Contract to Buy and Sell Real Estate Residential Colorado Real Estate Commission Approved Form

Understanding the Colorado Real Estate Commission Approved Form

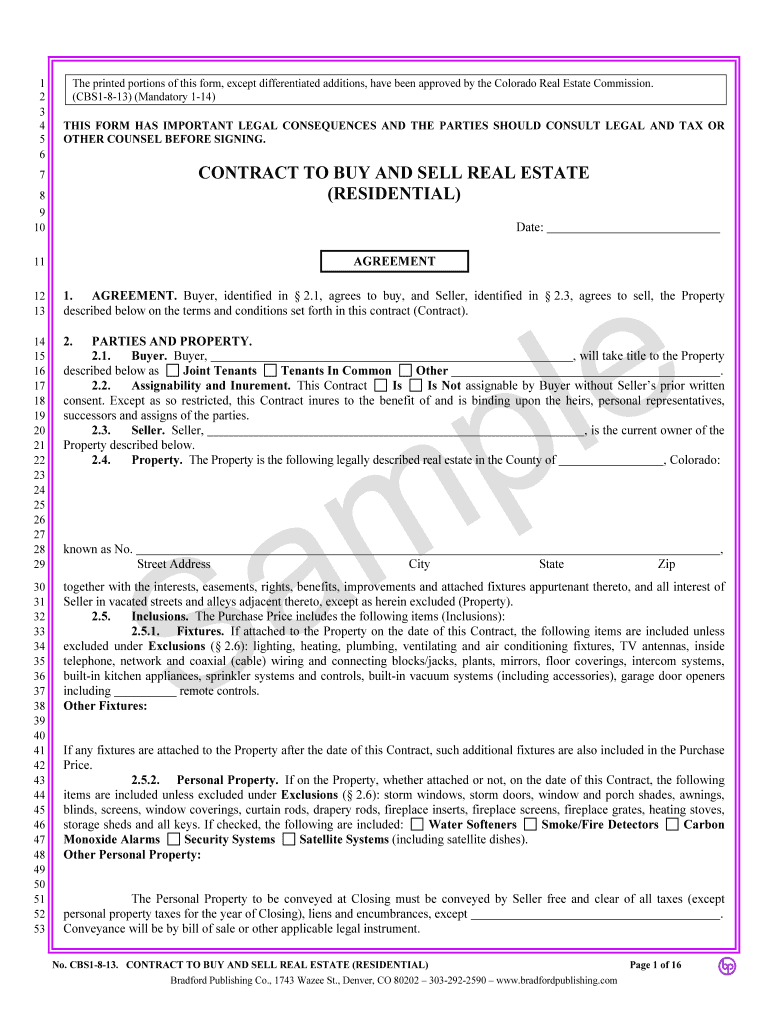

The Contract to Buy and Sell Real Estate Residential is a crucial document in Colorado real estate transactions. This form is designed to facilitate the sale of residential properties and is approved by the Colorado Real Estate Commission. It outlines the terms and conditions agreed upon by the buyer and seller, ensuring that both parties understand their rights and obligations. Key elements include the purchase price, financing details, and contingencies that may affect the transaction.

Steps to Complete the Colorado Real Estate Contract

Completing the Colorado real estate contract involves several important steps to ensure accuracy and compliance with state regulations. Begin by gathering necessary information about the property, including its legal description and any existing liens. Next, fill in the buyer and seller details, specifying the purchase price and any earnest money deposits. It is vital to include contingencies such as inspections, financing, and appraisals. Finally, both parties must sign the document, ideally in the presence of a notary to enhance its legal validity.

Legal Use of the Colorado Real Estate Contract

The Colorado real estate contract is legally binding once signed by both parties, provided that it meets state requirements. To ensure legal use, both the buyer and seller must fully understand the terms outlined in the contract. Additionally, the document must comply with Colorado laws regarding real estate transactions, including disclosure requirements and any applicable local regulations. Utilizing a reliable eSignature solution can further enhance the legal standing of the contract by ensuring secure and verified signatures.

Obtaining the Colorado Real Estate Commission Approved Form

The Contract to Buy and Sell Real Estate Residential can be obtained through various channels. The Colorado Real Estate Commission provides access to the official form on its website, ensuring that users have the most current version. Additionally, real estate professionals, such as agents and brokers, often have copies of the form readily available. It is essential to use the latest version of the form to ensure compliance with any recent changes in state regulations.

Key Elements of the Colorado Real Estate Contract

Understanding the key elements of the Colorado real estate contract is essential for both buyers and sellers. The contract typically includes the following components:

- Purchase Price: The agreed-upon amount for the property.

- Earnest Money: A deposit made by the buyer to demonstrate serious intent.

- Contingencies: Conditions that must be met for the sale to proceed, such as financing or inspection results.

- Closing Date: The date when the transaction is finalized and ownership is transferred.

- Disclosures: Required information about the property's condition and any known issues.

State-Specific Rules for the Colorado Real Estate Contract

Each state has unique regulations governing real estate transactions, and Colorado is no exception. Specific rules may pertain to the handling of earnest money, disclosure requirements, and the process for resolving disputes. Understanding these state-specific rules is crucial for ensuring compliance throughout the transaction. Buyers and sellers should familiarize themselves with Colorado's real estate laws or consult with a qualified real estate professional to navigate these requirements effectively.

Quick guide on how to complete contract to buy and sell real estate residential colorado real estate commission approved form

Complete Contract To Buy And Sell Real Estate Residential Colorado Real Estate Commission approved Form effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents promptly without any delays. Manage Contract To Buy And Sell Real Estate Residential Colorado Real Estate Commission approved Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Contract To Buy And Sell Real Estate Residential Colorado Real Estate Commission approved Form with ease

- Locate Contract To Buy And Sell Real Estate Residential Colorado Real Estate Commission approved Form and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Contract To Buy And Sell Real Estate Residential Colorado Real Estate Commission approved Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

I'm a real estate agent in India. Can I buy and sell real estate of US and Canada to my Indian clients legally and earn commission?

As a real estate agent and mortgage branch manager during the US mortgage 2008 meltdown, I was desperate to to get leads and tried buying some for both businesses. One of my better sources was a marketing call-center from India that was efficient, relatively cheap and legal.If you have a marketing/lead generating company, going through the right channels, then you can collect marketing fees.I'm uncertain if you can receive a real estate referral fee across international borders unless you work for one of the multinational brokerage corporations, though.

-

Is it more profitable to buy commercial real estate to rent out or is residential real estate a better option?

The rental yields on commercial real estate is generally higher than the rental yield on residential real estate.But in either case, the rent will not cover the EMI on the loans taken, even if you take only 80% of the value of the property as Loan.However, your yield is a combination of current value of the(a) future rentplus(b) appreciation of the propertyLess(d) Interest and other expenses incurred on the property.The current value of tax benefits should also be factored, to find the actual profit from the transaction. At this stage, it could be either or both or neither the Commercial Real Estate nor the Residential real Estate that can be profitable, depending on the entry and exit level, holding period etc.

-

In residential real estate wholesaling, where and how is the best way to learn about contracts?

This is not legal advice. Seek local counsel.This is just my take on what your objective is as wholesaler: find great deals off market for folks that want to flip houses. Therefore I am going to clue you into most of what you need to know about contacts:Offer plus acceptance supported by consideration ($10.00?)=ContractContracts for real estate must be in writing.Your welcome.Marketing, marketing and marketing is all you need to work on. Go to The Real Estate Investing Social Network for much more in-depth information from successful investors.

-

Residential Real Estate: How common is it to renegotiate an agreed selling price on a condo when the lender's evaluation comes in lower than the contract price?

In the current silicon valley market, renegotiations are becoming more and more uncommon.The ability to renegotiate the price will depend on 2 factors:1) The presence of an appraisal contingency - If you have made your offer subject to an appraisal contingency, you have essentially reserved the right to try and renegotiate based on the appraised value of the property. 2) The level of competition / number of offers on the property - If there were multiple offers on the property, and you managed to have your offer accepted with an appraisal contingency in place, you can attempt to renegotiate or break the contract. However, in a competitive situation, the seller may simply let you walk and take another offer from a buyer willing and able to pay a price higher than the appraised value. In a hot market, the fair market value of properties will typically be higher than the appraisal values, especially in multiple offer situations. In a softer market, you will see more renegotiating on the price of properties.Specifically, in regards to the person asking the question, 5% is a small variance. In my market, we see much larger percentages. If you decide to renegotiate, however, be prepared to have the seller say no. In an improving market they may be willing to wait it out.

-

I'm 19 and thinking of getting into real estate. How much would I need to save to start up, both for buy to let and residential options?

This is how I started in Real Estate and you are at a good age to do it. There is a great deal more to remember than just saving enough to buy and let a property. That’s easy. The harder part is buying the right property because success in real estate is often about location, location, location and once you own a property, even it it doesn’t perform, even if it depreciates, you still have to pay taxes and maintain it. So with that in mind remember that a poor or mediocre house in a good or up and coming neighborhood is almost always better than a great house in a bad or declining neighborhood. Do your research and find out where you want to buy before you even start looking for a property. Make connections with a realtor — and not the first one you meet, actually go an interview them — and then work with them based on your chemistry, their understanding of what you want and how well you get along. If you make the right partnership, a good realtor can help you make a great deal of money and it’s something that could last years and years and as the realtor becomes more successful, he or she will help propel you to success as well. They will also work to help you find tenants for your apartments. This is much more challenging than it sounds and it is time consuming and worrisome. A bad tenant is a disaster and you want to avoid that if at all possible. It doesn’t hurt to take a real estate course either. There are different kinds of courses such as a course that helps you get your real estate license or one that focuses on valuation of properties. If real estate development and accrual is your goal, either or both of these courses will be valuable.Now you have to think about the money. If you have a steady income from a regular job you can purchase a property with as little as 5 percent down plus closing costs, but you will have to pay PMI. PMI is a total rip-off and you need to keep an eye on it. Make sure you always know what your building is worth because once you hit 20 percent loan-to-value you can have PMI removed. But if you don’t pay attention the bank WILL NEVER TELL YOU when you no longer need PMI and will let you pay forever. That’s good money thrown down the sewer.One of the best strategies I have found is to buy a multi-family property because the bank assumes the rental income as part of your income and it allows you to purchase a much bigger building. For example, when I started I could only afford a house in the 100,000 range, but by purchasing a multi-family, I was able to get a house in the 200,000 dollar range. Not only did I have a place to live, but I was getting income from the apartments that reduced the amount I had to use to pay the mortgage.When you are starting out and money is tight you have to seriously consider your strategy. Are you purchasing to hold? Purchasing to re-sell for appreciation? Flipping fast? Or what? Each will determine the kind of mortgage you want to get. For couples starting out in life I always recommend a 30 year fixed mortgage because it’s safest mortgage with the easiest monthly payments. Although an ARM may have a lower rate, it’s for a short time and at the end, the monthly payment could skyrocket and you could lose the house if you can’t make the payment. But if your goal is to get in, fix up the house on the cheap and get out, then a short term ARM with a low rate is a good idea. But you really have to get out before the ARM expires and the rate goes up. If you plan to hold and let the property appreciate and it’s a multi-family that makes good income then get that 30 year fixed mortgage and let your money work for you instead of you working for your money. Keep an eye on mortgage rates and don’t be afraid to refinance as rates go down. The name of the game is maximizing the money in your pocket today and in the long run and the lower the rate, the more money you get to keep in your pocket month after month instead of paying to the mortgage company. When you’ve had enough and the building has appreciated enough, then you can sell it and take profits.You will want to make connections with certain people if you are going to collect properties. You want a good tax accountant; you want a good contractor who can repair the buildings fast and cheaply (good is desirable too, but it depends on your strategy — if you are flipping, “good” is a relative thing - “good enough” is the more likely strategy because time is money and YOU WANT TO GET OUT FAST when you are flipping.). You will need a landscaper or someone who can take care of the property and a manager who the tenants can call at 3AM to fix their clogged toilet. At the beginning, you will be all these things yourself but as you acquire property it will become too onerous to do it yourself. Taxation, in particular, is complicated. There are depreciation schedules and write-offs and if this is your real business, then there are even more complications and write-offs, but usually a tax professional knows how to handle them. You will need the numbers of a plumber, a locksmith, an electrician, your insurance agent and eventually a lawyer, especially if you decide to incorporate to limit liability.People think they can find cheap properties in foreclosures and short sales and often you can — but you usually have to be capable of putting up 10,000 dollars in a certified check immediately and then you have to be capable of getting a mortgage for the rest in a reasonable time frame. This requires either saving enough for the check, a big down payment and the ability to make the mortgage or a partner with deep pockets who can finance you for a piece of the pie.If you start to accrue properties there will come an inflection point when the income from the rents will be enough to sustain you and allow you to live a better life but that will not be right away. You will have to work at another, secure job for awhile to keep income coming in. You can refinance, consolidate loans and use property for leverage to purchase more properties but you must maintain a fine balance and not over-leverage yourself. Too much debt can bring the entire thing down like a house of cards. You have to reduce costs through re-fis and consolidation but you also have to work to maximize revenues through rents, appreciation and sales.Real estate has been a tried-and-true mechanism for generating wealth throughout the centuries and you can do it, too, if you are careful.

-

How can I get out of a real estate contract when I priced the property too low and really feel it is a mistake to sell it?

Number one thing is to step back and think objectively talking to your listing agent. Hopefully, you did use an experienced Realtor to help you set the price. If a home is priced correctly, you should expect to have interest and offers early. You may have to wait a while before you get another similar offer. When a home first goes on the market, you get both the people who’ve been looking for possibly weeks or more plus new buyers just starting.If you truly want to get out of the contract talk to a real estate attorney. As a seller contracts really don’t give you much out unless a buyer defaults. If this your homesteaded home, you may be able to avoid being forced to sell but could be held liable for buyers costs and possibly damages. Your home may even be held up from being sold to someone else. If you have a listing agreement, you may be responsible for commissions.Think carefully, then talk to an attorney.

-

Real Estate Investing: What should I and my buddy know before we buy a multi-family residential building to successfully renovate and rent it out at a profit?

I’ll approach this from the return on investment angle. Of course, there are lots of other responses along the lines of remodeling knowledge, local market knowledge, finance knowledge, etc. One of the axioms of real estate investing is that you make your money when you buy the property. To do so, you need understand your exit strategy, knowing when you plan to sell and the expected value at that time. From there, you back into what you can pay for the property today. It’s simple math really: final value less sale commissions, costs for design, permits, renovation, carry, and financing, and desired profit equals what you can pay for the property. Of course, the devil is in the details.The tricky part is establishing a credible estimate of those costs. If you are not in the construction or development world today, get to know someone who is and would be willing to mentor you along in this. Items to consider include: architect and engineering, permits (including how long it will take to get them), renovation costs, potential off-site costs (cities love new sidewalks), tenant improvements, commissions, financing, administrative costs, etc.Now if your plan is to keep the investment for cash flow, you would target what the stabilized proforma, or projected income stream will look like once your renovation is complete and you’ve leased up the property. Once you know that, you can project what the value will be and amount of debt it will support. Lenders will look at this from three perspectives: cash flow to debt service, loan to value, and loan to cost. Trust me, the almost always take the lower of the three. Knowing the amount financing your stabilized property will obtain will tell you how much equity you must come up with to pay for the property and renovation costs (hard and soft). You can raise this from your personal reserves or if it’s your first project, friends and family. Some other pieces of advice:Work with competent experts. Hire a good real estate attorney to work for you. Find a smart real estate broker who knows the market you’re interested in.Don’t be embarrassed to seek out experienced developers and investors for advice.Always include an appropriate contingency reserve (5% of hard costs and 3-5% of soft costs)Getting permits almost always takes longer than what the municipality tells you it will take.Don’t allow your earnest money deposit to become non-refundable until you have all of your ducks in a row: Solid proforma, funding nailed down, completed understanding of the permit process (try to not be required to close until you have obtained the necessary permits)

-

Residential Real Estate: What do you look for in a realtor to help you sell and/or buy a home in this competitive Silicon Valley market?

I'm going to give you a different answer then just about everyone else, i think.Id look for ambition, experience and industry contacts. My story selling a house in Santa Clara:Because I work in high tech startups, I have friends in high tech startups. I decided to use the services of one. The idiot who ended up as my broker spent $15K of my money in "repairs", left the house looking worse then when he started, and tied it up for almost 18 months without a single offer.When his contract was up I gave it to a guy I know in Santa Cruz who is really a land expert but is a full broker with his own brokerage and at the time had been in the business about 30 years. He didn't WANT to tie me to any sort of contract, and had it sold in 3 months.I will take experience and industry contacts over "web marketing" or any other gimmick any day of the year.

Create this form in 5 minutes!

How to create an eSignature for the contract to buy and sell real estate residential colorado real estate commission approved form

How to make an electronic signature for the Contract To Buy And Sell Real Estate Residential Colorado Real Estate Commission Approved Form in the online mode

How to create an electronic signature for the Contract To Buy And Sell Real Estate Residential Colorado Real Estate Commission Approved Form in Chrome

How to make an electronic signature for putting it on the Contract To Buy And Sell Real Estate Residential Colorado Real Estate Commission Approved Form in Gmail

How to generate an electronic signature for the Contract To Buy And Sell Real Estate Residential Colorado Real Estate Commission Approved Form from your mobile device

How to create an electronic signature for the Contract To Buy And Sell Real Estate Residential Colorado Real Estate Commission Approved Form on iOS devices

How to generate an eSignature for the Contract To Buy And Sell Real Estate Residential Colorado Real Estate Commission Approved Form on Android OS

People also ask

-

What are Colorado real estate contracts and why are they important?

Colorado real estate contracts are legally binding agreements that outline the terms of a property sale. These contracts are crucial as they protect the interests of both buyers and sellers, ensuring that all parties understand their obligations and rights during the transaction. Utilizing airSlate SignNow can simplify the management and eSigning process for these contracts.

-

How does airSlate SignNow facilitate Colorado real estate contracts?

airSlate SignNow streamlines the creation and signing of Colorado real estate contracts by providing a user-friendly platform for electronic signatures. With templates tailored for real estate, users can easily fill out and send contracts for quick eSigning, reducing delays in the transaction process. This ensures a smooth experience for both agents and clients.

-

What are the pricing options for using airSlate SignNow for Colorado real estate contracts?

airSlate SignNow offers various pricing plans that cater to different business needs, making it affordable for agents involved in Colorado real estate contracts. You can choose from individual, business, or enterprise plans, each offering features designed to enhance your document management process. A free trial is also available, allowing you to explore the platform before committing.

-

Can airSlate SignNow integrate with other tools used in real estate transactions?

Yes, airSlate SignNow seamlessly integrates with various real estate platforms and tools, enhancing the efficiency of managing Colorado real estate contracts. Popular integrations include CRM systems, cloud storage services, and project management tools. These integrations help streamline workflows, ensuring all aspects of real estate transactions are covered.

-

What are the security features of airSlate SignNow for managing Colorado real estate contracts?

Security is paramount when dealing with Colorado real estate contracts. airSlate SignNow employs advanced encryption and multi-factor authentication to protect your sensitive documents and data. This ensures that all eSigned contracts are secure and compliant with legal standards, providing peace of mind for both agents and clients.

-

How does electronic signing work for Colorado real estate contracts with airSlate SignNow?

Electronic signing of Colorado real estate contracts using airSlate SignNow is quick and straightforward. Users can upload their documents, add signature fields, and send them for eSigning. Recipients receive an email notification, allowing them to sign the document from any device, signNowly speeding up the contract execution process.

-

What benefits do I gain from using airSlate SignNow for my Colorado real estate contracts?

Using airSlate SignNow for Colorado real estate contracts offers numerous benefits, including increased efficiency, reduced paperwork, and faster transaction times. The platform's ability to automate the eSigning process minimizes errors and administrative burdens. Additionally, it enhances client experience through convenient and accessible signing options.

Get more for Contract To Buy And Sell Real Estate Residential Colorado Real Estate Commission approved Form

Find out other Contract To Buy And Sell Real Estate Residential Colorado Real Estate Commission approved Form

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament