Form N 288B, Rev , Application for Withholding Certificate for Dispositions by Nonresident Persons of Hawaii Real Property 2014

What is the Form N 288B, Rev , Application For Withholding Certificate For Dispositions By Nonresident Persons Of Hawaii Real Property

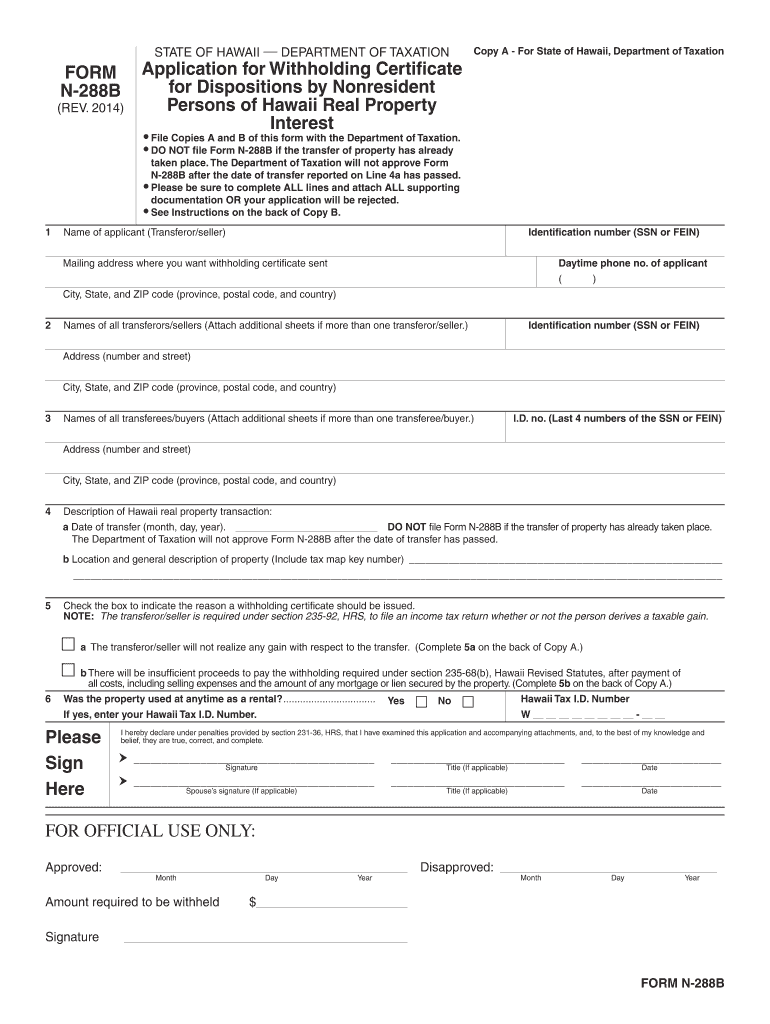

The Form N 288B, Rev , serves as an official application for a withholding certificate specifically designed for nonresident individuals disposing of real property in Hawaii. This form is essential for ensuring compliance with state tax regulations, as it allows nonresidents to request an exemption from withholding tax on the sale of their real estate. By obtaining this certificate, sellers can avoid unnecessary withholding, which can significantly impact their financial transactions.

Steps to Complete the Form N 288B, Rev , Application For Withholding Certificate For Dispositions By Nonresident Persons Of Hawaii Real Property

Completing the Form N 288B, Rev involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the details of the property being sold and the seller's identification. Next, accurately fill out each section of the form, ensuring that all information is complete and correct. After completing the form, review it thoroughly for any errors or omissions. Finally, submit the form to the appropriate state tax authority, either electronically or via mail, depending on the submission options available.

Legal Use of the Form N 288B, Rev , Application For Withholding Certificate For Dispositions By Nonresident Persons Of Hawaii Real Property

The legal use of Form N 288B, Rev is crucial for nonresident sellers to comply with Hawaii tax laws. This form must be submitted to the Department of Taxation to request a withholding certificate, which legally permits the seller to avoid or reduce withholding tax on the sale proceeds. Proper use of this form can prevent penalties and ensure that sellers retain more of their proceeds from real estate transactions.

Required Documents for the Form N 288B, Rev , Application For Withholding Certificate For Dispositions By Nonresident Persons Of Hawaii Real Property

When completing the Form N 288B, Rev, certain documents are typically required to support the application. These may include proof of identity, such as a government-issued ID, documentation related to the property sale, and any relevant tax identification numbers. Having these documents ready can facilitate a smoother application process and reduce the likelihood of delays.

Filing Deadlines / Important Dates for the Form N 288B, Rev , Application For Withholding Certificate For Dispositions By Nonresident Persons Of Hawaii Real Property

Filing deadlines for the Form N 288B, Rev are critical for nonresident sellers to avoid penalties. Generally, the form should be submitted at least ten days before the closing date of the property sale. It is essential to keep track of these deadlines to ensure that the application is processed in a timely manner, allowing sellers to benefit from any withholding exemptions they may qualify for.

Who Issues the Form N 288B, Rev , Application For Withholding Certificate For Dispositions By Nonresident Persons Of Hawaii Real Property

The Form N 288B, Rev is issued by the Hawaii Department of Taxation. This state agency is responsible for managing tax compliance and ensuring that all tax-related forms and applications are properly processed. Sellers should direct any inquiries regarding the form or its submission to this department for accurate and authoritative guidance.

Quick guide on how to complete form n 288b rev 2014 application for withholding certificate for dispositions by nonresident persons of hawaii real property

Your assistance manual on preparing your Form N 288B, Rev , Application For Withholding Certificate For Dispositions By Nonresident Persons Of Hawaii Real Property

If you're wondering how to produce and submit your Form N 288B, Rev , Application For Withholding Certificate For Dispositions By Nonresident Persons Of Hawaii Real Property, here are some brief guidelines to make tax reporting simpler.

To begin, you simply need to sign up for your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an exceptionally intuitive and powerful document solution that enables you to edit, create, and finalize your tax papers effortlessly. With its editor, you can toggle between text, checkboxes, and electronic signatures, and return to modify responses as needed. Optimize your tax handling with advanced PDF editing, eSigning, and straightforward sharing.

Follow the instructions below to finalize your Form N 288B, Rev , Application For Withholding Certificate For Dispositions By Nonresident Persons Of Hawaii Real Property in moments:

- Establish your account and commence working on PDFs within minutes.

- Utilize our directory to locate any IRS tax form; browse through variations and schedules.

- Click Obtain form to access your Form N 288B, Rev , Application For Withholding Certificate For Dispositions By Nonresident Persons Of Hawaii Real Property in our editor.

- Complete the mandatory fillable fields with your information (text, numbers, checkmarks).

- Employ the Signature Tool to add your legally-recognized electronic signature (if needed).

- Review your document and correct any mistakes.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Please be aware that submitting in written form can lead to increased return errors and postpone refunds. Naturally, prior to e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form n 288b rev 2014 application for withholding certificate for dispositions by nonresident persons of hawaii real property

Create this form in 5 minutes!

How to create an eSignature for the form n 288b rev 2014 application for withholding certificate for dispositions by nonresident persons of hawaii real property

How to make an eSignature for your Form N 288b Rev 2014 Application For Withholding Certificate For Dispositions By Nonresident Persons Of Hawaii Real Property in the online mode

How to create an eSignature for your Form N 288b Rev 2014 Application For Withholding Certificate For Dispositions By Nonresident Persons Of Hawaii Real Property in Chrome

How to generate an eSignature for putting it on the Form N 288b Rev 2014 Application For Withholding Certificate For Dispositions By Nonresident Persons Of Hawaii Real Property in Gmail

How to create an eSignature for the Form N 288b Rev 2014 Application For Withholding Certificate For Dispositions By Nonresident Persons Of Hawaii Real Property straight from your smartphone

How to generate an electronic signature for the Form N 288b Rev 2014 Application For Withholding Certificate For Dispositions By Nonresident Persons Of Hawaii Real Property on iOS devices

How to generate an electronic signature for the Form N 288b Rev 2014 Application For Withholding Certificate For Dispositions By Nonresident Persons Of Hawaii Real Property on Android OS

People also ask

-

What is Form N 288B, Rev, Application For Withholding Certificate For Dispositions By Nonresident Persons Of Hawaii Real Property?

Form N 288B, Rev, Application For Withholding Certificate For Dispositions By Nonresident Persons Of Hawaii Real Property, is a document used by nonresident individuals to apply for a withholding certificate in relation to the sale of Hawaii real property. This form helps ensure that the appropriate amount of tax is withheld during the transaction, making it essential for compliance with state tax laws.

-

How can airSlate SignNow help me with Form N 288B, Rev?

airSlate SignNow provides a user-friendly platform that simplifies the filling and eSigning process for Form N 288B, Rev, Application For Withholding Certificate For Dispositions By Nonresident Persons Of Hawaii Real Property. With its easy-to-use interface, you can quickly complete the form, obtain signatures, and store your documents securely—all in one place.

-

Is there a cost associated with using airSlate SignNow for Form N 288B, Rev?

Yes, airSlate SignNow offers a variety of pricing plans that cater to different business needs, including options for processing Form N 288B, Rev, Application For Withholding Certificate For Dispositions By Nonresident Persons Of Hawaii Real Property. These plans are designed to be cost-effective and can signNowly reduce the time and effort required for document management.

-

Can I integrate airSlate SignNow with other tools for managing Form N 288B, Rev?

Absolutely! airSlate SignNow can be easily integrated with various applications and platforms to enhance your document management workflow, including those needed for handling Form N 288B, Rev, Application For Withholding Certificate For Dispositions By Nonresident Persons Of Hawaii Real Property. This ensures you can work seamlessly across different tools and automate your processes.

-

What are the benefits of using airSlate SignNow for tax-related documents like Form N 288B, Rev?

Using airSlate SignNow for tax-related documents such as Form N 288B, Rev, Application For Withholding Certificate For Dispositions By Nonresident Persons Of Hawaii Real Property, provides numerous benefits. It streamlines the signing process, enhances security with encrypted signatures, and facilitates easier compliance with state tax regulations, all while saving time and reducing errors.

-

How secure is airSlate SignNow when handling sensitive forms like Form N 288B, Rev?

airSlate SignNow prioritizes security and complies with industry standards to ensure that sensitive documents, including Form N 288B, Rev, Application For Withholding Certificate For Dispositions By Nonresident Persons Of Hawaii Real Property, are handled safely. The platform utilizes encryption and secure storage options to protect your data from unauthorized access.

-

What features should I look for in airSlate SignNow when preparing Form N 288B, Rev?

When preparing Form N 288B, Rev, Application For Withholding Certificate For Dispositions By Nonresident Persons Of Hawaii Real Property, look for features in airSlate SignNow such as customizable templates, mobile access, and real-time tracking of document status. These features help streamline the process and ensure that all parties involved can easily access and sign the document.

Get more for Form N 288B, Rev , Application For Withholding Certificate For Dispositions By Nonresident Persons Of Hawaii Real Property

- Application and order to proceed as poor person new york state nycourts form

- Logic model template 2 azdhs form

- How solutions form answer key 389540920

- Amfi self declaration form c

- Schedule rnr massachusetts form

- Land tax registration form

- Va form 10 10172

- Kurunjang secondary college pre enrolment application form kurunjangsc vic edu

Find out other Form N 288B, Rev , Application For Withholding Certificate For Dispositions By Nonresident Persons Of Hawaii Real Property

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple