Form 401 Sc 2018

What is the SC tax exempt form?

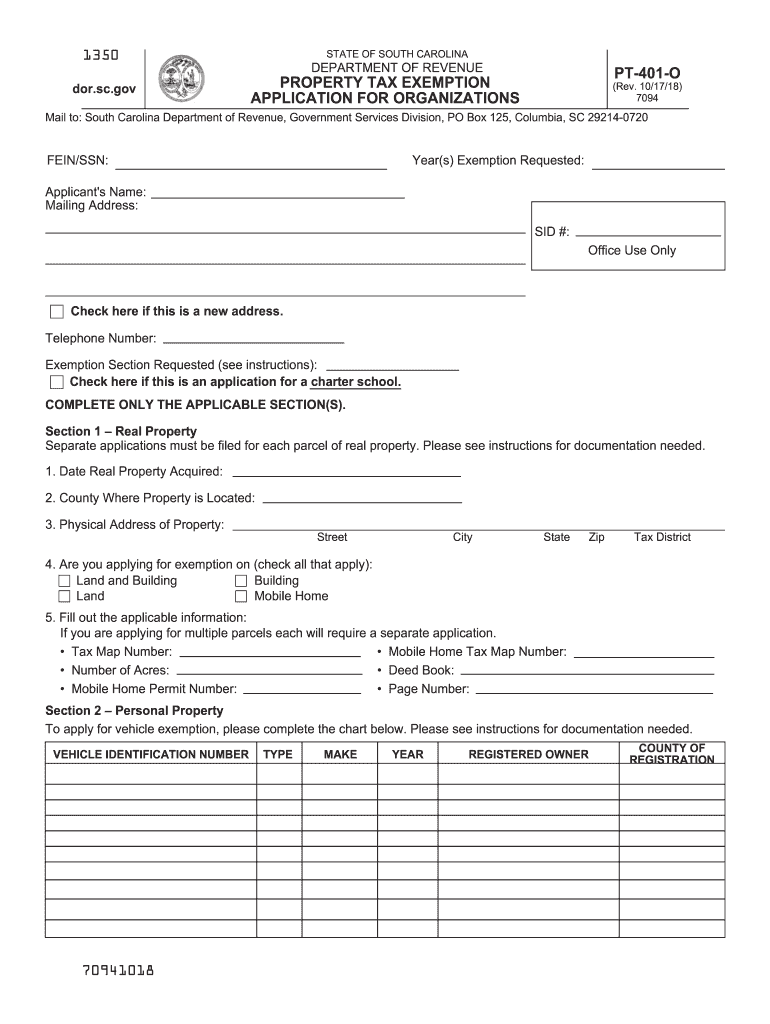

The SC tax exempt form, formally known as Form 401 SC, is a document used in South Carolina to claim an exemption from sales tax. This form is essential for qualifying entities, including certain non-profit organizations, government entities, and specific businesses, to avoid paying sales tax on eligible purchases. Understanding the purpose and requirements of this form is crucial for those seeking tax relief in the state.

How to use the SC tax exempt form

Using the SC tax exempt form involves a straightforward process. First, ensure that your organization qualifies for the exemption. Next, complete the form with accurate information, including the name of the entity, address, and the reason for the exemption. Once filled out, the form should be presented to vendors at the time of purchase to avoid sales tax charges. It is important to keep a copy for your records, as it may be required for future audits or compliance checks.

Steps to complete the SC tax exempt form

Completing the SC tax exempt form requires careful attention to detail. Follow these steps:

- Obtain the form from the South Carolina Department of Revenue website or through authorized channels.

- Fill in your organization’s name and address accurately.

- Indicate the specific reason for the tax exemption, ensuring it aligns with state regulations.

- Provide any additional required information, such as tax identification numbers.

- Review the form for completeness and accuracy before submission.

Legal use of the SC tax exempt form

The legal use of the SC tax exempt form is governed by state tax laws. It is critical that the form is used only by eligible entities as defined by the South Carolina Department of Revenue. Misuse of the form can lead to penalties, including back taxes and fines. Therefore, it is essential to understand the legal implications and ensure compliance with all relevant regulations when utilizing this form.

Required documents

When applying for tax exemption using the SC tax exempt form, certain documents may be required to support your claim. These typically include:

- A copy of the organization’s IRS determination letter, if applicable.

- Proof of the organization’s tax-exempt status.

- Any additional documentation that substantiates the reason for the exemption.

Eligibility criteria

To qualify for the sales tax exemption in South Carolina, organizations must meet specific eligibility criteria. Generally, this includes being a recognized non-profit entity, a governmental body, or an organization that serves a public purpose. Each category has its own set of guidelines, and it is advisable to review the requirements outlined by the South Carolina Department of Revenue to ensure compliance.

Form submission methods

The SC tax exempt form can be submitted through various methods, depending on the preferences of the submitting organization. Options include:

- In-person submission at designated state offices.

- Mailing the completed form to the appropriate department.

- Electronic submission, if available, through the South Carolina Department of Revenue's online portal.

Quick guide on how to complete wh 1605 south carolina department of revenue scgov

Effortlessly Prepare Form 401 Sc on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools you need to swiftly create, modify, and electronically sign your documents without any delays. Manage Form 401 Sc on any device using airSlate SignNow's Android or iOS applications and streamline your document-centric processes today.

How to Edit and eSign Form 401 Sc with Ease

- Obtain Form 401 Sc and click Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools offered by airSlate SignNow specifically designed for that purpose.

- Generate your signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 401 Sc to ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wh 1605 south carolina department of revenue scgov

Create this form in 5 minutes!

How to create an eSignature for the wh 1605 south carolina department of revenue scgov

How to create an electronic signature for your Wh 1605 South Carolina Department Of Revenue Scgov in the online mode

How to generate an eSignature for the Wh 1605 South Carolina Department Of Revenue Scgov in Google Chrome

How to make an eSignature for signing the Wh 1605 South Carolina Department Of Revenue Scgov in Gmail

How to make an electronic signature for the Wh 1605 South Carolina Department Of Revenue Scgov from your smartphone

How to create an eSignature for the Wh 1605 South Carolina Department Of Revenue Scgov on iOS devices

How to make an electronic signature for the Wh 1605 South Carolina Department Of Revenue Scgov on Android

People also ask

-

What is the SC tax exempt form, and why do I need it?

The SC tax exempt form is a document that allows organizations in South Carolina to make purchases without paying sales tax. This form is crucial for nonprofits, government entities, and other qualifying organizations to claim tax-exempt status on their purchases. By using the SC tax exempt form, businesses can save money on essential supplies and services, thereby redirecting these funds back into their operations.

-

How can airSlate SignNow help me manage my SC tax exempt form?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending documents, including the SC tax exempt form. Our solution allows you to complete and store your tax-exempt forms securely, streamlining your procurement process. Plus, with our audit trail feature, you can ensure that all signatures and submissions are properly documented.

-

Is there a cost associated with using airSlate SignNow for the SC tax exempt form?

Yes, while airSlate SignNow offers a variety of pricing plans, the cost depends on the features and integrations you need. Our price points are competitive, ensuring that you have access to a cost-effective solution for managing your SC tax exempt form and other essential documents. You can review our pricing structure on our website to find a plan that suits your needs.

-

Can I integrate airSlate SignNow with other applications for handling the SC tax exempt form?

Absolutely! airSlate SignNow seamlessly integrates with various popular applications like Google Drive, Salesforce, and Microsoft Office, making it easy for you to manage your SC tax exempt form alongside other business operations. This integration boosts efficiency and ensures a smoother workflow, enhancing overall productivity within your organization.

-

What are the benefits of eSigning the SC tax exempt form with airSlate SignNow?

eSigning the SC tax exempt form with airSlate SignNow offers numerous benefits including faster turnaround times, enhanced security, and reduced paper usage. With our platform, you can easily send the form for signature and receive it back promptly, all while ensuring compliance and maintaining a secure electronic record. This feature not only saves time but also aligns with eco-friendly practices.

-

Is airSlate SignNow compliant with South Carolina tax regulations regarding the SC tax exempt form?

Yes, airSlate SignNow is designed to comply with South Carolina tax regulations related to the SC tax exempt form. Our solution incorporates the necessary compliance measures to ensure that your electronic signatures and document management adhere to state laws. You can confidently utilize our platform knowing it meets the legal requirements for tax-exempt documentation.

-

How can I ensure my SC tax exempt form is securely stored?

With airSlate SignNow, your SC tax exempt form will be securely stored in our encrypted cloud environment, providing peace of mind regarding sensitive information. Our platform employs robust security protocols, including data encryption and secure access controls, to ensure that your documents are protected from unauthorized access. You can access and manage your forms anytime, knowing they are safe.

Get more for Form 401 Sc

Find out other Form 401 Sc

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile