Claim for Refund of the Estimated Gross Income Tax Payment for the Sale of New Jersey Real Estate, Form a 3128 2021-2026

Understanding the NJ Exit Tax Form A 3128

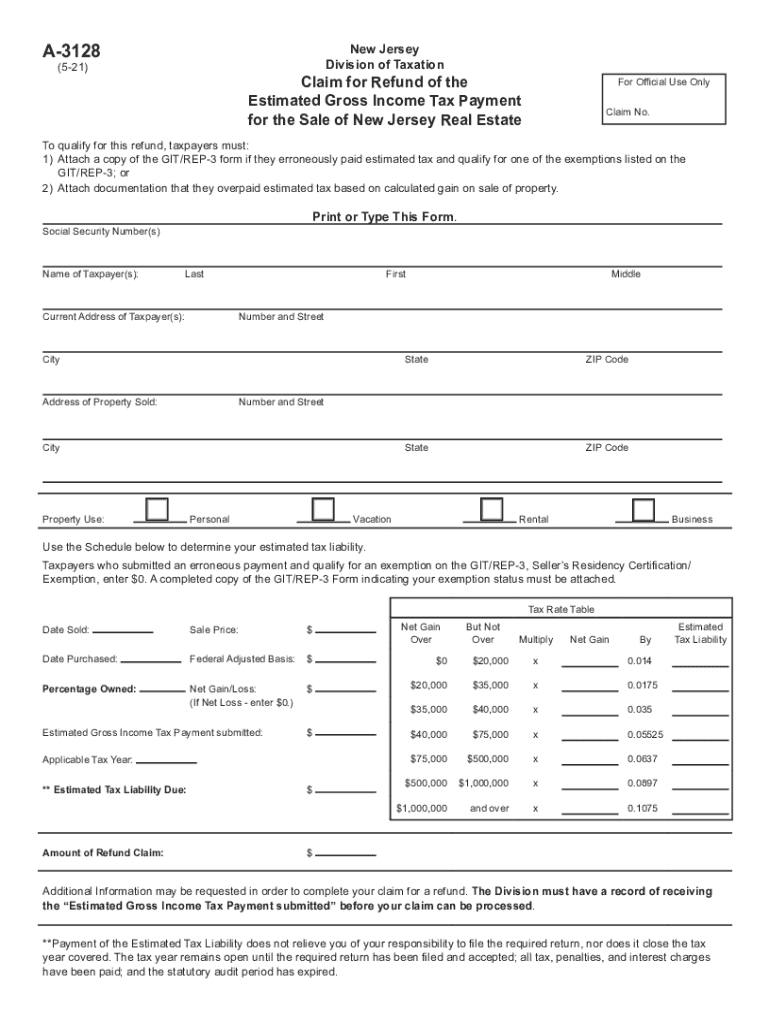

The NJ exit tax form, officially known as Form A 3128, is a critical document for individuals selling real estate in New Jersey. This form is used to claim a refund of the estimated gross income tax payment made at the time of the sale. The tax is typically withheld from the proceeds of the sale to ensure that the state collects taxes owed by non-residents. Understanding the purpose and requirements of this form is essential for a smooth transaction.

Steps to Complete the NJ Exit Tax Form A 3128

Completing the NJ exit tax form A 3128 involves several important steps:

- Gather necessary information, including your personal details, property information, and details of the sale.

- Fill out the form accurately, ensuring all required fields are completed.

- Attach any supporting documentation, such as proof of the estimated gross income tax payment.

- Review the form for accuracy before submission to avoid delays.

Required Documents for the NJ Exit Tax Form A 3128

When completing the NJ exit tax form A 3128, specific documents are necessary to support your claim. These may include:

- A copy of the closing statement from the real estate transaction.

- Proof of the estimated gross income tax payment made at the time of sale.

- Identification documents, such as a driver's license or Social Security number.

Filing Deadlines for the NJ Exit Tax Form A 3128

Timely submission of the NJ exit tax form A 3128 is crucial to avoid penalties. The form must typically be filed within a specific timeframe after the sale of the property. It is advisable to check the New Jersey Division of Taxation website for the most current deadlines and ensure compliance with all filing requirements.

Eligibility Criteria for the NJ Exit Tax Form A 3128

To be eligible to use the NJ exit tax form A 3128, certain criteria must be met:

- The individual must be a non-resident of New Jersey selling real estate within the state.

- The sale must have resulted in an estimated gross income tax payment that is eligible for a refund.

- All required documentation must be submitted along with the form.

Legal Use of the NJ Exit Tax Form A 3128

The NJ exit tax form A 3128 serves a legal purpose in the realm of real estate transactions. It allows sellers to reclaim any excess tax withheld at the time of the sale. Proper use of this form ensures compliance with New Jersey tax laws and protects the rights of sellers to receive refunds for overpayments.

Quick guide on how to complete claim for refund of the estimated gross income tax payment for the sale of new jersey real estate form a 3128 577675729

Effortlessly Prepare Claim For Refund Of The Estimated Gross Income Tax Payment For The Sale Of New Jersey Real Estate, Form A 3128 on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed forms, enabling you to access the right template and securely store it in the cloud. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and efficiently. Handle Claim For Refund Of The Estimated Gross Income Tax Payment For The Sale Of New Jersey Real Estate, Form A 3128 seamlessly on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and eSign Claim For Refund Of The Estimated Gross Income Tax Payment For The Sale Of New Jersey Real Estate, Form A 3128 with Ease

- Locate Claim For Refund Of The Estimated Gross Income Tax Payment For The Sale Of New Jersey Real Estate, Form A 3128 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, laborious form searches, or mistakes necessitating the printing of new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Alter and eSign Claim For Refund Of The Estimated Gross Income Tax Payment For The Sale Of New Jersey Real Estate, Form A 3128 and ensure clear communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct claim for refund of the estimated gross income tax payment for the sale of new jersey real estate form a 3128 577675729

Create this form in 5 minutes!

How to create an eSignature for the claim for refund of the estimated gross income tax payment for the sale of new jersey real estate form a 3128 577675729

The way to generate an e-signature for a PDF file online

The way to generate an e-signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to generate an e-signature right from your mobile device

The way to create an e-signature for a PDF file on iOS

The best way to generate an e-signature for a PDF on Android devices

People also ask

-

What is the NJ exit tax form?

The NJ exit tax form is a document required for residents who are leaving New Jersey to report and pay potential taxes on their assets. This form is crucial for ensuring compliance with state tax laws during the transition. By accurately completing the NJ exit tax form, you can avoid future tax liabilities.

-

How can airSlate SignNow help with the NJ exit tax form?

airSlate SignNow offers an efficient way to prepare and eSign your NJ exit tax form electronically. Our platform simplifies the process, ensuring you have all necessary fields completed accurately. With airSlate SignNow, you can complete your NJ exit tax form from anywhere, at any time.

-

Is there a cost associated with using airSlate SignNow for the NJ exit tax form?

Yes, there is a subscription fee for using airSlate SignNow, which varies based on the plan you choose. The pricing is competitive and provides great value by streamlining document signing processes, including the NJ exit tax form. This cost-effective solution ensures you can manage your documents without unnecessary delays.

-

What features does airSlate SignNow offer for signing the NJ exit tax form?

airSlate SignNow offers several features for eSigning your NJ exit tax form, including templates, reminders, and secure cloud storage. Users can easily upload documents, customize fields for signatures, and send them for signing. These features enhance the efficiency of managing your NJ exit tax form.

-

Can I track the status of my NJ exit tax form using airSlate SignNow?

Absolutely! With airSlate SignNow, you can track the status of your NJ exit tax form in real-time. This feature allows you to see when your document has been viewed, signed, or completed, ensuring you stay informed throughout the process.

-

Does airSlate SignNow integrate with other software for filling out the NJ exit tax form?

Yes, airSlate SignNow integrates seamlessly with various software tools, making it easier to fill out the NJ exit tax form. Whether you use CRM systems or document management tools, our integrations allow for smooth data transfer, saving time and effort.

-

What are the benefits of using airSlate SignNow for the NJ exit tax form?

Using airSlate SignNow for your NJ exit tax form offers numerous benefits, including enhanced security, improved efficiency, and ease of access. The platform is designed to simplify document signing while ensuring compliance with legal requirements. Additionally, its user-friendly interface makes the process straightforward for everyone.

Get more for Claim For Refund Of The Estimated Gross Income Tax Payment For The Sale Of New Jersey Real Estate, Form A 3128

- Al subpoena form

- Alabama registered agent form

- New resident guide alabama form

- Satisfaction release or cancellation of mortgage by corporation alabama form

- Satisfaction release or cancellation of mortgage by individual alabama form

- Partial release of property from mortgage for corporation alabama form

- Partial release of property from mortgage by individual holder alabama form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy alabama form

Find out other Claim For Refund Of The Estimated Gross Income Tax Payment For The Sale Of New Jersey Real Estate, Form A 3128

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe