Wt 4 2018

What is the Wt 4

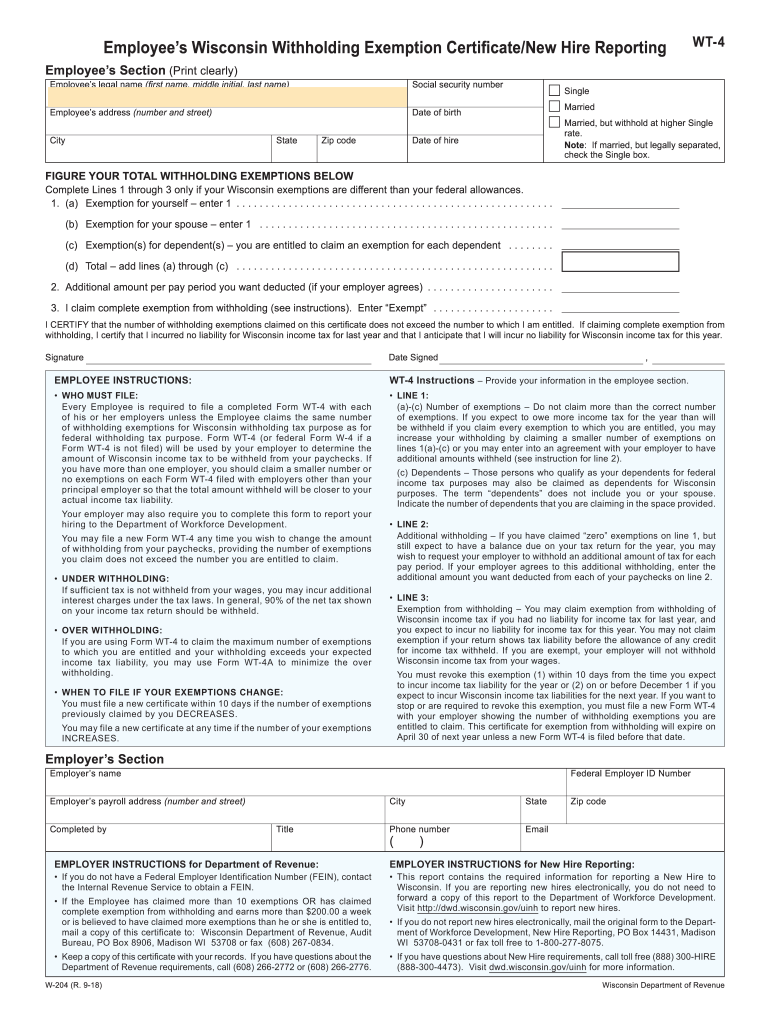

The Wisconsin WT-4 withholding form is a crucial document used by employers in Wisconsin to determine the amount of state income tax to withhold from employees' paychecks. This form is specifically designed for employees who wish to claim certain exemptions or adjustments to their withholding amounts. By accurately completing the WT-4, employees can ensure that their tax withholdings align with their financial situation, potentially avoiding overpayment or underpayment of taxes throughout the year.

How to obtain the Wt 4

To obtain the Wisconsin WT-4 withholding form, individuals can visit the official Wisconsin Department of Revenue website, where the form is available for download. Additionally, employers may provide copies of the form to their employees upon request. It is important to ensure that you are using the most current version of the form to comply with state tax regulations.

Steps to complete the Wt 4

Completing the Wisconsin WT-4 form involves several key steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Indicate your filing status, which can affect your withholding amount.

- Claim any applicable exemptions, such as those for dependents or specific tax situations.

- Review the instructions carefully to ensure accurate completion.

- Sign and date the form before submitting it to your employer.

Legal use of the Wt 4

The WT-4 form is legally recognized for establishing proper tax withholding in Wisconsin. To ensure its validity, the form must be filled out completely and accurately. Employers are required to keep the completed forms on file for their records. Utilizing a reliable eSignature tool can enhance the legal standing of the form, ensuring that it meets all necessary compliance standards under state and federal law.

Key elements of the Wt 4

Key elements of the Wisconsin WT-4 withholding form include:

- Personal identification details such as name and Social Security number.

- Filing status options, which determine the withholding rate.

- Exemption claims that allow employees to adjust their withholding based on specific circumstances.

- Signature and date fields to validate the form's authenticity.

Form Submission Methods

The completed Wisconsin WT-4 form can be submitted to your employer through various methods. Typically, employees may choose to deliver the form in person, send it via mail, or, if permitted, submit it electronically. It is advisable to confirm with your employer regarding their preferred submission method to ensure timely processing.

Quick guide on how to complete wi w4 2018 2019 form

Complete Wt 4 effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the features you need to create, edit, and eSign your documents promptly without delays. Handle Wt 4 on any device using airSlate SignNow's Android or iOS apps and simplify any document-related process today.

The easiest way to edit and eSign Wt 4 without effort

- Find Wt 4 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Verify the information and then click on the Done button to save your updates.

- Select how you wish to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in several clicks from any device of your choice. Edit and eSign Wt 4 and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wi w4 2018 2019 form

Create this form in 5 minutes!

How to create an eSignature for the wi w4 2018 2019 form

How to create an electronic signature for the Wi W4 2018 2019 Form online

How to generate an electronic signature for the Wi W4 2018 2019 Form in Chrome

How to generate an electronic signature for signing the Wi W4 2018 2019 Form in Gmail

How to make an electronic signature for the Wi W4 2018 2019 Form right from your smartphone

How to generate an electronic signature for the Wi W4 2018 2019 Form on iOS

How to create an eSignature for the Wi W4 2018 2019 Form on Android OS

People also ask

-

What is Wt 4 in the context of airSlate SignNow?

Wt 4 refers to the specific version of the airSlate SignNow platform that includes advanced features for document signing and management. This version is designed to enhance user experience, making it easier for businesses to send and eSign documents efficiently.

-

How much does airSlate SignNow Wt 4 cost?

The pricing for airSlate SignNow Wt 4 varies based on the subscription plan you choose. Generally, it offers competitive rates that cater to businesses of all sizes, ensuring you get a cost-effective solution for your document signing needs.

-

What features does airSlate SignNow Wt 4 offer?

airSlate SignNow Wt 4 includes a variety of features such as customizable templates, real-time tracking, and secure cloud storage. These features are designed to streamline the eSigning process, allowing users to send, receive, and manage documents effortlessly.

-

How can airSlate SignNow Wt 4 benefit my business?

By using airSlate SignNow Wt 4, your business can signNowly reduce the time spent on document management. The platform enhances productivity, minimizes paperwork, and accelerates the signing process, leading to faster decision-making and improved workflow efficiency.

-

Does airSlate SignNow Wt 4 integrate with other software?

Yes, airSlate SignNow Wt 4 offers seamless integrations with popular software applications such as Google Drive, Salesforce, and others. This allows you to enhance your document workflows by connecting with the tools your team is already using.

-

Is airSlate SignNow Wt 4 secure for sensitive documents?

Absolutely! airSlate SignNow Wt 4 employs state-of-the-art security protocols to ensure that your documents are kept safe and secure. With features like encryption and compliance with industry standards, you can trust that your sensitive information is protected.

-

Can I customize templates in airSlate SignNow Wt 4?

Yes, airSlate SignNow Wt 4 allows users to create and customize templates according to their specific needs. This feature helps streamline the document creation process, making it easier to maintain consistency and professionalism in your communications.

Get more for Wt 4

- Application for medicare levy exemption certification form

- Asb fastnet classic online form

- Oseegib beneficiary form

- Disputing criminal record information form nsw police force police nsw gov

- St matthews health care application for employment form

- Mse form

- Derbyshire police shotgun sale online form

- Mg 11 pdf form

Find out other Wt 4

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement