accurately is crucial for effective legal proceedings.

-

How can I fill out the fl 142 pdf form using airSlate SignNow?

You can easily fill out the fl 142 pdf form using airSlate SignNow's intuitive interface. Simply upload the document, and utilize our editing tools to input the necessary information. Once completed, you can securely eSign and share the form with relevant parties, ensuring a smooth process.

-

Is airSlate SignNow free to use for the fl 142 pdf?

airSlate SignNow offers various pricing plans, including a free trial for new users. While basic features are available for free, accessing premium features for managing the fl 142 pdf form and other documents may require a subscription. This allows users to choose a plan that best fits their needs.

-

What are the key features of airSlate SignNow for managing fl 142 pdf forms?

Key features of airSlate SignNow include eSigning, document creation, and cloud storage specifically designed for forms like the fl 142 pdf. With a user-friendly interface, customizable templates, and robust security measures, airSlate SignNow helps streamline document management and simplifies the eSigning process.

-

Can I integrate airSlate SignNow with other applications for fl 142 pdf management?

Yes, airSlate SignNow offers integration capabilities with a variety of applications, such as CRM systems, cloud storage services, and more. This allows for seamless management of the fl 142 pdf form along with other documents in your workflow. Integrating your tools enhances productivity and efficiency in handling legal forms.

-

What are the benefits of using airSlate SignNow for the fl 142 pdf form?

Using airSlate SignNow for the fl 142 pdf form offers numerous benefits, including increased efficiency in document processing, enhanced collaboration among parties, and secure eSigning capabilities. The platform reduces the risk of errors and provides a centralized location to manage all your important legal documents.

-

How secure is my information when using airSlate SignNow for the fl 142 pdf?

airSlate SignNow prioritizes the security of your information when handling documents like the fl 142 pdf. With advanced encryption, compliance with industry standards, and secure cloud storage, you can trust that your sensitive information remains protected during the signing and sharing process.

Get more for Florida Severance Tax

- Dbpr ddc form

- State of florida dbpr department of business and professional form

- Apply using a printable application myfloridalicensecom form

- State of florida department of business and professional regulation division of drugs devices and cosmetics destruction form

- Form 6031

- Form flrt 3111

- Insurance cancellation agreement under mspa form

- Log appraisal experience form

Find out other Florida Severance Tax

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form