Illinois Department of Revenue RUT 25 X Amended Use Tax 2021

What is the Illinois Department Of Revenue RUT 25 X Amended Use Tax

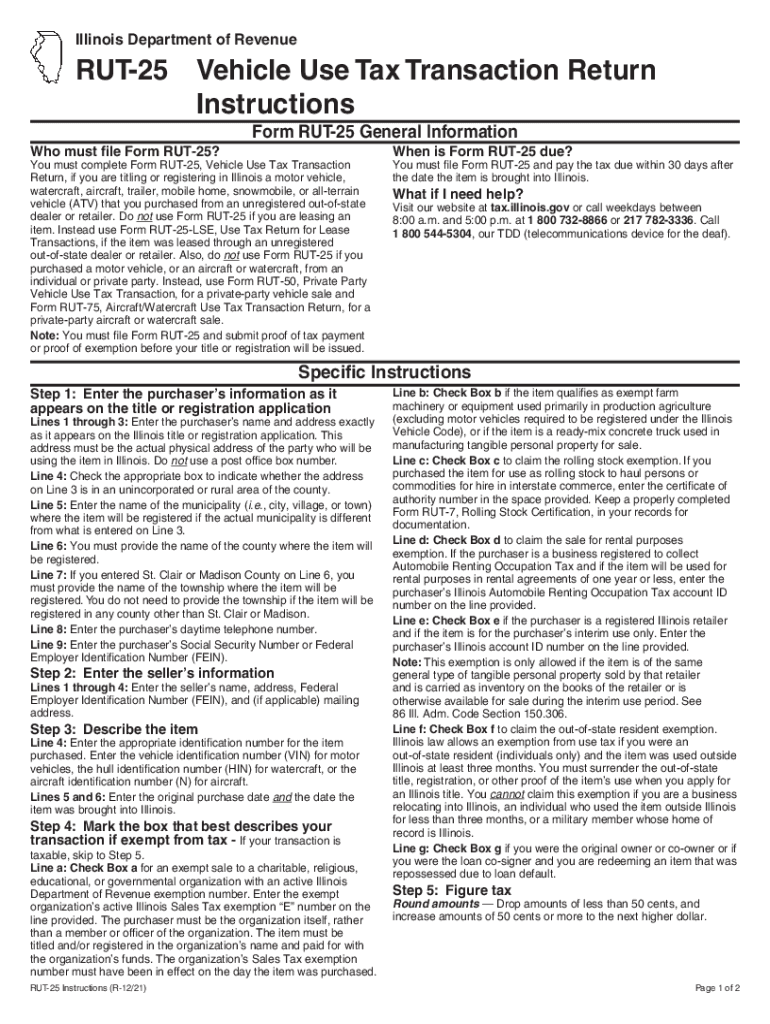

The Illinois Department of Revenue RUT 25 X Amended Use Tax is a specific form used by taxpayers in Illinois to report and amend their use tax obligations. This form is particularly relevant for individuals and businesses that have previously filed a use tax return but need to correct or update their information. The amended use tax ensures that taxpayers accurately report their use tax liabilities, which may arise from the purchase of tangible personal property that is used, consumed, or stored in Illinois.

Steps to complete the Illinois Department Of Revenue RUT 25 X Amended Use Tax

Completing the RUT 25 form involves several key steps to ensure accuracy and compliance. First, gather all relevant documentation, including previous tax returns and any supporting receipts. Next, fill out the form with updated information, ensuring that all fields are completed accurately. It is essential to indicate that this is an amended return by checking the appropriate box on the form. After completing the form, review it for any errors before submitting it to the Illinois Department of Revenue. Finally, retain a copy of the amended return for your records.

Legal use of the Illinois Department Of Revenue RUT 25 X Amended Use Tax

The legal use of the RUT 25 form is governed by Illinois state tax laws. This form allows taxpayers to amend their previously filed use tax returns, ensuring compliance with state regulations. To be considered legally binding, the form must be completed accurately and submitted within the designated time frame. It is crucial to understand that failure to file an amended return when necessary may result in penalties or additional tax liabilities.

Filing Deadlines / Important Dates

Filing deadlines for the RUT 25 form are critical for compliance. Taxpayers should be aware that amended returns should be filed as soon as discrepancies are identified. Generally, the Illinois Department of Revenue allows for amendments to be made within three years of the original filing date. It is advisable to stay updated on any changes to tax laws that may affect filing deadlines or procedures.

Required Documents

When filing the RUT 25 X Amended Use Tax, certain documents are required to support the amended claim. Taxpayers should have copies of the original tax return, any relevant receipts or invoices, and documentation that justifies the changes being made. This may include purchase agreements, shipping documents, or any correspondence with the Illinois Department of Revenue regarding the original filing.

Form Submission Methods (Online / Mail / In-Person)

The RUT 25 form can be submitted through various methods to accommodate taxpayer preferences. Options include online submission via the Illinois Department of Revenue's website, mailing a paper form to the appropriate address, or delivering the form in person at a local revenue office. Each method has its own processing times and requirements, so it is important to choose the one that best suits your needs.

Penalties for Non-Compliance

Failure to comply with the requirements of the RUT 25 form can lead to significant penalties. Taxpayers who do not file an amended return when necessary may face fines, interest on unpaid taxes, and potential legal action from the state. Understanding these penalties underscores the importance of accurate reporting and timely submissions to avoid unnecessary complications.

Quick guide on how to complete illinois department of revenue rut 25 x amended use tax

Effortlessly Manage Illinois Department Of Revenue RUT 25 X Amended Use Tax on Any Device

Digital document management has gained popularity among organizations and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow provides all the tools required to swiftly create, modify, and eSign your documents without delays. Handle Illinois Department Of Revenue RUT 25 X Amended Use Tax on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

The Simplest Way to Modify and eSign Illinois Department Of Revenue RUT 25 X Amended Use Tax with Ease

- Locate Illinois Department Of Revenue RUT 25 X Amended Use Tax and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or redact sensitive details using tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Modify and eSign Illinois Department Of Revenue RUT 25 X Amended Use Tax to ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct illinois department of revenue rut 25 x amended use tax

Create this form in 5 minutes!

How to create an eSignature for the illinois department of revenue rut 25 x amended use tax

The best way to make an e-signature for a PDF file online

The best way to make an e-signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to generate an e-signature straight from your mobile device

How to make an e-signature for a PDF file on iOS

The way to generate an e-signature for a PDF document on Android devices

People also ask

-

What is rut 25 and how does it relate to airSlate SignNow?

Rut 25 refers to a critical designation in document routing within airSlate SignNow's platform. It enables businesses to streamline the signing process efficiently, leading to faster turnaround times for agreements and contracts.

-

How much does it cost to use airSlate SignNow with rut 25 integration?

The pricing for airSlate SignNow varies based on the features you need, including integrations like rut 25. For the most accurate pricing details, check our pricing page or contact our sales team for customized solutions.

-

What features does airSlate SignNow offer for rut 25?

AirSlate SignNow offers several features tailored for rut 25, including customizable templates, real-time tracking of document status, and automated reminders. These features are designed to enhance the efficiency of your document workflows.

-

Can I integrate airSlate SignNow with other tools while using rut 25?

Yes, airSlate SignNow seamlessly integrates with various tools and platforms while utilizing rut 25. This integration allows businesses to enhance their workflows by connecting existing applications for a more cohesive experience.

-

What are the benefits of using airSlate SignNow for rut 25?

Utilizing airSlate SignNow for rut 25 provides signNow time savings, increased accuracy in document completion, and a reduction in administrative burdens. These benefits allow businesses to focus more on core activities rather than paperwork.

-

Is there a free trial available for airSlate SignNow with rut 25 features?

Yes, airSlate SignNow offers a free trial for users interested in exploring the rut 25 features. This trial gives you hands-on experience with the platform and its capabilities before making a commitment.

-

How can I get support for rut 25 in airSlate SignNow?

Support for rut 25 in airSlate SignNow is readily available through our customer support team. You can access resources through our FAQ, live chat, or contact our support team via email for personalized assistance.

Get more for Illinois Department Of Revenue RUT 25 X Amended Use Tax

- Legal last will and testament form for divorced and remarried person with mine yours and ours children maryland

- Legal last will and testament form with all property to trust called a pour over will maryland

- Written revocation of will maryland form

- Last will and testament for other persons maryland form

- Notice to beneficiaries of being named in will maryland form

- Estate planning questionnaire and worksheets maryland form

- Maryland personal form

- Demand to produce copy of will from heir to executor or person in possession of will maryland form

Find out other Illinois Department Of Revenue RUT 25 X Amended Use Tax

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed