State Tax Filing Guidance for Coronavirus Pandemic Aicpa 2020

Understanding the Missouri W-3 Form

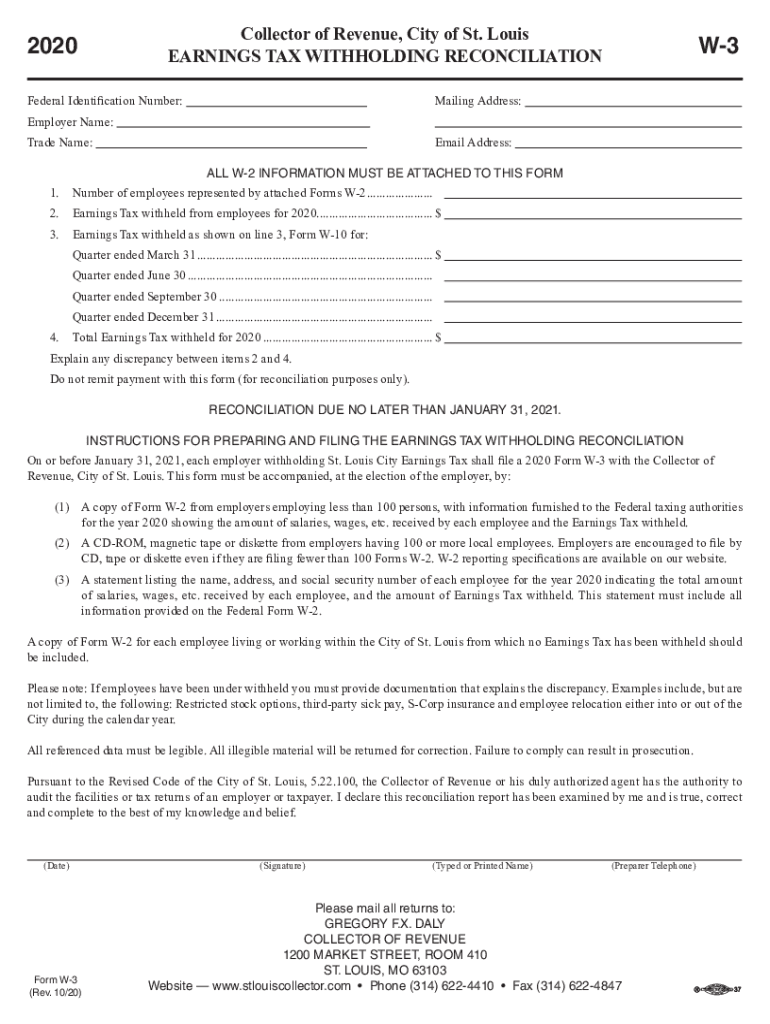

The Missouri W-3 form is a crucial document used for tax reporting purposes. It serves as a reconciliation of the income tax withheld from employees' wages and is submitted to the Missouri Department of Revenue. Employers must complete this form to summarize the total wages paid and the total income tax withheld during the tax year. This ensures compliance with state tax regulations and helps maintain accurate records for both the employer and the state.

Steps to Complete the Missouri W-3 Form

Completing the Missouri W-3 form involves several key steps to ensure accuracy and compliance. First, gather all necessary payroll records for the year, including total wages and tax withheld for each employee. Next, fill out the form by entering the total number of employees, total wages, and total tax withheld. It's essential to double-check all entries for accuracy. Finally, submit the completed form to the Missouri Department of Revenue by the specified deadline, which is typically the last day of January following the tax year.

Filing Deadlines for the Missouri W-3 Form

Employers must be aware of the filing deadlines for the Missouri W-3 form to avoid penalties. The form is due by January 31 of the year following the tax year being reported. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Timely submission is crucial to ensure compliance with state tax laws and to avoid potential fines.

Required Documents for Filing

When preparing to file the Missouri W-3 form, certain documents are essential. Employers should have their payroll records, including W-2 forms for each employee, which detail individual earnings and tax withholdings. Additionally, having a summary of total wages paid and total tax withheld will streamline the completion of the W-3 form. Ensuring all documents are accurate and complete will facilitate a smooth filing process.

Penalties for Non-Compliance

Failure to file the Missouri W-3 form on time or inaccuracies in the form can result in penalties. The Missouri Department of Revenue may impose fines for late submissions, which can accumulate over time. Additionally, if discrepancies are found in the reported figures, employers may face further scrutiny and potential audits. It is crucial for employers to prioritize compliance to avoid these financial repercussions.

Digital vs. Paper Version of the Missouri W-3 Form

Employers have the option to file the Missouri W-3 form either digitally or via paper submission. The digital version, often submitted through an online portal, can streamline the process and reduce the risk of errors. Conversely, paper submissions may require additional time for processing. Regardless of the method chosen, ensuring that the form is completed accurately and submitted on time is essential for compliance.

Quick guide on how to complete state tax filing guidance for coronavirus pandemic aicpa

Prepare State Tax Filing Guidance For Coronavirus Pandemic Aicpa seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage State Tax Filing Guidance For Coronavirus Pandemic Aicpa on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign State Tax Filing Guidance For Coronavirus Pandemic Aicpa effortlessly

- Obtain State Tax Filing Guidance For Coronavirus Pandemic Aicpa and click Get Form to begin.

- Use the tools we provide to complete your document.

- Select important sections of the documents or redact sensitive information with tools offered by airSlate SignNow specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal weight as a customary wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign State Tax Filing Guidance For Coronavirus Pandemic Aicpa and ensure excellent communication throughout the document preparation stages with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state tax filing guidance for coronavirus pandemic aicpa

Create this form in 5 minutes!

How to create an eSignature for the state tax filing guidance for coronavirus pandemic aicpa

The way to make an electronic signature for your PDF document online

The way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to make an eSignature from your smart phone

The way to generate an electronic signature for a PDF document on iOS

How to make an eSignature for a PDF file on Android OS

People also ask

-

What is mo w 3 and how does it relate to airSlate SignNow?

Mo w 3 refers to the third version of the initial mobile app that enhances efficiency in document signing. With airSlate SignNow, businesses can leverage mo w 3 to seamlessly send and eSign documents from their mobile devices, ensuring quick and easy access to documents anywhere and anytime.

-

What are the pricing options for using mo w 3 with airSlate SignNow?

AirSlate SignNow offers competitive pricing plans that include features of mo w 3 for various business needs. You can choose from monthly or annual subscriptions, with pricing tiers designed to accommodate businesses of all sizes, ensuring that everyone can benefit from the innovative capabilities of mo w 3.

-

What features does mo w 3 offer that enhance document signing?

Mo w 3 includes features like improved user interface, customizable templates, and advanced security protocols. These features make signing documents faster and more secure, enhancing the overall experience with airSlate SignNow, especially for teams that need quick document turnaround.

-

How can businesses benefit from the mo w 3 version of airSlate SignNow?

Businesses can streamline their document workflows with mo w 3, reducing the time spent on manual processes. By utilizing airSlate SignNow’s features in mo w 3, companies can increase efficiency, enhance collaboration, and improve customer satisfaction by allowing swift eSigning.

-

Does mo w 3 integrate with other applications?

Yes, mo w 3 is designed to integrate seamlessly with numerous third-party applications like Google Drive, Salesforce, and more. This capability allows users to enhance their document management processes within airSlate SignNow by connecting with tools they already use.

-

Is technical support available for mo w 3 users?

Absolutely! airSlate SignNow provides dedicated support for mo w 3 users through multiple channels, including live chat, email, and comprehensive help documentation. This ensures that all users can easily resolve issues and get the most out of their document signing experience.

-

How secure is the mo w 3 version of airSlate SignNow?

Mo w 3 maintains high-security standards, including end-to-end encryption and compliance with major regulations. This commitment to security ensures that all documents signed through airSlate SignNow are protected against unauthorized access and bsignNowes.

Get more for State Tax Filing Guidance For Coronavirus Pandemic Aicpa

- Wa rent increase form

- Washington partial form

- Washington landlord form

- Washington satisfaction judgment 497429655 form

- Partial release of judgment with individual and representative acknowledgments washington form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase washington form

- Waiver of lien with individual and representative acknowledgments washington form

- Partial waiver of lien with individual and representative acknowledgments washington form

Find out other State Tax Filing Guidance For Coronavirus Pandemic Aicpa

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free