Form 6325 2017

What is the Form 6325

The Form 6325, also known as the Certificate of Release of Federal Tax Lien, is an essential document used in the United States to formally release a federal tax lien. This form is issued by the Internal Revenue Service (IRS) once a taxpayer has paid their tax debt in full or has settled their liability through other means. The release of the lien is crucial as it clears the taxpayer's credit report and allows them to move forward without the burden of the lien affecting their financial standing.

How to obtain the Form 6325

To obtain Form 6325, taxpayers can request it directly from the IRS. This can be done through various methods, including:

- Visiting the IRS website to download the form.

- Calling the IRS customer service for assistance.

- Requesting the form via mail by sending a written request to the appropriate IRS office.

It is important to ensure that all requests are made to the correct IRS department to avoid delays in receiving the form.

Steps to complete the Form 6325

Completing Form 6325 involves several key steps to ensure accuracy and compliance. Here’s a simplified guide:

- Provide your name, address, and taxpayer identification number at the top of the form.

- Include details about the tax lien, such as the date it was filed and the amount owed.

- Indicate the reason for the release, such as payment in full or settlement.

- Sign and date the form to validate your request.

After filling out the form, it should be submitted to the IRS for processing.

Legal use of the Form 6325

The legal use of Form 6325 is governed by IRS regulations. It serves as an official document that confirms the release of a federal tax lien. This form is legally binding and must be completed accurately to ensure that the lien is removed from public records. Failure to properly submit the form may result in continued reporting of the lien, which can negatively impact a taxpayer's credit and financial opportunities.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with Form 6325 is crucial for taxpayers. Generally, the form should be submitted as soon as the tax debt is settled. While there are no specific deadlines for submitting Form 6325, timely submission is recommended to avoid complications with credit reporting. Taxpayers should also be aware of any relevant deadlines for tax payments or settlements to ensure that the form is filed in conjunction with those timelines.

Form Submission Methods (Online / Mail / In-Person)

Form 6325 can be submitted through various methods, depending on the taxpayer's preference and circumstances:

- Online: Taxpayers may be able to submit the form electronically through the IRS e-file system if they meet specific criteria.

- Mail: The completed form can be mailed to the appropriate IRS address, which is typically indicated on the form itself.

- In-Person: Taxpayers can also visit their local IRS office to submit the form directly.

Choosing the right submission method can help expedite the processing of the form and ensure a timely release of the lien.

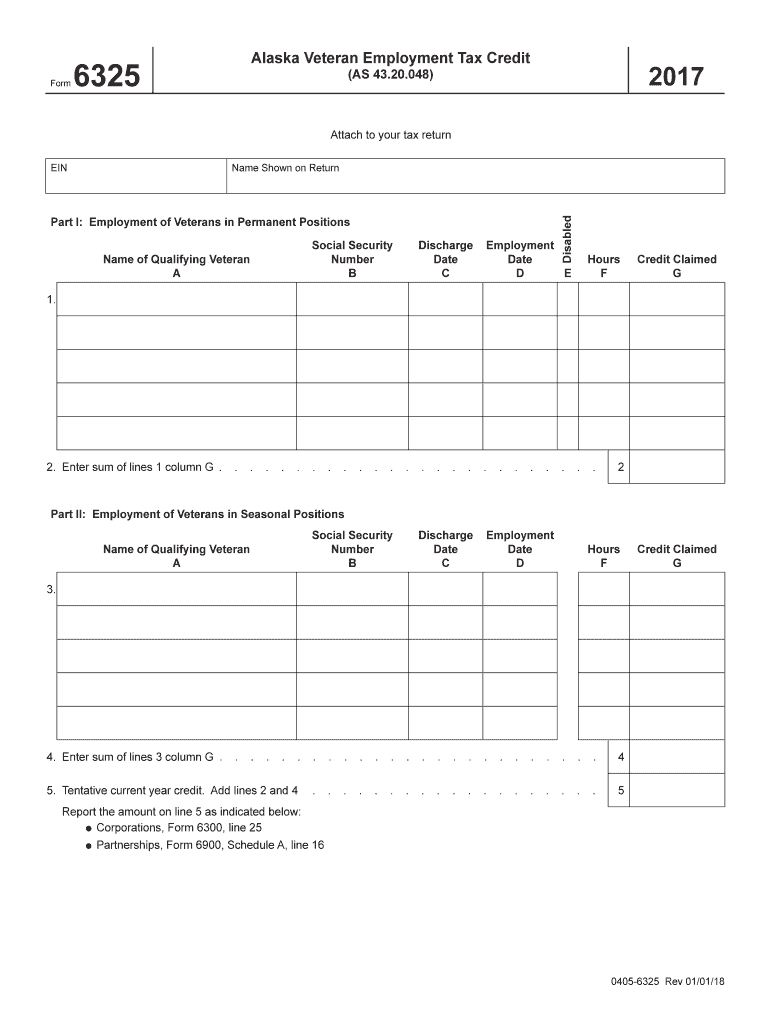

Quick guide on how to complete alaska veteran employment tax credit

Prepare Form 6325 effortlessly on any device

Online document administration has become a favored choice for businesses and individuals alike. It offers an excellent environmentally-friendly alternative to traditional printed and signed paperwork, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, adjust, and eSign your documents promptly without delays. Manage Form 6325 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign Form 6325 with ease

- Find Form 6325 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight relevant parts of the documents or obscure confidential information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a standard wet ink signature.

- Verify the details and then click the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the issues of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 6325 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alaska veteran employment tax credit

Create this form in 5 minutes!

How to create an eSignature for the alaska veteran employment tax credit

How to generate an eSignature for your Alaska Veteran Employment Tax Credit online

How to generate an eSignature for the Alaska Veteran Employment Tax Credit in Google Chrome

How to make an eSignature for putting it on the Alaska Veteran Employment Tax Credit in Gmail

How to make an electronic signature for the Alaska Veteran Employment Tax Credit straight from your smart phone

How to generate an electronic signature for the Alaska Veteran Employment Tax Credit on iOS

How to generate an eSignature for the Alaska Veteran Employment Tax Credit on Android

People also ask

-

What is form 6325 and how is it used?

Form 6325 is a document that can be utilized for various transactions. It serves as a formal request and can streamline communication in business processes. airSlate SignNow allows you to easily eSign and send form 6325, ensuring quick and efficient processing.

-

How can airSlate SignNow help with signing form 6325?

airSlate SignNow simplifies the process of signing form 6325 by providing an intuitive interface for electronic signatures. This not only saves time, but also reduces the administrative burden associated with manual signatures. The platform is designed for businesses looking to optimize their document workflows.

-

What are the pricing options for using airSlate SignNow for form 6325?

airSlate SignNow offers various pricing plans to fit the needs of different businesses, ensuring you can effectively manage form 6325 without breaking the bank. The pricing is competitive and flexible, allowing you to choose a plan that scales with your business requirements. Visit our website for detailed pricing information tailored for form 6325 handling.

-

What features does airSlate SignNow offer for managing form 6325?

airSlate SignNow provides a range of features for managing form 6325, including templates, secure cloud storage, and audit trails. You can store and access your documents easily, while also ensuring compliance and security. These features make it an all-in-one solution for efficient document management.

-

Can I integrate other applications with airSlate SignNow to manage form 6325?

Yes, airSlate SignNow supports a wide range of integrations with popular applications, making the management of form 6325 seamless. Whether it's through CRM systems, cloud storage, or other productivity tools, you can enhance your workflow effectively. This interoperability helps streamline your document processes.

-

What are the benefits of using airSlate SignNow for form 6325?

Using airSlate SignNow for form 6325 provides numerous benefits, including increased efficiency in document handling and the ability to eSign from anywhere. This reduces turnaround time and helps maintain smooth operations. Moreover, the solution is cost-effective, making it suitable for businesses of all sizes.

-

Is there a mobile app for signing form 6325 with airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that allows you to sign form 6325 on the go. This flexibility means you can manage your documents anytime, anywhere, ensuring that you never miss an important signing. The app is user-friendly and designed to cater to your busy schedule.

Get more for Form 6325

- Send transcripts online chabot college form

- Mn form 1998 e dmna dmna ny

- Form_mc61epdf wyoming department of transportation dot state wy

- Scotia glenville high school craft show form

- Hennepin canal parkwway deer hunt form

- Italy visa sample form

- Certification of financial responsibility fillable form

- Contra costa standardized hmis intake form contra costa health cchealth

Find out other Form 6325

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form