Loan Auto Form

What is the Loan Auto Form

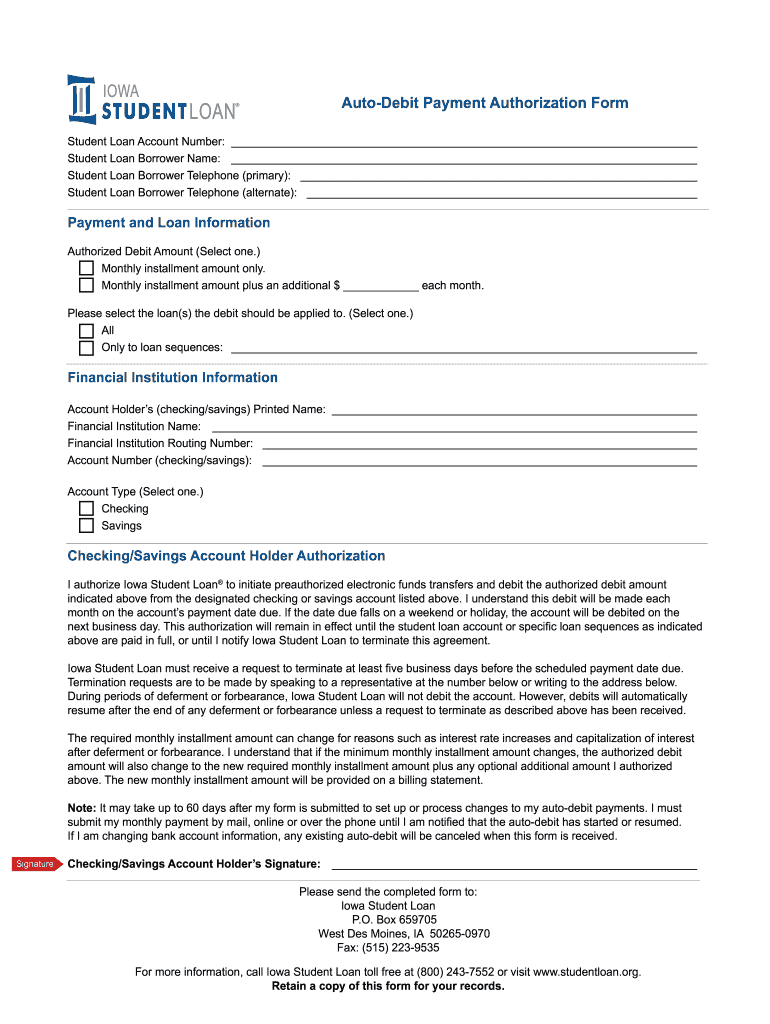

The loan auto form is a document used to authorize automatic debit payments for loans, ensuring timely payments directly from a borrower’s bank account. This form is essential for both lenders and borrowers, as it simplifies the repayment process and reduces the risk of missed payments. By completing the loan auto form, borrowers provide their banking details and consent for the lender to withdraw specified amounts on scheduled dates.

How to use the Loan Auto Form

Using the loan auto form involves several straightforward steps. First, obtain the correct version of the form, which may be available through your lender's website or customer service. Next, fill in your personal information, including your name, address, and loan account details. You will also need to provide your bank account information, including the account number and routing number. After completing the form, review it for accuracy and sign it to authorize the automatic payments. Finally, submit the form to your lender as instructed, either online or via mail.

Steps to complete the Loan Auto Form

Completing the loan auto form requires careful attention to detail. Follow these steps:

- Obtain the loan auto form from your lender.

- Fill in your personal information accurately.

- Provide your loan account number and relevant banking details.

- Specify the amount to be debited and the payment schedule.

- Review the form for any errors or omissions.

- Sign and date the form to authorize the automatic debit.

- Submit the completed form to your lender through the designated method.

Legal use of the Loan Auto Form

The loan auto form must be completed in compliance with applicable laws and regulations. In the United States, lenders are required to adhere to the Electronic Fund Transfer Act (EFTA), which governs automatic debits. This act mandates that borrowers receive clear disclosures regarding the terms of the automatic payments, including the frequency and amount. By using the loan auto form, borrowers consent to these terms, ensuring that both parties are protected under the law.

Key elements of the Loan Auto Form

Several key elements are essential to include in the loan auto form to ensure its effectiveness and legality:

- Borrower Information: Full name, address, and contact details.

- Loan Account Information: Account number and loan type.

- Bank Details: Bank name, account number, and routing number.

- Payment Amount: Specify the exact amount to be debited.

- Payment Schedule: Indicate the frequency of payments (e.g., monthly).

- Authorization Signature: Borrower’s signature and date to confirm consent.

Examples of using the Loan Auto Form

Loan auto forms are commonly used in various scenarios, such as:

- Student loans, where borrowers authorize monthly payments to avoid default.

- Auto loans, allowing for seamless monthly payments directly from a checking account.

- Personal loans, facilitating consistent repayment schedules to maintain good credit.

These examples illustrate how the loan auto form simplifies the repayment process and enhances financial management for borrowers.

Quick guide on how to complete auto debit payment authorization form iowa student loan studentloan

The optimal method to locate and endorse Loan Auto Form

Within the framework of an entire organization, ineffective paper approval processes can consume substantial working hours. Endorsing documents such as Loan Auto Form is a fundamental aspect of operations across any sector, which is why the proficiency of each contract’s lifecycle signNowly impacts the overall effectiveness of the organization. With airSlate SignNow, endorsing your Loan Auto Form can be as straightforward and quick as possible. You will discover with this platform the latest version of nearly any form. Even better, you can sign it immediately without the necessity of installing external applications on your device or printing any hard copies.

Steps to obtain and endorse your Loan Auto Form

- Explore our collection by category or utilize the search box to locate the document you require.

- Examine the form preview by clicking on Learn more to ensure it is the correct one.

- Hit Get form to start editing immediately.

- Fill out your document and include any needed information using the toolbar.

- When finished, select the Sign tool to endorse your Loan Auto Form.

- Choose the signature method that suits you best: Draw, Generate initials, or upload an image of your handwritten signature.

- Click Done to finish editing and proceed to document-sharing options as necessary.

With airSlate SignNow, you possess everything required to manage your documents efficiently. You can find, complete, edit, and even send your Loan Auto Form in a single tab effortlessly. Enhance your workflows by utilizing a singular, intelligent eSignature solution.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the auto debit payment authorization form iowa student loan studentloan

How to create an eSignature for your Auto Debit Payment Authorization Form Iowa Student Loan Studentloan online

How to create an electronic signature for the Auto Debit Payment Authorization Form Iowa Student Loan Studentloan in Google Chrome

How to create an eSignature for signing the Auto Debit Payment Authorization Form Iowa Student Loan Studentloan in Gmail

How to make an electronic signature for the Auto Debit Payment Authorization Form Iowa Student Loan Studentloan right from your smart phone

How to create an electronic signature for the Auto Debit Payment Authorization Form Iowa Student Loan Studentloan on iOS

How to create an electronic signature for the Auto Debit Payment Authorization Form Iowa Student Loan Studentloan on Android OS

People also ask

-

What is a loan auto and how does it work?

A loan auto is a financial product designed to help customers finance the purchase of a vehicle. It typically involves borrowing funds to cover the cost of the vehicle, which is then repaid over time with interest. Using airSlate SignNow, you can streamline the documentation process, ensuring efficiency and security in managing your loan auto agreements.

-

How can airSlate SignNow benefit my loan auto process?

airSlate SignNow simplifies the entire loan auto paperwork process by allowing users to electronically sign and send documents securely. This results in faster turnaround times and reduced paperwork errors. Plus, the easy-to-use interface ensures that you can manage your loan auto documents with minimal effort.

-

What features does airSlate SignNow offer for loan auto agreements?

airSlate SignNow offers a variety of features ideal for loan auto agreements, including document templates, eSignature capabilities, and automated workflows. These tools help ensure that all aspects of your loan auto agreement are handled efficiently, reducing the time required to finalize loans.

-

Is airSlate SignNow cost-effective for managing loan auto documents?

Yes, airSlate SignNow is a cost-effective solution for managing loan auto documents. With competitive pricing plans, businesses can save money while ensuring that their documentation needs are met. The ability to eliminate paper-based processes further enhances savings associated with loan auto management.

-

How secure is airSlate SignNow for handling loan auto agreements?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive loan auto agreements. The platform uses advanced encryption methods and complies with industry standards to protect your data. You can confidently manage your loan auto documents knowing they are safe and secure.

-

Can airSlate SignNow integrate with other tools for loan auto processing?

Absolutely! airSlate SignNow seamlessly integrates with a variety of software that is commonly used in loan auto processing, such as CRM systems and financial management tools. This integration helps streamline workflows, making it easier to manage your loan auto documents alongside other business processes.

-

What types of businesses can benefit from using airSlate SignNow for loan auto?

Many types of businesses, including car dealerships, financial institutions, and insurance companies, can benefit from using airSlate SignNow for loan auto processing. The platform is flexible and scalable, making it suitable for organizations of all sizes needing to manage loan auto documentation efficiently.

Get more for Loan Auto Form

Find out other Loan Auto Form

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer