Nj Form A3128 2019

What is the NJ Form A3128

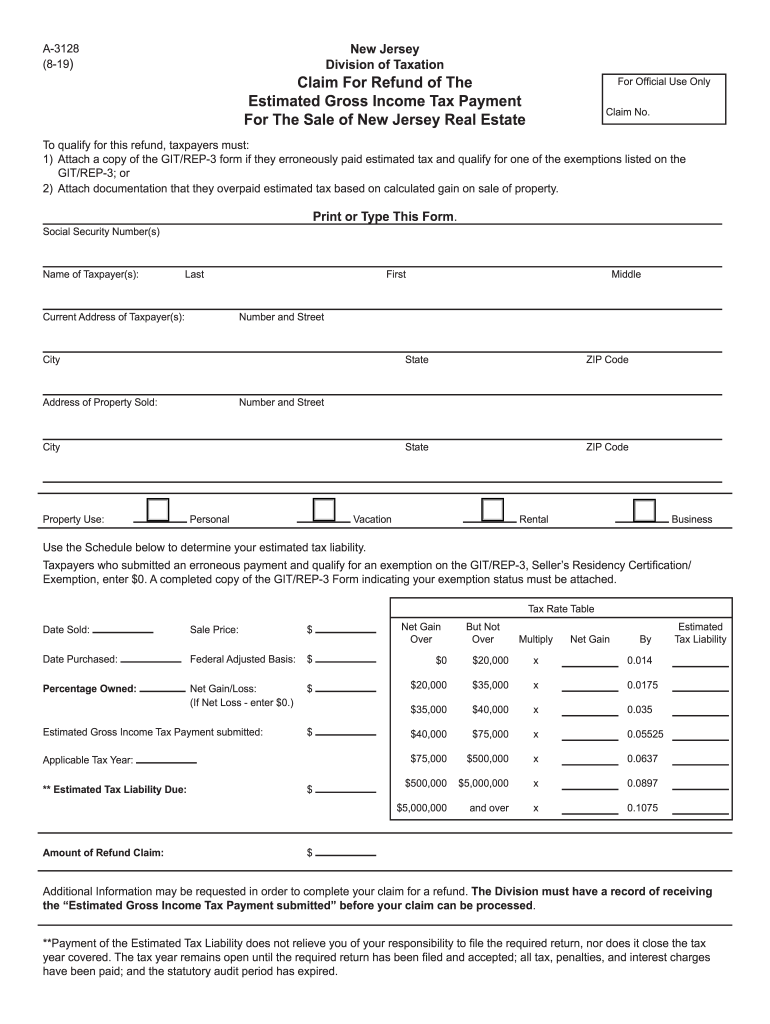

The NJ Form A3128, commonly referred to as the exit tax form, is a document required by the state of New Jersey for individuals who are selling their property and moving out of state. This form is essential for ensuring that the state collects any outstanding tax liabilities before a taxpayer leaves. The form captures important information about the sale, including the seller's details, the property address, and the sale price. It is crucial for compliance with New Jersey tax regulations.

Steps to complete the NJ Form A3128

Completing the NJ Form A3128 involves several key steps:

- Gather necessary information, including your name, address, and details of the property being sold.

- Fill out the form accurately, ensuring all sections are completed, especially those related to the sale price and date of sale.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the New Jersey Division of Taxation.

How to obtain the NJ Form A3128

The NJ Form A3128 can be obtained from the New Jersey Division of Taxation's official website. It is available as a downloadable PDF, which can be printed and filled out manually. Additionally, many real estate professionals and attorneys may have copies of the form available to assist clients during the property sale process.

Legal use of the NJ Form A3128

The NJ Form A3128 serves a legal purpose in the context of property sales and tax compliance. It is a legally binding document that must be completed and submitted to ensure that any tax obligations are settled before the seller leaves New Jersey. Failure to submit this form can result in penalties and tax liabilities that may follow the seller even after moving out of state.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the NJ Form A3128. Typically, the form should be submitted at the time of the property sale or shortly thereafter. Sellers should check with the New Jersey Division of Taxation for any specific deadlines that may apply to their situation, as these can vary based on individual circumstances.

Required Documents

When completing the NJ Form A3128, several documents may be required to support the information provided. These documents can include:

- Proof of property ownership, such as a deed.

- Sales contract or agreement.

- Any prior tax returns that may be relevant to the sale.

Quick guide on how to complete claim for refund of the estimated gross income tax payment for the sale of new jersey real estate form a 3128

Complete Nj Form A3128 effortlessly on any device

Web-based document management has gained increased traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to acquire the correct form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronic sign your documents quickly without delays. Handle Nj Form A3128 on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to edit and electronic sign Nj Form A3128 with ease

- Find Nj Form A3128 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to store your changes.

- Choose how you want to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your needs in document management in just a few clicks from any device of your preference. Alter and electronic sign Nj Form A3128 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct claim for refund of the estimated gross income tax payment for the sale of new jersey real estate form a 3128

Create this form in 5 minutes!

How to create an eSignature for the claim for refund of the estimated gross income tax payment for the sale of new jersey real estate form a 3128

How to make an electronic signature for your Claim For Refund Of The Estimated Gross Income Tax Payment For The Sale Of New Jersey Real Estate Form A 3128 online

How to make an electronic signature for your Claim For Refund Of The Estimated Gross Income Tax Payment For The Sale Of New Jersey Real Estate Form A 3128 in Google Chrome

How to create an electronic signature for signing the Claim For Refund Of The Estimated Gross Income Tax Payment For The Sale Of New Jersey Real Estate Form A 3128 in Gmail

How to create an electronic signature for the Claim For Refund Of The Estimated Gross Income Tax Payment For The Sale Of New Jersey Real Estate Form A 3128 straight from your smartphone

How to generate an eSignature for the Claim For Refund Of The Estimated Gross Income Tax Payment For The Sale Of New Jersey Real Estate Form A 3128 on iOS

How to generate an electronic signature for the Claim For Refund Of The Estimated Gross Income Tax Payment For The Sale Of New Jersey Real Estate Form A 3128 on Android devices

People also ask

-

What is the NJ exit tax form and why is it important?

The NJ exit tax form is a document that non-residents must complete when selling property in New Jersey. It ensures that any state taxes owed are paid before the transaction is finalized. Understanding this form is crucial for avoiding potential penalties and ensuring compliance with New Jersey tax regulations.

-

How can airSlate SignNow simplify the process of completing the NJ exit tax form?

AirSlate SignNow streamlines the process of filling out the NJ exit tax form by allowing users to fill, edit, and eSign documents quickly. With its user-friendly interface, you can complete the form efficiently and securely. This not only saves time but also reduces the errors often associated with manual filling.

-

Are there any fees associated with using airSlate SignNow for the NJ exit tax form?

AirSlate SignNow offers a cost-effective solution with transparent pricing for its services. Users can choose from various pricing plans based on their needs, ensuring that the costs for handling the NJ exit tax form are manageable. These plans include features that support multiple document types and help facilitate eSigning.

-

Can I integrate airSlate SignNow with other applications for handling the NJ exit tax form?

Yes, airSlate SignNow offers integrations with popular applications such as Google Drive, Dropbox, and CRM platforms. This means you can easily manage your documents related to the NJ exit tax form alongside your existing workflows. This integration capability enhances productivity and ensures that all relevant information is organized.

-

What are the benefits of using airSlate SignNow for signing the NJ exit tax form?

Using airSlate SignNow for signing the NJ exit tax form provides several benefits, including enhanced security, quick turnaround times, and ease of access from any device. With electronic signatures being legally recognized, you can complete transactions swiftly without the need for physical meetings. This convenience is particularly beneficial during busy selling seasons.

-

Is it safe to use airSlate SignNow to submit the NJ exit tax form?

Absolutely! AirSlate SignNow prioritizes user security and employs advanced encryption protocols to protect your data. When submitting the NJ exit tax form through our platform, rest assured that your information will remain confidential and secure throughout the process.

-

What if I need assistance with the NJ exit tax form while using airSlate SignNow?

AirSlate SignNow provides comprehensive support resources, including tutorials and a responsive customer support team. If you encounter challenges with the NJ exit tax form, you can easily access assistance. Our goal is to ensure that your experience is smooth and that you can complete your forms without any stress.

Get more for Nj Form A3128

- Baker college high school self certification form

- Nada39s fair credit compliance policy amp program national bb cadaopenroad form

- Baltimore city public schools domicile shared disclosure form

- Baltimore city public schools sst form

- First aid log bsaseabase form

- 430 310 form

- Small biz application e risk services form

- Request for proposals rfp p15 017 austin isd form

Find out other Nj Form A3128

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple