Missouri W 3 Form 2018

What is the Missouri W-3 Form

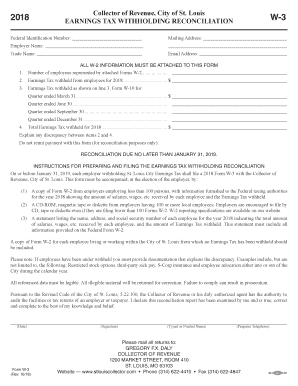

The Missouri W-3 form, also known as the 2018 earnings tax withholding reconciliation fillable, is a crucial document used by employers in Missouri to report the total amount of state income tax withheld from employees' wages during the year. This form consolidates the information from individual W-2 forms provided to employees, summarizing the state tax withholding for the entire year. It is essential for ensuring that both the employer and the state of Missouri have accurate records of tax withholdings, contributing to proper tax compliance and reporting.

How to Use the Missouri W-3 Form

Using the Missouri W-3 form involves several key steps. First, employers must gather all individual W-2 forms issued to employees for the tax year. Next, they need to accurately fill out the W-3 form by entering the total number of W-2s issued, the total wages paid, and the total state tax withheld. Once completed, the W-3 form must be submitted along with the W-2 forms to the Missouri Department of Revenue. This submission can help ensure that employees receive proper credit for the taxes withheld from their paychecks.

Steps to Complete the Missouri W-3 Form

Completing the Missouri W-3 form requires careful attention to detail. Follow these steps for accurate completion:

- Gather all W-2 forms issued to employees for the year.

- Enter the total number of W-2 forms in the designated field.

- Calculate and input the total wages paid to employees.

- Sum the total state income tax withheld and enter this amount.

- Review the form for accuracy before submission.

After completing the form, ensure it is signed and dated by an authorized representative of the business.

Legal Use of the Missouri W-3 Form

The Missouri W-3 form is legally required for employers who withhold state income tax from employee wages. Compliance with this requirement helps avoid penalties and ensures that the state has accurate records of tax withholdings. The form must be submitted annually, and failure to file can lead to fines and complications with employee tax records. Therefore, it is important for employers to understand the legal implications of this form and ensure timely and accurate submission.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines associated with the Missouri W-3 form. Typically, the form is due by January 31 of the year following the tax year being reported. This deadline aligns with the due date for W-2 forms, ensuring that all necessary documentation is submitted simultaneously. Meeting this deadline is crucial to avoid late fees and potential legal issues.

Form Submission Methods

The Missouri W-3 form can be submitted using various methods to accommodate different employer preferences. Employers can file the form electronically through the Missouri Department of Revenue's online portal, which is often the most efficient method. Alternatively, the form can be mailed to the appropriate state office. It is important to retain copies of all submitted forms for record-keeping purposes, regardless of the submission method chosen.

Quick guide on how to complete informational disbursement report city of st louis 2018 w3

Complete Missouri W 3 Form with ease on any device

Online document management has become increasingly favored by companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents quickly and efficiently. Manage Missouri W 3 Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign Missouri W 3 Form effortlessly

- Retrieve Missouri W 3 Form and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that task.

- Generate your eSignature using the Sign tool, which takes just a few seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to submit your form: via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Missouri W 3 Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct informational disbursement report city of st louis 2018 w3

Create this form in 5 minutes!

How to create an eSignature for the informational disbursement report city of st louis 2018 w3

How to generate an electronic signature for your Informational Disbursement Report City Of St Louis 2018 W3 in the online mode

How to generate an electronic signature for your Informational Disbursement Report City Of St Louis 2018 W3 in Chrome

How to create an electronic signature for putting it on the Informational Disbursement Report City Of St Louis 2018 W3 in Gmail

How to create an electronic signature for the Informational Disbursement Report City Of St Louis 2018 W3 from your smart phone

How to make an eSignature for the Informational Disbursement Report City Of St Louis 2018 W3 on iOS devices

How to create an electronic signature for the Informational Disbursement Report City Of St Louis 2018 W3 on Android

People also ask

-

What is a fillable mo w 3 form?

A fillable mo w 3 form is a tax form used to report wages paid to employees. With airSlate SignNow, you can easily create and manage fillable mo w 3 forms that can be completed electronically, saving you time and effort during tax season.

-

How can airSlate SignNow help with fillable mo w 3 forms?

AirSlate SignNow streamlines the process of creating fillable mo w 3 forms by allowing you to customize templates and share them securely. This ensures that all necessary details are captured accurately, simplifying your tax reporting process.

-

Is there a cost associated with using fillable mo w 3 forms in airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that include the use of fillable mo w 3 forms. Select the plan that best suits your business's needs, and you'll gain access to all features needed for efficient eSigning and document management.

-

Can I integrate airSlate SignNow with other tools for handling fillable mo w 3 forms?

Absolutely! airSlate SignNow offers seamless integrations with various applications, enhancing your ability to work with fillable mo w 3 forms. This ensures that your existing workflows remain undisturbed while optimizing your document management processes.

-

What are the key features of airSlate SignNow for managing fillable mo w 3 forms?

Key features of airSlate SignNow include customizable templates for fillable mo w 3 forms, advanced security options, and the ability to track document status in real-time. These functionalities make it the ideal solution for businesses looking to improve efficiency and compliance.

-

How secure are fillable mo w 3 forms stored in airSlate SignNow?

Security is paramount in airSlate SignNow, with robust measures in place to protect your fillable mo w 3 forms. All data is encrypted, and you can set access controls to ensure that only authorized personnel can view or edit sensitive documents.

-

Are fillable mo w 3 forms easy to share with employees?

Yes, sharing fillable mo w 3 forms is simple and efficient with airSlate SignNow. You can send forms via email or generate shareable links, allowing employees to access and complete their forms quickly, regardless of their location.

Get more for Missouri W 3 Form

Find out other Missouri W 3 Form

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy