Illinois Iternal Revnue 4506 2017

What is the Illinois Internal Revenue 4506?

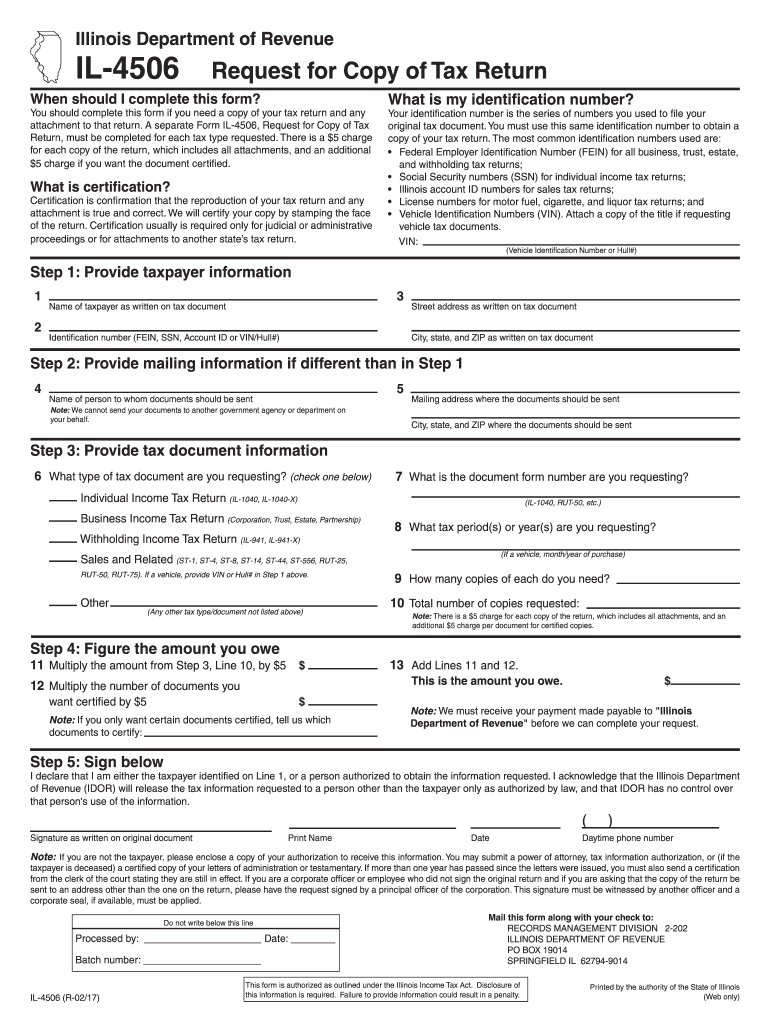

The Illinois Internal Revenue 4506 form, also known as the IL 4506, is a request for a copy of tax returns from the Illinois Department of Revenue. This form allows individuals and businesses to obtain copies of their filed tax returns, which may be necessary for various reasons, including loan applications, audits, or personal record-keeping. The form is essential for anyone needing to verify their tax history or provide documentation to third parties.

How to obtain the Illinois Internal Revenue 4506

To obtain the IL 4506 form, individuals can visit the Illinois Department of Revenue website or contact their local office. The form can typically be downloaded as a PDF, filled out electronically, and printed for submission. Alternatively, individuals may request a physical copy by mail or in person at designated locations. It is important to ensure that all required information is accurately completed to avoid delays in processing.

Steps to complete the Illinois Internal Revenue 4506

Completing the IL 4506 involves several key steps:

- Download the form from the Illinois Department of Revenue website.

- Provide personal information, including name, address, and Social Security number.

- Indicate the tax year(s) for which copies of the returns are requested.

- Sign and date the form to certify its accuracy.

- Submit the completed form via mail or electronically, depending on the submission method chosen.

Legal use of the Illinois Internal Revenue 4506

The IL 4506 form is legally recognized as a valid request for tax documents. When properly completed and submitted, it complies with the necessary legal requirements for obtaining tax transcripts. This ensures that the information provided is secure and protected under relevant privacy regulations. Users should be aware that unauthorized use of the form or falsification of information can lead to legal penalties.

Required Documents

When submitting the IL 4506 form, individuals may need to provide additional documentation to verify their identity. Commonly required documents include:

- A government-issued photo ID, such as a driver's license or passport.

- Proof of address, like a utility bill or bank statement.

- Any previous tax documents that may support the request.

Form Submission Methods

The IL 4506 can be submitted through various methods, including:

- Online: Some individuals may have the option to submit the form electronically through secure portals.

- Mail: Completed forms can be sent to the designated address provided on the form.

- In-person: Individuals can also visit local offices to submit their requests directly.

Quick guide on how to complete illinois request 2017 2019 form

Complete Illinois Iternal Revnue 4506 with ease on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly and without interruptions. Manage Illinois Iternal Revnue 4506 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The easiest way to edit and electronically sign Illinois Iternal Revnue 4506 with minimal effort

- Find Illinois Iternal Revnue 4506 and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that task.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, either by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, time-consuming form retrieval, or errors that necessitate the printing of new document versions. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Illinois Iternal Revnue 4506 to guarantee outstanding communication throughout the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct illinois request 2017 2019 form

Create this form in 5 minutes!

How to create an eSignature for the illinois request 2017 2019 form

How to make an eSignature for the Illinois Request 2017 2019 Form online

How to generate an eSignature for the Illinois Request 2017 2019 Form in Google Chrome

How to generate an eSignature for putting it on the Illinois Request 2017 2019 Form in Gmail

How to make an eSignature for the Illinois Request 2017 2019 Form right from your mobile device

How to create an electronic signature for the Illinois Request 2017 2019 Form on iOS

How to generate an eSignature for the Illinois Request 2017 2019 Form on Android

People also ask

-

What is the Illinois Internal Revenue 4506 form?

The Illinois Internal Revenue 4506 form is a request for a transcript of tax returns, used by individuals and businesses to obtain copies of their tax documents. This form can be crucial for loan applications, financial assessments, and verifying income. Understanding how to properly fill out the Illinois Internal Revenue 4506 can simplify your tax-related processes.

-

How can airSlate SignNow help with the Illinois Internal Revenue 4506 process?

airSlate SignNow streamlines the process of filling out and eSigning the Illinois Internal Revenue 4506 form. Our platform allows you to easily upload, sign, and send documents securely, making tax form submissions faster and more efficient. By using airSlate SignNow, you can ensure that your Illinois Internal Revenue 4506 is completed accurately and submitted on time.

-

Is there a cost associated with using airSlate SignNow for the Illinois Internal Revenue 4506?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different users, including businesses and individuals who need to manage their Illinois Internal Revenue 4506 forms. Our cost-effective solutions help you save time and reduce paperwork costs. You can choose a plan that best fits your requirements and budget.

-

What features does airSlate SignNow offer for managing the Illinois Internal Revenue 4506?

airSlate SignNow provides a range of features for managing the Illinois Internal Revenue 4506, including easy document upload, customizable templates, and secure eSignature capabilities. Our intuitive interface makes it simple to navigate the form-filling process while ensuring compliance with state regulations. These features enhance your document management experience.

-

Can I integrate airSlate SignNow with other software for the Illinois Internal Revenue 4506?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage your Illinois Internal Revenue 4506 forms alongside your existing workflows. Whether you use CRM systems, accounting software, or cloud storage solutions, our integration options can enhance your productivity and document handling.

-

What are the benefits of using airSlate SignNow for the Illinois Internal Revenue 4506?

Using airSlate SignNow for the Illinois Internal Revenue 4506 offers numerous benefits, including increased efficiency, reduced processing time, and enhanced security for your sensitive documents. Our platform ensures that your forms are handled confidentially and are easily accessible, simplifying the entire submission process. Plus, eSigning eliminates the need for printing and scanning.

-

Is airSlate SignNow secure for submitting the Illinois Internal Revenue 4506?

Yes, airSlate SignNow prioritizes security, making it a safe option for submitting your Illinois Internal Revenue 4506 forms. Our platform uses advanced encryption methods to protect your data throughout the entire process. You can trust that your personal and financial information remains confidential and secure with airSlate SignNow.

Get more for Illinois Iternal Revnue 4506

Find out other Illinois Iternal Revnue 4506

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement