Pa Rk1 2017

What is the PA RK1?

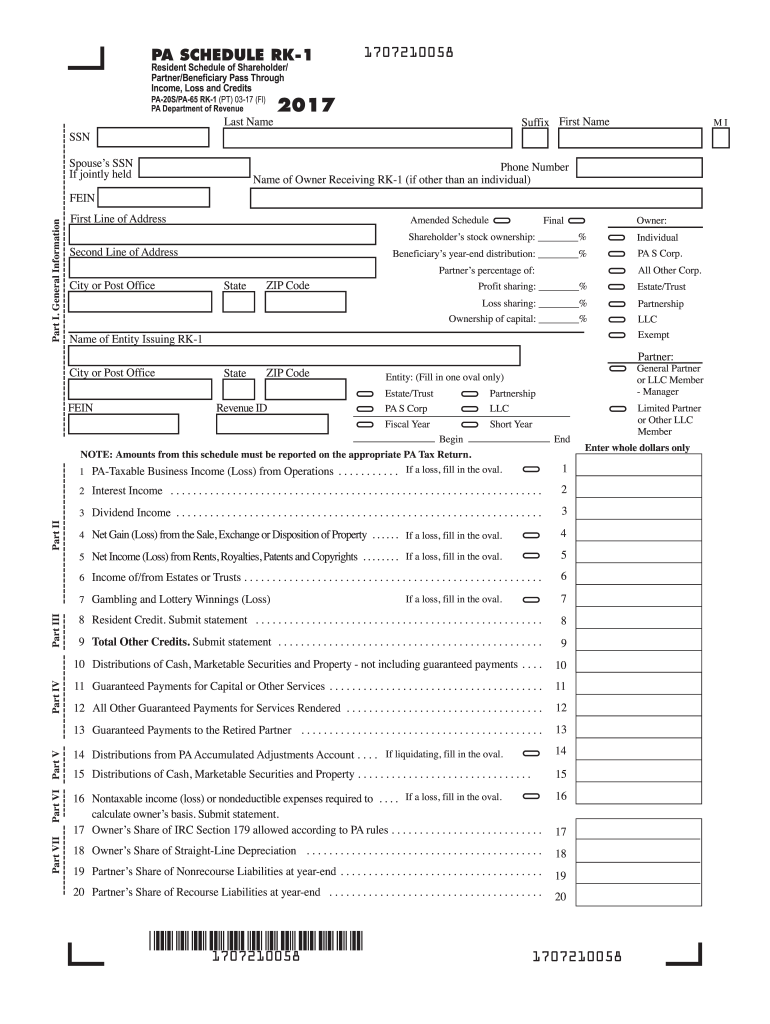

The PA RK1, officially known as the Pennsylvania Schedule RK-1, is a tax document used by partnerships, S corporations, and limited liability companies (LLCs) to report income, deductions, and credits to their shareholders or partners. This form provides essential information regarding each partner's share of income, loss, and credits, which is then reported on their individual tax returns. Understanding the PA RK1 is crucial for accurate tax reporting and compliance with Pennsylvania tax laws.

How to Use the PA RK1

To effectively use the PA RK1, shareholders must first receive the completed form from the partnership or S corporation. The form details each shareholder's share of the entity's income, deductions, and credits. Shareholders should then input this information on their personal income tax returns. It is important to ensure that the figures reported on the PA RK1 match those entered on the individual tax return to avoid discrepancies with the Pennsylvania Department of Revenue.

Steps to Complete the PA RK1

Completing the PA RK1 involves several key steps:

- Gather necessary financial documents, including income statements and prior year tax returns.

- Fill out the entity's income and deductions on the form.

- Calculate each partner's share based on their ownership percentage.

- Provide details of any credits that apply to the partners.

- Review the form for accuracy before submission.

Once completed, the PA RK1 should be distributed to all shareholders or partners for their records and tax filing purposes.

Legal Use of the PA RK1

The PA RK1 is legally binding when filled out correctly and submitted in accordance with Pennsylvania tax regulations. The information reported must be accurate and reflect the true financial status of the partnership or S corporation. Failure to comply with the legal requirements associated with the PA RK1 can result in penalties, including fines or audits by the Pennsylvania Department of Revenue.

Filing Deadlines / Important Dates

Filing deadlines for the PA RK1 typically align with the tax filing deadlines for partnerships and S corporations. Generally, these entities must file their tax returns by the fifteenth day of the fourth month following the end of their fiscal year. For most entities operating on a calendar year, this means the PA RK1 is due by April 15. Shareholders should also be aware of the deadlines for their individual tax returns, as the information from the PA RK1 is needed for accurate reporting.

Required Documents

To complete the PA RK1, several documents may be required:

- Financial statements of the partnership or S corporation.

- Prior year tax returns for reference.

- Documentation of any deductions or credits applicable to the entity.

- Ownership agreements or contracts that outline the distribution of income among partners.

Having these documents ready can streamline the process of completing the PA RK1 and ensure compliance with tax regulations.

Quick guide on how to complete pa rk 1 2017 2019 form

Complete Pa Rk1 effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to easily locate the right form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your papers swiftly without delays. Handle Pa Rk1 on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to modify and eSign Pa Rk1 without stress

- Obtain Pa Rk1 and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Mark essential sections of the documents or obscure sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form—by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Modify and eSign Pa Rk1 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pa rk 1 2017 2019 form

Create this form in 5 minutes!

How to create an eSignature for the pa rk 1 2017 2019 form

How to create an electronic signature for your Pa Rk 1 2017 2019 Form in the online mode

How to generate an electronic signature for your Pa Rk 1 2017 2019 Form in Chrome

How to create an electronic signature for putting it on the Pa Rk 1 2017 2019 Form in Gmail

How to make an eSignature for the Pa Rk 1 2017 2019 Form right from your mobile device

How to make an electronic signature for the Pa Rk 1 2017 2019 Form on iOS devices

How to generate an electronic signature for the Pa Rk 1 2017 2019 Form on Android OS

People also ask

-

What is the PA shareholders info form?

The PA shareholders info form is a legal document that collects essential information from shareholders in Pennsylvania. This form ensures compliance with state regulations and helps maintain accurate records of ownership. Utilizing airSlate SignNow simplifies the process of submitting and managing this form.

-

How does airSlate SignNow streamline the completion of the PA shareholders info form?

airSlate SignNow allows you to easily create, send, and eSign the PA shareholders info form electronically. Its user-friendly interface ensures a seamless experience for both senders and recipients. This efficiency reduces turnaround time and helps ensure accuracy in submission.

-

Is airSlate SignNow cost-effective for filing the PA shareholders info form?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. By choosing our solution, you can save on paper costs, printing, and postage. Plus, the time saved in document processing enhances overall efficiency and productivity.

-

What features does airSlate SignNow provide for managing the PA shareholders info form?

airSlate SignNow features comprehensive tools like document templates, auto-reminders, and secure eSigning capabilities for managing the PA shareholders info form. Additionally, real-time tracking allows you to monitor the status of your documents at any time. This ensures that everything is completed accurately and on schedule.

-

Are there integrations available for airSlate SignNow when filing the PA shareholders info form?

Absolutely! airSlate SignNow integrates seamlessly with various applications like Google Drive, Dropbox, and Salesforce. This flexibility allows you to access your documents and share the PA shareholders info form across platforms efficiently, enhancing your workflow.

-

How can airSlate SignNow benefit my business when using the PA shareholders info form?

Using airSlate SignNow for the PA shareholders info form can signNowly improve your document management process. The electronic signing feature accelerates approval times, while secure storage keeps all records organized and accessible. This means more time to focus on your business and less on paperwork.

-

Is customer support available if I encounter issues with the PA shareholders info form on airSlate SignNow?

Yes, airSlate SignNow provides excellent customer support to assist you with any issues related to the PA shareholders info form. Our dedicated team is available via chat, email, or phone to answer your questions and help troubleshoot any problems. Our goal is to ensure your experience is smooth and satisfying.

Get more for Pa Rk1

Find out other Pa Rk1

- How To Fax Electronic signature PPT

- How To Complete Electronic signature Word

- Complete Electronic signature Word Free

- Complete Electronic signature Document Free

- Complete Electronic signature Word Fast

- How To Complete Electronic signature PDF

- How Can I Complete Electronic signature Document

- Request Electronic signature Word Online

- How To Request Electronic signature Word

- Request Electronic signature Document Free

- Request Electronic signature Form Easy

- Add Electronic signature PDF Online

- Request Electronic signature Presentation Free

- Add Electronic signature PDF Free

- Add Electronic signature PDF Mac

- How To Add Electronic signature PDF

- How Do I Add Electronic signature PDF

- Add Electronic signature Document Online

- How To Add Electronic signature Document

- Add Electronic signature Word Mac