N288b 2020forms 2018

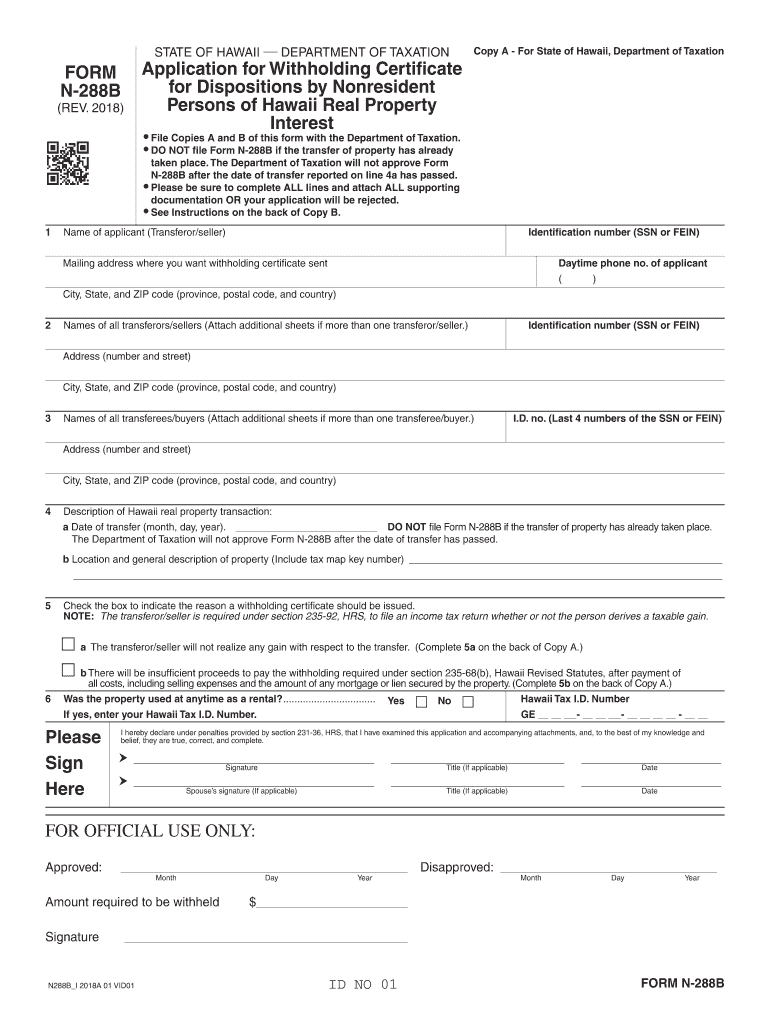

What is the N288b form?

The N288b form, also known as the Hawaii Department of Taxation Form N-288B, is a tax form used by individuals and businesses in Hawaii to report specific tax information. This form is essential for ensuring compliance with state tax regulations and is particularly relevant for those involved in certain tax-related activities. Understanding the N288b form is crucial for accurate tax reporting and fulfilling state requirements.

Steps to complete the N288b form

Completing the N288b form involves several key steps to ensure accuracy and compliance. Here is a straightforward guide to help you through the process:

- Gather necessary information, including your personal details and any relevant financial data.

- Access the N288b form online or obtain a physical copy from the Hawaii Department of Taxation.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Sign the form electronically or by hand, depending on your submission method.

- Submit the completed form either online, by mail, or in person at a designated location.

How to obtain the N288b form

The N288b form can be obtained through several methods, making it accessible for all taxpayers in Hawaii. You can download the form directly from the Hawaii Department of Taxation's official website. Alternatively, you may request a physical copy by contacting the department or visiting their office. Ensuring you have the correct version of the N288b form is vital for compliance.

Legal use of the N288b form

The N288b form is legally recognized for tax reporting in Hawaii. It is important to use this form in accordance with state laws and regulations. Filing the N288b form accurately and on time helps avoid penalties and ensures that you meet your tax obligations. It is advisable to familiarize yourself with any specific legal requirements that pertain to your situation.

Form Submission Methods

There are multiple methods available for submitting the N288b form, providing flexibility for taxpayers. You can choose to submit the form online through the Hawaii Department of Taxation's e-filing system, which offers a quick and efficient way to file. Alternatively, you may print the form and mail it to the appropriate address or deliver it in person at a local tax office. Each method has its own advantages, so consider your preferences when deciding how to submit your form.

Key elements of the N288b form

The N288b form contains several key elements that are essential for accurate tax reporting. These include:

- Taxpayer Information: Personal details such as name, address, and identification numbers.

- Income Reporting: Sections to report various types of income, deductions, and credits.

- Signature Section: A space for the taxpayer's signature, confirming the accuracy of the information provided.

- Filing Instructions: Guidance on how to complete and submit the form correctly.

Quick guide on how to complete n 288b 2018 2019 form

Your assistance manual on how to prepare your N288b 2020forms

If you’re seeking to understand how to finish and submit your N288b 2020forms, below are a few straightforward guidelines to make tax declaration considerably simpler.

To begin, you simply need to create your airSlate SignNow profile to revolutionize how you handle documents online. airSlate SignNow is an incredibly user-friendly and robust document solution that enables you to modify, generate, and finalize your income tax forms effortlessly. With its editor, you can alternate between text, check boxes, and eSignatures and return to amend responses as necessary. Streamline your tax administration with enhanced PDF editing, eSigning, and intuitive sharing.

Adhere to the instructions below to complete your N288b 2020forms in just a few moments:

- Set up your account and begin processing PDFs in minutes.

- Utilize our directory to obtain any IRS tax form; explore various versions and schedules.

- Click Get form to access your N288b 2020forms in our editor.

- Populate the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if required).

- Review your document and correct any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please be aware that filing on paper can lead to increased return errors and delayed reimbursements. Importantly, before e-filing your taxes, check the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct n 288b 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How do I fill out the NEET 2019 application form?

Expecting application form of NEET2019 will be same as that of NEET2018, follow the instructions-For Feb 2019 Exam:EventsDates (Announced)Release of application form-1st October 2018Application submission last date-31st October 2018Last date to pay the fee-Last week of October 2018Correction Window Open-1st week of November 2018Admit card available-1st week of January 2019Exam date-3rd February to 17th February 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of March 2019Counselling begins-2nd week of June 2019For May 2019 Exam:EventsDates (Announced)Application form Release-2nd week of March 2019Application submission last date-2nd week of April 2019Last date to pay the fee-2nd week of April 2019Correction Window Open-3rd week of April 2019Admit card available-1st week of May 2019Exam date-12th May to 26th May 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of June 2019Counselling begins-2nd week of June 2019NEET 2019 Application FormCandidates should fill the application form as per the instructions given in the information bulletin. Below we are providing NEET 2019 application form details:The application form will be issued through online mode only.No application will be entertained through offline mode.NEET UG registration 2019 will be commenced from the 1st October 2018 (Feb Exam) & second week of March 2018 (May Exam).Candidates should upload the scanned images of recent passport size photograph and signature.After filling the application form completely, a confirmation page will be generated. Download it.There will be no need to send the printed confirmation page to the board.Application Fee:General and OBC candidates will have to pay Rs. 1400/- as an application fee.The application fee for SC/ST and PH candidates will be Rs. 750/-.Fee payment can be done through credit/debit card, net banking, UPI and e-wallet.Service tax will also be applicable.CategoryApplication FeeGeneral/OBC-1400/-SC/ST/PH-750/-Step 1: Fill the Application FormGo the official portal of the conducting authority (Link will be given above).Click on “Apply Online” link.A candidate has to read all the instruction and then click on “Proceed to Apply Online NEET (UG) 2019”.Step 1.1: New RegistrationFill the registration form carefully.Candidates have to fill their name, Mother’s Name, Father’s Name, Category, Date of Birth, Gender, Nationality, State of Eligibility (for 15% All India Quota), Mobile Number, Email ID, Aadhaar card number, etc.After filling all the details, two links will be given “Preview &Next” and “Reset”.If candidate satisfied with the filled information, then they have to click on “Next”.After clicking on Next Button, the information submitted by the candidate will be displayed on the screen. If information correct, click on “Next” button, otherwise go for “Back” button.Candidates may note down the registration number for further procedure.Now choose the strong password and re enter the password.Choose security question and feed answer.Enter the OTP would be sent to your mobile number.Submit the button.Step 1.2: Login & Application Form FillingLogin with your Registration Number and password.Fill personal details.Enter place of birth.Choose the medium of question paper.Choose examination centres.Fill permanent address.Fill correspondence address.Fill Details (qualification, occupation, annual income) of parents and guardians.Choose the option for dress code.Enter security pin & click on save & draft.Now click on preview and submit.Now, review your entries.Then. click on Final Submit.Step 2: Upload Photo and SignatureStep 2 for images upload will be appeared on screen.Now, click on link for Upload photo & signature.Upload the scanned images.Candidate should have scanned images of his latest Photograph (size of 10 Kb to 100 Kb.Signature(size of 3 Kb to 20 Kb) in JPEG format only.Step 3: Fee PaymentAfter uploading the images, candidate will automatically go to the link for fee payment.A candidate has to follow the instruction & submit the application fee.Choose the Bank for making payment.Go for Payment.Candidate can pay the fee through Debit/Credit Card/Net Banking/e-wallet (CSC).Step 4: Take the Printout of Confirmation PageAfter the fee payment, a candidate may take the printout of the confirmation page.Candidates may keep at least three copies of the confirmation page.Note:Must retain copy of the system generated Self Declaration in respect of candidates from J&K who have opted for seats under 15% All India Quota.IF any queries, feel free to comment..best of luck

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

Which ITR form should an NRI fill out for AY 2018–2019 if there are two rental incomes in India other than that from interests?

Choosing Correct Income Tax form is the important aspect of filling Income tax return.Lets us discuss it one by one.ITR -1 —— Mainly used for salary income , other source income, one house property income ( upto Rs. 50 Lakhs ) for Individual Resident Assessees only.ITR-2 —- For Salary Income , Other source income ( exceeding Rs. 50 lakhs) house property income from more than one house and Capital Gains / Loss Income for Individual Resident or Non- Resident Assessees and HUF Assessees only.ITR 3— Income from Business or profession Together with any other income such as Salary Income, Other sources, Capital Gains , House property ( Business/ Profession income is must for filling this form) . For individual and HUF Assessees OnlySo in case NRI Assessees having rental income from two house property , then ITR need to be filed in Form ITR 2.For Detail understanding please refer to my video link.

Create this form in 5 minutes!

How to create an eSignature for the n 288b 2018 2019 form

How to create an eSignature for the N 288b 2018 2019 Form online

How to create an electronic signature for your N 288b 2018 2019 Form in Google Chrome

How to generate an eSignature for signing the N 288b 2018 2019 Form in Gmail

How to generate an electronic signature for the N 288b 2018 2019 Form right from your mobile device

How to generate an electronic signature for the N 288b 2018 2019 Form on iOS

How to make an electronic signature for the N 288b 2018 2019 Form on Android

People also ask

-

What are N288b 2020forms and how can they benefit my business?

N288b 2020forms are essential documents for specific tax processes that require electronic signing and submission. Using airSlate SignNow, businesses can efficiently manage these forms by sending and eSigning them securely, ensuring compliance with regulations while saving time and resources.

-

How does airSlate SignNow simplify the process of handling N288b 2020forms?

airSlate SignNow streamlines the handling of N288b 2020forms by providing an intuitive platform for document management. Users can easily create, send, and track these forms, ensuring that all necessary signatures are collected quickly and securely, which enhances workflow efficiency.

-

What is the pricing structure for using airSlate SignNow with N288b 2020forms?

The pricing for airSlate SignNow is competitive and designed to fit various business needs, including those that require handling N288b 2020forms. Plans are available for individuals, small businesses, and enterprises, ensuring you can find a solution that meets your budget without compromising on features.

-

Can airSlate SignNow integrate with other software when managing N288b 2020forms?

Yes, airSlate SignNow offers seamless integrations with various third-party applications, making it easier to manage N288b 2020forms alongside your existing workflows. This connectivity enhances productivity by allowing users to automate processes and share data between platforms effectively.

-

Is there a mobile app available for managing N288b 2020forms on the go?

Absolutely! airSlate SignNow provides a mobile app that allows users to manage N288b 2020forms from anywhere. With this app, you can send, sign, and track documents on your mobile device, ensuring that you maintain productivity even when you're away from your desk.

-

What security measures does airSlate SignNow employ for N288b 2020forms?

airSlate SignNow prioritizes security with advanced encryption protocols and secure data storage to protect your N288b 2020forms. Additionally, the platform complies with industry standards and regulations, giving users peace of mind that their sensitive information is safe.

-

Can I customize N288b 2020forms within airSlate SignNow?

Yes, airSlate SignNow allows for extensive customization of N288b 2020forms to suit your business needs. Users can add branding elements, create unique workflows, and include specific fields, ensuring that the forms align perfectly with your organizational requirements.

Get more for N288b 2020forms

- Oklahoma direct deposit enrollment form

- St tammany parish la sales use tax report form

- Dbpr 0090 duplicate license request state of florida form

- Gold silver bronze sponsorship packages template form

- Pd1 form

- Nipt test form

- Objection claim that an elector should not be enrolled 453389647 form

- Job ready program change of details form section 1 personal

Find out other N288b 2020forms

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF