Form Tc 208 2020-2026

What is the Form TC 208

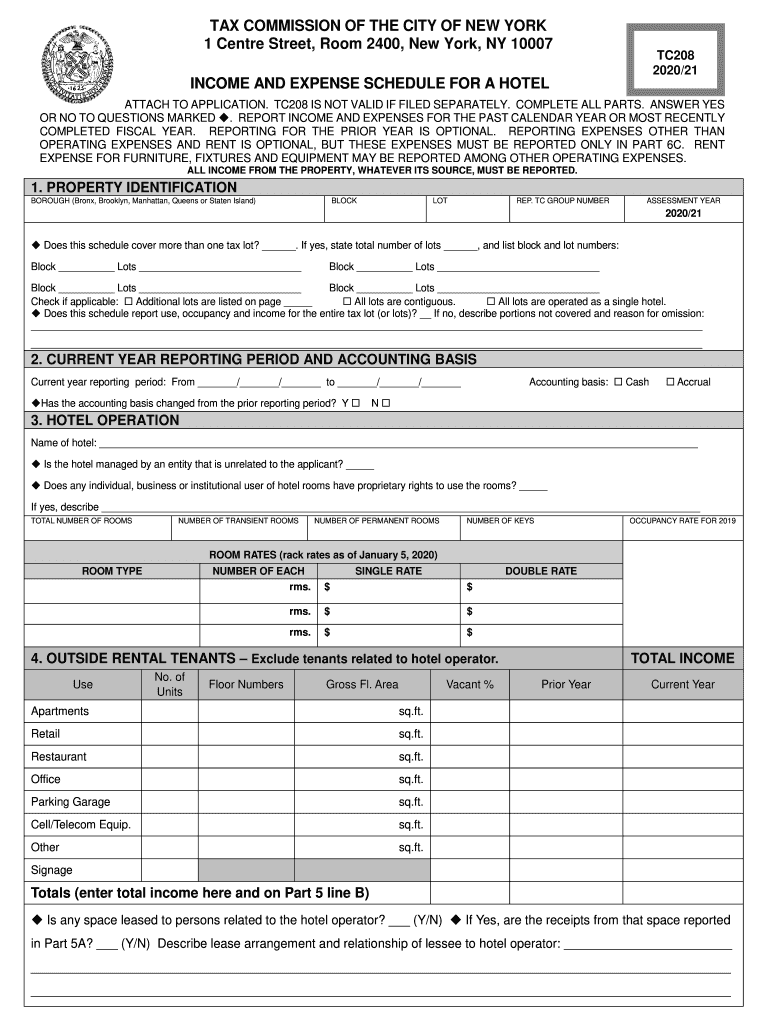

The TC 208 form, issued by the New York Tax Commission, is primarily used for reporting various tax-related information. It serves as a declaration for taxpayers to provide details about their income, deductions, and other pertinent financial data. This form is essential for ensuring compliance with state tax regulations and is typically required during the annual tax filing process.

How to use the Form TC 208

Using the TC 208 form involves several steps to ensure accurate completion. Taxpayers must first gather all necessary financial documents, including income statements and receipts for deductions. Once the required information is collected, individuals can fill out the form either electronically or by hand. It is crucial to follow the instructions provided on the form carefully to avoid errors that could lead to delays or penalties.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the TC 208 form is vital for compliance. Typically, the form must be submitted by April fifteenth of each year for the previous tax year. However, taxpayers should verify specific deadlines as they may vary based on individual circumstances or changes in tax law. Missing the deadline can result in penalties or interest on unpaid taxes.

Steps to complete the Form TC 208

Completing the TC 208 form involves a series of systematic steps:

- Gather Documentation: Collect all necessary financial documents, such as W-2s, 1099s, and receipts.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Report Income: Accurately report all sources of income as instructed on the form.

- Claim Deductions: Include any eligible deductions to reduce taxable income.

- Review and Sign: Double-check all entries for accuracy before signing the form.

- Submit the Form: File the completed form by the deadline, either electronically or by mail.

Legal use of the Form TC 208

The TC 208 form is legally binding when completed correctly and submitted on time. It must be filled out in accordance with New York state tax laws to ensure its validity. Taxpayers should be aware that any false information provided on the form can lead to legal consequences, including fines or criminal charges. Therefore, it is essential to maintain honesty and accuracy throughout the process.

Who Issues the Form

The New York Tax Commission is responsible for issuing the TC 208 form. This state agency oversees tax collection and ensures compliance with tax laws in New York. Taxpayers can obtain the form directly from the Tax Commission's official website or through authorized tax professionals.

Quick guide on how to complete income and expense schedule for a hotel tax

Effortlessly Prepare Form Tc 208 on Any Device

Managing documents online has gained signNow popularity among businesses and individuals alike. It presents an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents swiftly and without holdups. Handle Form Tc 208 on any device using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The easiest way to modify and electronically sign Form Tc 208 without hassle

- Obtain Form Tc 208 and then click Get Form to initiate.

- Utilize the tools available to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as an ink signature.

- Verify all information and then click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form Tc 208 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct income and expense schedule for a hotel tax

Create this form in 5 minutes!

How to create an eSignature for the income and expense schedule for a hotel tax

How to make an eSignature for the Income And Expense Schedule For A Hotel Tax online

How to make an electronic signature for the Income And Expense Schedule For A Hotel Tax in Google Chrome

How to make an eSignature for signing the Income And Expense Schedule For A Hotel Tax in Gmail

How to generate an electronic signature for the Income And Expense Schedule For A Hotel Tax from your smartphone

How to generate an eSignature for the Income And Expense Schedule For A Hotel Tax on iOS devices

How to generate an electronic signature for the Income And Expense Schedule For A Hotel Tax on Android

People also ask

-

What is the TC208 and why is it important?

The TC208 is an essential compliance document that businesses need to submit by a specific deadline. Knowing when the TC208 is due helps you stay compliant and avoid potential penalties. Utilizing airSlate SignNow ensures you can easily manage your documents and submit them on time.

-

When is the TC208 due for 2023?

The deadline for submitting the TC208 in 2023 is typically set by regulatory authorities. It's crucial to check for specific dates and ensure compliance. With airSlate SignNow, you can set reminders to ensure you don't miss when the TC208 is due.

-

How can airSlate SignNow help me with the TC208?

airSlate SignNow provides a seamless way to create, send, and eSign your TC208 documents. The platform's user-friendly interface makes it easy to prepare your paperwork swiftly and efficiently. With airSlate SignNow, you can ensure that your TC208 is submitted accurately by the due date.

-

What are the key features of airSlate SignNow related to document submissions?

Key features of airSlate SignNow include eSignature capabilities, automated workflows, and document tracking. These features are designed to simplify the submission process of important documents like the TC208. By using airSlate SignNow, you can manage your document submissions efficiently and ensure you meet when the TC208 is due.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is a cost-effective solution tailored for businesses of all sizes, including small enterprises. It offers various pricing plans to meet different needs, ensuring that you don’t overspend. By adopting airSlate SignNow, you not only save costs but also improve your compliance processes, including timely submissions of documents like the TC208.

-

Does airSlate SignNow integrate with other software?

Absolutely! airSlate SignNow integrates seamlessly with various popular software tools, making it easier to manage all your documents in one place. This integration ensures that your workflow remains uninterrupted, especially when dealing with deadlines like when the TC208 is due.

-

Can I store my TC208 documents securely with airSlate SignNow?

Yes, airSlate SignNow guarantees secure storage for your TC208 and other important documents. The platform uses encryption and complies with industry standards to protect your data. You can have peace of mind knowing that your documents are secure as you prepare to submit them when the TC208 is due.

Get more for Form Tc 208

Find out other Form Tc 208

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast