Trust Agreement or Declaration of Trust What Are They? Form

Understanding the Trust Agreement or Declaration of Trust

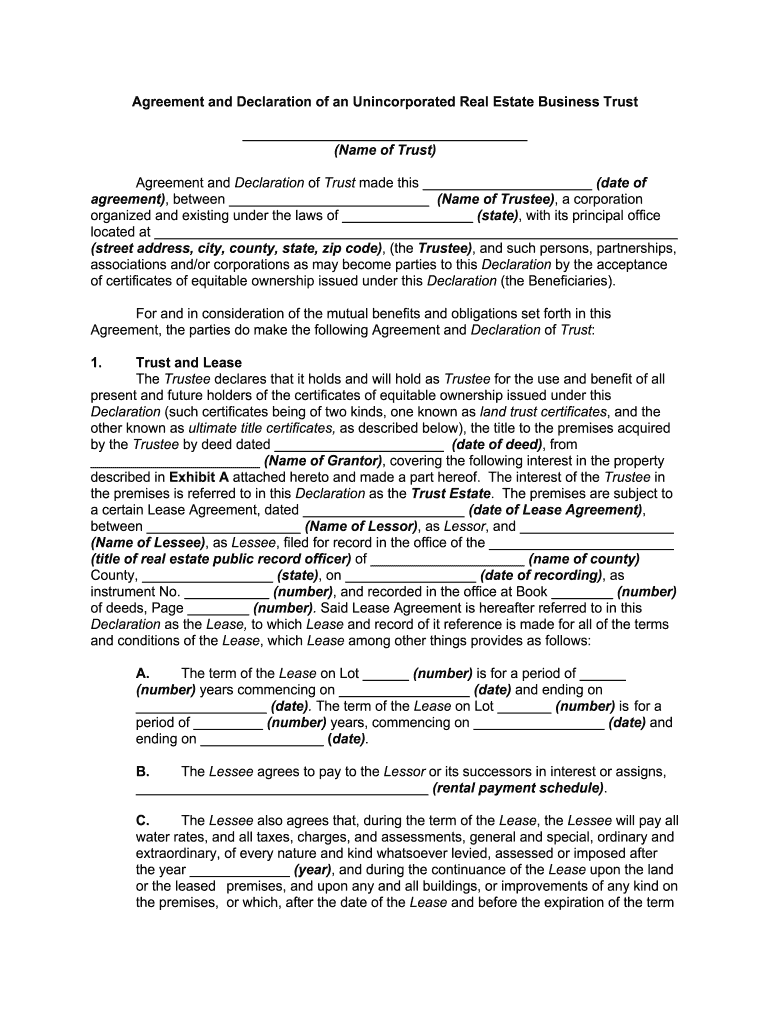

A Trust Agreement, often referred to as a Declaration of Trust, is a legal document that outlines the terms and conditions under which a trust is created and managed. This document establishes a fiduciary relationship between the trustor, who creates the trust, and the trustee, who manages the trust assets on behalf of the beneficiaries. It is essential for defining the roles and responsibilities of each party involved, ensuring that the trust operates according to the wishes of the trustor.

Key Elements of the Trust Agreement or Declaration of Trust

Several critical components must be included in a Trust Agreement to ensure its validity and effectiveness:

- Identification of Parties: Clearly state the names and roles of the trustor, trustee, and beneficiaries.

- Trust Purpose: Define the specific purpose of the trust, such as asset protection, estate planning, or charitable giving.

- Trust Assets: List the assets that will be placed in the trust, including real estate, investments, and personal property.

- Distribution Terms: Outline how and when the assets will be distributed to beneficiaries.

- Trustee Powers: Specify the powers and limitations of the trustee in managing the trust assets.

Steps to Complete the Trust Agreement or Declaration of Trust

Creating a Trust Agreement involves several key steps to ensure it meets legal requirements and accurately reflects the trustor's intentions:

- Determine the Type of Trust: Decide whether to establish a revocable or irrevocable trust based on your needs.

- Gather Necessary Information: Collect details about the trustor, trustee, beneficiaries, and trust assets.

- Draft the Agreement: Write the Trust Agreement, ensuring all essential elements are included.

- Review and Revise: Have the document reviewed by a legal professional to ensure compliance with state laws.

- Sign and Notarize: Execute the document in the presence of a notary public to enhance its legal standing.

Legal Use of the Trust Agreement or Declaration of Trust

The Trust Agreement serves various legal purposes, including estate planning, asset protection, and tax management. It allows trustors to control how their assets are managed and distributed after their passing. By establishing a trust, individuals can avoid probate, reduce estate taxes, and provide for minor children or dependents in a structured manner. Additionally, trusts can be used to protect assets from creditors and ensure that beneficiaries receive their inheritance according to the trustor's wishes.

IRS Guidelines for Trusts

The Internal Revenue Service (IRS) has specific guidelines regarding the taxation of trusts. Trusts may be subject to different tax rates depending on their classification. Revocable trusts are typically not taxed separately, as the trustor retains control over the assets. In contrast, irrevocable trusts may be taxed as separate entities. It is crucial for trustees to understand their tax obligations, including filing requirements and potential deductions. Consulting a tax professional can help ensure compliance with IRS regulations.

Eligibility Criteria for Establishing a Trust

Establishing a Trust Agreement requires meeting certain eligibility criteria. Generally, the trustor must be of legal age and mentally competent to create a trust. Additionally, the trust must have identifiable beneficiaries and assets to fund it. Trusts can be established by individuals, couples, or entities, depending on the purpose and structure of the trust. Understanding these criteria is essential for ensuring that the trust is valid and enforceable under state law.

Quick guide on how to complete trust agreement or declaration of trust what are they

Complete Trust Agreement Or Declaration Of Trust What Are They? seamlessly on any device

Web-based document management has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the appropriate form and securely preserve it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Handle Trust Agreement Or Declaration Of Trust What Are They? on any device using airSlate SignNow’s Android or iOS applications and enhance any document-oriented procedure today.

How to modify and electronically sign Trust Agreement Or Declaration Of Trust What Are They? effortlessly

- Locate Trust Agreement Or Declaration Of Trust What Are They? and then click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive details using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and holds the same legal standing as a traditional wet ink signature.

- Verify the information and then click on the Done button to retain your changes.

- Choose how you'd like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the stress of lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Trust Agreement Or Declaration Of Trust What Are They? and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the trust agreement or declaration of trust what are they

How to create an eSignature for your Trust Agreement Or Declaration Of Trust What Are They online

How to make an electronic signature for the Trust Agreement Or Declaration Of Trust What Are They in Google Chrome

How to create an eSignature for signing the Trust Agreement Or Declaration Of Trust What Are They in Gmail

How to generate an electronic signature for the Trust Agreement Or Declaration Of Trust What Are They straight from your smart phone

How to make an electronic signature for the Trust Agreement Or Declaration Of Trust What Are They on iOS devices

How to make an eSignature for the Trust Agreement Or Declaration Of Trust What Are They on Android OS

People also ask

-

What is an unincorporated business?

An unincorporated business is a type of business structure that operates without formal incorporation under state laws. This means the business owner retains full control and liability for the business's debts and obligations. Many small businesses and sole proprietorships fall under this category, making it an essential concept for entrepreneurs.

-

How can airSlate SignNow benefit an unincorporated business?

AirSlate SignNow offers an affordable and efficient way for unincorporated businesses to manage their document signing needs. The platform allows users to send, sign, and store documents electronically, streamlining workflows and reducing paperwork. With intuitive features, it helps unincorporated businesses save time and improve operational efficiency.

-

What are the pricing options for airSlate SignNow for unincorporated businesses?

AirSlate SignNow provides flexible pricing plans tailored for unincorporated businesses. Each plan is designed to accommodate various business sizes and budgets, ensuring that all users can access the essential eSignature features. Customers can choose from monthly or annual subscriptions to find the best fit for their needs.

-

Does airSlate SignNow offer features specifically for unincorporated businesses?

Yes, airSlate SignNow includes features that cater specifically to the needs of unincorporated businesses. Key tools such as templates, in-person signing, and automated reminders enhance the signing process. This ensures that business owners can manage their documents efficiently while focusing on building their business.

-

Can airSlate SignNow integrate with other tools used by unincorporated businesses?

Absolutely! AirSlate SignNow integrates seamlessly with various tools and platforms commonly used by unincorporated businesses, such as CRM systems, cloud storage services, and project management applications. This allows for a more connected workflow and helps businesses manage their online operations with ease.

-

Is airSlate SignNow secure for unincorporated businesses?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for unincorporated businesses. The platform utilizes encryption technology to protect sensitive information and complies with industry regulations such as eIDAS and ESIGN. This ensures that your documents are both secure and legally binding.

-

How easy is it to learn and use airSlate SignNow for an unincorporated business?

AirSlate SignNow is designed to be user-friendly, making it easy for unincorporated business owners to get started quickly. The platform features an intuitive interface, which enables users to navigate through document preparation and signing processes with minimal training. Additionally, a variety of resources are available for support.

Get more for Trust Agreement Or Declaration Of Trust What Are They?

- Application for ait program cdph 502 cdph ca form

- Letter of transfer episcopal diocese of pittsburgh episcopalpgh form

- Florida petition form 2015 2019

- Public information request form brazos county brazoscountytx

- Get 258837926 form

- 21 0966 fillable form

- Petition change 2016 2019 form

- Specialty behavioral health intake form

Find out other Trust Agreement Or Declaration Of Trust What Are They?

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter