Ks St 36 2019

What is the Kansas St 36?

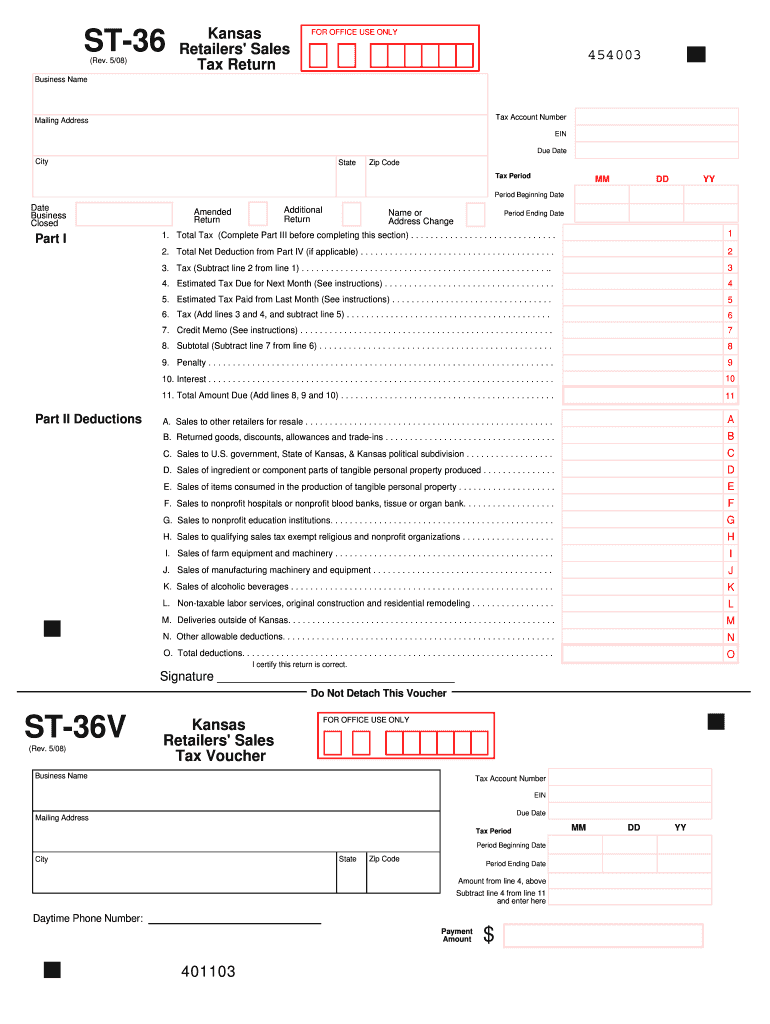

The Kansas St 36 is a tax form used by retailers in Kansas to report and remit sales tax collected during a specific reporting period. This form is essential for businesses operating within the state, as it ensures compliance with Kansas tax regulations. The St 36 captures details about taxable sales, exempt sales, and the total sales tax due. Retailers must accurately complete this form to avoid penalties and ensure proper tax reporting.

How to Use the Kansas St 36

Using the Kansas St 36 involves several steps to ensure accurate reporting. Retailers should first gather all necessary sales records for the reporting period. Next, they will fill out the form by entering total sales, exempt sales, and the calculated sales tax. It is important to double-check all entries for accuracy. Once completed, the form can be submitted either online or via mail, depending on the retailer's preference. Ensuring that all information is correct helps avoid issues with the Kansas Department of Revenue.

Steps to Complete the Kansas St 36

Completing the Kansas St 36 requires careful attention to detail. Follow these steps:

- Gather sales records for the reporting period.

- Determine total taxable sales and exempt sales.

- Calculate the total sales tax due based on applicable rates.

- Fill out the Kansas St 36 form with accurate figures.

- Review the form for completeness and accuracy.

- Submit the form online or by mail to the Kansas Department of Revenue.

Legal Use of the Kansas St 36

The Kansas St 36 must be used in accordance with state tax laws. This form serves as a legal document that verifies the sales tax collected by retailers. Proper use of the St 36 ensures that businesses remain compliant with Kansas tax regulations and avoid potential penalties. Retailers should keep copies of submitted forms and any supporting documents for their records, as these may be required in the event of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the Kansas St 36 vary based on the retailer's reporting schedule. Retailers typically file monthly, quarterly, or annually. It is crucial to be aware of these deadlines to avoid late fees and penalties. The Kansas Department of Revenue provides a calendar of important dates related to sales tax filings, which can help retailers stay on track with their submissions.

Form Submission Methods

Retailers have multiple options for submitting the Kansas St 36. The form can be filed online through the Kansas Department of Revenue's website, which may offer a more efficient process. Alternatively, retailers can print the completed form and mail it to the appropriate department. In-person submissions may also be possible at designated locations. Each method has its own advantages, and retailers should choose the one that best fits their needs.

Quick guide on how to complete ks st 36

Complete Ks St 36 seamlessly on any gadget

Online document administration has gained traction among businesses and individuals alike. It offers a flawless eco-conscious substitute to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without any holdups. Manage Ks St 36 on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Ks St 36 effortlessly

- Locate Ks St 36 and click on Get Form to begin.

- Utilize the tools we provide to submit your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to preserve your changes.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Ks St 36 and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ks st 36

Create this form in 5 minutes!

How to create an eSignature for the ks st 36

How to make an electronic signature for your Ks St 36 in the online mode

How to create an eSignature for the Ks St 36 in Google Chrome

How to create an eSignature for signing the Ks St 36 in Gmail

How to generate an eSignature for the Ks St 36 from your smartphone

How to generate an eSignature for the Ks St 36 on iOS devices

How to generate an electronic signature for the Ks St 36 on Android devices

People also ask

-

What is Ks St 36 and how does it relate to airSlate SignNow?

Ks St 36 refers to a specific document type or template available within airSlate SignNow's platform. It allows users to efficiently manage their signing processes. By utilizing Ks St 36, businesses can streamline their document workflow and enhance collaboration.

-

How much does it cost to use airSlate SignNow for Ks St 36 documents?

The pricing for airSlate SignNow varies based on the subscription plan chosen, but it is designed to be cost-effective for all businesses. Each plan includes features that support the management and eSigning of Ks St 36 documents, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for managing Ks St 36?

airSlate SignNow comes with a variety of features tailored for Ks St 36 documents, including customizable templates, advanced security measures, and real-time tracking. These features empower businesses to send, receive, and manage their documents seamlessly.

-

Can I integrate airSlate SignNow with other applications while using Ks St 36?

Yes, airSlate SignNow offers integrations with various applications, enhancing your ability to manage Ks St 36 documents. Whether you use CRM systems, cloud storage, or productivity tools, you can easily connect them with airSlate SignNow for a more streamlined workflow.

-

What are the benefits of using airSlate SignNow for Ks St 36 documents?

Using airSlate SignNow for Ks St 36 documents provides numerous benefits, including improved efficiency, reduced turnaround times, and enhanced document security. Businesses can save time and resources while ensuring compliance with legal standards.

-

Is airSlate SignNow user-friendly for handling Ks St 36 documents?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to manage Ks St 36 documents. The intuitive interface ensures that users can quickly learn how to send and eSign documents without extensive training.

-

What types of businesses can benefit from using airSlate SignNow for Ks St 36?

Businesses of all sizes and industries can benefit from using airSlate SignNow for Ks St 36 documents. Whether you're in real estate, finance, or education, the platform's versatility allows you to tailor your document management processes to meet your specific needs.

Get more for Ks St 36

Find out other Ks St 36

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free

- eSignature Pennsylvania Sales Invoice Template Secure