KANSAS Retailers' Sales Tax Return E Form RS Login 2021-2026

Understanding the Kansas Retailers' Sales Tax Return Form ST-36

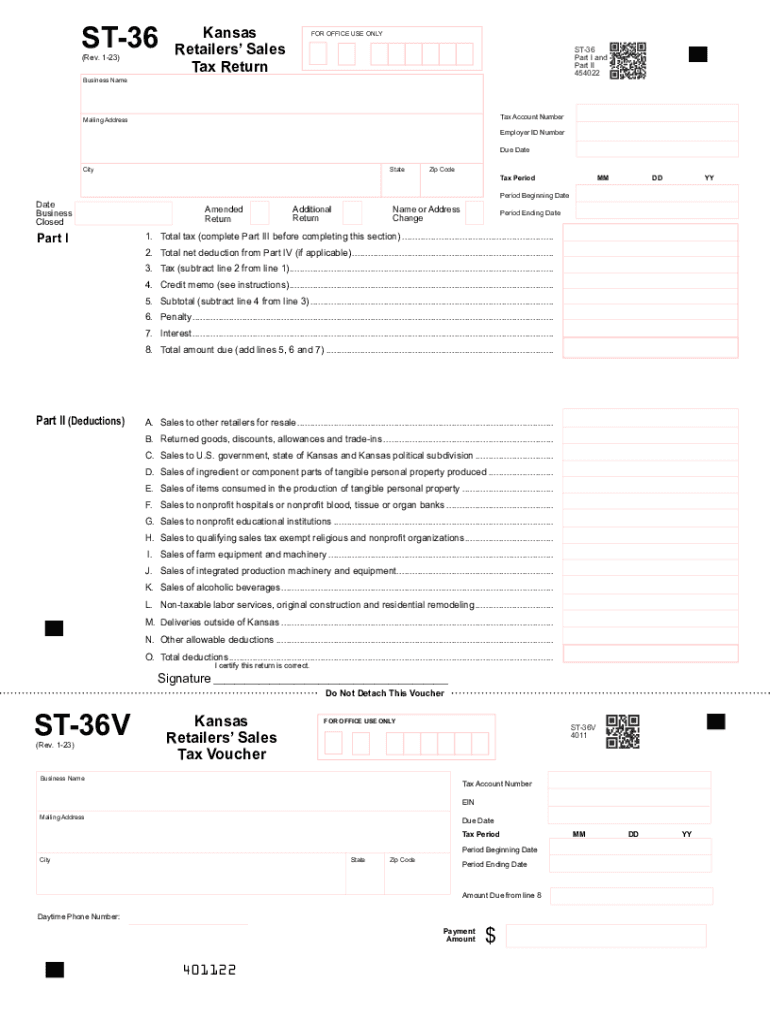

The Kansas Retailers' Sales Tax Return, commonly referred to as Form ST-36, is a crucial document for businesses operating in Kansas. This form is used to report sales tax collected from customers and remit it to the state. It is essential for compliance with Kansas tax laws and helps ensure that businesses fulfill their tax obligations accurately.

Steps to Complete the Kansas Retailers' Sales Tax Return Form ST-36

Completing the Kansas Retailers' Sales Tax Return involves several key steps:

- Gather all sales records for the reporting period, ensuring you have accurate data on taxable and non-taxable sales.

- Calculate the total sales tax collected during the period. This includes applying the correct sales tax rates based on the location of sales.

- Fill out the Form ST-36, entering your business information, total sales, and sales tax collected.

- Review the form for accuracy, ensuring all calculations are correct and all required fields are completed.

- Submit the completed form by the due date, either online or by mail, depending on your preference.

Filing Deadlines for the Kansas Retailers' Sales Tax Return Form ST-36

It is important to be aware of the filing deadlines for the Kansas Retailers' Sales Tax Return. Generally, businesses must file this form monthly, quarterly, or annually, depending on their sales volume. The specific due dates can vary, so it is advisable to check the Kansas Department of Revenue's website for the most current information regarding deadlines.

Required Documents for Filing the Kansas Retailers' Sales Tax Return Form ST-36

When preparing to file the Kansas Retailers' Sales Tax Return, businesses should have the following documents ready:

- Sales records detailing all transactions during the reporting period.

- Invoices and receipts that support the sales figures reported.

- Any exemption certificates for tax-exempt sales.

- Prior tax returns, if applicable, to ensure consistency and accuracy in reporting.

Penalties for Non-Compliance with Kansas Sales Tax Regulations

Failure to file the Kansas Retailers' Sales Tax Return on time or inaccuracies in reporting can result in penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for businesses to understand these risks and ensure timely and accurate filing to avoid complications.

Digital vs. Paper Version of the Kansas Retailers' Sales Tax Return Form ST-36

The Kansas Retailers' Sales Tax Return Form ST-36 can be filed either digitally or on paper. Filing online offers convenience and faster processing times, while paper filing may be preferred by those who are more comfortable with traditional methods. Regardless of the method chosen, it is crucial to ensure that the form is completed accurately and submitted by the deadline.

Quick guide on how to complete kansas retailers sales tax return e form rs login

Easily Prepare KANSAS Retailers' Sales Tax Return E Form RS Login on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the essential tools to create, edit, and electronically sign your documents quickly and without interruptions. Handle KANSAS Retailers' Sales Tax Return E Form RS Login on any device using airSlate SignNow's Android or iOS applications and streamline your document processes today.

How to Edit and Electronically Sign KANSAS Retailers' Sales Tax Return E Form RS Login with Ease

- Locate KANSAS Retailers' Sales Tax Return E Form RS Login and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details using tools specifically provided by airSlate SignNow.

- Create your signature with the Sign feature, which takes just seconds and has the same legal validity as a handwritten signature.

- Verify the details and click on the Done button to secure your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassles of lost or misfiled documents, tedious form searches, or errors that necessitate printing additional copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and electronically sign KANSAS Retailers' Sales Tax Return E Form RS Login while ensuring excellent communication throughout the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kansas retailers sales tax return e form rs login

Create this form in 5 minutes!

How to create an eSignature for the kansas retailers sales tax return e form rs login

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of '2009 retailers ksrevenue' in the context of airSlate SignNow?

The term '2009 retailers ksrevenue' refers to the revenue data that can be crucial for understanding business performance. Using airSlate SignNow, you can streamline document management related to this data, allowing for more efficient operations. Our platform ensures compliance and accuracy in your business processes associated with this revenue information.

-

How can airSlate SignNow assist retailers in managing their '2009 retailers ksrevenue' documents?

AirSlate SignNow provides a robust eSigning solution that allows retailers to manage '2009 retailers ksrevenue' documents effortlessly. You can create, send, and sign documents online, ensuring everything is organized and accessible. This helps reduce paperwork and increases operational efficiency, enabling better management of your retail revenue data.

-

What pricing options does airSlate SignNow offer for businesses focused on '2009 retailers ksrevenue'?

AirSlate SignNow offers competitive pricing plans suitable for various business sizes, including those focused on '2009 retailers ksrevenue'. Our pricing structure is transparent with no hidden fees, making it easy for you to choose a plan that fits your budget. With our cost-effective solution, businesses can efficiently handle all their documentation needs.

-

What features does airSlate SignNow provide that benefit '2009 retailers ksrevenue' management?

Our platform offers features such as customizable templates, bulk sending, and real-time tracking, which are valuable for retailers managing '2009 retailers ksrevenue'. You can ensure that all documents are handled correctly and promptly, reducing the error margin in revenue reporting. Additionally, advanced security features help protect sensitive information.

-

How does airSlate SignNow integrate with existing systems for handling '2009 retailers ksrevenue'?

AirSlate SignNow seamlessly integrates with various business applications, enhancing your ability to manage '2009 retailers ksrevenue'. This means you can sync your current systems and workflows with our eSigning solution. By integrating with tools like CRM systems and accounting software, you can streamline your document process without disruption.

-

What are the benefits of using airSlate SignNow for '2009 retailers ksrevenue' compliance?

Using airSlate SignNow helps ensure compliance with regulations surrounding '2009 retailers ksrevenue' documents. Our platform provides audit trails and legally binding signatures, making it easier to meet legal requirements. This not only safeguards your business but also instills confidence in your customers and partners.

-

Can airSlate SignNow assist with the analysis of '2009 retailers ksrevenue' data?

While airSlate SignNow primarily focuses on document management and eSigning, it can support the analysis of '2009 retailers ksrevenue' through integrations with analytical tools. By ensuring your documents are accurately signed and stored, you can easily retrieve and analyze data when needed. This creates a reliable foundation for making informed business decisions.

Get more for KANSAS Retailers' Sales Tax Return E Form RS Login

- Request for documented medical withdrawal arizona state university students asu form

- Los angeles college igetc form

- How to start a chicken farm business 2012 form

- Printable doctors excuse notes form

- Naap lab answers form

- Trumbull business college transcripts form

- Pilot club of leesville louisiana inc form

- Governed by igetc standards www lamission form

Find out other KANSAS Retailers' Sales Tax Return E Form RS Login

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself