N288b 2020forms 2019-2026

What is the N288b form?

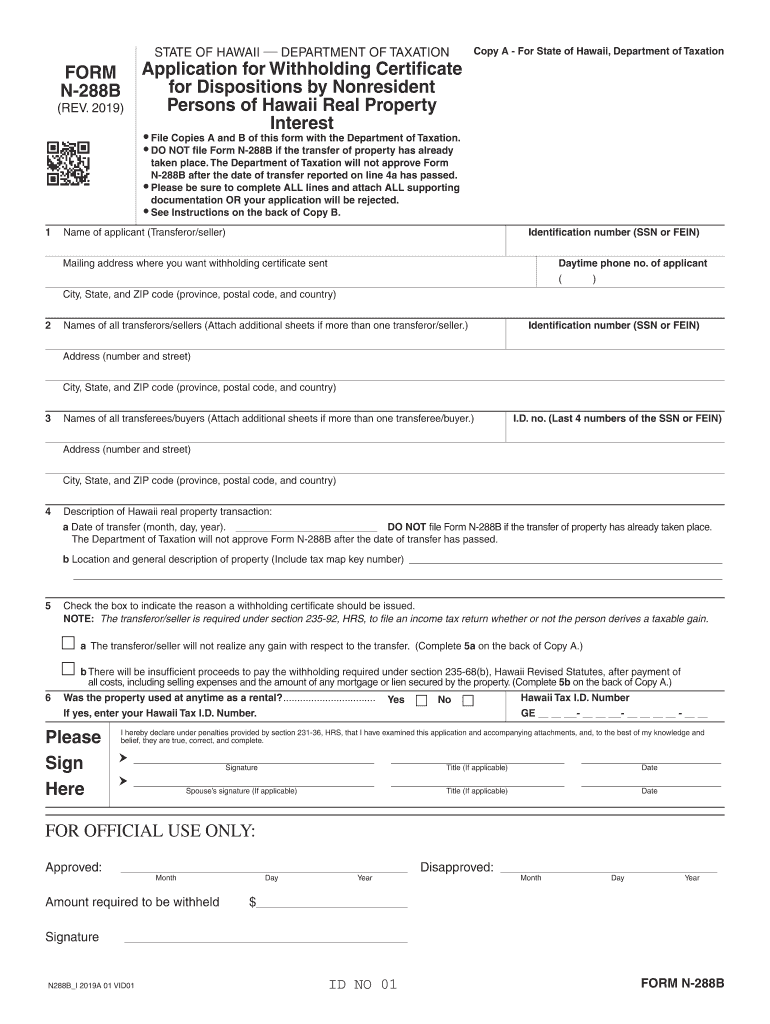

The N288b form, also known as the Hawaii application withholding form, is a crucial document for nonresidents who earn income in Hawaii. This form is used to request a reduced rate of withholding on certain types of income, ensuring that the correct amount of tax is withheld from payments. Understanding this form is essential for compliance with state tax laws and for managing tax liabilities effectively.

How to obtain the N288b form

The N288b withholding form can be obtained directly from the Hawaii Department of Taxation's website. It is available as a downloadable PDF, which can be printed and filled out. Additionally, tax professionals and accountants may provide copies of this form to their clients. Ensuring you have the most current version of the N288b form is vital for accurate tax reporting.

Steps to complete the N288b form

Completing the N288b form involves several key steps:

- Gather necessary information, such as your name, address, and taxpayer identification number.

- Indicate the type of income you are receiving and the applicable withholding rate.

- Provide any supporting documentation that may be required for your specific situation.

- Review the completed form for accuracy before submission.

Legal use of the N288b form

The N288b form is legally binding and must be filled out accurately to ensure compliance with Hawaii tax laws. Proper use of this form allows nonresidents to claim a reduced withholding rate, which can help manage tax liabilities. It is important to understand the legal implications of submitting this form, as inaccuracies can lead to penalties or increased tax obligations.

Filing deadlines for the N288b form

Filing deadlines for the N288b withholding form typically align with the tax year in which the income is earned. It is essential to submit the form before the first payment is made to ensure the correct withholding rate is applied. Keeping track of these deadlines helps avoid unnecessary penalties and ensures compliance with state regulations.

Examples of using the N288b form

There are various scenarios where the N288b form is applicable. For instance, a nonresident contractor performing services in Hawaii may use this form to request a lower withholding rate on their earnings. Similarly, nonresident investors receiving dividends or interest from Hawaii-based companies can also benefit from submitting the N288b form to reduce their withholding tax rate.

Quick guide on how to complete form n 288b rev 2019 application for withholding certificate for dispositions by nonresident persons of hawaii real property

Manage N288b 2020forms effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage N288b 2020forms on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign N288b 2020forms smoothly

- Find N288b 2020forms and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign N288b 2020forms and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form n 288b rev 2019 application for withholding certificate for dispositions by nonresident persons of hawaii real property

Create this form in 5 minutes!

How to create an eSignature for the form n 288b rev 2019 application for withholding certificate for dispositions by nonresident persons of hawaii real property

How to generate an eSignature for your Form N 288b Rev 2019 Application For Withholding Certificate For Dispositions By Nonresident Persons Of Hawaii Real Property in the online mode

How to generate an electronic signature for your Form N 288b Rev 2019 Application For Withholding Certificate For Dispositions By Nonresident Persons Of Hawaii Real Property in Google Chrome

How to generate an eSignature for signing the Form N 288b Rev 2019 Application For Withholding Certificate For Dispositions By Nonresident Persons Of Hawaii Real Property in Gmail

How to create an electronic signature for the Form N 288b Rev 2019 Application For Withholding Certificate For Dispositions By Nonresident Persons Of Hawaii Real Property from your smart phone

How to create an eSignature for the Form N 288b Rev 2019 Application For Withholding Certificate For Dispositions By Nonresident Persons Of Hawaii Real Property on iOS

How to create an electronic signature for the Form N 288b Rev 2019 Application For Withholding Certificate For Dispositions By Nonresident Persons Of Hawaii Real Property on Android devices

People also ask

-

What is the hawaii application withholding process?

The hawaii application withholding process is designed for employers to withhold state income tax from employees' wages. By understanding the requirements of this process, businesses can ensure compliance with Hawaii tax regulations. It is important to accurately calculate and remit these withholdings to avoid potential penalties.

-

How does airSlate SignNow support hawaii application withholding?

airSlate SignNow simplifies the hawaii application withholding process by providing templates for tax documents and eSign capabilities. Businesses can easily create, send, and manage the necessary forms while ensuring they comply with Hawaii's withholding regulations. The platform streamlines documentation, making it easier to handle employee tax withholdings.

-

What features does airSlate SignNow offer for handling hawaii application withholding?

airSlate SignNow offers features like customizable templates, automated workflows, and secure eSigning to assist with hawaii application withholding. These features enhance efficiency, reduce errors, and facilitate quicker document turnaround. This means your team can focus more on core business activities rather than paperwork.

-

Is airSlate SignNow affordable for managing hawaii application withholding?

Yes, airSlate SignNow is a cost-effective solution for managing hawaii application withholding. Our pricing plans are designed to accommodate businesses of all sizes, ensuring that you can effectively manage your withholding processes without breaking the bank. With various subscription options, it's easy to find a plan that fits your budget.

-

How does airSlate SignNow integrate with other tools to assist with hawaii application withholding?

airSlate SignNow integrates seamlessly with various HR and payroll systems, simplifying the hawaii application withholding process. This integration facilitates data transfer between platforms, minimizing manual entry and reducing the risk of errors. By connecting SignNow with your existing tools, you can enhance your workflow and compliance efforts.

-

What benefits does using airSlate SignNow provide for hawaii application withholding?

Using airSlate SignNow for hawaii application withholding offers numerous benefits, including increased efficiency and improved compliance. The platform's user-friendly interface allows for quick document preparation and eSigning, facilitating a smoother experience for both employers and employees. Ultimately, this leads to time savings and reduced administrative burden.

-

Can airSlate SignNow assist with electronically filing hawaii application withholding forms?

Yes, airSlate SignNow provides support for electronically filing hawaii application withholding forms, ensuring compliance with state requirements. Our platform allows for easy access to submitted documents and streamlined filing processes. This feature helps businesses maintain accurate records and fulfill their withholding responsibilities.

Get more for N288b 2020forms

- Hoosier lottery address form

- Los alamitos high school parking bpermitb contract losal form

- France long stay visa application form

- Fill in the blank ultrasounds form

- Form 163 notice of change or discontinuance mich

- Fis 2257 state of michigan mich form

- Employing broker notification form state of michigan mich

- Uia 1680 rev mich form

Find out other N288b 2020forms

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter