Kentucky Employers Income Tax Withheld Worksheet K 1 Form 2006

What is the Kentucky Employers Income Tax Withheld Worksheet K-1 Form

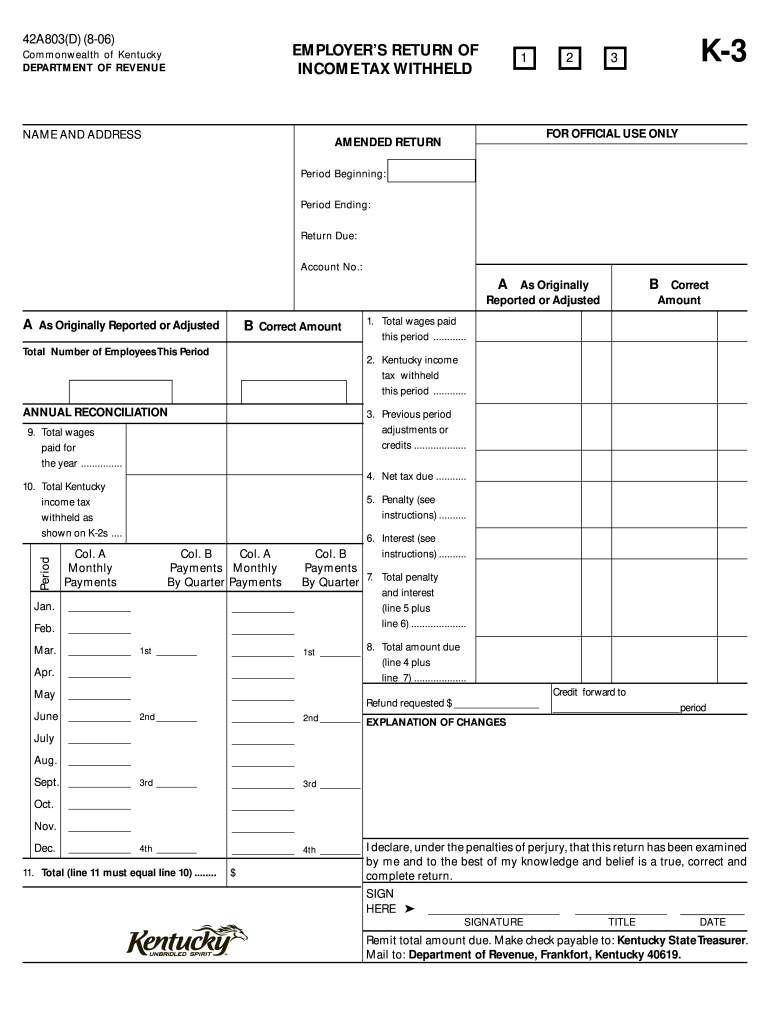

The Kentucky Employers Income Tax Withheld Worksheet K-1 Form is a critical document used by employers in Kentucky to calculate the amount of state income tax to withhold from employees' wages. This form is essential for ensuring compliance with state tax regulations and for accurately reporting withheld taxes to the Kentucky Department of Revenue. The K-1 form provides a structured way for employers to determine the correct withholding amounts based on various employee factors, including filing status and exemptions claimed.

How to obtain the Kentucky Employers Income Tax Withheld Worksheet K-1 Form

Employers can obtain the Kentucky Employers Income Tax Withheld Worksheet K-1 Form through several methods. The form is available for download from the Kentucky Department of Revenue's official website. Additionally, employers may request a physical copy from their local tax office or consult with a tax professional for assistance. It is important to ensure that the most current version of the form is used, as tax regulations may change annually.

Steps to complete the Kentucky Employers Income Tax Withheld Worksheet K-1 Form

Completing the Kentucky Employers Income Tax Withheld Worksheet K-1 Form involves several key steps:

- Gather necessary employee information, including names, Social Security numbers, and filing statuses.

- Determine the appropriate withholding allowances based on employee submissions, such as W-4 forms.

- Calculate the total wages subject to withholding for each employee.

- Utilize the worksheet to compute the correct withholding amount, referencing the state tax tables as needed.

- Document the calculated amounts on the K-1 form and retain copies for your records.

Legal use of the Kentucky Employers Income Tax Withheld Worksheet K-1 Form

The Kentucky Employers Income Tax Withheld Worksheet K-1 Form is legally required for employers to accurately report and remit state income tax withholdings. Employers must ensure that the form is completed correctly to avoid penalties and interest for non-compliance. The form must be retained as part of the employer's tax records for a specified period, as outlined by state tax laws. Proper use of this form helps maintain transparency and accountability in tax reporting.

Key elements of the Kentucky Employers Income Tax Withheld Worksheet K-1 Form

Key elements of the Kentucky Employers Income Tax Withheld Worksheet K-1 Form include:

- Employee identification details, such as name and Social Security number.

- Filing status options, including single, married, or head of household.

- Withholding allowances claimed by the employee.

- Total wages subject to withholding.

- Calculated withholding amounts based on state tax tables.

Filing Deadlines / Important Dates

Employers must be aware of specific deadlines for filing the Kentucky Employers Income Tax Withheld Worksheet K-1 Form. Generally, the form should be submitted alongside the employer's payroll tax filings, which are typically due on a quarterly basis. It is crucial to stay informed about any changes to deadlines, as the Kentucky Department of Revenue may adjust these dates based on legislative updates or administrative decisions.

Quick guide on how to complete kentucky employers income tax withheld worksheet k 1 2006 form

Your assistance manual on how to prepare your Kentucky Employers Income Tax Withheld Worksheet K 1 Form

If you’re interested in learning how to fill out and present your Kentucky Employers Income Tax Withheld Worksheet K 1 Form, here are a few straightforward guidelines to simplify tax submission.

Firstly, you need to create your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a user-friendly and powerful document solution that enables you to modify, design, and finalize your tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and return to update details as necessary. Enhance your tax management with advanced PDF editing, eSigning, and intuitive sharing.

Follow the instructions below to complete your Kentucky Employers Income Tax Withheld Worksheet K 1 Form in just a few minutes:

- Create your account and start working on PDFs within minutes.

- Utilize our directory to find any IRS tax form; browse versions and schedules.

- Click Retrieve form to open your Kentucky Employers Income Tax Withheld Worksheet K 1 Form in our editor.

- Populate the necessary fillable fields with your information (text, numbers, check marks).

- Use the Signature Tool to insert your legally-recognized eSignature (if required).

- Review your document and rectify any mistakes.

- Save modifications, print a copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes using airSlate SignNow. Please be aware that submitting on paper can lead to increased return mistakes and delayed refunds. Before e-filing your taxes, check the IRS website for declaration guidelines applicable to your state.

Create this form in 5 minutes or less

Find and fill out the correct kentucky employers income tax withheld worksheet k 1 2006 form

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

-

According to instructions, if you earn less than $1,500, say $15 in interest, you don't have to fill out a Schedule B--if it's ordinary income, where do you put it on the new forms? (I know the government won't give up a penny in tax.)

If you have less than $1500 in interest income, and do not attach Schedule B, you should report your total taxable interest directly on Form 1040, Line 2b.

-

My company pays the TDS for the current financial year and the amount of tax was Rs. 0 because I am in the first slab. Do I still need to fill out an ITR-1 if I have Form 16 from my employer?

Receiving a Form 16 from your employer does not directly imply that you need to file an Income Tax Return. A Return has to be filed if your total income (including salary and any income from say savings bank account interest, interest income on fixed deposits, rental income) is more than the minimum income which is exempt from tax. This minimum exempt income is Rs 2,00,000 for FY 2013-14 and Rs 2,50,000 for FY 2014-15 and FY 2015-16.So you need to sum up the total income earned by you in a financial year and see if you are required to pay tax and file a Return.Return filing has several advantages too -Need a Refund – In case excess TDS has been deducted on your income and you need to claim a refund - in this situation you must file a return to claim the tax refund. For example, even though your total income is below the taxable limit, a bank deducted TDS on your FD interest - to get the refund of this TDS you'll have to file a Return.Need a Loan – When you signNow out to a bank or a financial institution for a loan a house loan or a personal loan - they usually require copies of your IT returns to check your credit worthiness. And therefore, it makes sense to keep your finances in order and file an IT return.Visas - Some countries require copies of your IT returns when they provide you a travel or a work visa.You can read more in detail here Are You required to file an IT Return in India?You'll find a lot of helpful topics here which have been addressed in very simple and easy format ClearTax's Series on Salary Income. Understand Salary Income, Deductions, Form-16Do note that if you file with http://www.cleartax.in you never have to choose which form to file since we do that for you automatically.signNow out to us support@cleartax.in if you need help!

-

As a partner in an LLC also hired by it as a contractor, with the LLC reporting all my income on a schedule K-1, what tax forms should I use (Federal and California)? Am I allowed to contribute to a personal SEP IRA as if I were self-employed?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling. And, Treasury does not consider the payments we dicuss below as employee payments (Treasury Regulation Section 1.707–1(c)).Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the kentucky employers income tax withheld worksheet k 1 2006 form

How to create an eSignature for the Kentucky Employers Income Tax Withheld Worksheet K 1 2006 Form in the online mode

How to generate an electronic signature for the Kentucky Employers Income Tax Withheld Worksheet K 1 2006 Form in Chrome

How to create an eSignature for putting it on the Kentucky Employers Income Tax Withheld Worksheet K 1 2006 Form in Gmail

How to generate an eSignature for the Kentucky Employers Income Tax Withheld Worksheet K 1 2006 Form from your smart phone

How to create an electronic signature for the Kentucky Employers Income Tax Withheld Worksheet K 1 2006 Form on iOS devices

How to create an eSignature for the Kentucky Employers Income Tax Withheld Worksheet K 1 2006 Form on Android

People also ask

-

What is the Kentucky Employers Income Tax Withheld Worksheet K 1 Form?

The Kentucky Employers Income Tax Withheld Worksheet K 1 Form is a tax document used by employers in Kentucky to report the income tax withheld from employees' wages. This worksheet helps ensure that businesses comply with state tax regulations and accurately calculate the withholding amounts for their employees. Using the Kentucky Employers Income Tax Withheld Worksheet K 1 Form is essential for proper tax reporting and employee payroll management.

-

How can airSlate SignNow help with the Kentucky Employers Income Tax Withheld Worksheet K 1 Form?

airSlate SignNow provides a streamlined platform for businesses to easily send, eSign, and manage the Kentucky Employers Income Tax Withheld Worksheet K 1 Form. Our solution simplifies document handling, allowing employers to efficiently gather signatures and ensure compliance with tax requirements. With airSlate SignNow, you can focus on your business while we take care of your document workflows.

-

Is airSlate SignNow affordable for small businesses handling the Kentucky Employers Income Tax Withheld Worksheet K 1 Form?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses handling the Kentucky Employers Income Tax Withheld Worksheet K 1 Form. Our pricing plans offer flexibility and scalability, ensuring that you only pay for the features you need. This affordability makes it easier for small businesses to manage their tax documentation efficiently.

-

What features does airSlate SignNow offer for managing the Kentucky Employers Income Tax Withheld Worksheet K 1 Form?

airSlate SignNow offers several features tailored for managing the Kentucky Employers Income Tax Withheld Worksheet K 1 Form, including customizable templates, secure eSigning, and real-time tracking. Additionally, our platform allows for seamless document sharing and integration with other business tools. These features enhance productivity and ensure that your tax documents are processed accurately and efficiently.

-

Can I integrate airSlate SignNow with other software for the Kentucky Employers Income Tax Withheld Worksheet K 1 Form?

Absolutely! airSlate SignNow seamlessly integrates with various software applications, making it easy to manage the Kentucky Employers Income Tax Withheld Worksheet K 1 Form alongside your existing tools. This integration helps streamline your workflow, allowing you to automate processes and minimize manual data entry. With these integrations, you can enhance your overall document management experience.

-

How secure is airSlate SignNow for handling the Kentucky Employers Income Tax Withheld Worksheet K 1 Form?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like the Kentucky Employers Income Tax Withheld Worksheet K 1 Form. Our platform employs advanced encryption and compliance with industry standards to protect your data. You can trust that your documents remain secure and confidential throughout the signing process.

-

What are the benefits of using airSlate SignNow for the Kentucky Employers Income Tax Withheld Worksheet K 1 Form?

Using airSlate SignNow for the Kentucky Employers Income Tax Withheld Worksheet K 1 Form offers numerous benefits, including improved efficiency, reduced turnaround time, and enhanced accuracy in document management. Our user-friendly platform simplifies the eSigning process, allowing you to focus on your core business activities. By leveraging airSlate SignNow, you can ensure compliance and streamline your tax reporting.

Get more for Kentucky Employers Income Tax Withheld Worksheet K 1 Form

Find out other Kentucky Employers Income Tax Withheld Worksheet K 1 Form

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form