St 36 Form 2017

What is the St 36 Form

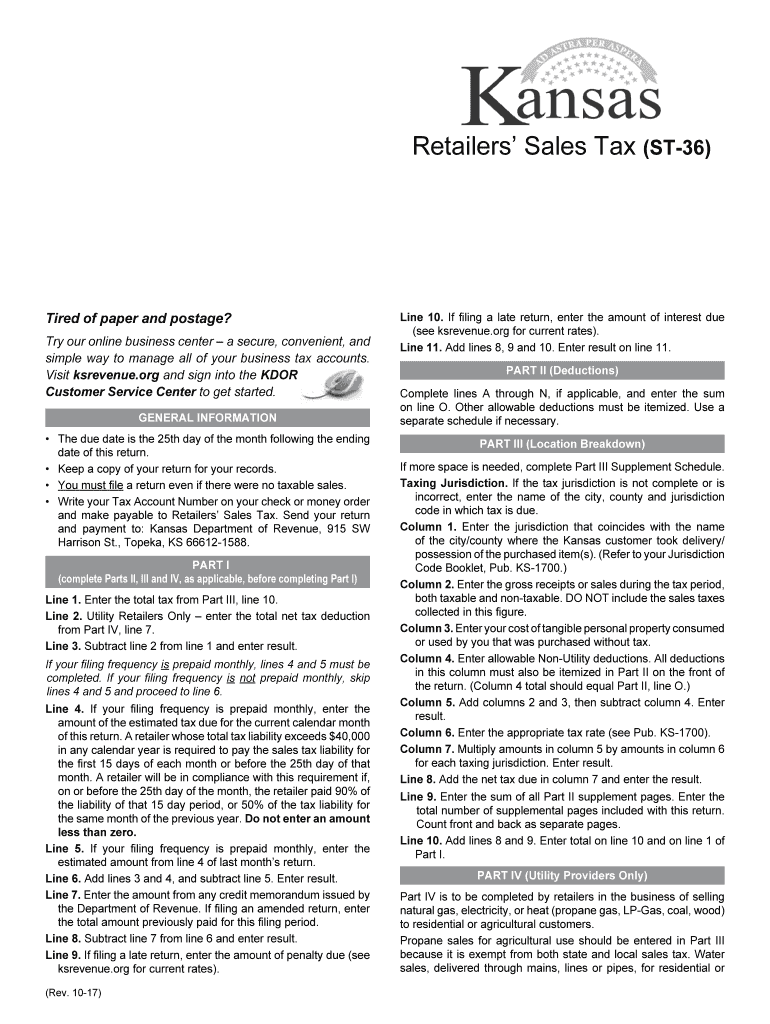

The St 36 form, also known as the Kansas Retailers' Sales Tax Return, is a document used by businesses in Kansas to report and remit sales tax collected from customers. This form is essential for ensuring compliance with state tax laws and is required for all retailers operating within Kansas. It captures vital information about sales transactions, tax collected, and any applicable deductions or exemptions. Properly completing the St 36 form is crucial for maintaining good standing with the Kansas Department of Revenue.

Steps to complete the St 36 Form

Completing the St 36 form involves several key steps to ensure accuracy and compliance. First, gather all necessary sales records, including receipts and invoices, to determine the total sales amount for the reporting period. Next, calculate the total sales tax collected based on the applicable tax rate. Fill out the form by providing your business information, total sales, and the amount of tax due. Finally, review the completed form for any errors before submitting it to the Kansas Department of Revenue.

Legal use of the St 36 Form

The St 36 form is legally binding when filled out correctly and submitted on time. It serves as an official record of sales tax collected and remitted to the state. To ensure its legal standing, businesses must adhere to the guidelines set forth by the Kansas Department of Revenue, including accurate reporting of sales figures and timely submission. Failure to comply with these requirements may result in penalties or legal repercussions.

Form Submission Methods

The St 36 form can be submitted through various methods to accommodate different business needs. Businesses have the option to file the form online through the Kansas Department of Revenue's website, which provides a streamlined process for electronic submission. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has specific guidelines and deadlines, so it is essential to choose the one that best fits your operational workflow.

Filing Deadlines / Important Dates

Filing deadlines for the St 36 form are critical for maintaining compliance with Kansas tax laws. Generally, the form is due on the 25th of the month following the end of the reporting period. For example, sales made in January must be reported by February 25. It is important for businesses to mark their calendars and ensure timely submissions to avoid late fees or penalties. Additionally, certain periods may have specific deadlines, such as quarterly or annual filings, which should be confirmed through the Kansas Department of Revenue.

Key elements of the St 36 Form

The St 36 form includes several key elements that must be accurately filled out to ensure proper processing. These elements include the business name, address, and identification number, as well as the total sales amount, sales tax collected, and any deductions or exemptions claimed. Each section of the form is designed to capture specific information that the Kansas Department of Revenue requires for tax assessment and compliance. Understanding these elements is essential for correct form submission.

Quick guide on how to complete kansas sales tax return 2017 2019 form

Execute St 36 Form effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to locate the correct form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, amend, and eSign your documents quickly and without delays. Handle St 36 Form on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign St 36 Form with ease

- Find St 36 Form and click on Get Form to begin.

- Utilize the provided tools to complete your form.

- Emphasize important sections of your documents or redact sensitive information using the tools specifically offered by airSlate SignNow for that function.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to submit your form—via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that require reprinting new document versions. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Alter and eSign St 36 Form to ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kansas sales tax return 2017 2019 form

Create this form in 5 minutes!

How to create an eSignature for the kansas sales tax return 2017 2019 form

How to make an electronic signature for your Kansas Sales Tax Return 2017 2019 Form online

How to make an eSignature for the Kansas Sales Tax Return 2017 2019 Form in Google Chrome

How to generate an electronic signature for signing the Kansas Sales Tax Return 2017 2019 Form in Gmail

How to make an eSignature for the Kansas Sales Tax Return 2017 2019 Form straight from your smart phone

How to make an eSignature for the Kansas Sales Tax Return 2017 2019 Form on iOS

How to create an electronic signature for the Kansas Sales Tax Return 2017 2019 Form on Android devices

People also ask

-

What is st36 in the context of airSlate SignNow?

ST36 refers to a specific feature within the airSlate SignNow platform that enhances the efficiency of document management and eSignature processes. This feature streamlines the workflow, ensuring that users can easily send, track, and sign documents without any hassle. By utilizing ST36, your business can signNowly improve its document handling efficiency.

-

How much does airSlate SignNow's ST36 feature cost?

The cost of utilizing the ST36 feature within airSlate SignNow varies based on the pricing plan you select. airSlate SignNow offers several tiers of pricing, ensuring that businesses of all sizes can find a cost-effective solution for their eSigning needs. For precise pricing related to ST36, it’s best to check our pricing page or contact our sales team.

-

What are the key features of the ST36 tool?

The ST36 tool includes features such as customizable templates, automated workflows, and real-time document tracking. These functionalities provide users with a comprehensive solution for managing documents efficiently. With ST36, you can ensure that the signing process is not only quick but also secure and compliant.

-

What benefits does using ST36 provide for businesses?

Using ST36 can signNowly streamline your document workflows, reduce turnaround time, and enhance collaboration. It empowers businesses to adopt a more digital approach to document management, resulting in lower operational costs and increased productivity. Moreover, it ensures that all documents are securely signed and stored.

-

Can ST36 integrate with other software tools?

Yes, ST36 offers seamless integration with several popular software tools, including CRM systems and project management platforms. This capability allows you to incorporate ST36 into your existing workflows effortlessly. By integrating ST36, you can enhance your team's productivity by minimizing manual processes and ensuring smooth data flow.

-

Is it easy to set up and use the ST36 feature?

Absolutely! The ST36 feature is designed to be user-friendly, with an intuitive interface that makes it easy even for those who aren’t tech-savvy. Our platform provides comprehensive resources and support to ensure a smooth setup, allowing you to quickly embrace the benefits of efficient document management.

-

What types of documents can I eSign with ST36?

With ST36, you can eSign a wide variety of documents, including contracts, agreements, and forms, making it suitable for numerous industries. The flexibility of ST36 allows you to handle everything from HR documents to client agreements, ensuring that your eSignature needs are met regardless of the document type. This versatility makes ST36 a valuable tool for any business.

Get more for St 36 Form

- Pan example of personal details filled section on psckgoke for an unemployed person form

- Longos online application form

- Spar application form pdf

- Airport jobs in cayman islands form

- Marble slab applicationpdffillercom form

- Application delaware river port authority drpa form

- Short form standard subcontract associated general contractors agc ca

- Bprs scale form

Find out other St 36 Form

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy