Accordance with the Following Terms and Provisions Form

Key elements of the Missouri living trust

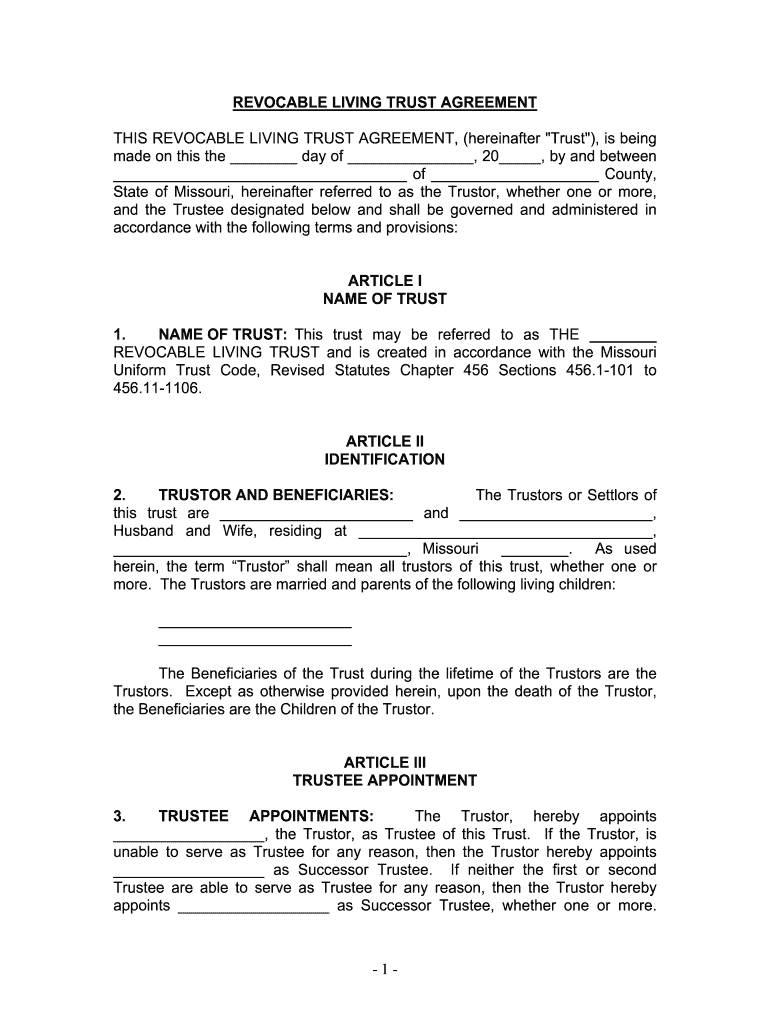

A Missouri living trust is a legal arrangement that allows individuals to manage their assets during their lifetime and specify how those assets should be distributed upon their death. Key elements of a Missouri trust include:

- Trustee: The person or institution responsible for managing the trust assets.

- Beneficiaries: Individuals or entities designated to receive the trust assets.

- Trust document: The legal document outlining the terms of the trust, including the powers of the trustee and the rights of the beneficiaries.

- Revocability: Many Missouri trusts are revocable, meaning the grantor can alter or dissolve the trust at any time during their lifetime.

Steps to complete the Missouri trust form

Completing a Missouri trust form involves several important steps to ensure that the trust is valid and meets legal requirements. Here’s a straightforward process to follow:

- Gather necessary information about assets, beneficiaries, and the desired structure of the trust.

- Choose a reliable trustee who will manage the trust according to its terms.

- Draft the trust document, clearly outlining the terms, conditions, and instructions for asset distribution.

- Sign the trust document in the presence of a notary public to ensure its legal validity.

- Fund the trust by transferring ownership of assets into the trust's name.

State-specific rules for the Missouri living trust

Missouri has specific rules that govern the creation and management of living trusts. Understanding these regulations is crucial for ensuring compliance:

- Creation: A living trust must be created in writing and signed by the grantor.

- Funding: Assets must be formally transferred to the trust to be included in the trust estate.

- Revocation: The grantor retains the right to revoke or amend the trust at any time unless it is irrevocable.

- Tax implications: Living trusts in Missouri do not typically affect income tax obligations, but estate taxes may apply upon the grantor's death.

Legal use of the Missouri living trust

The legal use of a Missouri living trust encompasses various aspects that ensure it serves its intended purpose effectively:

- Asset protection: A living trust can protect assets from probate and provide privacy regarding asset distribution.

- Control: The grantor can dictate terms for asset management and distribution, ensuring their wishes are followed.

- Continuity: In the event of the grantor's incapacity, the trustee can manage the trust assets without court intervention.

Required documents for establishing a Missouri trust

To establish a Missouri living trust, several documents are necessary to ensure proper setup and compliance with state laws:

- Trust agreement: The primary document that outlines the terms and conditions of the trust.

- Asset list: A detailed inventory of the assets to be included in the trust.

- Identification: Valid identification of the grantor and trustee, such as a driver's license or passport.

- Transfer documents: Legal documents required to transfer ownership of assets into the trust.

Examples of using the Missouri living trust

Understanding practical applications of a Missouri living trust can clarify its benefits. Here are some common scenarios:

- Estate planning: Individuals use trusts to ensure their assets are distributed according to their wishes, avoiding probate.

- Minor children: Parents may establish a trust to manage assets for their children until they reach adulthood.

- Special needs planning: Trusts can be set up to provide for individuals with disabilities without jeopardizing their eligibility for government assistance.

Quick guide on how to complete accordance with the following terms and provisions

Accomplish Accordance With The Following Terms And Provisions effortlessly on any gadget

Digital document administration has gained traction with companies and individuals alike. It offers an excellent environmentally-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage Accordance With The Following Terms And Provisions on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

The simplest method to modify and electronically sign Accordance With The Following Terms And Provisions without hassle

- Locate Accordance With The Following Terms And Provisions and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Accordance With The Following Terms And Provisions and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the accordance with the following terms and provisions

How to make an eSignature for your Accordance With The Following Terms And Provisions in the online mode

How to create an eSignature for the Accordance With The Following Terms And Provisions in Chrome

How to generate an electronic signature for signing the Accordance With The Following Terms And Provisions in Gmail

How to generate an electronic signature for the Accordance With The Following Terms And Provisions straight from your smartphone

How to make an electronic signature for the Accordance With The Following Terms And Provisions on iOS devices

How to make an eSignature for the Accordance With The Following Terms And Provisions on Android devices

People also ask

-

What is a Missouri living trust?

A Missouri living trust is a legal document that allows individuals to manage their assets during their lifetime and distribute them after death without going through probate. It provides flexibility and control over how assets are handled. Setting up a Missouri living trust can simplify the estate planning process.

-

How does a Missouri living trust differ from a will?

Unlike a will, a Missouri living trust allows for the immediate transfer of assets upon death without the lengthy probate process. This means your beneficiaries can access the trust assets more quickly. Additionally, a living trust offers privacy, as it is not generally subject to public record like a will.

-

What are the benefits of creating a Missouri living trust?

Creating a Missouri living trust offers several benefits, including avoiding probate, maintaining privacy, and allowing for easier management of your assets. It also allows for continued management in case of incapacitation and can provide clarity on how assets should be distributed. This makes it an effective tool for estate planning.

-

How much does it cost to set up a Missouri living trust?

The cost of setting up a Missouri living trust can vary depending on the complexity of your estate and whether you hire an attorney. Typically, you might expect to pay anywhere from $500 to $3,000 for legal assistance. However, many affordable resources are available, allowing you to create a Missouri living trust efficiently.

-

Can I modify my Missouri living trust after it’s created?

Yes, a Missouri living trust is a revocable trust, meaning you can modify or revoke it at any time while you are alive. This flexibility allows you to change beneficiaries, add assets, or update terms as your circumstances change. It's essential to regularly review your Missouri living trust to ensure it aligns with your current wishes.

-

What types of assets can be included in a Missouri living trust?

A Missouri living trust can hold a variety of assets, including real estate, bank accounts, investments, and personal property. However, certain assets like retirement accounts and life insurance may require specific consideration. It's essential to work with a professional to ensure all eligible assets are properly transferred into the trust.

-

How does a Missouri living trust work after my death?

After your death, a Missouri living trust allows your designated trustee to manage and distribute your assets to beneficiaries as outlined in the trust document. This process bypasses probate, ensuring that your assets are transferred more quickly and privately. Having a living trust simplifies the transition for your loved ones during a challenging time.

Get more for Accordance With The Following Terms And Provisions

Find out other Accordance With The Following Terms And Provisions

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation