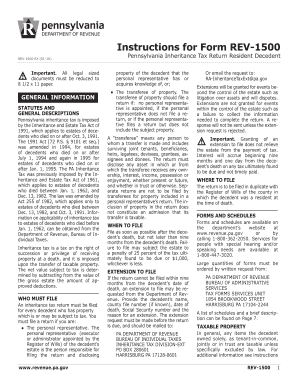

Fillable Instructions for Form REV 1500 Pennsylvania Inheritance Tax 2016

What is the Fillable Instructions For Form REV 1500 Pennsylvania Inheritance Tax

The Fillable Instructions For Form REV 1500 Pennsylvania Inheritance Tax provide essential guidance for individuals responsible for filing inheritance tax in Pennsylvania. This form is specifically designed to assist executors, administrators, and heirs in understanding their obligations under Pennsylvania law regarding inheritance tax. It outlines the necessary steps to complete the form accurately, helping to ensure compliance with state regulations.

Steps to Complete the Fillable Instructions For Form REV 1500 Pennsylvania Inheritance Tax

Completing the Fillable Instructions For Form REV 1500 involves several key steps:

- Gather all relevant information, including details about the deceased, the beneficiaries, and the assets involved.

- Access the fillable form, which can be downloaded from the Pennsylvania Department of Revenue website.

- Carefully follow the instructions provided on the form, ensuring all fields are filled out accurately.

- Calculate the inheritance tax owed based on the value of the estate and the relationship of the beneficiaries to the deceased.

- Review the completed form for accuracy and completeness before submission.

Legal Use of the Fillable Instructions For Form REV 1500 Pennsylvania Inheritance Tax

The Fillable Instructions For Form REV 1500 are legally binding documents that must be completed in accordance with Pennsylvania law. Ensuring that the form is filled out correctly is crucial, as inaccuracies can lead to penalties or delays in processing. The instructions provide clarity on legal requirements, helping users understand their responsibilities and the implications of the inheritance tax.

Required Documents for the Fillable Instructions For Form REV 1500 Pennsylvania Inheritance Tax

When completing the Fillable Instructions For Form REV 1500, certain documents are necessary to support the information provided. These may include:

- The death certificate of the deceased.

- A copy of the will or trust documents, if applicable.

- Documentation of all assets, including appraisals and titles.

- Identification of all beneficiaries and their relationship to the deceased.

Form Submission Methods for the Fillable Instructions For Form REV 1500 Pennsylvania Inheritance Tax

The completed Fillable Instructions For Form REV 1500 can be submitted through various methods:

- Online submission via the Pennsylvania Department of Revenue's e-filing system.

- Mailing the completed form to the appropriate regional office.

- In-person delivery at designated Pennsylvania Department of Revenue offices.

Filing Deadlines for the Fillable Instructions For Form REV 1500 Pennsylvania Inheritance Tax

It is essential to be aware of the filing deadlines associated with the Fillable Instructions For Form REV 1500. Generally, the inheritance tax return must be filed within nine months of the date of death to avoid penalties. Extensions may be available under certain circumstances, but it is advisable to check with the Pennsylvania Department of Revenue for specific guidelines.

Quick guide on how to complete fillable instructions for form rev 1500 pennsylvania inheritance tax

Effortlessly Prepare Fillable Instructions For Form REV 1500 Pennsylvania Inheritance Tax on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any holdups. Manage Fillable Instructions For Form REV 1500 Pennsylvania Inheritance Tax on any device with the airSlate SignNow applications for Android or iOS and enhance your document-centric processes today.

The most efficient way to modify and electronically sign Fillable Instructions For Form REV 1500 Pennsylvania Inheritance Tax with ease

- Locate Fillable Instructions For Form REV 1500 Pennsylvania Inheritance Tax and select Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with specialized tools that airSlate SignNow offers for this purpose.

- Generate your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, exhausting form navigation, or errors requiring the printing of new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your chosen device. Modify and electronically sign Fillable Instructions For Form REV 1500 Pennsylvania Inheritance Tax to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable instructions for form rev 1500 pennsylvania inheritance tax

Create this form in 5 minutes!

How to create an eSignature for the fillable instructions for form rev 1500 pennsylvania inheritance tax

How to generate an eSignature for the Fillable Instructions For Form Rev 1500 Pennsylvania Inheritance Tax in the online mode

How to create an eSignature for your Fillable Instructions For Form Rev 1500 Pennsylvania Inheritance Tax in Chrome

How to generate an eSignature for signing the Fillable Instructions For Form Rev 1500 Pennsylvania Inheritance Tax in Gmail

How to generate an eSignature for the Fillable Instructions For Form Rev 1500 Pennsylvania Inheritance Tax straight from your mobile device

How to make an eSignature for the Fillable Instructions For Form Rev 1500 Pennsylvania Inheritance Tax on iOS devices

How to create an eSignature for the Fillable Instructions For Form Rev 1500 Pennsylvania Inheritance Tax on Android OS

People also ask

-

What are Fillable Instructions For Form REV 1500 Pennsylvania Inheritance Tax?

Fillable Instructions For Form REV 1500 Pennsylvania Inheritance Tax are detailed guidelines that assist users in completing the inheritance tax form accurately. They provide step-by-step information on how to fill out various sections of the form, ensuring compliance with state regulations. This is essential for those who are managing estate taxes in Pennsylvania.

-

How can airSlate SignNow help with Fillable Instructions For Form REV 1500 Pennsylvania Inheritance Tax?

airSlate SignNow simplifies the process of accessing and completing Fillable Instructions For Form REV 1500 Pennsylvania Inheritance Tax. With our user-friendly platform, you can easily fill out, sign, and send the document, all while ensuring that every required section is completed accurately. Our solution reduces the hassle typically associated with paper forms.

-

Are there any costs associated with using airSlate SignNow for Fillable Instructions For Form REV 1500 Pennsylvania Inheritance Tax?

Yes, using airSlate SignNow involves a subscription fee that varies based on the features you need. However, our service is cost-effective compared to traditional paper processing, saving you time and reducing errors. We offer various plans to ensure that individuals and businesses can find a suitable option.

-

What features does airSlate SignNow offer for Fillable Instructions For Form REV 1500 Pennsylvania Inheritance Tax?

airSlate SignNow includes features like eSignature capabilities, document templates, and automated reminders, making it easier to manage Fillable Instructions For Form REV 1500 Pennsylvania Inheritance Tax. Moreover, our platform offers secure storage and the ability to track document status, facilitating efficient and worry-free tax filing.

-

Can I integrate airSlate SignNow with other software for managing Fillable Instructions For Form REV 1500 Pennsylvania Inheritance Tax?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions, allowing you to manage Fillable Instructions For Form REV 1500 Pennsylvania Inheritance Tax alongside your existing tools. Whether you're using CRM software, cloud storage, or project management tools, our integrations enhance your workflow and improve productivity.

-

Are Fillable Instructions For Form REV 1500 Pennsylvania Inheritance Tax secure with airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. We utilize advanced encryption protocols to ensure that your Fillable Instructions For Form REV 1500 Pennsylvania Inheritance Tax and any sensitive data are kept secure. You can trust that your documents are protected throughout the eSigning process.

-

What are the benefits of using airSlate SignNow for Fillable Instructions For Form REV 1500 Pennsylvania Inheritance Tax?

Using airSlate SignNow for Fillable Instructions For Form REV 1500 Pennsylvania Inheritance Tax streamlines the process, reduces errors, and saves time. Our platform allows you to quickly complete and sign your forms while providing a secure environment for managing your documents. This enhances your overall efficiency in handling estate tax matters.

Get more for Fillable Instructions For Form REV 1500 Pennsylvania Inheritance Tax

- Northcentral university transcript request form

- Issi form 122 northeastern

- Contractors39 bexcise tax returnb state of south dakota state sd form

- Transcript st johns university form

- Claim of lienform florida

- Statutory declaration form w45a i mycpf cpf gov

- Group health statement form

- Initial two step tuberculin skin test report form college of saint csbsju

Find out other Fillable Instructions For Form REV 1500 Pennsylvania Inheritance Tax

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF