N288c 2019

What is the N288c

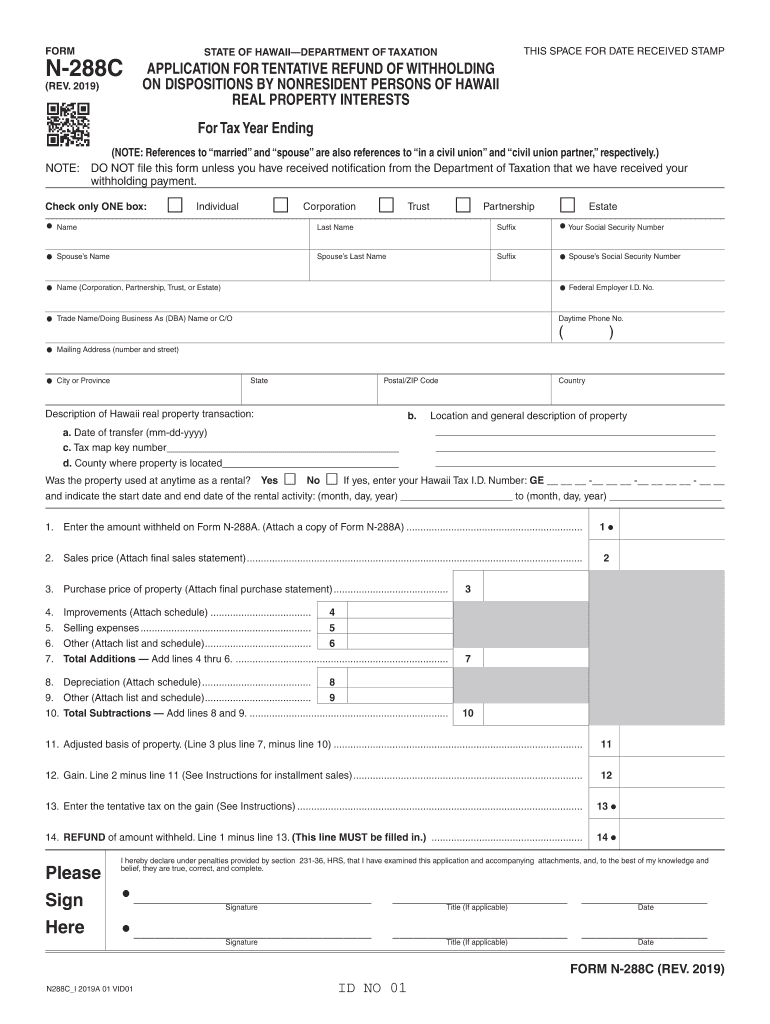

The Hawaii Form N-288C is a tax document specifically designed for non-resident individuals or entities that have sold real property in Hawaii. This form is part of the state's tax compliance measures under the Hawaii Real Property Tax Act (HARPTA). It is primarily used to report and withhold taxes on the gain from the sale of real estate, ensuring that the state collects the appropriate taxes from non-residents who may not otherwise be subject to Hawaii's tax laws.

How to use the N288c

To use the Hawaii Form N-288C, sellers must complete the form accurately and submit it to the Hawaii Department of Taxation. The form requires detailed information about the property sold, the seller's identification, and any applicable deductions or exemptions. It is crucial to ensure that all information is correct to avoid delays or penalties. Once completed, the form should be submitted along with the required payment for any taxes owed.

Steps to complete the N288c

Completing the Hawaii Form N-288C involves several steps:

- Gather necessary information, including the property's sale price and any related expenses.

- Fill out the seller's information, including name, address, and taxpayer identification number.

- Provide details about the property, including the address and the date of sale.

- Calculate the gain from the sale and determine the withholding amount based on the applicable tax rate.

- Review the form for accuracy and completeness before submission.

Legal use of the N288c

The legal use of the Hawaii Form N-288C is governed by state tax laws that require non-residents to report gains from real estate sales. Proper completion and submission of this form are essential to comply with HARPTA regulations. Failure to use the form correctly can result in penalties, including fines or additional tax liabilities. It is advisable to consult with a tax professional to ensure compliance with all legal requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Hawaii Form N-288C are crucial for compliance. Generally, the form must be submitted at the time of the real estate transaction. It is important to check specific deadlines based on the transaction date, as late submissions can incur penalties. Keeping track of these dates helps ensure that all tax obligations are met in a timely manner.

Required Documents

When completing the Hawaii Form N-288C, certain documents may be required to support the information provided. These documents typically include:

- Proof of sale, such as a sales contract or closing statement.

- Identification documents, including a Social Security number or Employer Identification Number.

- Any relevant documentation for deductions or exemptions claimed.

Form Submission Methods (Online / Mail / In-Person)

The Hawaii Form N-288C can be submitted through various methods to accommodate different preferences. Options include:

- Online submission through the Hawaii Department of Taxation's e-filing system.

- Mailing the completed form to the appropriate tax office.

- In-person submission at designated tax offices for immediate processing.

Quick guide on how to complete hawaii application for tentative refund of withholding form

Effortlessly Prepare N288c on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as a perfect environmentally friendly alternative to traditional printed and signed documents, enabling you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly and without interruptions. Manage N288c on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to Modify and Electronically Sign N288c with Ease

- Find N288c and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select key sections of the documents or obscure sensitive information with specialized tools provided by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes only seconds and holds the same legal validity as a handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form: via email, SMS, invite link, or download it to your computer.

Eliminate worries over lost or misfiled documents, tedious form navigation, or errors that necessitate reprinting. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Modify and electronically sign N288c to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct hawaii application for tentative refund of withholding form

Create this form in 5 minutes!

How to create an eSignature for the hawaii application for tentative refund of withholding form

How to generate an eSignature for the Hawaii Application For Tentative Refund Of Withholding Form in the online mode

How to create an electronic signature for your Hawaii Application For Tentative Refund Of Withholding Form in Chrome

How to generate an eSignature for putting it on the Hawaii Application For Tentative Refund Of Withholding Form in Gmail

How to create an electronic signature for the Hawaii Application For Tentative Refund Of Withholding Form right from your smart phone

How to generate an eSignature for the Hawaii Application For Tentative Refund Of Withholding Form on iOS devices

How to create an electronic signature for the Hawaii Application For Tentative Refund Of Withholding Form on Android devices

People also ask

-

What is the hawaii form n 288c 2016 used for?

The hawaii form n 288c 2016 is a crucial document for businesses in Hawaii to report certain tax information relating to their operations. By understanding its purpose, you can ensure compliance and avoid potential penalties. airSlate SignNow simplifies this process, allowing you to easily fill and eSign this form online.

-

How can I fill out the hawaii form n 288c 2016 using airSlate SignNow?

Filling out the hawaii form n 288c 2016 with airSlate SignNow is straightforward. You can upload your document and utilize our intuitive editing tools to input the necessary information before eSigning. Our platform saves you time and effort while maintaining accuracy.

-

Is airSlate SignNow a cost-effective solution for managing hawaii form n 288c 2016?

Yes, airSlate SignNow offers competitive pricing that makes it affordable for businesses of all sizes to manage the hawaii form n 288c 2016 efficiently. By choosing our platform, you save on printing and mailing costs and increase your productivity. Try our free trial to see the savings for yourself.

-

What features does airSlate SignNow offer for hawaii form n 288c 2016?

airSlate SignNow provides essential features for handling the hawaii form n 288c 2016, including eSigning, secure document storage, and automated workflows. Our platform ensures that your documents are managed safely and efficiently, helping you stay organized and compliant.

-

Can I integrate airSlate SignNow with other software for processing hawaii form n 288c 2016?

Absolutely! airSlate SignNow supports integration with various software tools, which streamlines the process you need to complete the hawaii form n 288c 2016. Integrate seamlessly with popular applications to enhance your document management experience and boost productivity.

-

What are the benefits of using airSlate SignNow for hawaii form n 288c 2016?

Using airSlate SignNow for the hawaii form n 288c 2016 offers numerous benefits, including time savings, increased efficiency, and enhanced compliance. Our user-friendly interface allows for a smooth signing experience, ensuring that your documents are handled swiftly and securely.

-

How secure is my data when using airSlate SignNow for hawaii form n 288c 2016?

Security is a top priority at airSlate SignNow. When processing the hawaii form n 288c 2016, your data is protected through advanced encryption and compliance with industry standards. You can trust that your documents and sensitive information are handled with the utmost care.

Get more for N288c

- Custom earpieces order form phonak

- Last will and testament of free arizona legal forms

- Form weight and balance

- City of greeley application amp permit form

- Assignment front page form

- California dmv information security agreement lexisnexis

- Alabama adoption report 2009 2019 form

- Troop roster form girl scouts of connecticut gsofct

Find out other N288c

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now