State of Maryland, Hereinafter Referred to as the Trustor and the Trustee Form

What is the State of Maryland, Hereinafter Referred To As The Trustor And The Trustee

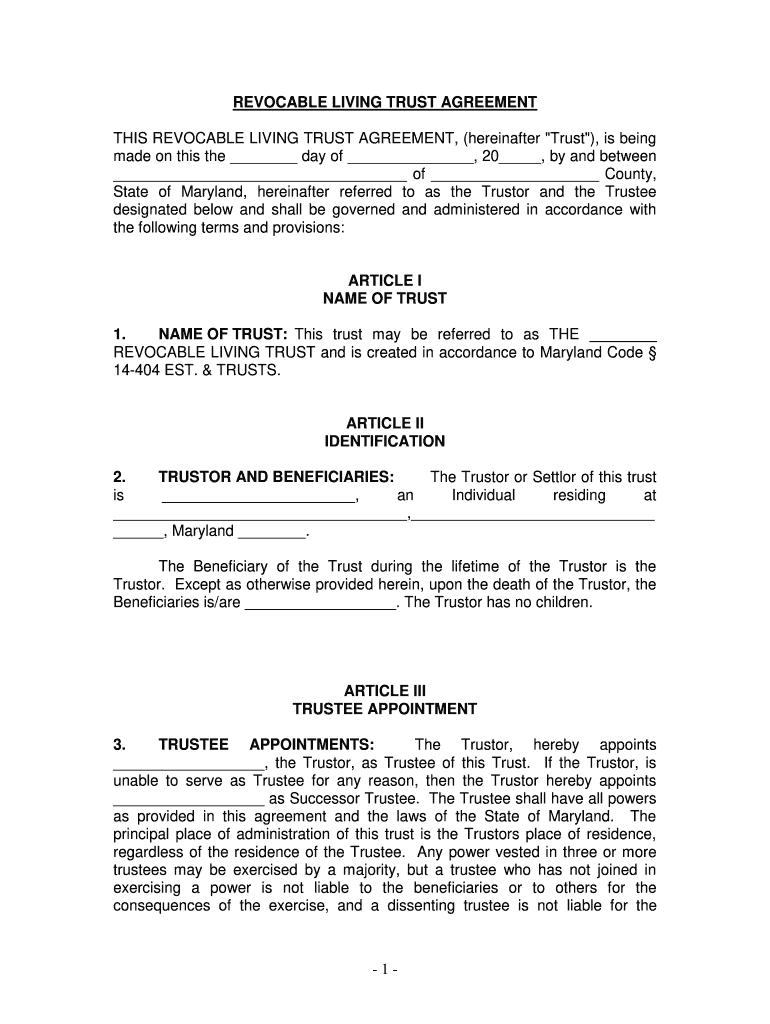

The State of Maryland, in the context of trust law, designates the individual or entity establishing the trust as the trustor. This party is responsible for defining the terms and conditions of the trust, including how assets should be managed and distributed. The trustee, appointed by the trustor, is tasked with overseeing the trust's assets and ensuring that they are managed according to the trustor's wishes. Understanding the roles of both the trustor and the trustee is essential for anyone involved in estate planning or asset management in Maryland.

How to Use the State of Maryland, Hereinafter Referred To As The Trustor And The Trustee

Using the trustor and trustee form in Maryland involves several steps. First, the trustor must clearly outline their intentions regarding asset distribution and management. This includes specifying beneficiaries and any conditions that apply. Once the trustor has finalized these details, they can complete the form, ensuring all required information is accurately provided. The trustee then assumes responsibility for executing the trust as per the trustor's instructions. It is advisable for both parties to consult legal professionals to ensure compliance with state laws and regulations.

Steps to Complete the State of Maryland, Hereinafter Referred To As The Trustor And The Trustee

Completing the trustor and trustee form in Maryland involves a systematic approach:

- Identify the assets to be placed in the trust.

- Determine the beneficiaries and their respective shares.

- Draft the terms of the trust, including any specific conditions.

- Complete the trustor and trustee form with accurate details.

- Sign the form in the presence of a notary public to ensure legal validity.

Following these steps carefully helps ensure that the trust is established correctly and in accordance with Maryland law.

Legal Use of the State of Maryland, Hereinafter Referred To As The Trustor And The Trustee

The legal use of the trustor and trustee form in Maryland is governed by state trust laws. The trust must comply with the Maryland Trust Act, which outlines the requirements for establishing a valid trust. This includes ensuring that the trustor has the legal capacity to create a trust and that the trust is executed with proper formalities. Additionally, the trustee must act in the best interests of the beneficiaries, adhering to fiduciary duties and responsibilities as defined by law.

Key Elements of the State of Maryland, Hereinafter Referred To As The Trustor And The Trustee

Several key elements must be included in the trustor and trustee form to ensure its validity:

- The name and contact information of the trustor.

- The name and contact information of the trustee.

- A detailed description of the assets being placed in the trust.

- Clear instructions regarding the distribution of assets to beneficiaries.

- Signatures of the trustor and trustee, along with a notary seal.

Incorporating these elements helps to create a comprehensive and legally binding trust document.

State-Specific Rules for the State of Maryland, Hereinafter Referred To As The Trustor And The Trustee

Maryland has specific rules that govern the creation and management of trusts. These include requirements for documentation, the powers granted to trustees, and the rights of beneficiaries. It is essential for trustors to be aware of these regulations to ensure that their trusts are compliant with state laws. For instance, Maryland law may dictate how trustees should handle trust assets and the obligations they have towards beneficiaries, including the necessity for regular accounting and reporting.

Quick guide on how to complete state of maryland hereinafter referred to as the trustor and the trustee

Effortlessly Prepare State Of Maryland, Hereinafter Referred To As The Trustor And The Trustee on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers a perfect environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Handle State Of Maryland, Hereinafter Referred To As The Trustor And The Trustee on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign State Of Maryland, Hereinafter Referred To As The Trustor And The Trustee without hassle

- Obtain State Of Maryland, Hereinafter Referred To As The Trustor And The Trustee and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information using the tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Decide how you want to send your form: via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choosing. Modify and electronically sign State Of Maryland, Hereinafter Referred To As The Trustor And The Trustee and guarantee seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state of maryland hereinafter referred to as the trustor and the trustee

How to generate an eSignature for the State Of Maryland Hereinafter Referred To As The Trustor And The Trustee online

How to make an eSignature for your State Of Maryland Hereinafter Referred To As The Trustor And The Trustee in Google Chrome

How to generate an electronic signature for signing the State Of Maryland Hereinafter Referred To As The Trustor And The Trustee in Gmail

How to make an electronic signature for the State Of Maryland Hereinafter Referred To As The Trustor And The Trustee straight from your smart phone

How to make an electronic signature for the State Of Maryland Hereinafter Referred To As The Trustor And The Trustee on iOS

How to generate an electronic signature for the State Of Maryland Hereinafter Referred To As The Trustor And The Trustee on Android devices

People also ask

-

What is a trustor in the context of airSlate SignNow?

A trustor in airSlate SignNow refers to an individual or entity that grants authority to others to sign documents on their behalf. This role is crucial in ensuring that all agreements are legally binding and meet the necessary compliance standards. Understanding the trustor's role can enhance the efficiency of your document signing process.

-

How does airSlate SignNow ensure trustor security?

airSlate SignNow prioritizes security for trustors by utilizing advanced encryption and secure data storage. Features like two-factor authentication and audit trails enable trustors to monitor their documents and signing activities. This focus on security helps maintain the integrity and confidentiality of sensitive information.

-

What pricing plans does airSlate SignNow offer for trustors?

airSlate SignNow provides various pricing plans tailored to meet the needs of different trustors and organizations. Each plan includes features that allow trustors to manage documents effortlessly. You can choose from individual, business, or enterprise plans, depending on the number of users and required functionalities.

-

What features should trustors look for in airSlate SignNow?

Trustors should look for features such as customizable templates, automated workflows, and the ability to track document statuses in airSlate SignNow. These functionalities empower trustors to streamline the signing process and enhance collaboration within their teams. Additionally, eSignature capabilities ensure legal compliance across various documents.

-

How can airSlate SignNow benefit trustors?

airSlate SignNow benefits trustors by simplifying the document signing process, reducing turnaround times, and lowering costs associated with traditional signing methods. With an intuitive interface, trustors can easily manage and send documents for eSignature, signNowly improving overall operational efficiency. This ultimately leads to quicker decision-making and improved client satisfaction.

-

Does airSlate SignNow integrate with other tools for trustors?

Yes, airSlate SignNow offers integrations with various applications and services, making it highly versatile for trustors. Popular integrations include CRM systems, project management tools, and cloud storage services. These integrations allow trustors to streamline their workflows and improve productivity by connecting their existing ecosystems.

-

What support options does airSlate SignNow offer to trustors?

AirSlate SignNow provides comprehensive support for trustors, including live chat, email support, and a detailed knowledge base. This ensures that trustors can get assistance whenever they encounter issues or need clarification on using the platform. With reliable support, trustors can maximize their experience while minimizing potential disruptions.

Get more for State Of Maryland, Hereinafter Referred To As The Trustor And The Trustee

- Referralauthorization request form uhc military west

- Form no 1118 owner s sale agreement and earnest money

- Change of ownership form slingshotpdf

- 62nd state science engineering fair of florida official abstract and certification form

- Shaving profile form

- Sweet home healthcare timesheets form

- Alabama drivers license template form

- Wells fargo mortgage assistance application fha wells fargo mortgage assistance application fha form

Find out other State Of Maryland, Hereinafter Referred To As The Trustor And The Trustee

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF