RUT 25 Vehicle Use Tax Transaction Return 2016

What is the RUT 25 Vehicle Use Tax Transaction Return

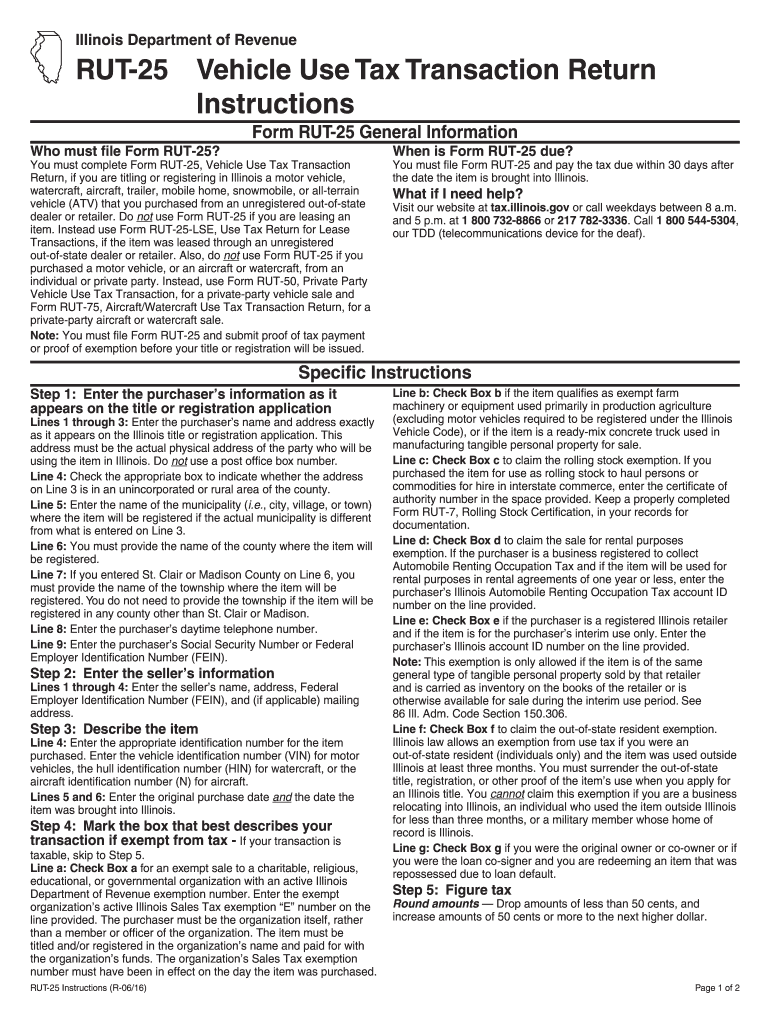

The RUT 25 Vehicle Use Tax Transaction Return is a specific form used in the United States to report and pay the vehicle use tax. This tax applies to individuals and businesses that use vehicles registered in Illinois. The form captures essential information about the vehicle, including its make, model, and year, as well as details about the owner and the purpose of use. Understanding this form is crucial for compliance with state tax regulations.

How to use the RUT 25 Vehicle Use Tax Transaction Return

Using the RUT 25 Vehicle Use Tax Transaction Return involves several steps. First, gather all necessary information about the vehicle and its usage. Next, fill out the form accurately, ensuring that all details are complete and correct. After completing the form, you can submit it either online or via mail, depending on your preference. It is essential to keep a copy of the submitted form for your records, as it serves as proof of compliance with tax obligations.

Steps to complete the RUT 25 Vehicle Use Tax Transaction Return

Completing the RUT 25 form requires careful attention to detail. Follow these steps for accurate completion:

- Gather vehicle information, including the Vehicle Identification Number (VIN), make, model, and year.

- Identify the owner of the vehicle and provide their contact information.

- Specify the purpose of the vehicle's use, whether personal or business-related.

- Calculate the applicable tax based on the vehicle's value and usage.

- Review the form for accuracy and completeness before submission.

Legal use of the RUT 25 Vehicle Use Tax Transaction Return

The RUT 25 Vehicle Use Tax Transaction Return is legally binding once completed and submitted according to state regulations. To ensure its legal standing, it must be filled out accurately and submitted within the required timeframe. The form serves as an official record of the vehicle use tax payment, which is essential for compliance with Illinois tax laws. Failure to submit the form can lead to penalties and interest on unpaid taxes.

Form Submission Methods

The RUT 25 Vehicle Use Tax Transaction Return can be submitted through various methods. Users can choose to file the form online, which is often the most efficient option. Alternatively, it can be mailed to the appropriate tax authority or submitted in person at designated locations. Each method has its own processing times and requirements, so it is advisable to select the one that best fits your needs.

Penalties for Non-Compliance

Failure to file the RUT 25 Vehicle Use Tax Transaction Return or to pay the associated tax can result in significant penalties. These may include late fees, interest on unpaid amounts, and potential legal action from tax authorities. It is important to be aware of the deadlines and ensure that the form is submitted on time to avoid these consequences.

Quick guide on how to complete rut 25 vehicle use tax transaction return

Easily Prepare RUT 25 Vehicle Use Tax Transaction Return on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-conscious alternative to traditional printed and signed paperwork, enabling you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly and without delays. Handle RUT 25 Vehicle Use Tax Transaction Return from any device using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

Simplest Method to Modify and eSign RUT 25 Vehicle Use Tax Transaction Return Effortlessly

- Find RUT 25 Vehicle Use Tax Transaction Return and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your device of choice. Edit and eSign RUT 25 Vehicle Use Tax Transaction Return while ensuring excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rut 25 vehicle use tax transaction return

Create this form in 5 minutes!

How to create an eSignature for the rut 25 vehicle use tax transaction return

How to make an electronic signature for your Rut 25 Vehicle Use Tax Transaction Return in the online mode

How to make an electronic signature for your Rut 25 Vehicle Use Tax Transaction Return in Chrome

How to make an electronic signature for putting it on the Rut 25 Vehicle Use Tax Transaction Return in Gmail

How to make an electronic signature for the Rut 25 Vehicle Use Tax Transaction Return right from your mobile device

How to create an eSignature for the Rut 25 Vehicle Use Tax Transaction Return on iOS

How to make an eSignature for the Rut 25 Vehicle Use Tax Transaction Return on Android OS

People also ask

-

What is the RUT 25 Vehicle Use Tax Transaction Return?

The RUT 25 Vehicle Use Tax Transaction Return is a tax form used to report the use tax on vehicles purchased or leased in Illinois. This form ensures compliance with state laws regarding vehicle taxation. By accurately submitting your RUT 25, you help streamline the tax process for vehicle ownership.

-

How do I complete the RUT 25 Vehicle Use Tax Transaction Return?

To complete the RUT 25 Vehicle Use Tax Transaction Return, gather necessary information such as vehicle details, purchase cost, and your personal information. You can fill out the form manually or utilize digital solutions like airSlate SignNow for an easier, more efficient process. Make sure to review the completed form for accuracy before submission.

-

What are the benefits of using airSlate SignNow for the RUT 25 Vehicle Use Tax Transaction Return?

Using airSlate SignNow for the RUT 25 Vehicle Use Tax Transaction Return offers a streamlined process for eSigning and sending documents. Its user-friendly interface and secure electronic signatures save you time and ensure your forms are properly completed. Additionally, you can track and manage your documents in real-time, reducing the chances of errors.

-

Is there a fee associated with filing the RUT 25 Vehicle Use Tax Transaction Return?

Filing the RUT 25 Vehicle Use Tax Transaction Return typically involves a tax amount based on the vehicle's purchase price rather than a standard filing fee. However, using services like airSlate SignNow may incur subscription or transaction fees. Always check current regulations and pricing to ensure you’re aware of any potential costs.

-

Can I integrate airSlate SignNow with other platforms for managing RUT 25 Vehicle Use Tax Transaction Returns?

Yes, airSlate SignNow offers integrations with various platforms, enabling seamless management of your RUT 25 Vehicle Use Tax Transaction Returns. You can connect with popular applications like CRM systems, accounting software, and document management solutions for enhanced workflow efficiency. This connectivity helps you organize and automate your tax-related documents effectively.

-

What if I make a mistake on my RUT 25 Vehicle Use Tax Transaction Return?

If you find an error on your RUT 25 Vehicle Use Tax Transaction Return after submission, it’s essential to correct it as soon as possible. Typically, you may need to file an amended return. Utilizing airSlate SignNow can simplify the process of creating a new document and resubmitting it, ensuring your tax obligations are fulfilled correctly.

-

How can I track the status of my RUT 25 Vehicle Use Tax Transaction Return?

You can track the status of your RUT 25 Vehicle Use Tax Transaction Return by accessing state tax websites or using tracking features in solutions like airSlate SignNow. Many digital document management systems provide notifications and updates, allowing you to stay informed about your return’s progress. Always keep copies of your submitted documents for reference.

Get more for RUT 25 Vehicle Use Tax Transaction Return

- Short term provider application packet for ibcle cerps form

- Geriatric depression scale long form make check mark in

- Members direct deposit form

- Rtgs form icici

- Employee grievance form archdiocese of galveston houston archgh

- Organo application form

- Ofc form 22 company information sheet nhgov nh

- Slinky wave lab form

Find out other RUT 25 Vehicle Use Tax Transaction Return

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free