Ifta 100 Mn 2016-2026

What is the IFTA 100 MN?

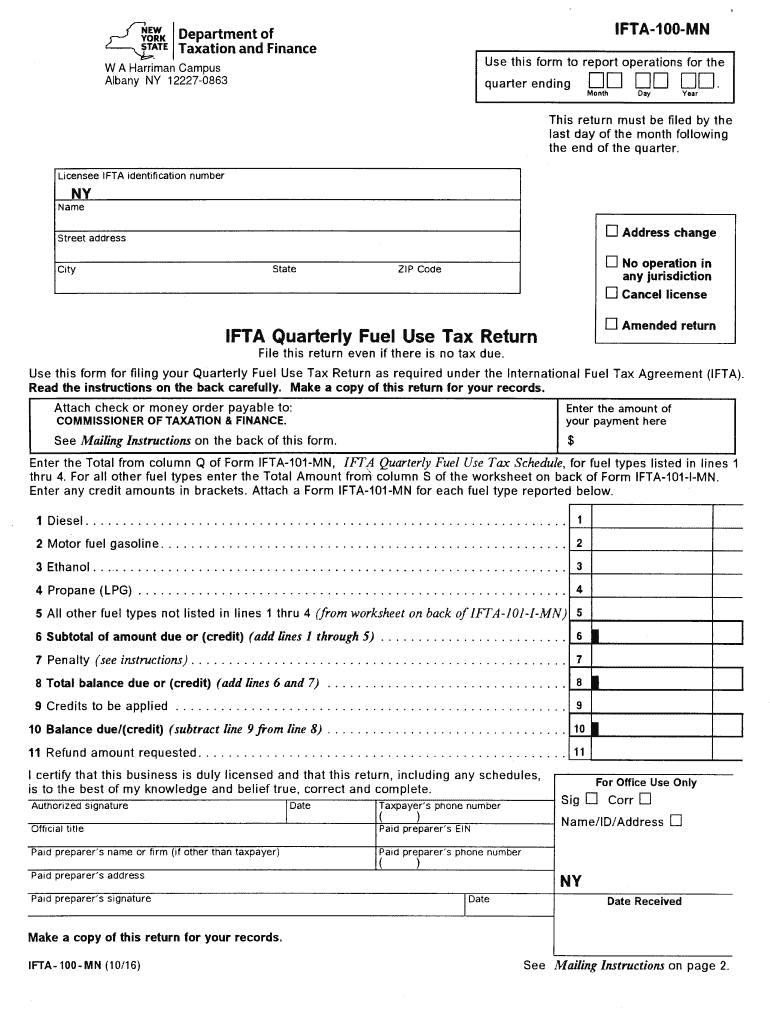

The IFTA 100 MN is a specific form used by motor carriers in Minnesota to report fuel use and calculate taxes owed under the International Fuel Tax Agreement (IFTA). This form consolidates fuel tax information from various jurisdictions into a single report, simplifying the tax filing process for interstate carriers. By using the IFTA 100 MN, carriers can ensure compliance with state and federal regulations while accurately reporting their fuel consumption across multiple states.

Steps to Complete the IFTA 100 MN

Completing the IFTA 100 MN involves several key steps to ensure accuracy and compliance:

- Gather necessary data: Collect fuel purchase receipts, mileage reports, and any other relevant documentation for the reporting period.

- Calculate total miles driven: Record the total miles driven in each jurisdiction, including both taxable and exempt miles.

- Calculate fuel consumption: Sum the total gallons of fuel purchased in each jurisdiction.

- Complete the form: Fill in the IFTA 100 MN with the gathered data, ensuring all calculations are accurate.

- Review for accuracy: Double-check all entries and calculations to avoid errors that could lead to penalties.

- Submit the form: File the completed IFTA 100 MN by the designated deadline, either online or via mail.

Legal Use of the IFTA 100 MN

The IFTA 100 MN must be used in accordance with state and federal laws governing fuel tax reporting. Accurate completion is essential, as inaccuracies can lead to legal penalties and fines. Carriers are required to maintain detailed records of their fuel purchases and mileage to support the information reported on the form. Compliance with the IFTA regulations ensures that carriers contribute fairly to the maintenance of roadways and infrastructure.

Required Documents

To complete the IFTA 100 MN, certain documents are necessary:

- Fuel purchase receipts: These should detail the type and amount of fuel purchased.

- Mileage logs: Records of miles driven in each jurisdiction during the reporting period.

- Previous IFTA returns: Reference past filings for consistency and accuracy.

- Vehicle identification information: Details about the vehicles used for reporting.

Form Submission Methods

The IFTA 100 MN can be submitted through various methods to accommodate different preferences:

- Online submission: Many states offer electronic filing options for convenience and speed.

- Mail: Completed forms can be sent to the designated state tax authority.

- In-person: Some jurisdictions allow for in-person submissions at local tax offices.

Penalties for Non-Compliance

Failure to comply with IFTA regulations can result in significant penalties. Common consequences include:

- Fines: Monetary penalties may be imposed for late filings or inaccuracies.

- Interest charges: Accrued interest on unpaid taxes can increase the total amount owed.

- Suspension of IFTA credentials: Repeated non-compliance may lead to the revocation of IFTA privileges.

Quick guide on how to complete ifta 100 2016 2019 form

Effortlessly prepare Ifta 100 Mn on any device

Digital document management has gained immense popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely retain it online. airSlate SignNow equips you with all the features needed to swiftly create, modify, and electronically sign your documents without delays. Manage Ifta 100 Mn across any platform with airSlate SignNow's Android or iOS applications and simplify any document-driven task today.

The easiest way to modify and electronically sign Ifta 100 Mn without hassle

- Locate Ifta 100 Mn and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the specific tools that airSlate SignNow offers for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the concerns of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow accommodates your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Ifta 100 Mn to ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ifta 100 2016 2019 form

Create this form in 5 minutes!

How to create an eSignature for the ifta 100 2016 2019 form

How to make an electronic signature for the Ifta 100 2016 2019 Form online

How to create an electronic signature for the Ifta 100 2016 2019 Form in Chrome

How to create an eSignature for putting it on the Ifta 100 2016 2019 Form in Gmail

How to create an eSignature for the Ifta 100 2016 2019 Form straight from your smart phone

How to make an eSignature for the Ifta 100 2016 2019 Form on iOS

How to create an eSignature for the Ifta 100 2016 2019 Form on Android

People also ask

-

What is Ifta 100 Mn in relation to airSlate SignNow?

Ifta 100 Mn refers to the integration of airSlate SignNow with the International Fuel Tax Agreement, allowing businesses to manage their fuel tax reporting efficiently. Using airSlate SignNow for Ifta 100 Mn ensures compliance with regulations while simplifying the document signing process.

-

How does airSlate SignNow support Ifta 100 Mn compliance?

airSlate SignNow offers features that streamline the documentation and submission processes required for Ifta 100 Mn compliance. By utilizing our platform, businesses can easily eSign necessary forms and maintain accurate records, reducing the risk of errors or audits.

-

What are the pricing options for using airSlate SignNow with Ifta 100 Mn?

airSlate SignNow provides flexible pricing plans tailored for various business needs, including those specifically looking to utilize Ifta 100 Mn. You can choose from monthly or annual subscriptions, ensuring you get the best value while managing your fuel tax documents.

-

Can airSlate SignNow integrate with other software for Ifta 100 Mn?

Yes, airSlate SignNow seamlessly integrates with various accounting and fleet management software, enhancing the efficiency of Ifta 100 Mn processes. This integration allows for automatic data transfer, minimizing manual entry and ensuring your documents are always up to date.

-

What features does airSlate SignNow offer for managing Ifta 100 Mn documents?

With airSlate SignNow, you gain access to powerful features such as customizable templates, bulk sending, and real-time tracking for Ifta 100 Mn documents. These tools enhance your workflow, making it easier to manage and monitor all related paperwork.

-

How can airSlate SignNow improve the efficiency of my Ifta 100 Mn submissions?

By using airSlate SignNow, your Ifta 100 Mn submissions can be completed faster and more accurately. The platform's eSignature capabilities eliminate the delays associated with physical document signing and mailing, ensuring timely submission of your fuel tax reports.

-

Is there a mobile app for airSlate SignNow that supports Ifta 100 Mn?

Yes, airSlate SignNow offers a mobile app that allows users to manage Ifta 100 Mn documents on the go. This means you can eSign, send, and track your fuel tax forms anytime, anywhere, providing added convenience and flexibility for your business.

Get more for Ifta 100 Mn

- Building permit application form fiu facilities management

- Lease vrlta form

- Louisiana purchase agreements form

- Order form jacket

- Vics bill lading form

- Yrc bill of lading form

- Removal of home inspection contingency form

- Request for work permit work experience ca dept of education this form is used to employ a minor and request a work permit for

Find out other Ifta 100 Mn

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now