Florida Severance Tax 2019-2026

What is the Florida Severance Tax

The Florida severance tax is a tax imposed on the extraction of natural resources, such as minerals and fossil fuels, from the state. This tax applies to various activities, including the extraction of oil, gas, and certain minerals. The revenue generated from this tax is used to support state infrastructure and environmental programs. Understanding the specifics of the Florida severance tax is essential for businesses and individuals involved in resource extraction to ensure compliance with state regulations.

Steps to complete the Florida Severance Tax

Completing the Florida severance tax involves several key steps:

- Determine the type of resource being extracted and the applicable tax rate.

- Gather necessary documentation, including production reports and sales records.

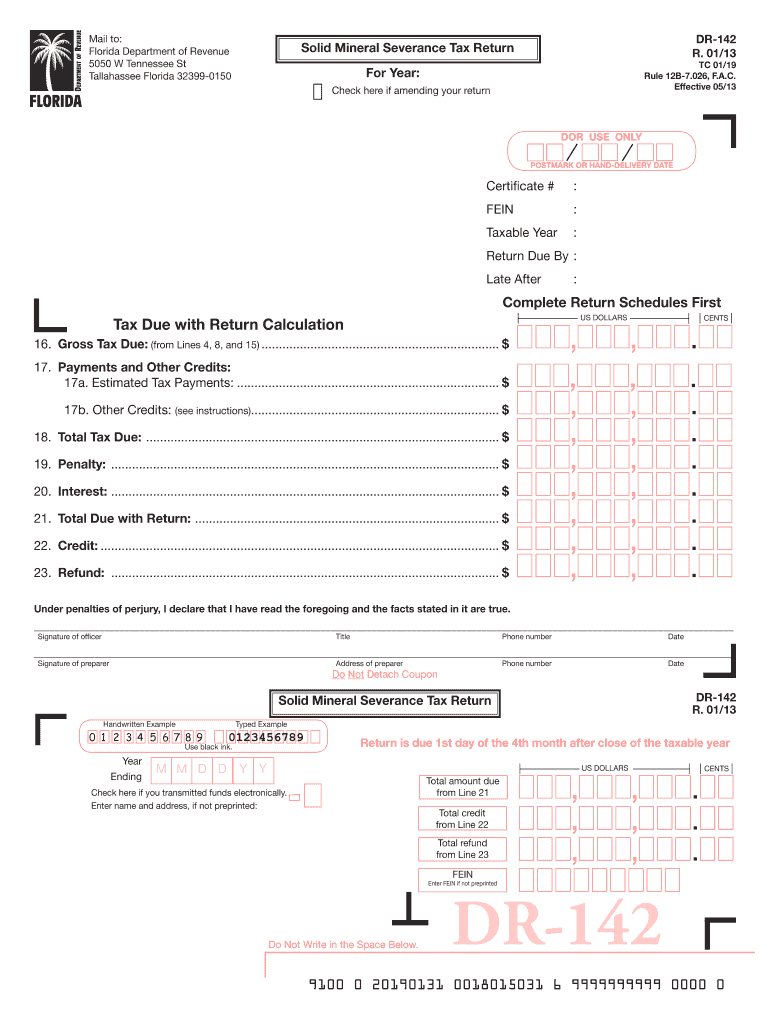

- Fill out the declaration solid severance tax fill form accurately, ensuring all required fields are completed.

- Calculate the total tax owed based on the extracted quantity and applicable rates.

- Submit the completed form along with any required payments to the Florida Department of Revenue.

Key elements of the Florida Severance Tax

Several key elements define the Florida severance tax:

- Tax Rates: Vary depending on the type of resource extracted.

- Filing Frequency: Taxpayers may be required to file monthly, quarterly, or annually based on their extraction volume.

- Exemptions: Certain activities or small-scale operations may qualify for exemptions.

- Compliance Requirements: Accurate reporting and timely payments are essential to avoid penalties.

Required Documents

To successfully file the Florida severance tax, taxpayers must prepare and submit several documents:

- Production Reports: Detailed records of the quantity of resources extracted.

- Sales Records: Documentation of sales transactions related to the extracted resources.

- Completed Tax Form: The declaration solid severance tax fill form, filled out correctly.

Penalties for Non-Compliance

Failure to comply with the Florida severance tax regulations can result in significant penalties. These may include:

- Late Filing Penalties: Fees assessed for failing to submit tax forms on time.

- Interest Charges: Accrued on unpaid taxes from the due date until payment is made.

- Legal Action: Potential legal consequences for continued non-compliance or fraudulent reporting.

Form Submission Methods

Taxpayers can submit the Florida severance tax form through various methods:

- Online Submission: Using the Florida Department of Revenue's online portal for electronic filing.

- Mail: Sending the completed form and payment via postal service to the appropriate department address.

- In-Person: Delivering the form directly to a local Department of Revenue office.

Quick guide on how to complete florida severance tax

Complete Florida Severance Tax with ease on any device

Digital document management has become widely adopted by businesses and individuals alike. It serves as an excellent environmentally-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the features necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage Florida Severance Tax seamlessly across all platforms using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Florida Severance Tax effortlessly

- Find Florida Severance Tax and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with the tools specifically provided by airSlate SignNow for this purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional hand-written signature.

- Review all details and click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new copies of documents. airSlate SignNow satisfies all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Florida Severance Tax and ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct florida severance tax

Create this form in 5 minutes!

How to create an eSignature for the florida severance tax

How to generate an eSignature for the Florida Severance Tax online

How to make an eSignature for your Florida Severance Tax in Chrome

How to generate an eSignature for signing the Florida Severance Tax in Gmail

How to create an eSignature for the Florida Severance Tax straight from your smart phone

How to generate an eSignature for the Florida Severance Tax on iOS

How to create an electronic signature for the Florida Severance Tax on Android OS

People also ask

-

What is the FL DR 142 form?

The FL DR 142 form is essential for declaring and transferring ownership of property in Florida. It's commonly used in real estate transactions to ensure compliance with state regulations. Understanding how to fill out the FL DR 142 form correctly is crucial for smooth property transactions.

-

How does airSlate SignNow facilitate the use of the FL DR 142 form?

AirSlate SignNow simplifies the process of sending and eSigning the FL DR 142 form. With our user-friendly platform, you can create and manage your documents efficiently. This streamlines the workflow, allowing for quicker transactions and better organization.

-

What are the costs associated with using airSlate SignNow for the FL DR 142 form?

AirSlate SignNow offers competitive pricing plans that cater to businesses of all sizes for using the FL DR 142 form. We provide flexible subscription options to ensure you only pay for what you need. Checking our pricing page can help determine the best plan for your needs.

-

Is the FL DR 142 form legally recognized when eSigned?

Yes, the FL DR 142 form is legally recognized when eSigned through airSlate SignNow. Our platform adheres to strict eSignature laws ensuring that your documents are valid and enforceable. This compliance gives you peace of mind while managing your property transactions.

-

Can I customize the FL DR 142 form using airSlate SignNow?

Absolutely! AirSlate SignNow allows you to customize the FL DR 142 form to suit your specific needs. You can add your branding, include additional fields, and tailor it to meet any particular requirements you may have for your transactions.

-

What features help manage the FL DR 142 form efficiently?

AirSlate SignNow provides a variety of features to manage the FL DR 142 form effectively. With tools like template creation, real-time notifications, and document tracking, you can keep everything organized throughout the signing process. This enhances your overall productivity and ensures timely document handling.

-

How does airSlate SignNow integrate with other systems for the FL DR 142 form?

AirSlate SignNow easily integrates with numerous applications to streamline the workflow of the FL DR 142 form. Whether you use CRM systems or accounting software, our integrations provide seamless document management capabilities, enhancing overall efficiency in your operations.

Get more for Florida Severance Tax

Find out other Florida Severance Tax

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free