Instructions Ohio Motor Fuel Tax Refund Claim for Transit Buses 2016

What is the Ohio fuel tax refund form?

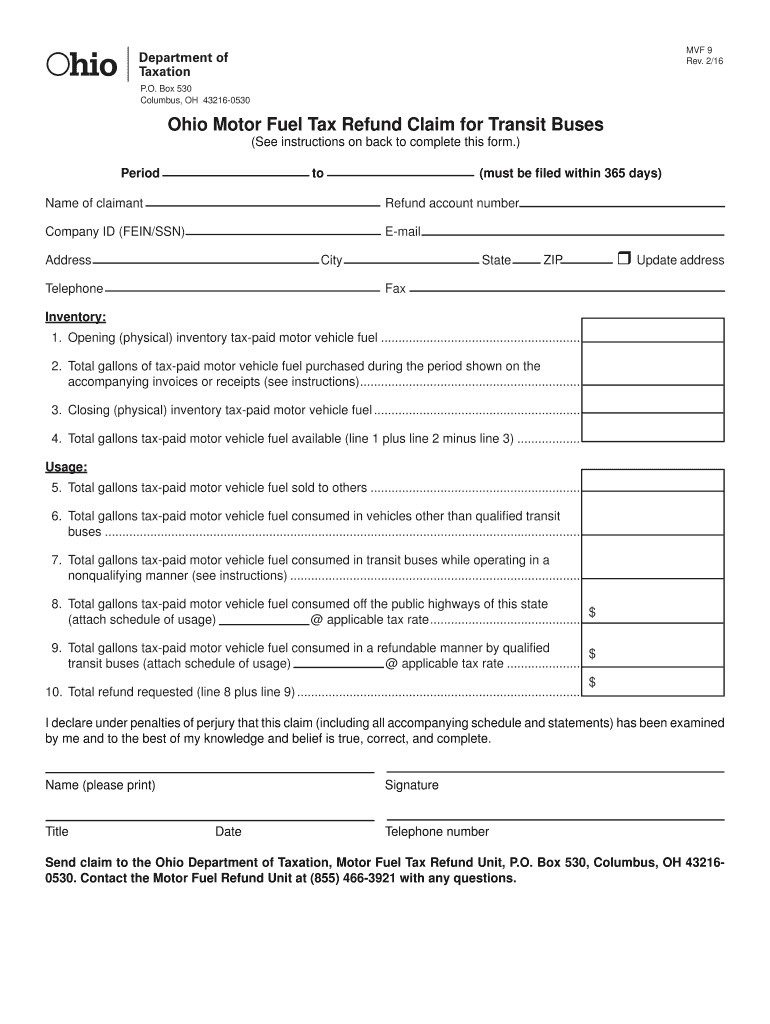

The Ohio fuel tax refund form is a document that allows individuals and businesses to claim a refund on fuel taxes paid for specific uses, such as operating transit buses. This form is essential for those who qualify under Ohio law, enabling them to recover taxes that may have been overpaid or that were not applicable to their fuel consumption. Understanding the purpose and requirements of this form is crucial for ensuring compliance and maximizing potential refunds.

Steps to complete the Ohio fuel tax refund form

Completing the Ohio fuel tax refund form involves several key steps. First, gather all necessary documentation, including receipts for fuel purchases and any relevant identification numbers. Next, accurately fill out the form, ensuring all fields are completed and that the information matches your supporting documents. After filling out the form, review it for accuracy before submitting it. Finally, keep a copy of the completed form and all supporting documents for your records.

Eligibility criteria for the Ohio fuel tax refund form

To qualify for a refund using the Ohio fuel tax refund form, applicants must meet specific eligibility criteria. Generally, the form is intended for individuals or businesses that use fuel for non-taxable purposes, such as public transportation or agricultural activities. Additionally, applicants must provide proof of fuel purchases and demonstrate that the fuel was used in accordance with Ohio regulations. Understanding these criteria is vital to ensure that your application is valid and that you receive the refund you are entitled to.

Required documents for the Ohio fuel tax refund form

When preparing to submit the Ohio fuel tax refund form, certain documents are required to support your claim. These typically include:

- Receipts for fuel purchases

- Proof of eligibility, such as vehicle registration or tax-exempt status

- Identification numbers, such as your Social Security number or Employer Identification Number (EIN)

Having these documents ready will facilitate a smoother application process and increase the likelihood of a successful refund claim.

Form submission methods for the Ohio fuel tax refund form

The Ohio fuel tax refund form can be submitted through various methods, providing flexibility for applicants. Typically, submissions can be made online via the Ohio Department of Taxation's website, by mail, or in person at designated offices. Each method has its own processing times and requirements, so it is important to choose the one that best fits your needs and to ensure that all documentation is included with your submission.

Key elements of the Ohio fuel tax refund form

Understanding the key elements of the Ohio fuel tax refund form is essential for successful completion. Key elements include:

- Personal or business information, including name and address

- Details of fuel purchases, including dates and amounts

- Signature and date line, confirming the accuracy of the information provided

Each of these elements plays a crucial role in the processing of your refund claim, and ensuring they are correctly filled out can help prevent delays.

Quick guide on how to complete motor fuel tax ohio department of taxation ohiogov

Effortlessly Prepare Instructions Ohio Motor Fuel Tax Refund Claim For Transit Buses on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Instructions Ohio Motor Fuel Tax Refund Claim For Transit Buses on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to modify and electronically sign Instructions Ohio Motor Fuel Tax Refund Claim For Transit Buses effortlessly

- Locate Instructions Ohio Motor Fuel Tax Refund Claim For Transit Buses and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details using the tools airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the frustration of lost or misplaced files, cumbersome form searches, or errors requiring new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Modify and electronically sign Instructions Ohio Motor Fuel Tax Refund Claim For Transit Buses to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct motor fuel tax ohio department of taxation ohiogov

Create this form in 5 minutes!

How to create an eSignature for the motor fuel tax ohio department of taxation ohiogov

How to make an eSignature for the Motor Fuel Tax Ohio Department Of Taxation Ohiogov in the online mode

How to generate an eSignature for your Motor Fuel Tax Ohio Department Of Taxation Ohiogov in Chrome

How to make an electronic signature for putting it on the Motor Fuel Tax Ohio Department Of Taxation Ohiogov in Gmail

How to make an eSignature for the Motor Fuel Tax Ohio Department Of Taxation Ohiogov from your mobile device

How to generate an electronic signature for the Motor Fuel Tax Ohio Department Of Taxation Ohiogov on iOS

How to generate an eSignature for the Motor Fuel Tax Ohio Department Of Taxation Ohiogov on Android

People also ask

-

What is the Ohio fuel tax refund form?

The Ohio fuel tax refund form is a document that allows businesses and individuals to claim refunds on fuel taxes paid for certain eligible fuels. This form is crucial for anyone who has overpaid on fuel taxes or qualifies for rebates under state regulations. Completing the form accurately can help you recover funds and ensure compliance with Ohio tax laws.

-

How can I file the Ohio fuel tax refund form?

You can file the Ohio fuel tax refund form by completing it online through the Ohio Department of Taxation's website or by submitting a paper form. Make sure to gather all necessary documentation, such as receipts and proof of purchases, to support your claim. Utilizing efficient document management tools like airSlate SignNow can streamline the eSigning process for your forms.

-

Is there a fee to use the Ohio fuel tax refund form service?

There is no fee specifically associated with filing the Ohio fuel tax refund form. However, if you use services like airSlate SignNow for eSigning or document management, there may be associated subscription costs. It is recommended to evaluate all potential expenses to determine the most cost-effective solution for managing your fuel tax refunds.

-

What documents do I need to submit with the Ohio fuel tax refund form?

When submitting the Ohio fuel tax refund form, you typically need to include supporting documentation such as receipts, invoices, and a record of fuel purchases. Ensure that you have accurate records for the fuel taxes you paid to facilitate a successful claim. Using digital tools like airSlate SignNow can help keep your documents organized and accessible during this process.

-

How long does it take to process the Ohio fuel tax refund form?

The processing time for the Ohio fuel tax refund form can vary but usually takes several weeks to complete. This depends on the volume of claims received and the accuracy of the submitted information. To expedite the process, ensure you provide complete documentation and use services like airSlate SignNow to avoid any delays with signing and submission.

-

Can I track the status of my Ohio fuel tax refund form claim?

Yes, you can track the status of your Ohio fuel tax refund form claim through the Ohio Department of Taxation's online system. After submitting your form, you will typically receive confirmation and may also get updates about your application status. Utilizing the digital capabilities of airSlate SignNow can help keep your documents in order while waiting for updates.

-

What are the benefits of using airSlate SignNow for my Ohio fuel tax refund form?

Using airSlate SignNow for your Ohio fuel tax refund form simplifies the eSigning process, making document management more efficient. With airSlate SignNow's user-friendly interface and cost-effective pricing, you can reduce the time spent on paperwork and focus more on your business operations. The platform also enhances security and compliance for sensitive tax documents.

Get more for Instructions Ohio Motor Fuel Tax Refund Claim For Transit Buses

- Ud 105 2014 2019 form

- Virginia experience verification form state legal forms

- New mexico continuing education course state legal forms

- Missouri standardized credentialling form state legal forms

- Attachment j6 small business subcontracting plan hanford site hanford form

- Complaint for divorce tennessee bar association tba form

- Application for term conversion liberty national life form

- Axis bank kyc formpdffillercom

Find out other Instructions Ohio Motor Fuel Tax Refund Claim For Transit Buses

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile