Nj Claim for Refund Form 2019

What is the NJ Claim For Refund Form

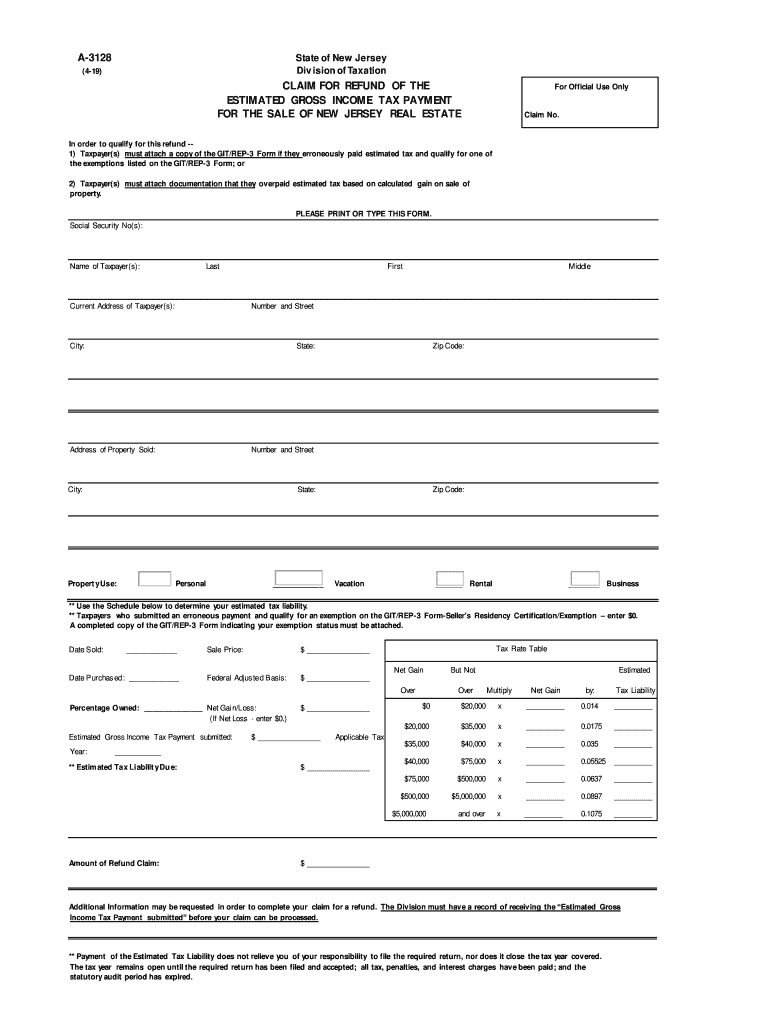

The NJ Claim For Refund Form, also known as Form A-3128, is a document used by taxpayers in New Jersey to request a refund for overpaid taxes. This form is particularly relevant for individuals and businesses who have made tax payments that exceed their actual tax liability. The form allows taxpayers to formally initiate the refund process with the New Jersey Division of Taxation.

How to use the NJ Claim For Refund Form

To effectively use the NJ Claim For Refund Form, taxpayers must first gather all relevant documentation that supports their claim for a refund. This includes proof of overpayment, such as tax returns, payment receipts, and any correspondence with the tax authority. Once the necessary documents are collected, the taxpayer fills out the form, providing accurate information regarding their tax situation and the amount they believe they are owed. After completing the form, it should be submitted to the appropriate tax office as specified in the form instructions.

Steps to complete the NJ Claim For Refund Form

Completing the NJ Claim For Refund Form involves several key steps:

- Gather necessary documents, including tax returns and proof of payment.

- Obtain the NJ Claim For Refund Form from the New Jersey Division of Taxation website or a local tax office.

- Fill out the form accurately, ensuring all personal and tax information is correct.

- Attach any supporting documentation that validates your claim.

- Submit the completed form and attachments to the designated tax office.

Required Documents

When filing the NJ Claim For Refund Form, it is essential to include certain documents to support your claim. Required documents may include:

- Copies of prior tax returns for the years in question.

- Payment receipts or bank statements showing tax payments made.

- Any correspondence with the New Jersey Division of Taxation related to the overpayment.

Filing Deadlines / Important Dates

Taxpayers should be aware of specific deadlines when submitting the NJ Claim For Refund Form. Generally, claims must be filed within three years from the date the tax was paid or within two years from the date the tax return was filed, whichever is later. It is crucial to adhere to these timelines to ensure that the claim is processed without delays.

Penalties for Non-Compliance

Failing to comply with the regulations surrounding the NJ Claim For Refund Form can result in penalties. Taxpayers who do not file their claims within the specified deadlines may forfeit their right to a refund. Additionally, submitting false information on the form can lead to further legal consequences, including fines or other penalties imposed by the New Jersey Division of Taxation.

Quick guide on how to complete nj dot a 3128 2019

Complete Nj Claim For Refund Form effortlessly on any device

Online document management has become increasingly favored by companies and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed documents, as you can acquire the correct form and securely archive it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents promptly without holdups. Handle Nj Claim For Refund Form on any platform with the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to alter and eSign Nj Claim For Refund Form seamlessly

- Locate Nj Claim For Refund Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information carefully and click on the Done button to save your modifications.

- Select how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from the device of your choice. Edit and eSign Nj Claim For Refund Form and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nj dot a 3128 2019

Create this form in 5 minutes!

How to create an eSignature for the nj dot a 3128 2019

How to make an eSignature for the Nj Dot A 3128 2019 in the online mode

How to make an electronic signature for the Nj Dot A 3128 2019 in Google Chrome

How to generate an eSignature for putting it on the Nj Dot A 3128 2019 in Gmail

How to make an electronic signature for the Nj Dot A 3128 2019 right from your mobile device

How to make an eSignature for the Nj Dot A 3128 2019 on iOS devices

How to create an electronic signature for the Nj Dot A 3128 2019 on Android OS

People also ask

-

What is the Nj Claim For Refund Form?

The Nj Claim For Refund Form is a document used by individuals in New Jersey to request a refund for overpaid taxes or fees. By completing this form, taxpayers can ensure they receive any eligible refunds promptly. Utilizing airSlate SignNow simplifies the process of signing and submitting the Nj Claim For Refund Form electronically.

-

How can airSlate SignNow help with the Nj Claim For Refund Form?

airSlate SignNow provides a user-friendly platform for electronically signing the Nj Claim For Refund Form, making it easier to manage your documents. With our solution, you can quickly fill out, sign, and send the form directly to the appropriate tax authorities. This streamlines the refund process and helps you avoid delays.

-

Is there a cost associated with using airSlate SignNow for the Nj Claim For Refund Form?

Yes, airSlate SignNow offers competitive pricing plans to suit various business needs. While there is a nominal fee for using our services, the efficiency gained from electronically managing your Nj Claim For Refund Form often outweighs the cost, saving you time and hassle in the long run.

-

What features does airSlate SignNow offer for the Nj Claim For Refund Form?

airSlate SignNow offers a range of features that enhance the experience of managing the Nj Claim For Refund Form. These include template creation, in-app signing, and secure cloud storage for all your documents. Additionally, our platform allows for real-time tracking of the form's status, ensuring you stay informed throughout the process.

-

Can I integrate airSlate SignNow with other software for my Nj Claim For Refund Form?

Absolutely! airSlate SignNow supports seamless integrations with various software applications that can help you manage your Nj Claim For Refund Form more effectively. Whether you use CRM systems or document management tools, our platform can easily connect to enhance your workflow.

-

How do I get started with airSlate SignNow for the Nj Claim For Refund Form?

Getting started with airSlate SignNow for the Nj Claim For Refund Form is simple. You can sign up for an account on our website, choose a suitable plan, and access our intuitive dashboard. From there, you can upload your form, add the necessary details, and start the signing process.

-

What are the benefits of using airSlate SignNow for the Nj Claim For Refund Form?

Using airSlate SignNow for the Nj Claim For Refund Form offers numerous benefits, including increased efficiency, improved accuracy, and enhanced security. Our electronic signature solution ensures your forms are signed quickly and securely, signNowly reducing turnaround time and helping you receive your refunds faster.

Get more for Nj Claim For Refund Form

Find out other Nj Claim For Refund Form

- Sign Montana Banking RFP Easy

- Sign Missouri Banking Last Will And Testament Online

- Sign Montana Banking Quitclaim Deed Secure

- Sign Montana Banking Quitclaim Deed Safe

- Sign Missouri Banking Rental Lease Agreement Now

- Sign Nebraska Banking Last Will And Testament Online

- Sign Nebraska Banking LLC Operating Agreement Easy

- Sign Missouri Banking Lease Agreement Form Simple

- Sign Nebraska Banking Lease Termination Letter Myself

- Sign Nevada Banking Promissory Note Template Easy

- Sign Nevada Banking Limited Power Of Attorney Secure

- Sign New Jersey Banking Business Plan Template Free

- Sign New Jersey Banking Separation Agreement Myself

- Sign New Jersey Banking Separation Agreement Simple

- Sign Banking Word New York Fast

- Sign New Mexico Banking Contract Easy

- Sign New York Banking Moving Checklist Free

- Sign New Mexico Banking Cease And Desist Letter Now

- Sign North Carolina Banking Notice To Quit Free

- Sign Banking PPT Ohio Fast